Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 25 Mar, 2024

By Milan Ringol

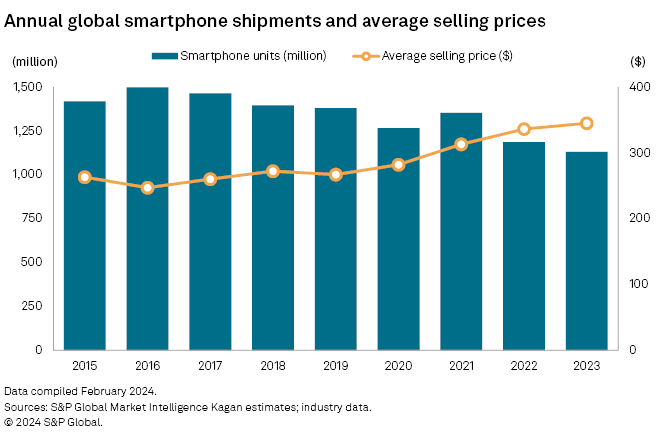

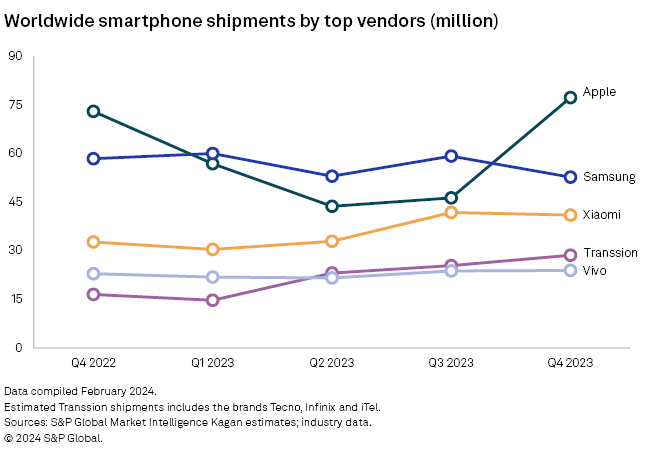

The 10-quarter streak of declining global smartphone shipments was finally broken in the fourth quarter of 2023 with a 9% year-on-year growth, as emerging markets showed signs of recovery at the tail end of the year. While the year ended on a high note, much of 2023 saw smartphone demand stymied by macroeconomic challenges that curbed discretionary spending. Full-year 2023 shipments declined 4.7% year over year, making it the lowest annual volume since 2013, when smartphone shipments hit 1 billion units in a year for the first time.

Despite the downward shipment trend, the estimated annual smartphone revenue in 2023 was the third highest ever on record, propped up by 5G proliferation and a simultaneous premiumization trend.

5G has rapidly become a common feature since the first smartphones with 5G capability launched in 2019. The addition of different 5G-spectrum antennas, coupled with the 5G hype at the time, gave vendors a justification for price hikes resulting in 5G-capable phones typically having higher retail pricing than non-5G phones. This is most obvious among 5G smartphones that have a 4G/LTE variant.

Simultaneously, many vendors have been shifting more of their attention toward the premium segment, offering more high-end models and increasing their proportion among the total product mix. This allowed vendors to maximize revenue as they faced limited supply during component shortages and softening demand against difficult macroeconomic conditions.

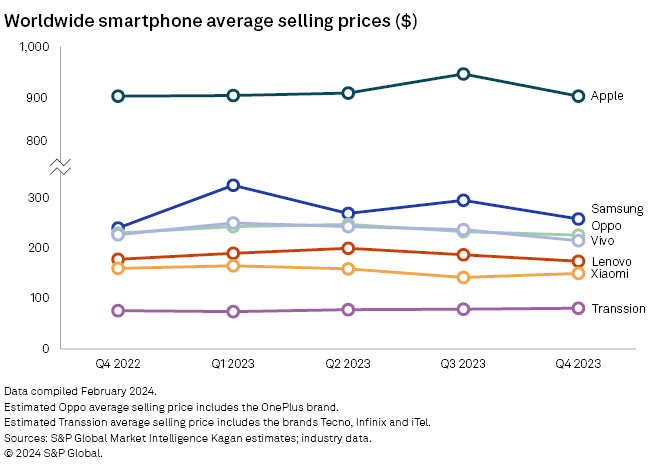

The combined effects of the "5G tax" and premiumization steadily inflated the estimated smartphone average selling price (ASP) which had hovered around $262 from 2015 through 2019 but then rose every year for four years to hit $345 by 2023.

Apple led the pack with estimated smartphone shipments up 6% year over year in fourth-quarter 2023 supported by robust demand for the iPhone 15 lineup, which we estimate accounted for over half of its total shipments. The steady buildup of Apple's smartphone ASP over the past three years resulted in its annual smartphone revenue to exceed $200 billion for the first time.

In contrast, Samsung appeared to struggle as its fourth-quarter shipments declined year over year – the only top vendor to do so. Although Samsung retained the top spot for total shipments in 2023, it did so by the slimmest of margins against Apple. Unless Samsung can reverse the -5.0% CAGR on annual shipments it registered between 2018 and 2023, Apple could take the lead in 2024 after having gained 4.9 percentage points of annual market share over the same period.

The remaining vendors among the top five primarily operate in the low-end and midrange segments and benefited from the ongoing economic recovery among emerging markets in the fourth quarter. Estimated global shipments for Xiaomi rebounded while Transsion's leaped year over year as it expands across the Asia-Pacific and Latin America. In comparison, Vivo's growth was much more subdued as the company lost market share to Huawei in the Chinese market.

Other vendors, outside the top five by shipment volume, were estimated to have shipped more units year over year in the fourth quarter. Most of these vendors operate primarily in the low-end and midrange markets where competition is extremely fierce, and some have found small niches as they struggle to go up against the incumbents named above. This group includes Oppo, Realme, Lenovo, Huawei, Honor and Sony.

S&P Global Market Intelligence Kagan's quarterly worldwide smartphone analysis provides estimates for shipments, revenue, average selling prices and market shares of select vendors based on business unit revenues, supply chain information and proprietary shipment and market share tracking models. MI clients can access our full report that includes a North America vendor breakout.