Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Apr, 2016 | 08:00

Highlights

Analysis of the impact of oversupplies of oil and natural gas on earnings performance in the midstream sector.

In "Midstream update – 2015 financials substantially eroded as bleak 'new normal' unfurled", Regulatory Research Associates, a part of S&P Global Market Intelligence, considers the ongoing challenges to upstream and midstream companies, and releases its aggregated and segmented study of financial performance through calendar 2015.

RRA notes that financial quality measures at midstream and upstream exploration and production enterprises deteriorated substantially with respect to several notable metrics in calendar 2015. Given the expectation for oversupplies of oil and natural gas to persist, downward pressure on financial performance is likely to continue through 2016, with indications of recovery improbable or muted until the latter part of 2017.

RRA's analysis shows that for the companies in the firm's coverage universe, from 2014 to 2015, total debt increased 16%, versus the years 2012 through 2014, when debt increased by between 20% and 45% each year.

In 2015, versus 2014, equity market capitalization decreased 32%, versus the 2012-though-2014 time period when annual growth in market cap was 30% to 50%.

In addition, EBITDA decreased about 30%, when in the prior three years it had grown in a range between 15% and 30% annually.

Also from 2014 to 2015, net operating income declined by 46% and net income fell by some 86%--driven by impairments and write downs.

At the same time, capital expenditures grew by only 6%, versus 2013 and 2014, years in which midstream capital expenditures grew by 40% and 53%, respectively.

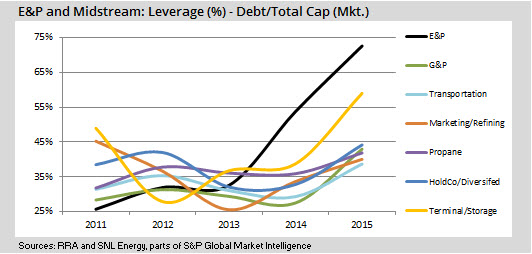

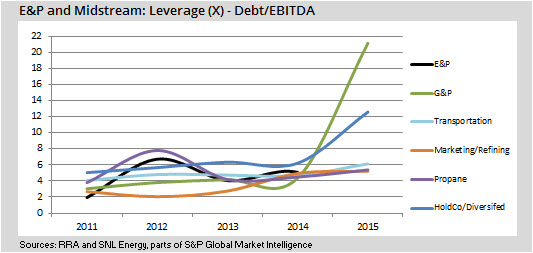

From a leverage standpoint, the ratios of debt to total market cap, total debt to total capitalization and debt to EBITDA all rose precipitously in 2015 versus 2014 levels.

Meanwhile, metrics for interest coverage, capital expenditure coverage, earned ROE and operating margin have fell dramatically from 2014 levels in 2015.

What's driving upstream and midstream strain?

The expectation for oversupplies of oil and natural gas to exist for the near- to medium-term has preserved, if not intensified, downward pressure on present and expected commodities prices.

There are several factors that may perpetuate the supply surplus for the next several years:

Unabated, to only marginally lower, U.S. oil and natural gas production, as technological improvements in well completion efficiencies have maximized initial well production and moderated the decline curve; Resilient global oil production, driven by OPEC member countries and other significantly energy reliant economies such as Russia; The potential for global output moderation likely offset by Iran's return to pre-sanctions export levels;Weaker U.S. producers maintaining production to maintain cash flow; Record high crude oil storage levels, coupled with the expectation for additional supply to enter the market; and, slackened global demand.

These factors should create conditions for challenged oil and natural gas prices for at least the next several years, with the expectation for more widespread EBITDA erosion, potentially reduced processing volumes, especially within the natural gas liquids space due to product prices below cost, re-contracting/renegotiation at lower processing prices, and rolling hedge expirations.