Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 9, 2025

By Tanya Peevey

The recent executive order temporarily halting US offshore wind development creates uncertainty for the industry and could jeopardize the ambitious renewable portfolio standard goals of some states in the Northeast region. With high offshore wind speeds, many states in the region have mandated the procurement of offshore wind generation. Halting offshore wind development will compel states in the PJM Interconnection LLC, ISO New England and the New York ISO to substitute other energy sources, including solar, storage and gas.

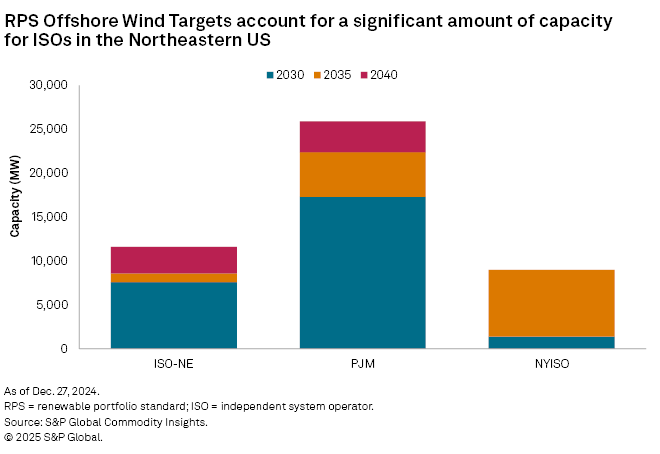

➤ Offshore wind targets of states in PJM total 25.9 GW, accounting for only 13% of the estimated 2040 peak demand, while ISO-NE's 11.6-GW target is 39% of its demand.

➤ More than three-quarters of NYISO's 9 GW of mandated offshore wind capacity is not required until 2035, allowing for a longer timeline to meet renewable portfolio standard (RPS) goals.

➤ States in the Northeast region will leverage solar, storage and gas capacity to compensate for the reduction in offshore wind capacity, with the exact supply mix varying by location.

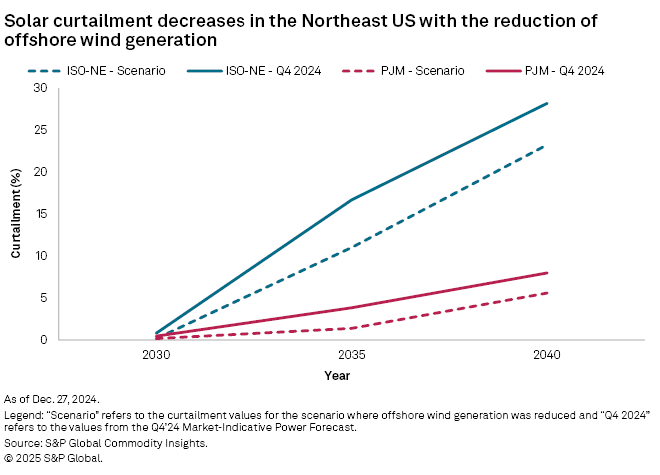

➤ Solar and onshore wind resources stand to gain from the reduction in offshore wind generation, as solar and wind curtailment decreases, increasing energy revenue.

➤ The reduction in offshore wind will delay but not derail states' overarching RPS goals, with RPS mandates being met about three to four years later. However, the share of generation from clean energy remaining relatively stable over the forecast horizon.

State-level offshore wind targets in PJM total a staggering 25.9 GW by 2040, led by New Jersey and Maryland, with respective targets of 11 GW by 2040 and 8.5 GW by 2030. Virginia's offshore wind target of 5.2 GW by 2034 is also included in the PJM target, as the operating Coastal Virginia Offshore Wind (Virginia Offshore Wind Technology Advancement Project) project is interconnected to PJM. While PJM has the most ambitious offshore wind target of the independent system operators considered here, the executive order may not be as disruptive to its energy mix, as its total target in 2040 represents only 13% of estimated peak demand that year.

In contrast, ISO-NE's combined offshore wind RPS target of 11.6 GW across its member states constitutes a substantial 39% of its projected peak demand in 2040. Without offshore wind, ISO-NE will need to supplement energy generation with other renewable sources to meet its RPS goals.

NYISO's target of 9 GW by 2035 accounts for 26% of its estimated peak demand that year. Notably, more than three-quarters of this capacity is not required until 2035, providing NYISO with a longer timeline to achieve its RPS offshore wind targets. Additionally, the interim target of 1.4 GW is expected to be met by 2026 due to existing offshore wind projects currently under construction and those with power purchase agreements. Due to NYISO's long runway, we have not examined changes in its capacity mix in detail.

To understand the potential impact of a reduction in offshore wind generation due to the executive order, we have compared the Q4 2024 Market-Indicative Power Forecast to a scenario that removes existing offshore wind projects without a PPA and assumes that the RPS offshore wind targets are not reached. The total removed planned offshore wind capacity is 0.8 GW in PJM, 1.3 GW in NYISO and 3.9 GW in ISO-NE.

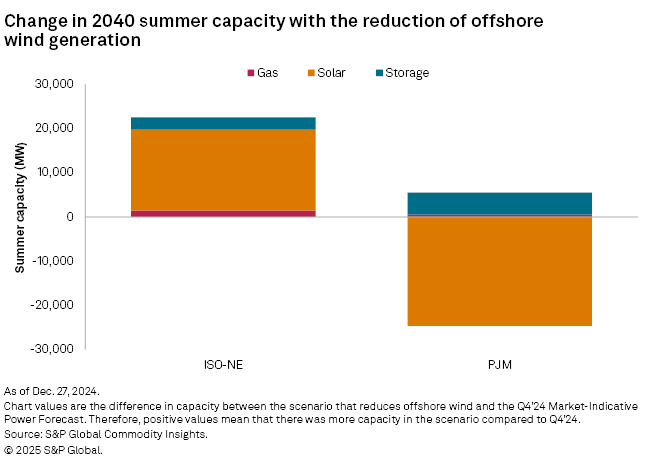

In ISO-NE, the anticipated reduction in the 11.6 GW of mandated offshore wind generation will be more than compensated for by the addition of 18.2 GW of solar capacity and 2.7 GW of energy storage. Onshore wind capacity remains the same between the two forecasts. The region benefits from a steady supply of onshore wind, nuclear and hydroelectric generation, along with healthy reserve margins at the forecast's outset. This diverse energy mix means that no additional gas capacity is necessary to maintain reliability; instead, 1.4 GW of existing gas remains online. The increased solar penetration will enhance arbitrage opportunities, leading to more frequent charging and discharging of storage systems.

For NYISO, the change in capacity and generation is very similar to what is shown in ISO-NE, with 10 GW of solar capacity added and 1.2 GW of gas not retiring. This offsets the 9.0 GW of reduced targeted offshore wind capacity but reduces the reserve margins, as the effective load-carrying capacity (ELCC) of solar is less than that of offshore wind.

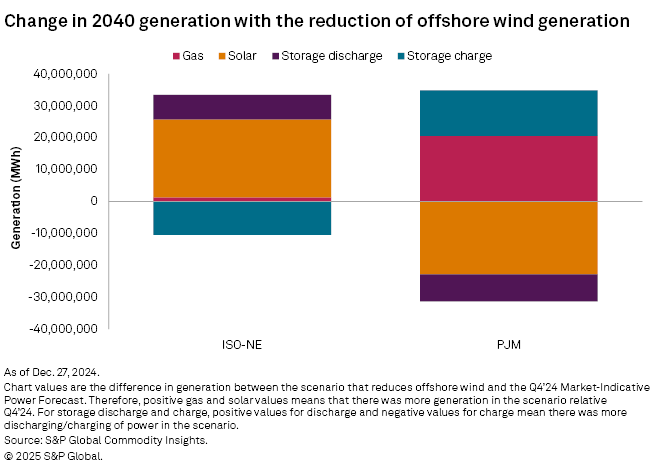

PJM is forecast to generate 25% of its energy from wind by 2040 and maintain an 18% reserve margin, just above the 17.8% target. In comparison, ISO-NE boasts a higher generation share of 50% from wind and a more robust 34% reserve margin. Due to tighter reserve margins and lower wind penetration, PJM will need to construct an additional 0.5 GW of gas capacity and 5.0 GW of storage capacity to compensate for the decrease in offshore wind generation during non-sunny hours. About 10 GW of additional onshore wind capacity will also need to be built, but with a nearly 26-GW loss of renewable capacity from removing the RPS offshore wind mandate, this is still a net reduction in wind generation.

This change in the supply mix means a shift from hybrid solar to stand-alone storage is required for reliability, ultimately reducing solar capacity and shifting the amount of charging and discharging that typically capitalizes on lower daytime energy prices to the overnight hours. The forecast reserve margins remain stable, as the gas and storage capacity needed for reliability lessens due to their higher ELCC values compared to solar and wind.

The impact of reduced offshore wind generation is more pronounced in PJM, where changes in gas generation are significant. Existing and previously forecast gas plants benefit from the decrease in offshore wind resources. In ISO-NE, where onshore wind is plentiful, solar power plants see greater revenue benefits, driven by increased storage arbitrage and a notable uptick in solar output. Solar plants in NYISO would also see greater revenue benefits as their generation increases.

Reduced offshore wind will delay but not derail states' overarching RPS goals. Connecticut and Massachusetts in ISO-NE and the District of Columbia, Delaware and New Jersey in PJM will meet their RPS mandates three to four years later.

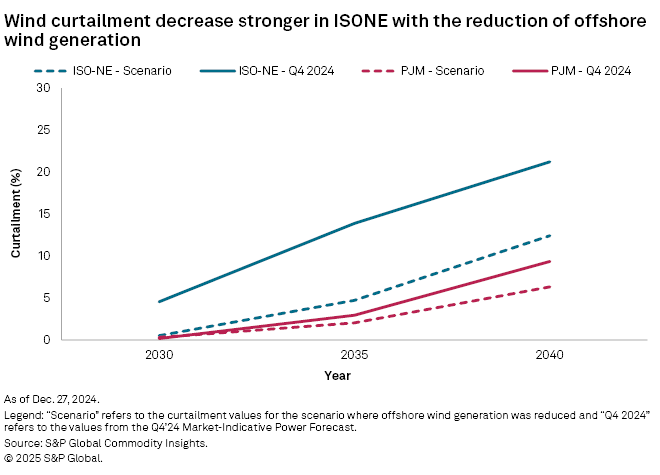

The reduction in offshore wind generation within ISO-NE creates headroom for solar and wind generation, decreasing their curtailment. In the current scenario, wind curtailment is expected to be 12% by 2040 — a decrease of 9 percentage points — while solar curtailment decreases by 5 percentage points.

For PJM, curtailment levels were already low, and the need for new capacity driven by datacenter load increases means that tighter reserve margins are anticipated in the near term. The removal of offshore wind resources reduces wind curtailment and the associated decrease in solar capacity contributes to lower solar generation curtailment.

Both solar and wind resources in PJM and ISO-NE stand to gain from the reduction in offshore wind generation, as more of their output is likely to be needed by power end users, thus increasing energy revenue.

Even with the reductions in curtailment, the percentage of total clean energy generation remains relatively stable in ISO-NE over the forecast horizon, while PJM experiences a slight decrease due to increased gas generation compensating for the loss of overnight power from offshore wind sources.

Offshore wind development was already facing challenges post-COVID, as contracts needed renegotiation to adapt to the economic climate of supply chain disruptions and cost increases. Notable examples include Boardwalk Offshore Wind (Empire Wind 1) (Rockaway Peninsula), Sunrise Wind I & II Offshore Farm (Holbrook) and, more recently, Atlantic Shores Offshore Wind LLC.

President Donald Trump's shift in energy policy relative to his predecessor has created additional uncertainty for investors in renewable energy. The Jan. 20, 2025, executive order pausing offshore wind development has had immediate consequences, such as objections from the Save Long Beach Island group, resulting in the Environmental Appeals Board remanding the Atlantic Shores Environmental Protection Agency (EPA) Clean Air permit. The EPA requested this remand to reevaluate the project, with the offshore wind Presidential Memorandum providing context and support for the request.

Moreover, the Trump administration's interior secretary issued a new order in April, directing the Empire Wind 1 offshore wind project's construction to be halted, directly challenging the state of New York's energy policies.

Despite these challenges, owners of projects that are either under construction or not scheduled for completion until 2030 or later and/or are slated to supply power to states with a favorable view of offshore wind remain confident in their investments.

The temporary halt in offshore wind development poses challenges for Northeast states striving to meet their RPS goals. The ripple effects will be felt across the energy landscape as investors and operators adjust their strategies and supply mix in response to changing conditions.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Adam Wilson contributed to this article.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Data visualization by Joseph Reyes and Chris Allen Villanueva. Cartography by Leigh Lunas.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Theme

Location

Products & Offerings

Segment