Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Jun, 2017 | 11:15

Highlights

The following post comes from Kagan, a research group within S&P Global Market Intelligence.

To learn more about our TMT (Technology, Media & Telecommunications) products and/or research, please request a demo.

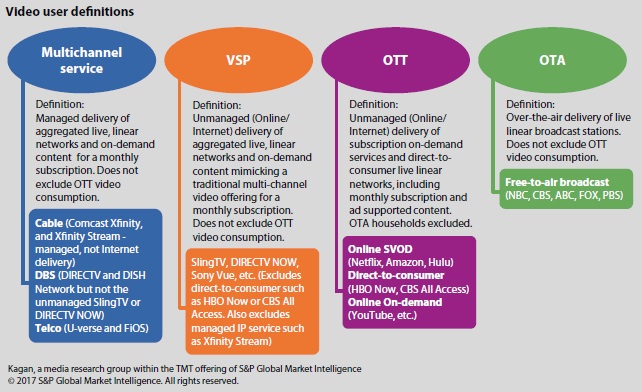

The intensifying erosion of traditional multichannel subscribers in the U.S. is further splintering a video landscape in which streamed bundles, online subscription services, self-aggregation and even over-the-air delivery are playing more prominent roles.

The inexorable impact of changing consumption habits have multichannel service providers bracing for mounting losses, while virtual service providers (VSPs) are lining up to capitalize, despite their own economic challenges and over-the-top options taking advantage of the inflection.

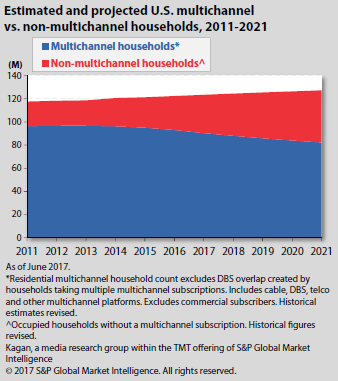

Estimated and Projected U.S. Multichannel vs. Non Multichannel HHs (2011 to 2021)

The frenetic transformation has amplified the conditions for change and instability in the market, according to the latest segmentation of video delivery options among U.S. households from Kagan, a media research group within S&P Global Market Intelligence.

While households with a traditional multichannel subscription are positioned to remain in the solid majority in the five-year outlook, upward momentum lies firmly with alternative services, which combined account for a non-multichannel tally on pace to exceed one quarter of occupied households in 2017, and crest one third by 2021.

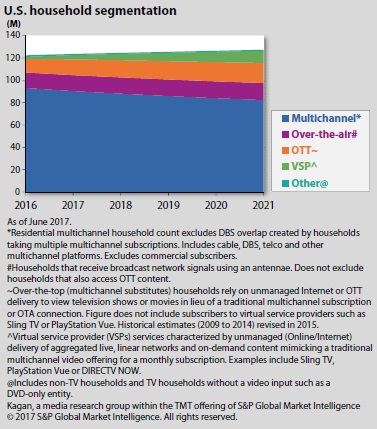

U.S. Household Segmentation

The segmentation of non-multichannel households includes three primary subgroups: OTT-only, VSP, and OTA households. The key directions in the outlook ended 2021 are as follows: