Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 07, 2023

By Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

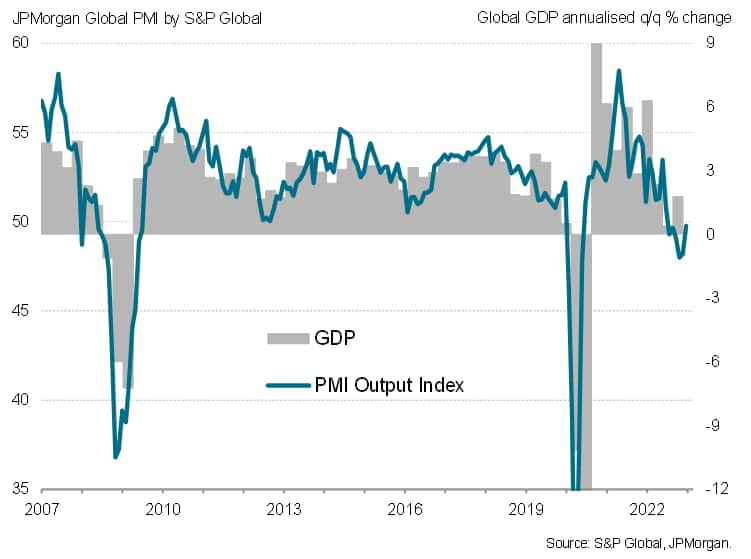

The global downturn persisted for the sixth straight month at the start of the new year though the rate of decline eased to only a marginal pace to indicate that the downturn had further eased. Weakness in demand and output underpinned the latest contraction though improvements in regions including mainland China led to better global PMI readings.

The J.P.Morgan Global Composite Output Index - produced by S&P Global - posted 49.8 in January, up from 48.2 in December 2022. This marked the sixth consecutive month of global contraction, but at the slowest rate in the current sequence and is broadly consistent with stable global GDP.

Leading the improvement was the global services sector, where activity edged back into growth for the first time since last July, albeit only marginally. Mainland China, which saw pandemic restrictions ease, returned to expansion alongside Japan and the Eurozone.

While a contraction in the manufacturing sector was meanwhile sustained for the sixth successive month, the rate of decline the least pronounced since last August. A shallower decline in new orders for global manufactured goods supported the latest change, as did an easing of supply constraints in the goods producing sector.

The latest developments also enthused businesses with confidence at its highest in eight months and improving across both the manufacturing and service sectors. That said, a sense of caution prevails in the global economy as witnessed through firms often being reluctant to hire and acquire inputs, preferring to focus on destocking. It will be important to see improvements in purchasing and inventory policies in particular to lend weight to the increasingly optimistic view on future output.

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.