Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 23, 2023

Capacity in the US truckload sector continues to contract after an unprecedented expansion, but not so fast that it is putting much pressure on truckload pricing.

That may change in the first half of 2024 if current trends in inventory reduction, fuel prices and carrier exits from the market continue, logistics executives say. But the number of trucking companies supplying the market would have to be reduced sharply.

Data from the Federal Motor Carrier Safety Administration (FMCSA) shows the number of active US motor carrier operating authorities dropped 16,521 from last December through September, a 4.5% decline.

However, with more than 352,300 operating authorities still active, the number of available motor carriers is still higher than at the end of 2021, the last boom year for trucking, despite ongoing attrition.

Compared with the end of 2019, the number of active operating authorities is 46.4% higher, according to the FMCSA. The number of carriers with operating authority rose 12.6% in 2020, 28.7% in 2021 and 5.7% in 2022. All told, the number increased by 128,115 from 2019 through 2022.

"We're way above where we used to be before the pandemic," Mazen Danaf, senior economist at Uber Freight, said in an interview. "Will we lose all of them? No.

"Demand is higher right now than it used to be prior to the pandemic, even after the freight recession," Danaf added. "It's down from the peak in 2022, but it's still higher than in 2019."

Uber and other logistics providers say they see larger numbers of small carriers closing, but not enough to tighten capacity significantly. "We haven't seen major signs of a supply correction," Danaf said.

Instead, Danaf has seen a "reallocation" of capacity as larger carriers hire drivers from those failed carriers. Trucking's hiring engine appears to be slowing in the fourth quarter, however.

"We're still seeing carriers exit but we're not seeing an increase in payrolls," he said.

More inventory, not just carriers, must exit before the truckload market pulls out of its rut, said Tom Nightingale, CEO of AFS Logistics.

"I expect that the truckload sector will continue bumping around the bottom until enough inventory has bled out of the system and the combination of high interest, lower volumes and high fuel costs pushes more carriers and brokers out of the market," Nightingale told the Journal of Commerce Thursday. "The definitive inflection will probably occur shortly after Lunar New Year."

As 2023 draws to a close, truckload supply and demand remain far from balanced. That could change if fuel prices spike or freight demand rises faster than expected during the holiday season, according to Corey Klujsza, vice president of pricing and procurement strategy at Coyote Logistics.

In the third quarter, "many carriers were, and still are, running at unsustainable levels," Klujsza said in the Coyote Curve Index Q4 forecast. By unsustainable, he means their operating costs were higher than revenue.

"There has been enough sustained pressure on the supply side over the last several quarters to constrict the amount of available capacity and push rates higher," Klujsza said. But the slim increases seen to date are largely from fuel surcharges and the fact that "there's no room left to drop," he said.

Coyote predicts that despite ample capacity, truckload spot rates will turn inflationary and rise year over year in the first quarter.

Some brokers that expect rates to increase in 2024 are urging shippers to take bids to market now to lock in lower rates, rather than wait until later next year. But others aren't clear when rates will rise and by how much.

"While the [Coyote Curve] index will certainly flip inflationary in 2024, we don't anticipate the sort of extreme conditions experienced in the last inflationary market in 2020 and 2021," Klujsza said.

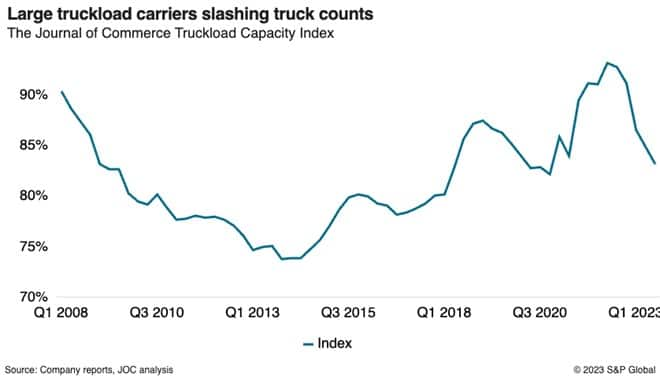

Large truckload carriers also are clawing back excess capacity by culling trucks and slowing hiring. The Journal of Commerce Truckload Capacity Index (TCI) dropped 1.7 percentage points in the third quarter to a reading of 83.2%, 10 percentage points lower than its peak in the second quarter of 2022.

The index, based on truck counts at a group of large publicly owned truckload companies, shows those carriers reacted quickly to limit the financial damage caused by falling spot and contract rates.

The TCI also underscores that the largest truckload fleets, as a whole, never returned to the capacity levels they had before the 2008-09 recession. The index is based on truck counts in the fourth quarter of 2006, before the "inventory correction" and "freight recession" that preceded the Great Recession.

The trucking expansion over the past decade, as well as during the COVID-19 pandemic, has favored smaller fleets and independents.

Uber Freight noted some positive signs for truckload demand in its fourth-quarter outlook. Truckload demand increased 1.2% in the third quarter from the second quarter, Danaf said, while real spending on goods rose 0.5% quarter to quarter and was flat year over year.

"We're seeing signs that are encouraging, but it doesn't mean we'll have a recovery in a couple of months," he said. Danaf expects a "gradual lift off the bottom, maybe lower than the historical rate of growth."

The Cass Freight Shipments Index fell 4.7% in October from the previous month, reversing two back-to-back month-to-month gains, and was down 9.5% year over year, Cass Information Systems said Thursday.

"The 2023 peak season is off to a muted start, but we think overall freight volumes are better than those in the for-hire sector measured by Cass data, as private fleet insourcing persists," Tim Denoyer, senior analyst at ACT Research, said in the monthly Cass report.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?