Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

5 Apr, 2017 | 14:00

Highlights

In a positive sign for the mining industry, aggregate cash holdings were significantly higher at the end of 2016.

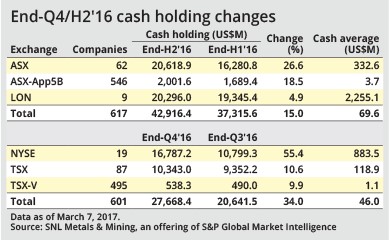

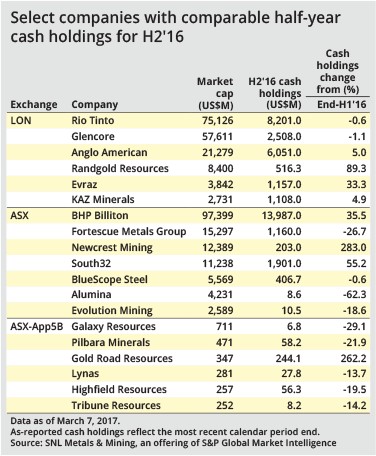

Mining companies were flush at the end of 2016 in terms of their cash balances, giving the mining industry a confident outlook for the current year. The 617 ASX- and London-listed companies ended the year with cash balances totaling US$42.92 billion, marking a 15% increase compared with the US$37.32 billion aggregated cash holdings at the end of June 2016. On a quarterly basis, the 601 NYSE-, Toronto- and TSX-V-listed companies for which such a comparison can be made reported a 34% increase between the third and fourth quarters of last year, with US$20.64 billion in total cash holdings at the end of the third quarter, and US$27.67 billion at the end of the fourth quarter.

The SNL Metals & Mining database has compiled cash holdings for companies on the Australian, London, New York and Toronto stock exchanges for the final three quarters of 2016. The third quarter saw a 7% increase in combined cash holdings of the companies on these stock exchanges, compared with the same group of companies at the end of the previous quarter. However, a majority of the Australian and London-based producers only report cash holdings on a biannual basis, and thus there was no comparable third-quarter data.

The combined year-end cash holdings of the NYSE-listed companies increased by a striking 55% compared with the equivalent end-September balance. One key factor for this positive change is the near tenfold quarter-on-quarter increase in the cash balance of Albemarle. Meanwhile, comparing Albemarle's total cash holdings at the end of December quarters in 2016 and 2015, the company showed an almost elevenfold improvement to US$2.27 billion in cash and cash equivalents. The increase was largely generated by the net proceeds from the company's sale of Albemarle's Chemetall Surface Treatment business to BASF SE.

To download the full analysis, please complete the form.

With an increasingly bullish outlook of the mining sector, are you equipped to enter the market with conviction?