Strong recovery in global trade evident fueled by rising market optimism, nonetheless, the pandemic is still not under control and could endanger the global economy.

Main Observations

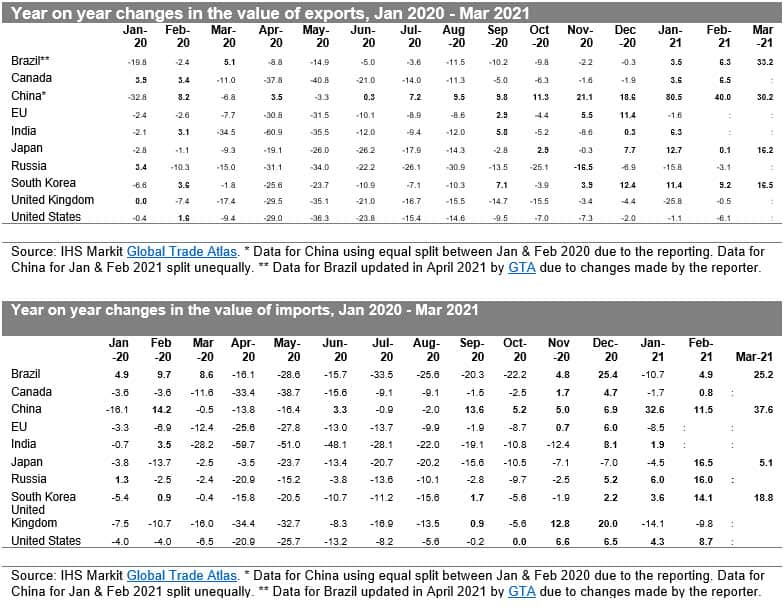

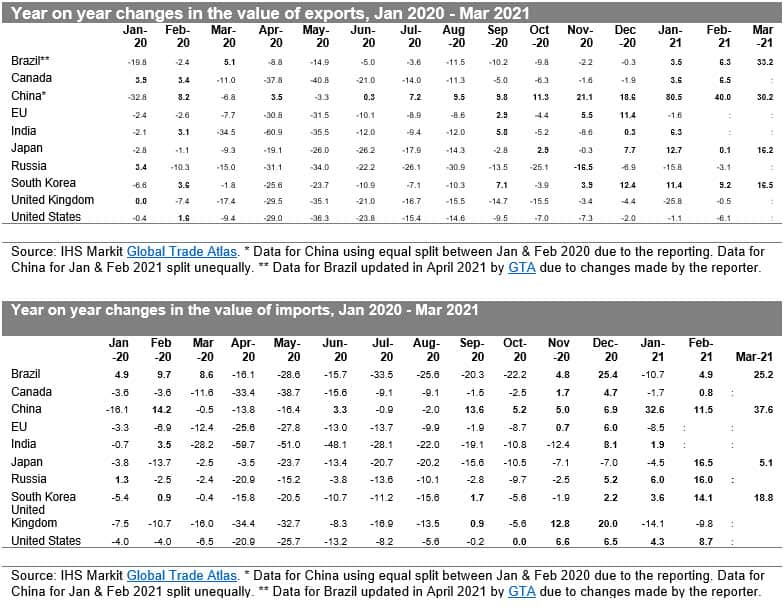

- Exports have increased for China in 2020 by 4.0% year-on-year and declined in all other top ten economies, with the largest declines reported for India (-14.8%), the UK (-15.2%) and Russia (-19.2%)

- Q1 2021 brings a clear rebound in particular for East Asia, and a more adverse situation for the UK, US and Russia; exports of the top ten outperformed imports

- Chinese exports grew for the tenth month in a row. It is the fifth month in a row for South Korea, and the fourth one for Japan, which indicates that the recovery in East Asia is broad and is leading the global recovery; on the other extreme, American and British exports are declining for 12 or more months in a row

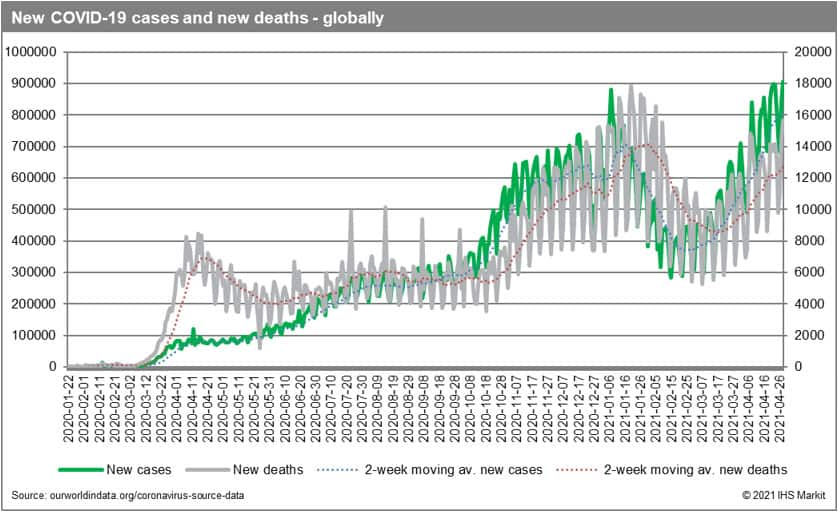

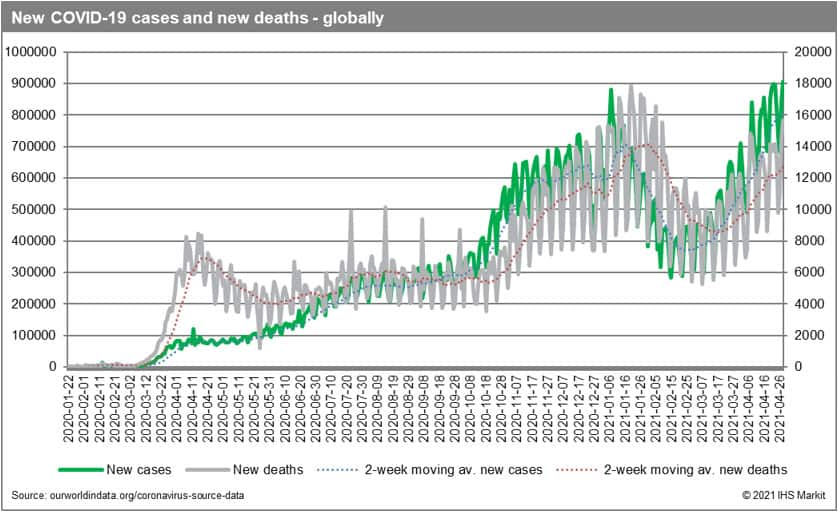

- The cumulative number of confirmed cases of COVID-19 globally by April 29, 2021, reached 149.6 million and 3.15 million deaths; the 2-week moving averages of global new cases and deaths are still rising with variants spreading fast in Brazil and India; the COVID-19 pandemic is ongoing and could endanger global recovery if the situation escalates; only 3.3% of the global population are vaccinated with two doses by now

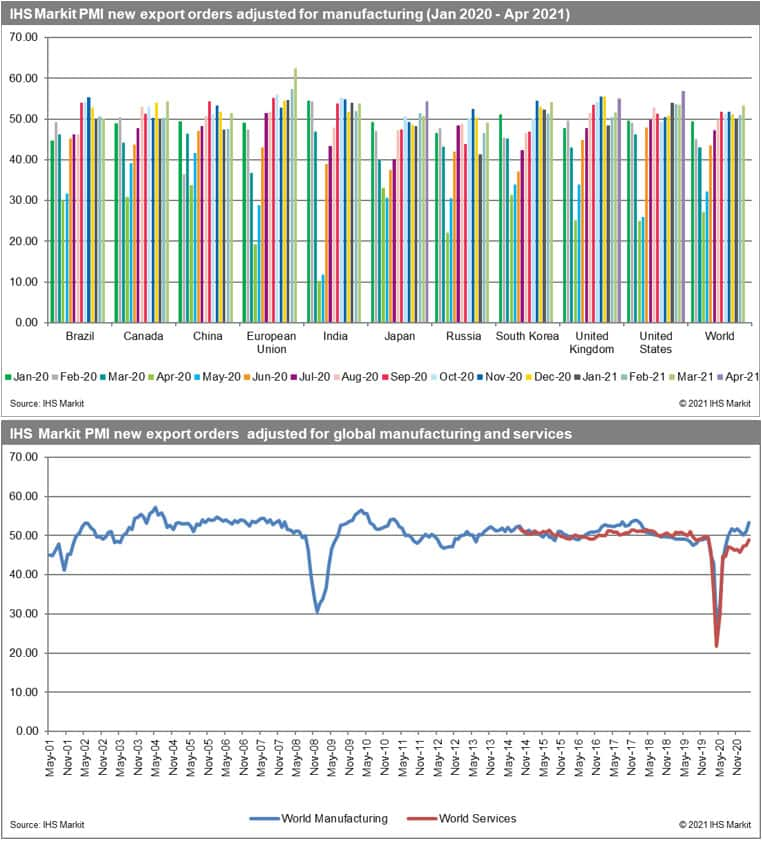

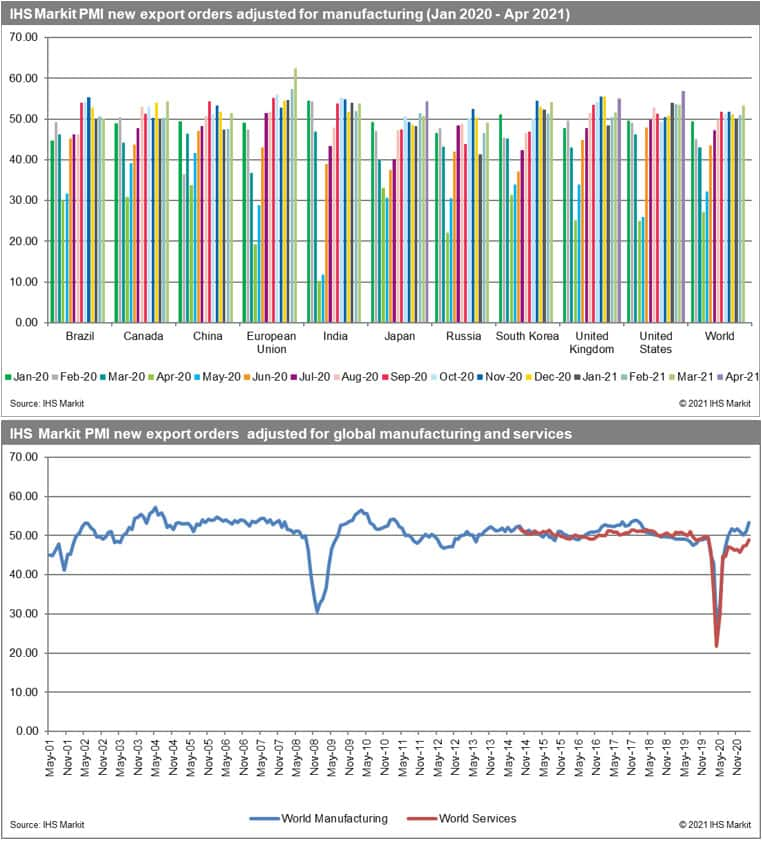

- The adjusted PMI NExO readouts for the global manufacturing industry in March 2021 were above the benchmark value of 50.0 points (53.38, a rise of +2.38 point on the February 2021 readout) and nine out of the top ten economies. The only country to report the PMI NExO below the benchmark value is Russia; EU-27, in turn, had the highest readout of 62.43 in March 2021

- We foresee a global recovery in 2021 with year-on-year real GDP growth rates predicted to reach 5.3% (4.3% in 2022) - adjusted upwards for 2021 by 0.2% in comparison to the March release. The growth rates are predicted to vary between 4.8% (3.9 in 2022) for advanced, 6.2% (5.0%) for emerging, and 4.9% (4.7%) for developing states; five out of the top ten economies were growing in Q1 2021 and the recovery should be visible in all top ten economies in Q2 with the highest growth boost forecasted for India and the UK (the worst performer in Q1)

Changes in Trade of the Top Ten Economies

- With the new trade data updated regularly in our Global Trade Atlas as reported by the states (adjusted for Brazil in April 2021 for the whole of 2020), we have the final estimates of the total contraction in trade in 2020 for the top ten economies

- Chinese exports have increased in 2020 by 4.0% year-on-year - the contraction was present only in Q1 (-13.4% followed by a steady recovery: +0.1% in Q2, +8.8% in Q3, and +17.1% in Q4. All other top ten economies suffered a contraction in exports in 2020 which varied from -5.5% for South Korea, -6.9% for Brazil, -7.2% in the EU, -9.1% in Japan, -12.5% in Canada and -12.9% in the case of the U.S.; the largest declines were present in India (-14.8%), the UK (-15.2%) and Russia (-19.2%)

- In January 2021 most top ten economies reported year-on-year growth in the value of exports varying from +3.5% for Brazil to 80.5% for China; the U.S. (-1.1%), EU (-1.6%), Russia (-15.8%), and the UK (-25.4%) reported a year-on-year decline; please take into account that the figures for China (mainland) partially reflect the way the trade data for January-February were reported in 2020 and 2021 as well as the impact of the pandemic starting earlier than for the remaining top ten economies

- In February most top ten states reported once again a year-on-year growth in the value of exports varying from 0.1% for Japan to +40.0% for China; with declines reported at this stage by the UK (-0.5% yoy), Russia (-3.1%), and the U.S. (-6.1%)

- As could have been expected, exports for all the countries that have already reported data for March 2021, grew year-on-year by 16.2% for Japan and South Korea (+16.5%), China (+30.2%), and Brazil (+33.2%)

- Chinese exports grew for the tenth month in a row. It is the fifth month in a row for South Korea, and the fourth one for Japan, which indicates that the recovery in East Asia is broad and is leading the global recovery; the establishment of the RCEP in 2021 could strengthen the role of the region in global trade (two countries have already ratified the Agreement - Thailand and China)

- On the other hand, American and British exports are declining for 12 or more months in a row

- Japanese and Brazilian exports have grown for two months in a row, the upturn is more sustained in South Korea (the fourth month of increases); the situation is serious in the UK - the last year-on-year increase in the value of exports was reported in January 2020 (pre-COVID)

- The UK seems to be struck the most out of the top ten group, apart from Russia, a combined effect of COVID-19 and harsh lockdowns related to the spread of the British variant and Brexit as well as disappointment with only partial successful negotiations on the UK-EU trade agreement; the success of mass vaccination in the UK is though likely to bring a turn around in the upcoming months with the uncertainty over mid-run effects of Brexit starting to affect the situation of both the UK and EU-27

- In contrast to exports, in all top ten economies imports contracted year-on-year in 2020; the decline varied from -0.4% for China to -23.3% in India; at the same time for most of the states the contraction in imports was deeper than the contraction in exports

- All top ten economies reported contraction in imports in Q1 and Q2 of 2020; in Q3 imports were growing only in the case of China; in Q4 2020 imports were above 2019 levels in most of the top ten states apart from EU (-1.1% year-on-year), South Korea (-1.7%), Russia (2.4%), India (-4.9%) and Japan (-8.2%); imports were growing the fastest in the UK (+7.8%)

- In January 2021, imports were growing year-on-year in India (+1.9%), South Korea (+3.6%), the U.S. (+4.3%), Russia (+6.0%), and China (+32.6%) and declined in the remaining top ten economies with the largest declines reported year-on-year for Brazil (-10.7%) and the UK (-14.1%)

- In February 2021, imports were growing year-on-year in all countries (that have reported data) apart from the UK (-9.8%) with the largest gains in South Korea (+14.1%), Russia (+16.0%), and Japan (+16.5%)

- All countries that have reported data for March 2021 are showing increases ranging from +5.1% for Japan, +18.8 for South Korea to +25.2% for Brazil, and +37.6% for China

- Chinese imports are growing the seventh month in a row which proves the deep nature of the recovery, it's the 4th month in a row for South Korea and the second for Japan; this could be indicative of growing consumer confidence and increasing internal demand strengthening the likelihood for sustained recovery

Prospects for the Forthcoming Months

- The reaction in trade in 2020 was consistent with the escalating global COVID-19 pandemic and steps taken by individual countries/territories in controlling or mitigating it. The situation in 2021 is likely to be similar with the development dependent on the success of mass vaccination programs and the severity of the third and potentially next waves. This is the key differentiator between the four different scenarios of the World Bank's Global Economic Outlook from January 2021 and an element embedded in the baseline macroeconomic scenario of IHS Markit

- The overall impact of COVID-19 on global trade and the global economy will depend on the duration, severity, and spatial distribution of the pandemic and associated severity of containment efforts taken by individual states.

- The cumulative number of confirmed cases of COVID-19 globally by April 29, 2021, reached 149.6 million and 3.15 million deaths

- The cumulative number of cases is the largest in Europe (44.6 million), North America (37.4 million), Asia (30.5 million), and South America (24.6 million)

- Looking from the individual country perspective, the cumulative number of cases is the highest in the U.S. (32.2 million), India (18.4 million), Brazil (14.5 million) followed by France (5.6 million), Turkey (4.75 million), Russia (4.7 million), the UK (4.4million), and Italy (4.0 million). 16 countries so far have registered more than two million cases of COVID-19 and 26 countries have registered more than one million cases. The first five countries account for half of the global cases of COVID-19 since the outbreak with the U.S. alone accounting for 21.5%

- In April 2021 COVID-19 was spreading the fastest in India (6.1 million cases), Brazil (1.8 million cases), the USA (1.8 million cases), and Turkey (1.4 million cases). The top ten countries affected included as well France, Argentina, Iran, Germany, and Poland; the highest death toll in April 2021, in turn, was observed in Brazil, India, the U.S., Poland and Mexico

- The two-week moving averages of global new cases and deaths are still rising with the vicious variants spreading fast in Brazil and India; the COVID-19 pandemic is ongoing

- The reported number of vaccinations globally reached 1.09 billion with 255 million people fully vaccinated, which is equivalent to 3.3% of the global population only; the speed of vaccination is picking up the pace, however, inequalities abound, only two countries or territories report by now the vaccination rate with two doses above of 60% - Gibraltar (95.1%) and the Falklands (62.5%)

- The adjusted PMI new exports orders (PMI NExO) readouts for the global manufacturing industry in March 2021 were above the benchmark value of 50.0 points (53.38, a rise of +2.38 point on the February 2021 readout) for nine out of the top ten economies. The only country to report the PMI NExO below the benchmark value is Russia (49.01); the highest readouts for March are reported for the European Union (62.43), Canada (54.40) and South Korea (54.18)

- The PMI for the EU-27 shows a positive trend rising the fourth month in a row, which could be indicative of sustained recovery; in comparison to February 2021, the highest increases are identified for the EU (+5.06 points), Canada (+4.18) and China (+3.80)

- We have three readouts for April 2021 already available for Japan (54.33), UK (55.06) and the U.S. (56.82) that are pointing to strong growth in trade in the forthcoming months

- Both PMI NExO for global manufacturing and global services showed a rapid COVID-19 crisis and quick V-shape recovery, however, the readouts for services are still below the 50.0 points benchmark (since July 2019!); the situation in services started to improve in January 2021 (the third month of reported growth) and the situation in global manufacturing significantly improving on February readouts (the readouts stand at 53.38 for global manufacturing and 49.01 for global services)

- The most recent real GDP growth forecasts from IHS Markit were published on 15 April 2021 and are based on the baseline scenario of the impact of COVID-19 on the global economy

- We now estimate the contraction of global GDP by 3.6% in 2020 varying between -4.7% for advanced, -1.7% for emerging, and -5.4% for developing economies

- We foresee a global recovery in 2021 with year-on-year real GDP growth rates predicted to reach 5.3% (4.3% in 2022) - adjusted upwards for 2021 by 0.2% in comparison to the March release. The growth rates are predicted to vary between 4.8% (3.9 in 2022) for advanced, 6.2% (5.0%) for emerging, and 4.9% (4.7%) for developing states

- From a quarterly perspective, both Q3 (-1.5%) and Q4 (-0.4%) proved to bring a continuing global recession in 2020. We predict a global recovery to have taken place already in the Q1 of 2021 (+3.5%) driven mostly by emerging states with the stronger hike in the present Q2 of 2021 (+10.2%). It is worth stressing, that the IHS Markit predictions for the first two quarters of 2021 have been adjusted upwards from the preceding release.

- Recovery in China has already started in Q2 of 2020 following the COVID-19 related contraction in the first quarter. Apart from China (+18.8%), four other economies out of the top ten group are now estimated to have grown in real terms in the first quarter of 2021, these are Brazil (+0.2%), Canada (+0.5%), South Korea (+0.4%) and the U.S. (+0.1%). The UK economy is estimated to have contracted year-on-year in Q1 2021 by 6.5%. The major recovery in all the states is predicted continually for the present quarter of 2021 with the strongest boost predicted for India and the UK

Please note that China (mainland) reported an aggregated value of trade for January-February 2020 and 2021 - for the year 2020 the data in the database was equally split between the two months, while for 2021 the data were split unequally.

Please note that Brazil has revised data for 2020 affecting the reported growth rates (please be careful not to compare the current GTM Report with prior editions due to significant changes)

This column is based on data from IHS Markit Maritime & Trade Global Trade Atlas (GTA) and GTA Forecasting.

For more details about Global Trade Atlas Forecasting please visit the product page

The full version of this article is available on the Connect platform for IHS Markit clients with a subscription to GTA/GTA Forecasting.

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics