Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Jul, 2016 | 09:00

Highlights

After five years, nickel's fortunes may be at a turning point...

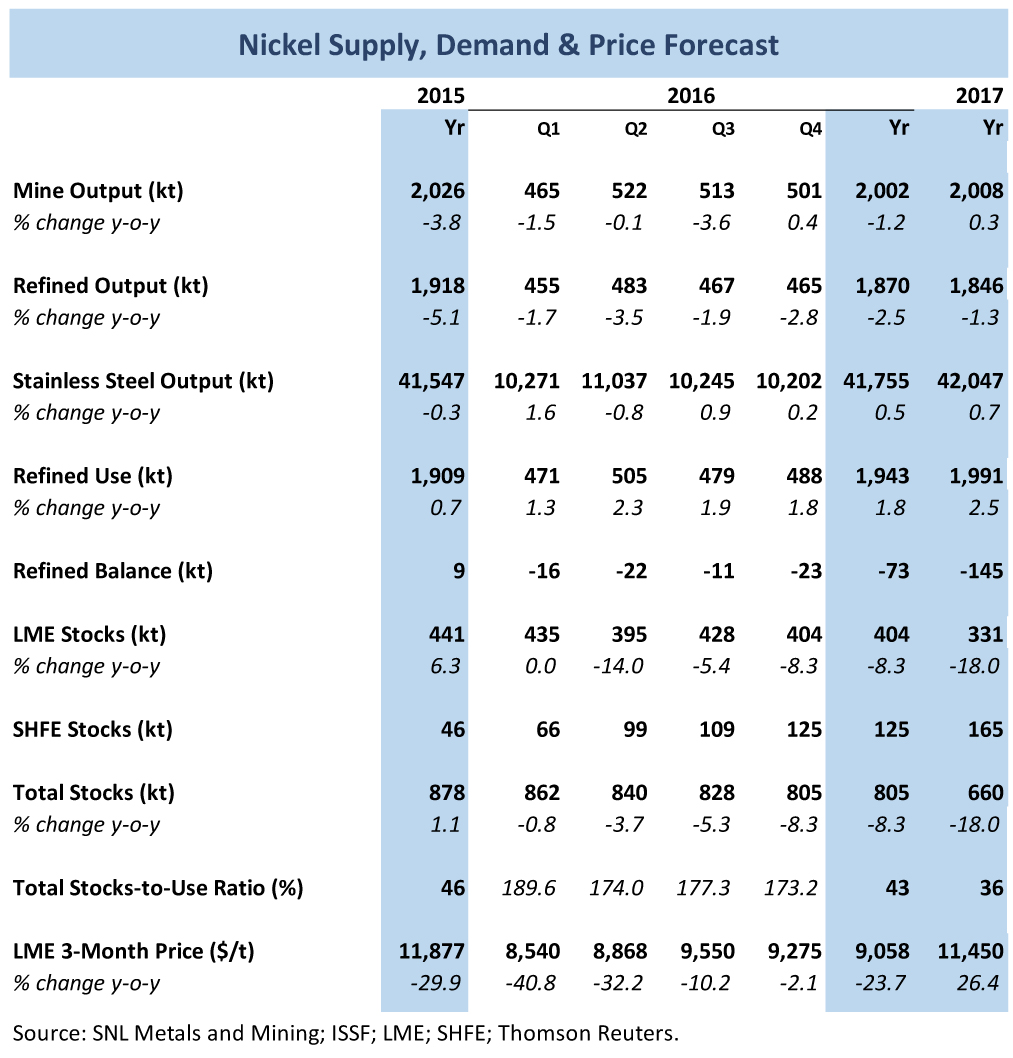

We forecast that three-month prices on the London Metal Exchange will average US$9,058/t this year and US$11,450/t in 2017.

Nickel prices have broken through US$10,000/t, and a new monthly report by SNL Metals & Mining, a group within S&P Global Market Intelligence, is positive on the metal's prospects over the next 18 months. In the recently published Nickel Briefing Service, we forecast that three-month prices on the London Metal Exchange will average US$9,058/t this year and US$11,450/t in 2017.

The nickel market has suffered a difficult past five years, with the price falling from a peak of almost US$30,000/t in early 2011 to a low of US$13,000/t in 2013. After a recovery to over US$21,000/t in May 2014, the price more than halved in a two-year period, bottoming at just under US$7,600/t in February this year.

The price has rallied over the past five months, and reached a nine-month high in mid-July amid expectations of supply cuts in the Philippines, which is the world's largest producer of nickel ore, with some 135,000 t of contained metal in the June quarter.

Our analysts expect the greater environmental scrutiny announced by the new Philippine government to result in a decline in ore exports. Operations have already been suspended at two nickel mines, and the government has stopped issuing new exploration permits as part of its environmental crackdown.

Globally, we expect accelerating cuts in metals output, coupled with improving demand, to push the nickel market into a deficit of 73,000 t this year, deepening to a shortfall of 145,000 t in 2017.

However, despite some of the more positive factors impacting the nickel market, in the near term these are expected to make a relatively small dent in global stocks of the metal. After nearly a decade of market surpluses, we estimate total nickel stocks at 840,000 t, of which the LME holds 380,000 t and the Shanghai Futures Exchange 97,000 t. These stocks represent 22 weeks of consumption, compared with an average of 12 weeks of consumption over the previous five years.

While nickel prices look set to make gains over the next year, or so, we conclude that the metal is unlikely to regain its previous heights without further fundamental support.

Request more information on our proprietary Metals & Mining research here.