Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 07, 2022

By Jingyi Pan and Chris Williamson

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

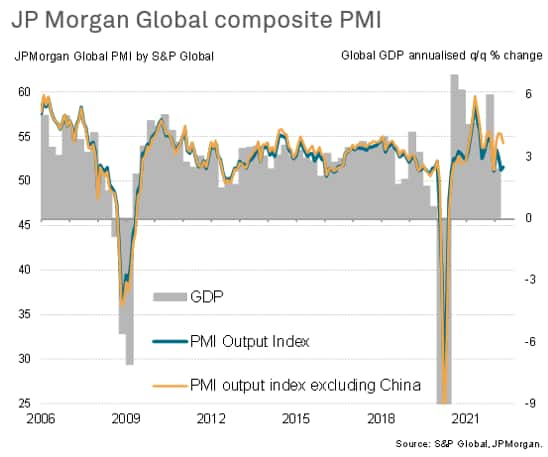

The global economy expanded for a 23rd straight month in May, according to the JPMorgan Global PMI™ (compiled by S&P Global), with the rate of growth accelerating for the first time in three months as the lockdown-driven downturn in mainland China showed signs of easing.

The rate of growth was nevertheless amongst the weakest so far during the pandemic recovery period as the downturns that have afflicted the Chinese and Russian economies continued to weigh on global output. Excluding China, the global PMI registered 54.3, indicative of a more impressive annualised GDP growth rate of 3.5%. Certainly, signs have pointed to the worst being over for China with the Caixin composite PMI, compiled by S&P Global, rising to 42.2 in May from 37.2 in April. But questions remain with respect to how quickly China will rebound from here, and how will the easing of restrictions play out on both the demand and supply side.

As far as May PMIs are concerned, services activity continued to buoy overall global growth amid looser COVID-19 restrictions. That said, service sector recoveries may lose momentum in coming months as pent-up demand fades. Meanwhile manufacturing performance remained subdued, with global output falling for a second straight month, affected primarily by falling Chinese production. The release of pent-up demand as mainland China eases restrictions may bode well for overall demand and ease supply constraints, though it will be important to weigh any consequent price pressures.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.