Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Case Study — Feb 06, 2025

THE CLIENTS

THE USERS

MARKET CONTEXT

According to S&P Global Ratings research, global structured finance issuance, including covered bonds, hit $1.3 trillion in 2024, representing a 30% year-over-year increase. In the United States, structured finance issuance surged 65% to $771 billion, driven by increased securitization as issuers respond to potential regulatory changes affecting banks.[1]

This growth was not without risks. On the CLO front, the latest credit ratings research maintains a positive outlook for leveraged credit performance due to improving credit metrics and expected interest rate cuts. However, the article suggested caution due to sector dispersion and geopolitical risks and noted a pronounced dispersion in CLO across sectors and rating levels[2]. Within the US Broadly Syndicated Loans segment, 21.2% of CLOs were rated B- and below, and 18.6% have a negative outlook (see below).

B- Exposure (%) and Ratings Bias information on US CLOs on broadly Syndicated Loans

Source: From US CLO Insights | Broadly Syndicated Loans dashboard on RatingsDirect® on CIQ Pro, from S&P Global Market Intelligence. As of February 2025. For illustration Only

PAIN POINTS

All these indicate a need for closer credit surveillance for this growing CLO asset class. For example, clients are looking to:

SOLUTIONS

Source: Creditpro® from S&P Global Market Intelligence, as of February 2025.

For illustration Only

CreditPro®, available on desktop, XpressAPI, API Drive, Snowflake and XpressfeedTM,

tracks credits in transitions, defaults and recoveries of structured finance and the underlying industry-sectors. This dataset covers 17,000+ corporates and financial institutions, and over 120,000 structured finance issues. Users can drill down into ratings transitions and default trends of speculative grade rated entities by country and industry.

RatingsDirect® is reinvented on S&P Capital IQ Pro.

Users can now access S&P Global Ratings' new and existing content and improved analysis and surveillance tools on the platform, alongside S&P Capital IQ Pro features² and differentiated data through combined core pages and reimagined functionality, achieving powerful insight.

Thematic Research structured finance and private markets / CLOs include

Some of this research is featured in the "Hot Topics" page. This section typically highlights significant events, changes in credit ratings, and emerging issues that may impact various sectors or individual entities - offering a curated overview of critical information that can aid in decision-making and analysis.

Source: RatingsDirect® on S&P Capital IQ Pro, S&P Global Market Intelligence, as

of February 2025. For illustration only.

Credit Monitor on RatingsDirect® on CIQ Pro is a powerful tool for to more efficiently surveil a list of companies (e.g. all rated entities within an industry-sector in a country), securities. With Credit Monitor, you can access the latest updates at the portfolio level, identify the top risks, and start your analysis with just a few clicks.

A portfolio-level Overview of US speculative grade rated technology issuers, the number of credit ratings upgrades outnumbered downgrades over the past three months. However, Outlook/Watch Negative entities outnumber Outlook/Watch positive by 4:1.

Source: Credit monitor as part of RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

Furthermore, looking back at the past year, the number of downgrades in the sample of speculative grade rated technology entities outweighed upgrades over the past year (see Ratings Distribution & Migration below).

Source: Credit monitor as part of RatingsDirect on CIQ Pro®, as of

February 2025. For illustration Only.

Drilling down into individual entities from the above list, the Credit Monitor features enhanced visualization and analytics via CreditStats Direct® dashboard. This view is enhanced with color-coded quartiles, flagging entities whose benchmarks that fall below or exceed S&P Capital IQ peers.

Source: RatingsDirect® on S&P Capital IQ Pro, S&P Global Intelligence, as of February 2025. For illustration only.

When used in combination with Outlook Financial Thresholds, key metrics and thresholds that clients monitor that can potentially indicate significant changes in credit quality. These thresholds are extracted from the upside and downside scenarios of research articles for rated Corporates. Users leverage these triggers to effectively monitor the credit risk of one or more entities, enabling informed decision-making.

Source: Credit monitor as part of RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

Clients with CIQ Pro subscription can access related Events, Company Filings, Investor presentations and Key Developments are integrated into the landing page (see screenshot below).

Source: Credit monitor as part of RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

CLO Capabilities on RatingsDirect® on CIQ Pro

We have recently launched new CLO visualization tools that summarize the CLO market trends and credit quality of the cumulative debt obligations. For example, in the screenshot below, which is extracted from “US CLO Insights” page (link here). The aggregated data presented here is based on a sample of S&P Global Ratings’ rated CLOs from January 2024 onwards; and compares the performance of Broadly Syndicated Loans pre- and post-pandemic.

Source: US CLO Insights is part of RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

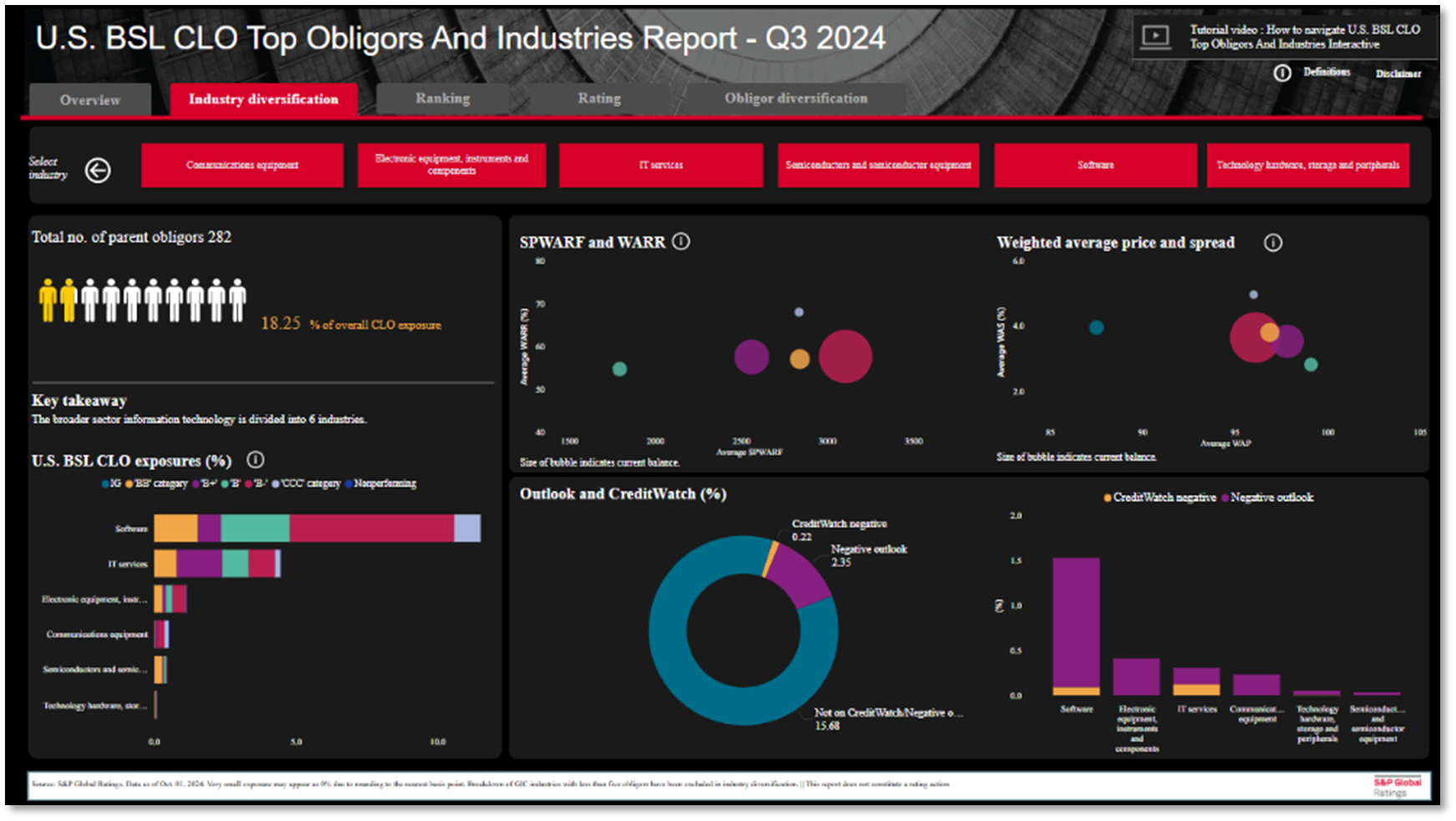

We have developed dynamic visualization tools off our U.S. BSL CLO Top Obligors and Industries quarterly publication (latest report linked here), covering the top 250 obligors representing half of the assets under management across U.S. BSL CLO exposures rated by S&P Global Ratings. It provides descriptive information on ratings distribution by ranking (see screenshot below).

Source: RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

Users can drilldown into individual industries or sectors (see illustration below with the technology industry), with informaiton on parent obligors, credit ratings distributions, risk factors (default risk and recovery) and pricing & credit spreads between loan price and par value.

Source: US BSL CLO Top Obligors And Industries Report – Q3 2024, part of RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

The upgraded Structured Credit (Including CLO) landing page on RatingsDirect® on CIQ Pro highlights key credit trends relating to your filtered domicile of assets and collateral types.

Source: RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

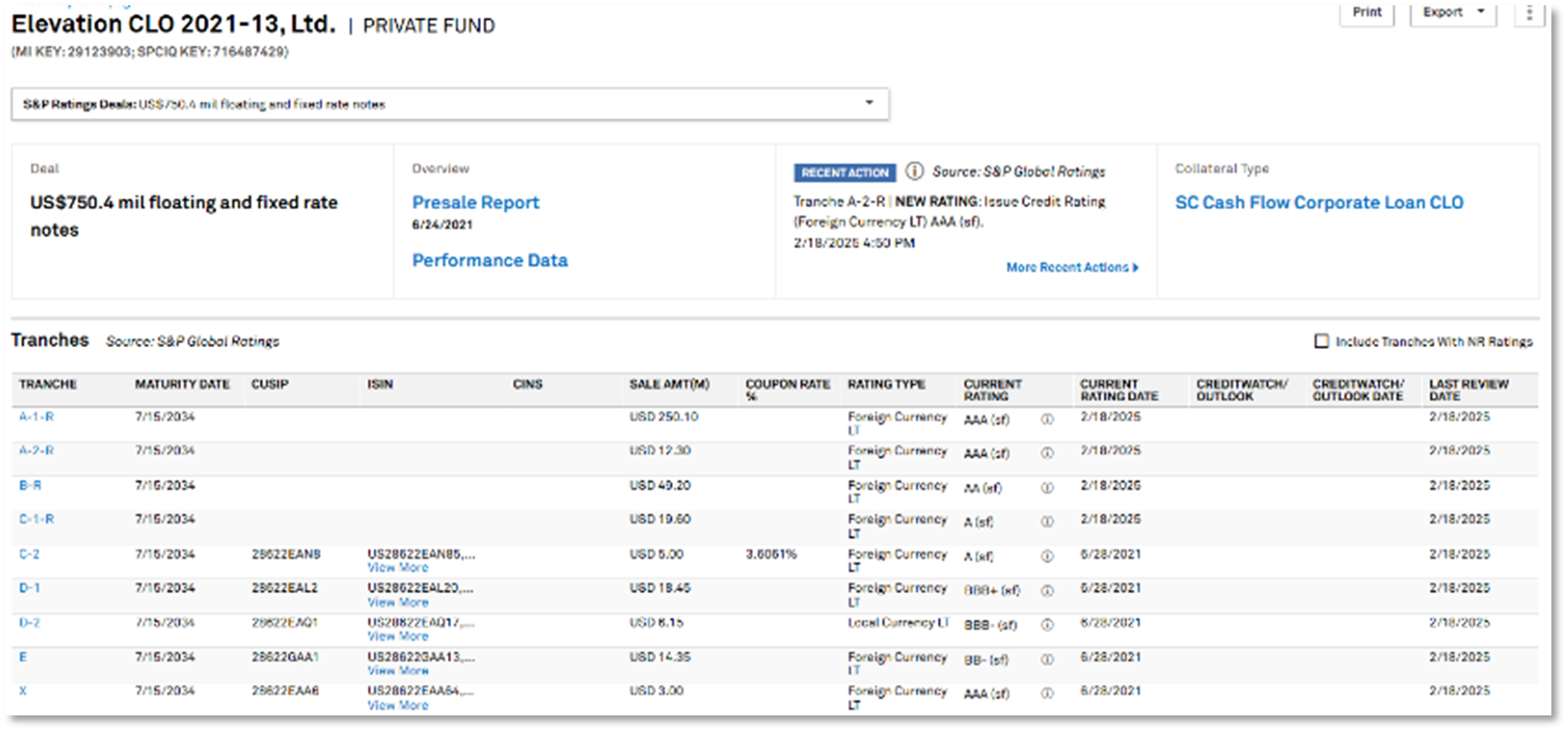

You can use this landing page to conveniently drill down into individual deals, with descriptive and tranche information.

Source: RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

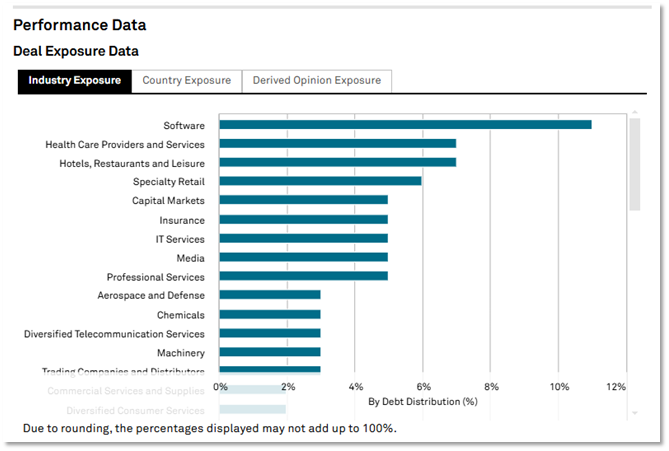

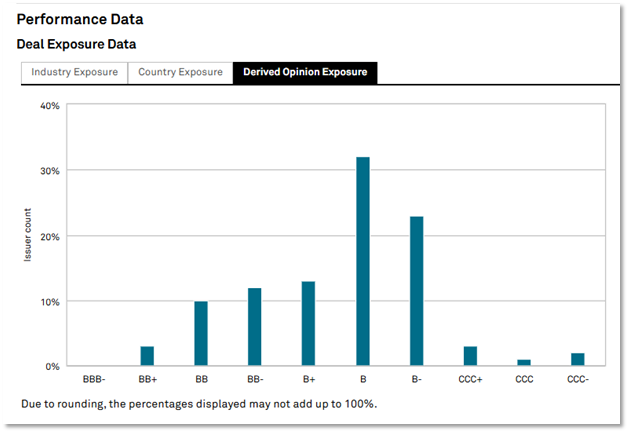

Deal level data offers transparency around its Industry Exposure and Derived Opinion Exposure

Source: RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

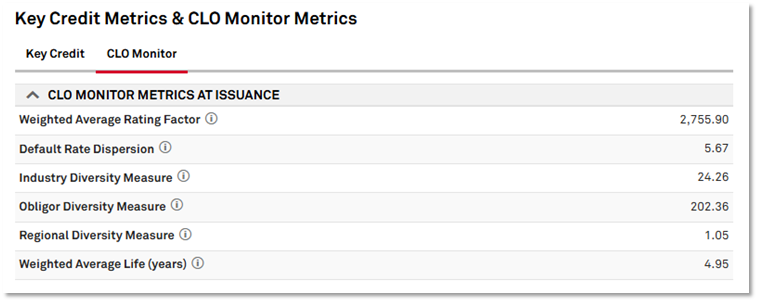

Plus, a deep dive into Key Credit Metrics and CLO monitor metrics of the deal

Source: RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

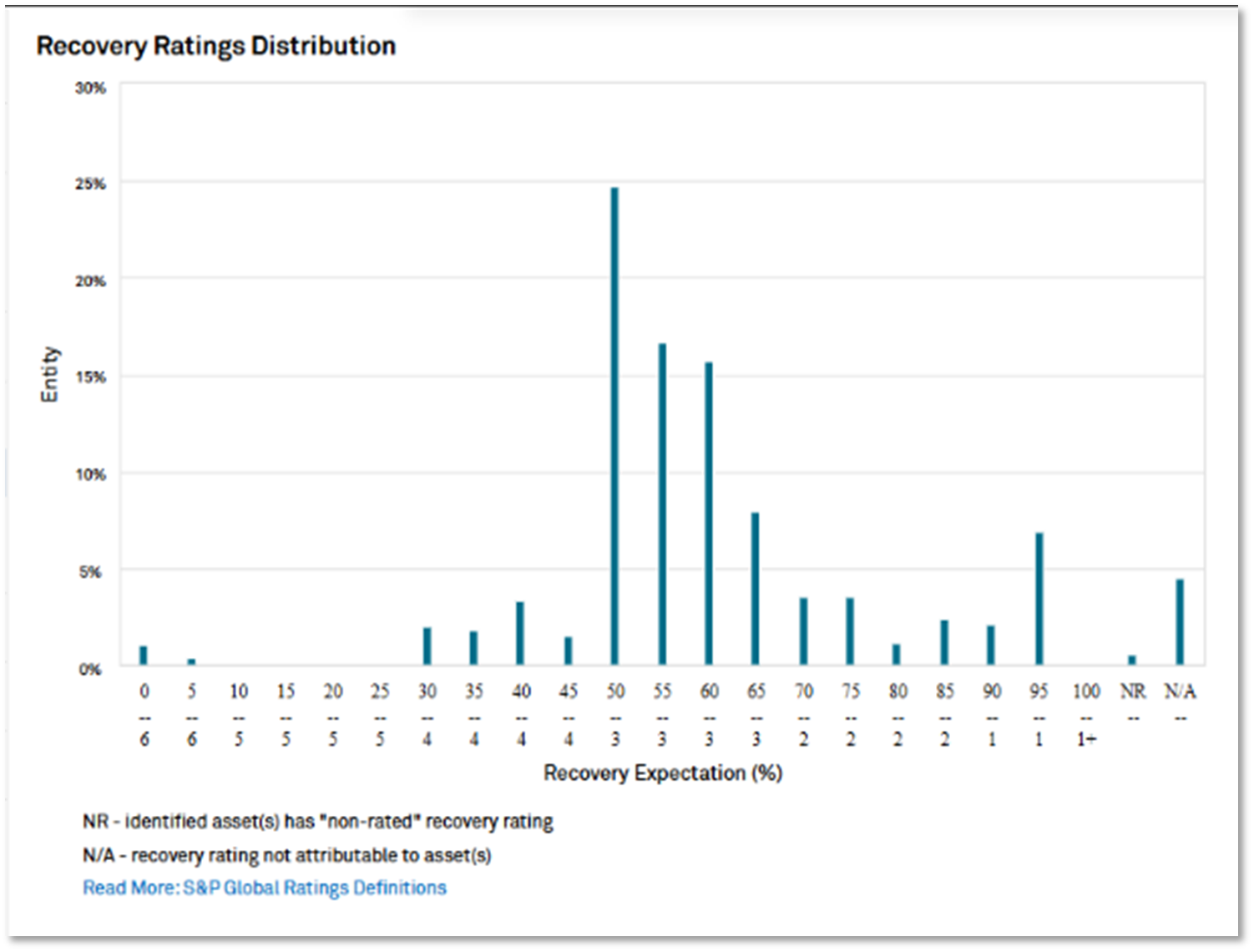

Finally, the Recovery Ratings Distribution and underlying research offers an opinion on the expected recovery in the event of a payment default on a specific issue.

Source: RatingsDirect on CIQ Pro®, as of February 2025. For illustration Only.

Related capabilities and Insights:

BENEFITS

The enhanced CLO workflow

Credit Monitor

Content Type

Products & Offerings

Segment