Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jun, 2017 | 14:45

Highlights

U.S. managed care insurers are experiencing troublesome medical loss ratios in the individual market.

Preliminary medical loss ratios for 2016 at several top U.S. managed care insurers show how some health companies are struggling in the individual market.

Preliminary medical loss ratios for 2016 at several top U.S. managed care insurers show how some health companies are struggling in the individual market.

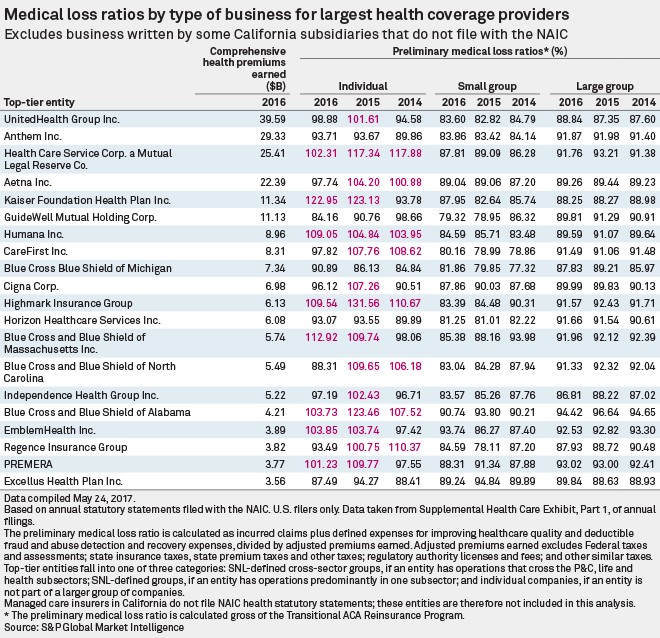

When a calculated preliminary medical loss ratio is above 100%, it indicates an insurer received less in earned premiums than it paid out in claims and quality improvement. Of the top 20 insurers, based on comprehensive health earned premiums, eight had individual preliminary medical loss ratios over 100% in 2016. No insurer broke that threshold within small or large group plans.

Executives at a handful of insurers have been vocal about losses within their individual businesses, or more specifically, the exchange markets within the Affordable Care Act. Mark Bertolini, Aetna Inc.'s chairman and CEO, stated during the company's fourth-quarter earnings call that "for-profit and nonprofit companies have collectively lost billions of dollars" in the public exchanges.

Losses from the public exchanges have caused many insurers to either limit their participation or completely exit them. Aetna and Humana Inc. both chose the latter course and have announced they will leave the state exchanges at the end of 2017.

For the third straight year, Humana recorded an individual preliminary medical loss ratio over 100%. The year-over-year increase of 420 basis points in 2016, the second-highest reported increase, put Humana's preliminary medical loss ratio at 109.05%, according to the analysis by S&P Global Market Intelligence. Humana CFO Brian Kane said during the company's first-quarter earnings call that he expects the losses to continue in 2017, with "approximately $45 million overall for our ACA and our non-ACA combined individual products."

Health Care Service Corp. a Mutual Legal Reserve Co.'s calculated individual preliminary medical loss ratio improved in 2016, but remained above the 100% threshold, as has been the case for the past three years. Health Care Service Corp.'s year-over-year improvement in its individual medical loss ratio benefited from lower incurred claims. Management credited the decrease to lower prescription drug costs per member and lower overall membership numbers in 2016, according to its annual regulatory filing.

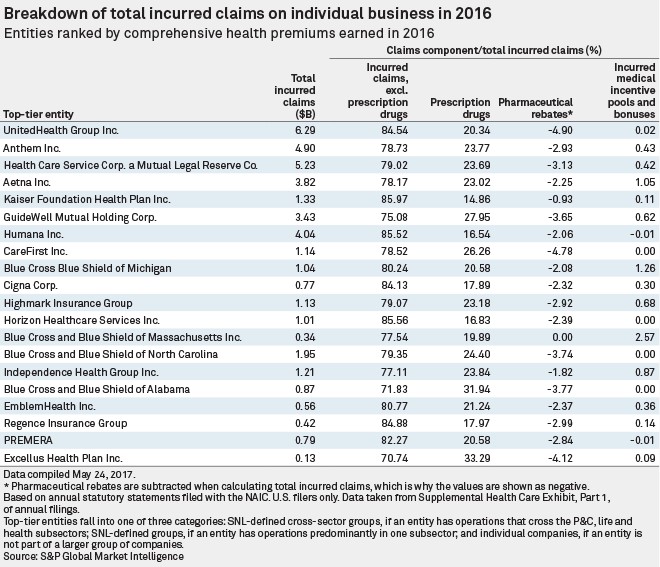

The decrease in prescription drug cost per member for Health Care Service Corp. bucked the trend of the other insurers within the analysis. When taking a simple calculation of the total cost of prescription drugs divided by total number of covered lives reported, for comprehensive individual health line of business, 17 out of the 20 insurers showed increased prescription drug cost per member in 2016.

On the other end of the spectrum, Cigna Corp. and Blue Cross & Blue Shield of North Carolina recorded double-digit year-over-year decreases in their calculated individual preliminary medical loss ratios. The former saw a ratio of 96.12% for 2016, while the latter posted a ratio of 88.31%.

Blue Cross & Blue Shield of North Carolina in a regulatory filing noted several factors that contributed to its lower medical loss ratio, including lower paid medical expenses for individuals under the age of 65 within Affordable Care Act plans.

Prescription drugs accounted for a larger percentage of total incurred claims at Blue Cross & Blue Shield of North Carolina in 2016, but the actual dollar amount spent was roughly 15% lower when compared to 2015. Incurred claims excluding prescription drugs for Blue Cross & Blue Shield of North Carolina were $1.55 billion in 2016, which amounted to a decrease of $539.2 million from the prior year.

To learn more about the tools used to conduct this analysis, take a deeper dive into our essential solutions for insurance.