Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jan 18, 2022

Calendar Week of 1/17/2022 (Martin Luther King Jr. Day Holiday)

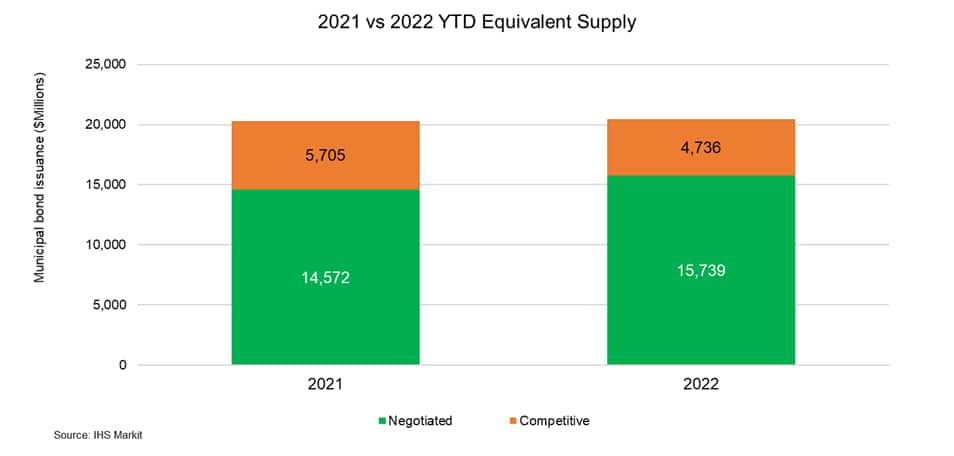

Primary supply will resume over the course of a Holiday-shortened week as state and local issuers navigate evolving economic conditions coupled with unexpected setbacks stemming from the pandemic. Investors continue to dedicate focus towards economic data following the most recent consumer price index figures for December which posted 7%, marking accelerated inflation levels witnessed during the early 1980s. The sharp rise in inflation continues to present challenges for individuals and businesses across the nation, resulting in sharp increases for basic goods and services, coupled with weaker supply activity across various sectors. Regardless of supply chain constraints and lackluster employment levels, a main driving factor of current inflation is correlated to the flood of federal cash injection over the course of the pandemic which has weakened purchasing power while predominantly supporting gains across equities. Rampant inflation has presented a change of tone from the fed, who originally viewed inflation as a transitory phase, impacting monetary and fiscal policy decisions while participants now forecast up to seven rate hikes throughout the course of the year in an effort to combat economic downfalls. As market participants prepare for rate hikes, US treasuries and munis continue to witness weaker performance as yields widen across the curve, highlighted across muni benchmarks which bear flattened by 5-9bps over the course of last week, resulting in the 10YR and 30YR Muni/UST ratio hovering at 67% and 79% respectively. With benchmark yields expected to climb, issuers may accelerate pricing activities in order to take advantage of opportunistic borrowing levels to reduce financing expenditures, potentially fueling larger primary volumes across the first quarter as issuers seek to lock-in lower borrowing rates. Despite higher yields across various credits and sectors, institutional and retail demand for muni paper continues to run strong, highlighted by oversubscribed new issue deals as buyside players put cash to work across safe haven investments, with munis presenting a superior option for low-risk appetite investors seeking capital preservation.

Buyside demand for new issue paper remains in-tact after last week's calendar provided $10.9Bn of par ($) size for institutional participants, marking greater supply to complement overarching investor demand registered across the primary market. The State of Louisiana (Aa2/AA-/-) represented one of the larger negotiated deals from last week, selling $621mm of taxable gasoline and fuel tax revenue refunding bonds, spanning across 05/2022-05/2041, with noteworthy bumps of 10-25bps witnessed throughout the scale given robust investor demand. The Comal Independent School District, TX (Aaa/-/-) also priced in the negotiated arena last week, offering $419mm unlimited tax school building bonds spanning across 02/2023-02/2047 with MAC spreads of +16bps registered in the 10YR maturity, given bumps of 1-5bps noted across the scale, with the greatest bumps noted in the short term durations. This week's Holiday-shortened calendar is slated to provide $8.1Bn of new issue paper, spanning across 182 deals with the New York City Transitional Finance Authority (Aa1/AAA/AAA) leading the negotiated calendar to sell $950mm of future tax secured subordinate bonds across 02/2024-02/2051 on Thursday 01/20 with JP Morgan listed as the book running manager. The New Jersey Transportation Trust Fund Authority (Baa1/BBB/BBB+/A-) will also tap into the negotiated arena to sell $750mm of transportation program bonds spanning 06/2031-06/2050 with ~$385mm of bonds housed in longer dated maturities. This week's competitive calendar will span across 105 new issues for a total of $1.63Bn, led by Fairfax County, Virginia (Aaa/AAA/AAA) auctioning $272mm of public improvement bonds across 10/2022-10/2041, selling on Wednesday 01/19.

Posted 18 January 2022 by Matthew Gerstenfeld, Municipal Bond Business Development Specialist, IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.