Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 21, 2021

By Jamil Naayem

In 2022, the MENA region's economic growth is expected to accelerate, driven by improving consumption and investment spending along with strengthening external demand. Our base case now rests on high oil prices, albeit with rising volatility, and increasing oil production in line with OPEC+ quotas, in 2022-23.

Higher oil prices are a double-edged sword for MENA economies. On the one hand, oil-exporting countries see higher oil prices as a boon, feeding state coffers and boosting foreign-currency-earnings generation capacity. This provides them with further resources to spend on economic development and employment creation. On the other hand, oil-importing economies see them as a curse, exacerbating fiscal and external imbalances and causing upward pressures on consumer price inflation.

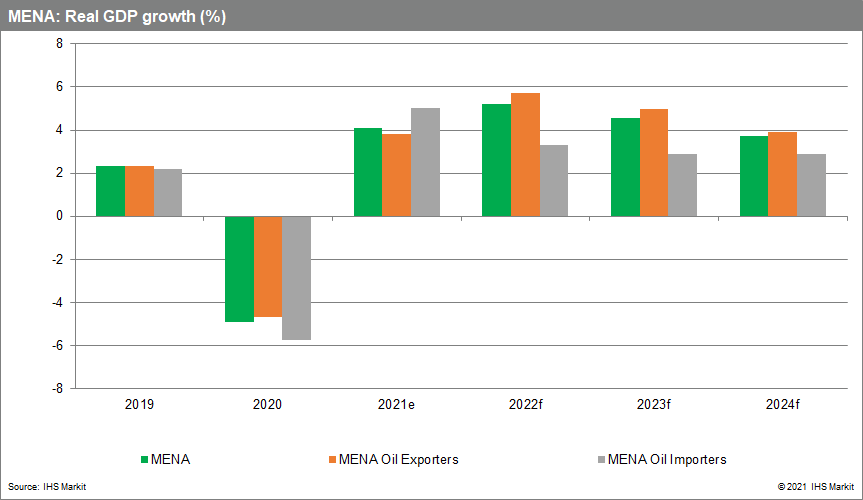

Overall, we expect higher oil revenues to provide a further uplift to real GDP growth in the MENA region from 4.1% in 2021 to 5.2% in 2022 and 4.6% in 2023. Oil exporters should witness solid annual real GDP growth in the 5-7% range in 2022-23 on the back of rising oil revenues, accelerating from a 3.8% bounce back estimated for 2021. Oil importers, on the other hand, are estimated to record a 5.0% rise in real GDP in 2021, after a 5.7% contraction in 2020, followed by a more-moderate expansion of around 3% on average in 2022-23.

Our baseline scenario assumes a progressive return to full normalcy across the world as countries accelerate their COVID-19 vaccination drive. Virus mutations such as the Delta variant or the recent Omicron variant may cause disruptions in places and lead to further waves of the disease, especially in the harsh winter months leading up to spring 2022. However, with vaccination gaining ground and proving effective at reducing the number and probability of severe cases and hospitalizations, the global economy is likely to steer through the pandemic better generally than during previous COVID-19 waves.

In the MENA region, vaccination is proceeding at varying speeds, with only a handful of countries having reached or, being close to, reaching herd immunity. Countries such as Bahrain, Israel, Saudi Arabia, and the United Arab Emirates have been at the forefront of global vaccination. Other countries such as Kuwait and Iran are making fast progress. The rest, among which Algeria, Egypt, Iraq, Lebanon, Syria, and Yemen are lagging behind and thus are more susceptible to witnessing new waves of COVID-19, especially in the coming winter months.

The caveat in the growth scenario lies at the level of inflation. With oil (and gas) still at the core of energy generation, high energy prices are synonymous with upward inflationary pressures, directly affecting transportation and import prices, among others. In this sense, MENA oil-importing economies are particularly prone to such a trend. The issue is that high oil prices are coinciding with high food prices and supply bottlenecks, which are mostly a legacy of the pandemic. COVID-19 pandemic-induced business closures and weaker economic activity during 2020 led many companies to refrain from purchasing some intermediate inputs. As the economic revival has gained ground, the rise in demand has exceeded supply and caused global supply chain disruptions. This is also affecting shipping distribution and causing temporary shortages of merchandise across parts of the globe.

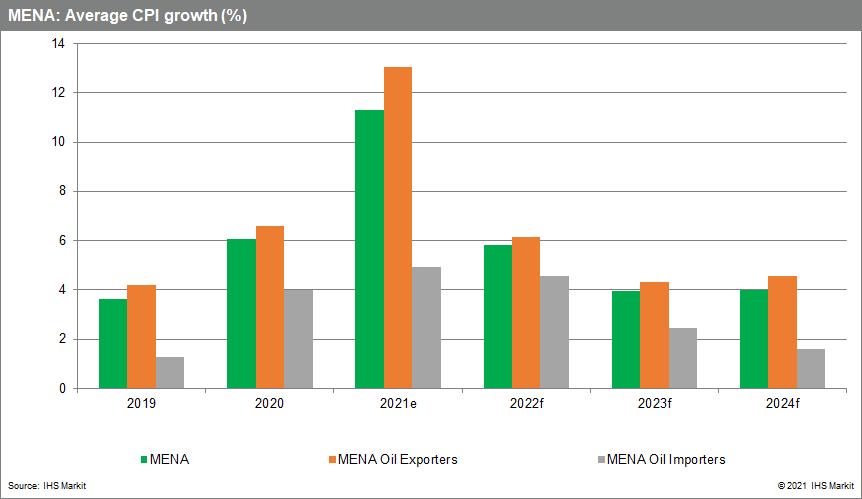

We expect supply bottlenecks to dissipate during 2022, possibly by the second half of the year, other things being equal. Consequently, we expect the increasing price pressures to last a few more months but ease thereafter, causing yearly average inflation rates to edge up only moderately. IHS Markit currently projects average MENA CPI growth to reach 5.8% in 2022 and 4.0% in 2023, after surging to an estimated 11.3% in 2021, with consumer prices edging up in GCC states but inflation remaining moderate at around 1.5% during the same period.

In the context of recovering real GDP growth and upward inflationary pressures amid still-uncertain pandemic prospects, central banks are either phasing out or pursuing support measures, depending on the country. However, central banks have maintained key policy rates at ultra-low levels to foster credit and investment growth. Many economies are maintaining their currency pegs to the US dollar. They are usually tracking the US Federal Reserve's monetary policy decisions. We currently do not expect the US Fed to start lifting rates before late 2022 (although risks of an early lift-off exist) and expect prolonged accommodative conditions until then. Unless wage inflation starts picking up substantially, adding to the commodity and energy price pressures, central banks in the advanced economies are unlikely to alter their monetary policy stance for the better part of 2022.

Other central banks (especially Egypt) are likely to watch interest rate decisions in the US closely, because of the looming risk of capital flight from emerging markets once advanced economies start raising interest rates. Nonetheless, risks of a new "Taper Tantrum" scenario in the case of an earlier-than-expected tightening of US monetary policy are considered low in most countries, including Egypt where policy rates will remain on hold at least until the second half of 2022.

We see more downside than upside risks to our economic outlook for the MENA region. Among these are commodity price volatility, uncertainties over supply chain disruptions, politico-security tensions, and the COVID-19 pandemic. Upside risks include mainly a faster-than-expected vaccine rollout boosting immunity and contributing to higher international demand for MENA-produced goods, and an Iran/US political deal that generates positive repercussions throughout the GCC/Levant region.

However, we believe that with COVID-19 cases currently increasing in many parts of the world, especially throughout Europe, and with deal negotiation talks likely to be protracted between Iran and the international community, downside risks outweigh upside risks.

In summary, inflation risks and COVID-19 variants are the major downside risks to global and MENA economic growth prospects for 2022 onwards. However, at this juncture, we believe that the conditions for healthy economic growth in the region are in place.

Posted 21 December 2021 by Jamil Naayem, Associate Director, Global Intelligence & Analytics, S&P Global Market Intelligence