Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jul, 2017 | 10:15

Highlights

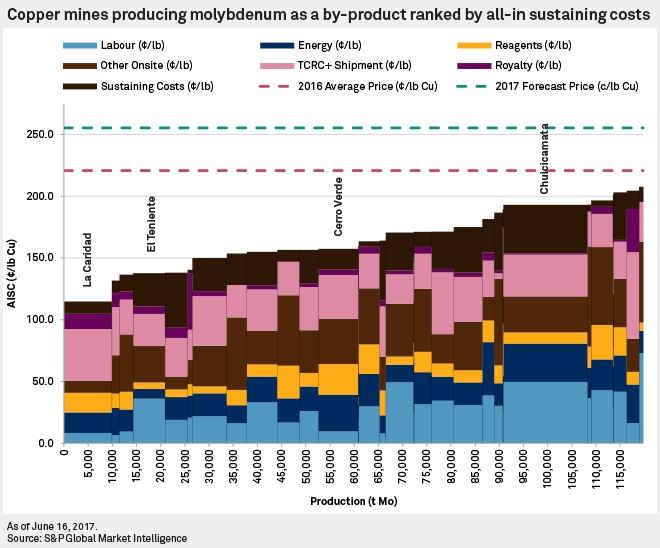

Low molybdenum prices squeeze out primary producers in the U.S., but copper-molybdenum producers keep mining.

S&P Global Market Intelligence's Mine Economics data indicates that the current, relatively low level of molybdenum prices is putting primary producers under pressure. The three-month molybdenum price on the London Metal Exchange is up just 5% for the first half of 2017. This constrained price environment for molybdenum has led to a scaling back in production at the Henderson and Climax operations in the U.S.

Meanwhile, the maintenance of domestic steel production has provided market support in China, a large consumer of molybdenum. Coupled with the growing concentration of Chinese output among the largest players and production cost reductions, a mostly captive Chinese molybdenum market has given local primary producers some respite from falling molybdenum concentrate prices.

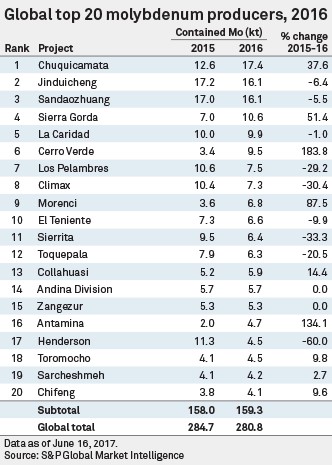

Global molybdenum supply contracted in 2016 for the second consecutive year since peaking in 2014. The main drop originated from falling production in the U.S., with output elsewhere remaining steady or increasing slightly.

Molybdenum output in the U.S. fell 1.4% to 280,845 tonnes, due to losses at the Climax and Henderson primary molybdenum operations. Elsewhere, Chinese production increased, while molybdenum output in Latin America also grew year-over-year, primarily from the copper sector.

China is the largest producer of molybdenum, accounting for over 45% of global supply. Estimated production in China increased 1.7% to 128,900 tonnes in 2016, despite large reductions from China's largest producers. Jinduicheng Molybdenum Co. Ltd.'s Jinduicheng mine reported a 6.4% drop in production to 16,100 tonnes, with China Molybdenum Co. Ltd.'s Sandaozhuang estimated to have experienced similar losses.

Output in the U.S. fell significantly in 2016. This reflected large reductions from Freeport McMoRan's primary molybdenum Climax and Henderson properties, as well as at the Sierritacopper-molybdenum mine. A near-doubling of molybdenum production at Freeport's other copper-molybdenum mine, Morenci, thanks to grade improvement, was not enough to offset the former reductions. Rio Tinto's Bingham Canyon dropped off the top 20 list — from tenth place previously — despite a significant increase in copper production. This was due to mining lower molybdenum-grade material during the period. Overall, the 15,379 tonnes loss in the U.S. equated to a net contraction in global output of over 5%, which was not completely offset by increases in other countries.

In Latin America, molybdenum output increased significantly on the back of increased production from the Chilean and Peruvian copper sectors. In addition to the 37.6% growth at Codelco's Chuquicamata, making it the largest producing operation in our dataset, Sierra Gorda (KGHM Polska Miedz SA) saw a 51.4% increase in output. This made Sierra Gorda the fourth-largest operation in 2016, with 10,552 tonnes of molybdenum. Output at Sierra Gorda is expected to peak this year, but this high output level will not be maintained in the long run due to gradual depletion of high-grade molybdenum ore. The planned Phase II of the project has been postponed due to market conditions. Cerro Verde (Freeport-McMoRan Inc.) reported a near tripling of output, which was attributable to the completion of an expansion project that achieved nameplate operating rates in the first quarter 2016.

There were, however, some reductions in production. Los Pelambres (Antofagasta Plc) in Chile reported a 3,100-tonne decline in molybdenum production due to lower molybdenum grade ore being processed. Toquepala (Southern Copper Corp.) in Peru also saw a fall in its molybdenum output. Southern Copper Corp., however, expects improved copper and molybdenum production over the next few years at Toquepala due to a U.S.$1.2 billion expansion project.

Approximately 72% of global molybdenum supply is sourced as a by-product of primary copper output, led by the largest producer, Codelco's Chuquicamata. However, both the second- and third-largest producers of molybdenum, Jinduicheng and Sandaozhuang, are primary molybdenum producers.

Learn how you can benchmark cost curves to evaluate operational efficiency of mines with our Mine Economics model.