Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 13, 2025

By Tim Zawacki and Husain Rupawala

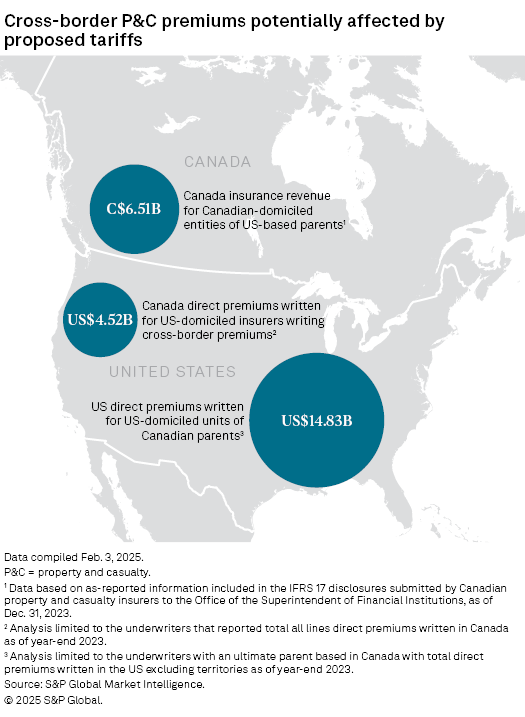

Elevated tariffs on certain auto parts imported from mainland China have contributed modestly to loss-cost inflation for US auto insurers since their first imposition in 2018. Now, though, a more sweeping program — largely but temporarily forestalled prior to implementation on Feb. 4 — poses a potentially broader impact on the industry.

A review of private and commercial auto rate filings collected by S&P Global Market Intelligence finds that companies such as The Allstate Corp. and the group led by Utica Mutual Insurance Co. considered the 2018 tariffs when determining their actuarial indications for certain auto insurance programs.

The new round of tariffs, which impact trade with Canada and Mexico in addition to mainland China, could significantly increase costs for a range of replacement parts. These three markets collectively account for substantial percentages of vehicle bumpers, auto glass and airbags imported into the US. Any tariff-driven decline in North American cross-border commerce could also have macroeconomic fallout that impacts the flow of goods and, consequently, demand for commercial transportation, potentially hindering premium growth.

Either development would be unwelcome at a time when the industry has been making considerable progress in using rate and non-rate actions to address pandemic-era loss-cost inflation, which stems from multiple sources.

Supply chain concerns resurface

A combination of factors caused US private auto incurred losses to spike from the second half of 2021 through the end of 2023. Prominent among them were supply chain challenges as countries implemented varying levels of public health restrictions to mitigate the spread of COVID-19.

Prolonged factory closures, port congestion and other factors led to significant delays in the availability of parts to repair damaged vehicles. This, in turn, contributed to increased loss severity due to the extended time often required to resolve otherwise routine claims. As a result, some repairable vehicles were written off entirely. Even as supply chain issues dissipated, loss-cost inflation persisted as claims frequency returned to pre-pandemic levels and labor-related expenses rose.

Private auto loss ratios materially improved for the industry through the first three quarters of 2024. We have projected that several prominent carriers' stellar results will lead the business line back to underwriting profitability for the full calendar year. Carriers have largely achieved this improvement through significant increases in earned premiums resulting from multiple rounds of rate increases for most programs and geographies, at a time when incurred losses have largely stabilized. While used vehicle values have declined from their pandemic peaks, the US Consumer Price Index component measuring the cost of motor vehicle maintenance and repair has continued to reach new all-time highs.

Although the single cause of tariffs on China, Canada and Mexico may not be enough to stymie the industry's progress, their impact would likely not be immaterial either, given the relative prominence of each of those countries in the US automotive supply chain.

Trade data compiled by S&P Global show that the three countries accounted for 82.3% of the $1.09 billion worth of US imports of front windshields, rear windows and other automobile windows through the first 11 months of 2024. They were also responsible for 46.4% of the $1.48 billion in US imports of motor vehicle bumpers and related parts.

Allstate notably incorporated the Trump administration's imposition of tariffs on one particular category of goods imported from mainland China in the late 2010s when setting loss trends in various private auto rate filings. Under the Trade Act of 1974's Section 301, "Trade Remedies to be Assessed on Certain Products from China," the administration set tariffs on various auto parts and other items first at a level of 10% in 2018 and then at 25% in 2019.

The company's 9.6% adjustment to its non-catastrophe losses in the comprehensive coverage as outlined in a 2020 Nebraska filing, for example, was based on the following inputs: 1) 55% of auto glass being imported from China, 2) 70% of glass-related losses stemming from parts, 3) an estimate of 38.5% of glass losses affected by tariffs and, ultimately, 4) multiplying 38.5% by the amount of the tariff instituted. The effect of this adjustment was minor, however, as the company's selection of ultimate losses and loss adjustment expenses for the comprehensive coverage in accident year 2019 accounted for less than 1.7% of its selections across all coverages.

Hypothetically applying the same methodology to all physical damage coverages, a 9.6% increase in private auto physical damage direct incurred losses at the industry level in the third quarter of 2024 would have increased the overall private auto loss ratio for the period to nearly 67.0% from an as-reported result of 64.5%. This is likely an overstatement given that the prevalence of imported auto parts — aside from auto glass — from Mexico, China and Canada may be lower, and labor may constitute a higher share of losses stemming from other types of damage.

Allstate indicated in the 2020 filing and various conference calls in the late 2010s that it was monitoring the loss-cost impact of tariffs on other items, including metallic parts. The tariffs notably took effect during an otherwise favorable time in the private auto underwriting cycle. We are arguably at a similar point in the current cycle, and The Travelers Cos. Inc. executives said during a Jan. 22 conference call that they are principally focused on rate adequacy in the private auto business as opposed to trying to predict the hypothetical financial impact of tariffs.

Some commercial auto writers also accounted for the impact of tariffs in their trend selections in the past. American Resources Insurance Co. Inc., in a 2018 Tennessee filing, proposed a new loss-cost multiplier in the comprehensive and collision coverages.

Members of the Utica National group, for example, indicated in a 2023 Georgia filing that prior to the tariffs taking effect, the company adjusted losses upward for accident years by 3.8% in the physical damage, comprehensive and collision coverages to account for a variety of developments, including the company's expectation that tariffs on imported auto parts "will further increase future repair bills" and "take several years to be accounted for in loss experience."

A top-line toll

According to the US Bureau of Transportation Statistics, there were more than 7 million inbound border crossings by trucks at land ports along the US/Mexico border in 2024 and more than 5.1 million such inbound crossings along the US/Canada border. Both figures represented declines from 2023 activity, but traffic trends have varied significantly. Inbound US/Mexico crossings by trucks hit a new high of nearly 7.4 million in 2023; inbound US/Canada crossings by trucks have generally trended lower for decades after peaking at more than 7 million in 2000.

Trucking industry associations in the US and Canada warned tariffs could reduce freight volumes and significantly boost operating costs. The American Trucking Associations said that a 25% tariff on goods imported from Mexico could cause the cost of a new tractor to spike by as much as $35,000, adding to a series of fiscal challenges that carriers have faced in recent years from higher labor costs and rising liability insurance premiums.

To the extent tariffs triggered a material reduction in demand for cross-border freight traffic, some commercial auto policies may include so-called lay-up credits that can be applied to vehicles that have been parked for extended periods of time (typically a minimum of 30 to 90 days, depending on the policy and insurer) due to unforeseen circumstances. A number of insurers issued lay-up credits on commercial fleets during the spring of 2020 during the COVID-19 pandemic, for example.

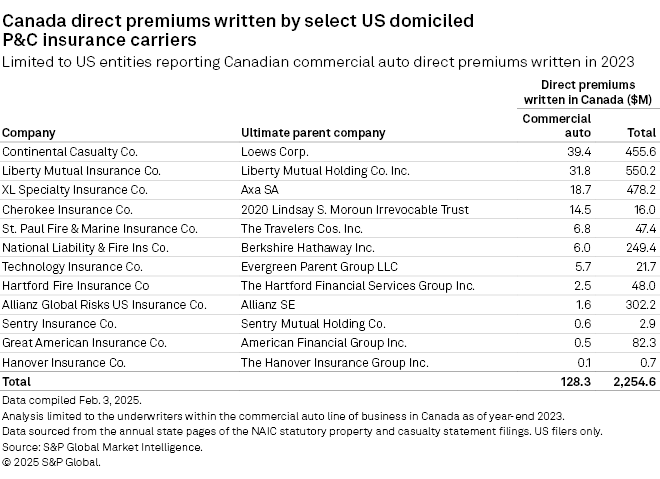

The largest US commercial auto insurers based on 2023 direct premiums written were The Progressive Corp., Travelers, Liberty Mutual Holding Co. Inc., Old Republic International Corp., and Zurich North America. Travelers' St. Paul Fire and Marine Insurance Co. and Liberty Mutual Insurance Co. were two of the 12 US-domiciled insurance companies that reported some amount of commercial auto direct premiums written in Canada in 2023.

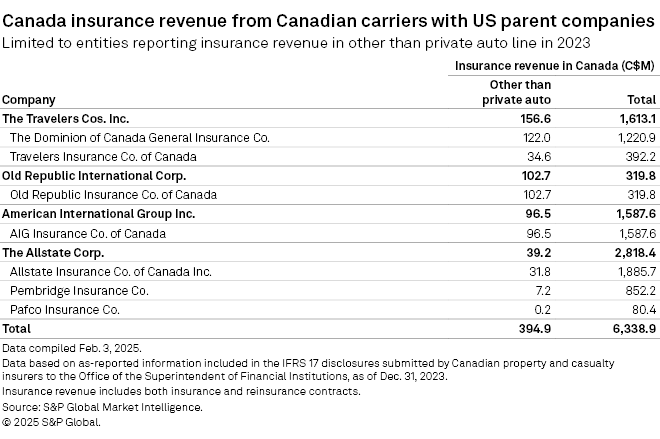

Travelers and Old Republic were two of the four US parents of Canada-domiciled insurers that reported writing other-than-private auto insurance business in 2023. Travelers Insurance Co. of Canada and Dominion of Canada General Insurance Co. combined for C$156.6 million of revenue from that line, and Old Republic Insurance Co. of Canada was responsible for C$102.7 million in volume.

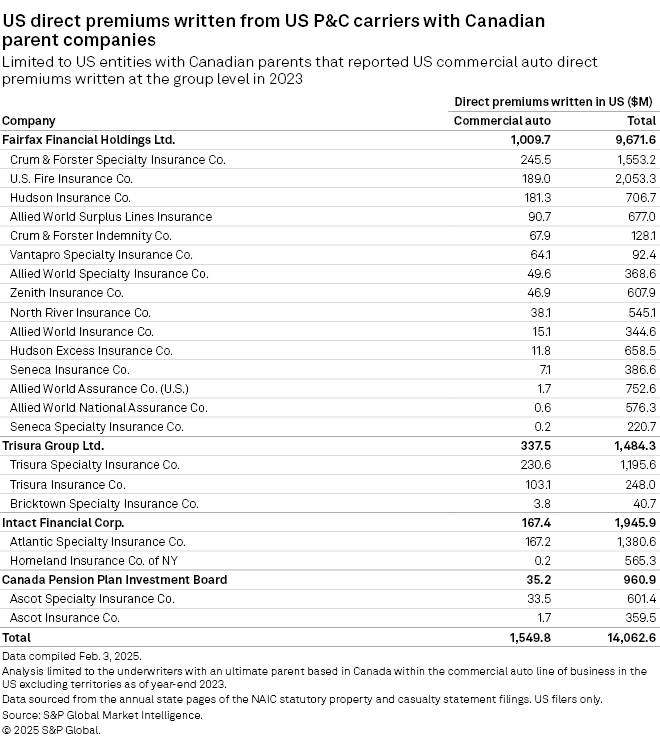

Several US P&C groups with Canadian parents maintained a meaningful presence in the US commercial auto market. The various US-domiciled subsidiaries of Toronto-based Fairfax Financial Holdings Limited combined to rank as the No. 16 US commercial auto writer based on 2023 direct premiums written. Trisura Group Ltd. and Intact Financial Corp., each of which is also headquartered in Toronto, generated $337.5 million and $167.4 million, respectively, in US commercial auto premium volume from their US subsidiaries.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.