Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 17, 2022

By Lewis Cooper

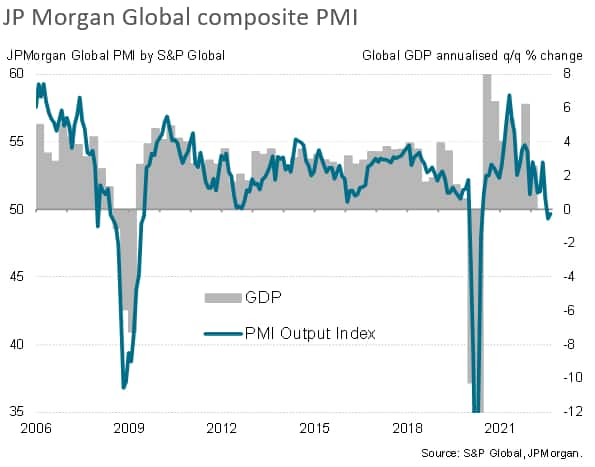

September saw the level of global economic activity contract for the second successive month, as output fell more quickly at manufacturers but stabilised at service providers. However, the rate of overall decline eased slightly since August, reflecting a marked easing in the downturn in the US and return to growth in Japan.

The J.P.Morgan Global Composite Output Index - produced by S&P Global - posted 49.7 in September, up from August's 26-month low of 49.3.

National PMI data highlighted downturns in the US, the euro area (with only France among the big-four EA economies to see expansion) and the UK. Output rose in Japan, Brazil, Russia and Australia.

The level of incoming new business was unchanged during September, as a further decrease in manufacturing was offset by a modest increase at service providers. The trend in new export orders remained a drag on overall new work intakes, declining at the steepest pace since June 2020. Decreases were seen in both the manufacturing and service sectors, with the sharper downturn in the former. The US, the euro area, Japan, the UK and Brazil were among the larger economies to see new export business fall.

Cost pressures globally remain elevated, though trends vary by region. While cost inflation showed further signs of moderating in the US and many emerging markets, helping support demand in some cases, inflationary pressures intensified in Europe due to the energy crisis. These varying inflation pressures played a part not only in driving disparities in current demand conditions, but also greatly affected future output expectations, which have deteriorated markedly in Europe.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location