Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Apr, 2022

PE/VC Investment Landscape in CEE

Positioned in the heart of Europe, the Central and Eastern European region (CEE)[15] offers easy access to the EU single market and its own market of continually increasing consumer demand. Well-educated, skilled professionals are supported by experienced local general partners in the environment where innovation is embraced by the government.[16]

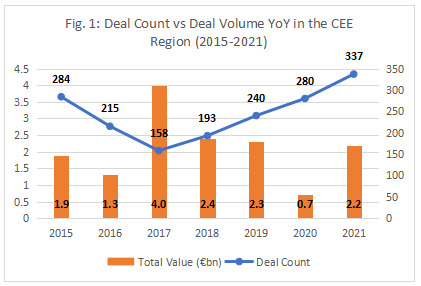

Fig. 1: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

After relatively subdued deal-making activity in 2020, the aggregate deal value in the CEE region hit €2.3bn in 2021, an increase of 214% YoY but still not as high as €4bn reported in 2017 (Fig. 1). In total, 337 transactions were closed in 2021, the highest tally since 2015 and 40% above the five-year average of 241 transactions per year. Poland was the most invested country by deal count and accounted for 31% of all completed deals in the region between 2015–2021.

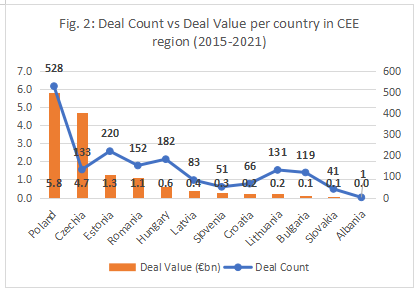

Poland leads the CEE in terms of deal value, with a total reported transaction value of €5.8 in the same period (Fig. 2). It is important to note that in the region, PE/VC deal activity reporting is often driven by a few one-off mega deals. The biggest deal with Poland’s online marketplace, Allegro Group sp. z o.o.,[17] accounted for almost €3bn in 2017. Similarly, Czechia reached an aggregate deal value of €4.7bn (Fig.2), but this was largely a result of two mega deals in 2019 and 2020: an acquisition of majority stake of Czech Grid Holding, a.s.[18] and Zentiva Group, a.s.[19] Both deals combined accounted for 83% of the total deal value in the country in the study period.

Fig. 2: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

Looking at more recent data, the number of deals in 2021 for Poland is 91. This represents just 15% of the total of the 528 deals made in the country between 2015-2021, but it accounts for 27% of all the deals in the CEE in 2021, placing Poland in the lead position in the CEE PE/VC market. While Polish companies received just €440m in 2021, that nevertheless represents a healthy growth of 142% YoY. Notably, 2021 was also a good year for Romanian firms, which received more than €190m in funding, a 1168% growth YoY and accounting for 8% of the CEE market. The two largest deals amounted to €108m between two FinTech firms: Fintech OS SRL[20] and PayPoint Services Romania SRL.[21]

Based on the Global PE/VC survey conducted by Market Intelligence in the end of 2021, we see that ESG is becoming an increasingly relevant investment strategy in CEE. 35% of respondents in the region said that in 2022 they were looking to invest in companies with a good ESG track record. In addition, 43% reported that their firms have started to establish ESG-related practices, which is up from 22% in 2020.

Industry trends in CEE

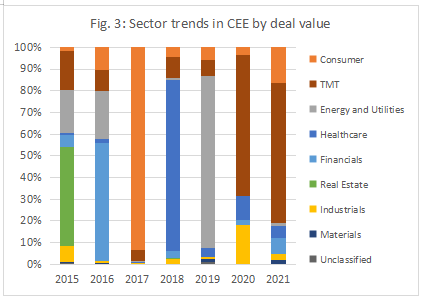

In the past two years, the Technology, Media & Telecommunications sector has gained more traction in the CEE, receiving more than €1.4bn in PE/VC funding (Fig. 3). The sector accounted for 65% of all investments in 2021, which is 212% growth YoY in deal value. On the other hand, the Real Estate sector has been declining since it reached its highest point in 2015, and today accounts for the lowest market share in terms of deal value in the region over the whole study period.

Fig. 3: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

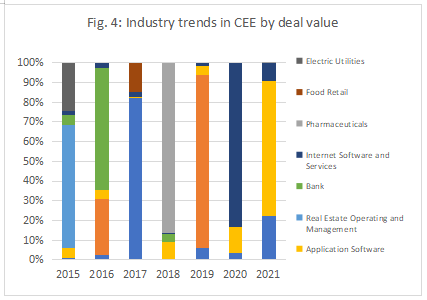

Within the Technology, Media & Telecommunications sector, the Application Software industry amassed the highest deal volume of PE/VC investments in the CEE region in 2021, with reported total of €950m in funding received (Fig. 4). The biggest deal of the year involved Estonian taxi and food delivery firm Bolt Technology OÜ[22] with a total value exceeding €620m. The second largest deal comes from the Internet and Direct Marketing industry, where Czech consumer retail firm VELKÁ PECKA s.r.o.[23] received €290m over two funding series in 6 months.

In the last two years, the Internet Software and Services industry has also been popular with PE/VC investors, receiving in total more than €399m of reported funding. The two biggest deals in the period were responsible for 60% of the total deal value: where Croatia’s CRM solutions firm INFOBIP d.o.o. received €170m[24] in Series A funding, and Poland’s e-learning platform Brainly Spółka[25] received €66m in PE/VC funding.

Fig. 4: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

CEE is gaining traction with foreign sponsors

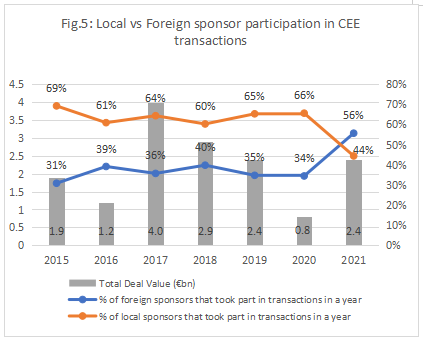

From 2015–2020, the majority of sponsors YoY in CEE deals were domestic PE/VCs at 61% on average. However, in 2021, foreign sponsors accounted for 56% of the total number of investors participating in transactions, which is a 168% growth over 2020. 2021 also marks the first year when the number of foreign PE/VCs participating in CEE transactions exceeded the number of domestic sponsors. However, that change does not translate into a higher deal value but rather represents a growth in deal count (Fig. 5).

Fig. 5: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

Based on the reported transactions data in the CEE from 2015 to 2021, out of local sponsors the PE/VC firm with most investments in the region is Eleven Ventures, with 88% of the transactions happening in their home country of Bulgaria. Estonian firm Wise Guys Holding OÜ is the second in the list, with the majority of their investments located in Estonia and Lithuania (Table 1). Another Estonian sponsor, AS BaltCap, focuses mainly on Baltic states. Although Estonia has a population of just over 1.3 million people, Estonian PE/VC firms have a strong presence in the CEE market. Considering the size of Polish PE/VC market it is surprising to find Polish sponsors at the bottom of the list, with Venture INC ASI S.A. and Inovo Venture Partners participating mostly in domestic transactions.

The largest reported deal in the CEE by a domestic investor was completed in 2021, when Poland-based Abris Capital Partners acquired 100% of the Polish healthcare network operator Scanned A.S. for €76m.[26] The largest deal where both foreign and domestic sponsors participated also happened in 2021, with VELKÁ PECKA s.r.o.[27] receiving €290m in two reported transactions.

Table 1: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region and reflects sponsors with a 23+ deal count.

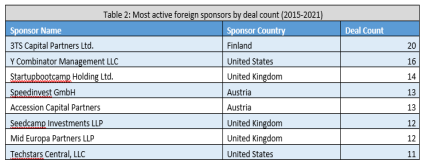

U.S. and UK based sponsors participated in 28% and 19%, respectively, of all transactions in the CEE from 2015-2021. The most active U.S. sponsor is Y Combinator Management LLC, which participated in 16 transactions, of which the majority were made in Hungary and Poland. Of the UK’s sponsors, Startupbootcamp Holding Ltd[28] was the most active in the region, having participated in 14 reported transactions during this period. However, the firm that participated in the highest number of transactions was 3TS Capital Partners[29] from Finland, which participated in 20 transactions in total.

Table 2: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region and reflects sponsors with a 10+ deal count (retrieved from Capital IQ).

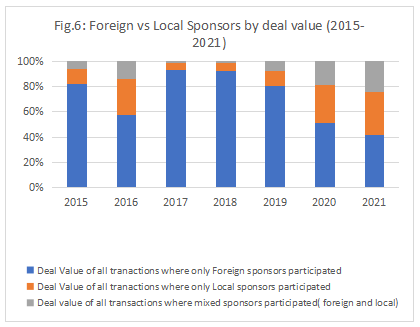

When it comes to reported deal value, foreign investors were clearly in the lead in the period of 2015-2019; however, in 2020 domestic sponsors started bringing more money into the transactions, which increased the value of mixed transactions (Fig. 6). As with Poland’s Allegro, foreign investors continue to be major force behind mega deals (buyouts) in the region, and they are increasingly investing alongside domestic buyers in the smaller transactions’ brackets (Growth, VC later stage).

Fig. 6: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

Keeping an eye on Estonia

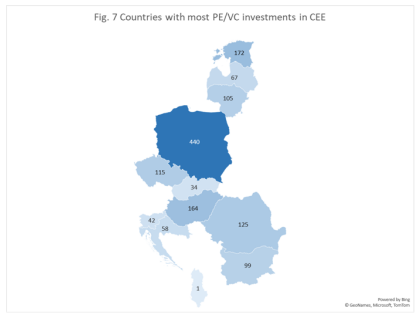

Between 2015 and 2021, 172 Estonian firms received PE/VC backing and despite the small size of its population, of just over 1.3 million, this country proves to be highly attractive to PE/VC investors (Fig.7). The deal count in 2021 showed a growth of 73% over 2020, which translates to a 1547% growth in deal value during the same timeframe.

Fig. 7: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets based in the CEE region.

The deals made in 2021 alone had higher deal value than all the deals from 2015 to 2020 combined. The most notable ones were Bolt Technology OÜ[30] (€620m), Skeleton Technologies OÜ [31](€70m) and Veriff OÜ [32](€58m). In 2021, Estonia’s total deal value was €929.4m, which corresponds to 43% of aggregate deal value in the CEE. In comparison, Poland’s deal value in 2021 amounted to €440m, which accounts for only 20% of aggregate deal value.

Estonia proves to be a country with ambitious and highly skilled start-up founders, and the country has also produced a number of well-known unicorns. One of those unicorns is London’s Wise PLC, a FinTech developed by Estonian founders Kristo Kaarmann[33] and Taavet Hinrikus[34] and which is now traded on the LSE. Another is Bolt Technology OÜ, which is challenging Uber for CEE market share. Bolt’s current post-money valuation stands at over €7.4bn.[35]

Expectations for Estonian start-ups remain high. There were more than 220 reported transactions in the country between 2015 and 2021, amounting to a reported aggregate value of almost €1.3bn. The recent successes of the firms named, have attracted the attention of investors to the country and its start-ups. The government has introduced education programs aimed at encouraging young people to develop programming skills,[36] and they have also introduced initiatives to promote a healthy economic environment and ensure Estonia ranks high on the Ease of Doing Business index.[37]

Estonian sponsors are actively investing in the CEE region, participating in 242 transactions between 2015-2021; the most active firms were Wise Guys Holding OÜ and AS BaltCap who participated in 48 and 23 transactions, respectively. As for foreign investors, the most active ones were Finland’s Icebreaker with 7 transactions; Jersey’s TMT Investments PLC and the UK’s Passion Capital Investments LLP tied for second with 6 transactions each.

Russia’s PE/VC market: An Overview

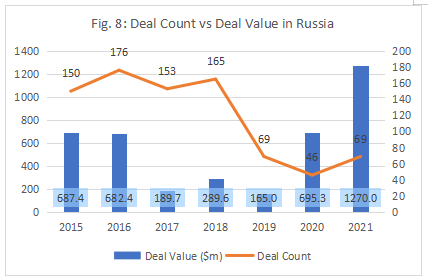

Despite the increase in reported deal value in Russia during 2020-2021, the total deal count has been considerably lower than in the previous years. In addition, the majority of transactions by deal value in Russia were M&As (whole or majority), which represented a reported deal value of over $1.5bn during the period of 2015-2021, out of the total $4bn. The Russian private equity market underperformed in comparison to smaller countries like Poland and Czechia, where the deal value in the same period exceeded $6.5bn and $5.3bn, respectively.

In the last two years, the reported total deal count was only 115, but deal value reached almost $2bn, which is a 332% growth in comparison with the deal value of the 2019-2020 period (Fig. 8). The biggest reported deal in 2021 was the acquisition of chemicals producer Hexion PSR,[38] where two private equity firms each acquired 50% of the firm in a deal worth $337m. Similarly, in 2020, 72% of the total reported value came from the acquisition of chemicals producer LLC Korund,[39] which was purchased for $500m by the group of investors.

Fig. 8: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets headquartered in Russia.

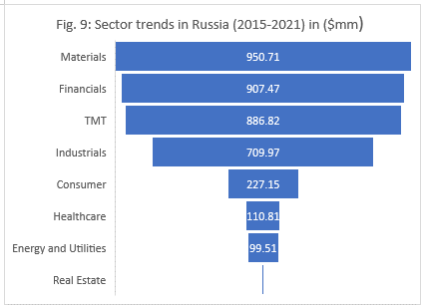

As a result of these two deals, the Materials sector is now the most invested-in sector in Russia during the study period (Fig. 9), led by firms in the Commodity Chemicals industry.

Fig. 9: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets headquartered in Russia.

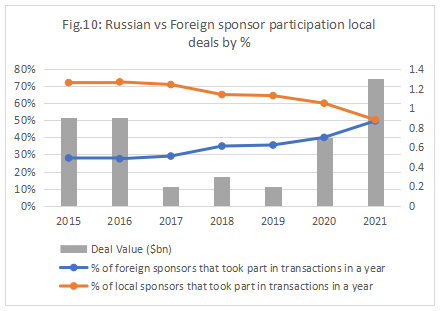

Foreign sponsor participation in transactions involving Russian companies has been slowly increasing, and in 2021 foreign sponsors participated in the same number of transactions as domestic sponsors (Fig. 10). However, it is important to note that the deal count has remained relatively low for the past three years (Fig. 8). One of the reasons for low deal count could be that companies, even those in the start-up stages, prefer to relocate out of Russia because their clients are reluctant to take on the risks related to the political and economic instability of the country.[40]

Fig. 10: Source: S&P Global Market Intelligence. Data based on reported transactions completed between 2015-2021 with targets headquartered in Russia.

In the past three years the most active sponsor by reported deal count was Internet Initiatives Development Fund Invest;[41]

however, their aggregate deal value is just over $3m. Baring Vostok[42] participated in ten deals in the same period and their total value exceeds $497m.

Table 3: Data is based on reported transactions completed within the 2019-2021 period in Russia and reflects sponsors with a 6+ deal count (retrieved from Capital IQ).

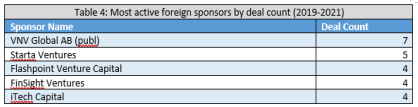

The most active foreign sponsor is Sweden’s VNV Global AB,[43] which participated in deals valued at over $83m. Starta Ventures,[44] from the U.S., participated in 5 deals with a reported aggregate deal value of $1m.

Table 4: Data is based on reported transactions completed within the 2019-2021 period in Russia and reflects sponsors with a 4+ deal count (retrieved from Capital IQ).

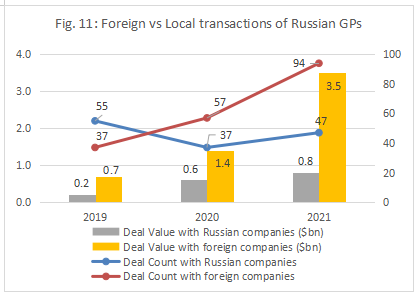

Based on the reported transactions between 2019-2021, even Russia-based private equity and venture capital firms seem to prefer investing abroad, as both deal count and deal value show notable growth in 2020 and 2021 (Fig. 11). The majority of Russian sponsors participate in deals involving firms based in the U.S.

Fig. 11: Screener includes the number of transactions and deal value within the 2019-2021 period. Data is based on reported completed transactions in the period.

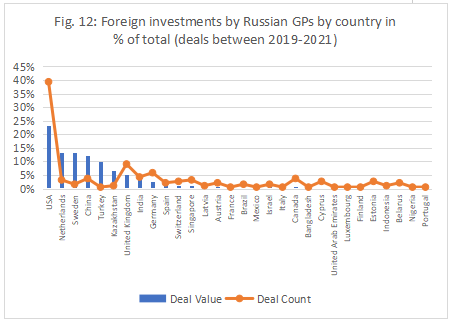

When looking in isolation at all foreign locations where Russian sponsors participate, we find that 23% of the total deal value and 39.4% of the total deal count happens in the U.S. The Netherlands comes second in terms of deal value, and the UK comes second in terms of deal count (Fig. 12).

Fig. 12: Screener includes the number of transactions and deal value within the 2019-2021 period. Data is based on reported completed transactions in the period.

[15] For the purpose of this article, Central and Eastern Europe, as per OECD definition, covers Albania, Bulgaria, Croatia, the Czechia, Hungary, Poland, Romania, the Slovakia, Slovenia, and the three Baltic States: Estonia, Latvia and Lithuania.

[16] Invest Europe, “Private Equity in CEE: Creating Value and Continued Growth”, Published on Feb 11, 2021 Retrieved from: https://www.investeurope.eu/about-private-equity/private-equity-impact/private-equity-in-cee/

[17] Allegro Group Sp. z o.o., S&P Capital IQ Pro. (As of February 17, 2022). Retrieved from: Read More

[18] Czech Grid Holding, a.s., S&P Capital IQ Pro. (As of February 17, 2022). Retrieved from: Read More

[21] PayPoint Services Romania SRL., S&P Capital IQ Pro. (As of February 17, 2022). Retrieved from: Read More

[28] Startupbootcamp Holding Ltd., S&P Capital IQ Pro. (As of February 17, 2022). Retrieved from: Read More

[29] 3TS Capital Partners Ltd., S&P Capital IQ Pro. (As of February 17, 2022). Retrieved from: Read More

[31] Skeleton Technologies OÜ, S&P Capital IQ Pro. (As of February 17, 2022). Retrieved from:Read More

[41] Internet Initiatives Development Fund Invest, S&P Capital IQ Pro. (As of February 17, 2022). Retrieved from: Read More

Research

Research