Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2016 | 15:15

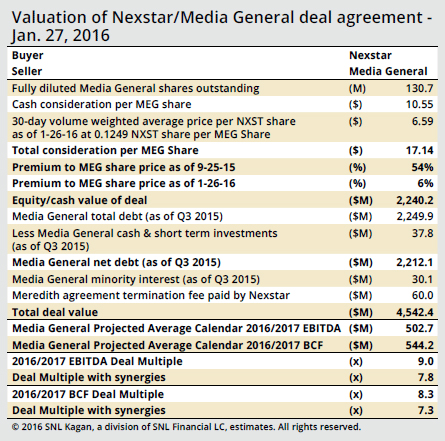

Nexstar Broadcasting Group Inc.'s persistence has paid off with the $4.6 billion deal announced Jan. 27 to acquire Media General Inc. at $17.14 per share. We estimate the deal is valued at the higher end of recent multiples at 9.0x 2016-17 EBITDA on the seller's side and 7.8x 2016-17 EBITDA on the buyer's side, including $76 million in annual synergies.

With a combined 171 full-power stations in 100 markets (147 owned-and-operated stations and 24 JSA/SSAs), the renamed Nexstar Media Group will rank first overall in number of stations, markets and projected total annual revenue in excess of $2.3 billion. It will be the second largest affiliate station group owner in terms of U.S. TVHHs reached behind Tribune Media Co.

While Meredith Corp. leaves with $60 million in cash and the "first-pass" opportunity to negotiate for the purchase of certain broadcast and digital assets at Media General, it will most likely not end there with more consolidation expected in the industry for mid-tier to small broadcasters looking to scale up with retrans, digital, and original content driving future growth in the business.

Nexstar's final deal price for Media General breaks down to $10.55 in cash and 0.1249 per share in NXST stock, which on a 30-day volume weighted average price as of Jan. 26 is $6.59 per MEG share for a total consideration price of $17.14. That is a 54% premium to MEG's share price back on Sept. 25, 2015, after Nexstar's first bid proposal and 6% premium to MEG's Jan. 26 share price. Upon completion of the deal, which is expected to close by the fourth quarter, Media General shareholders would own approximately 34% of the combined company.

However, that deal value excludes the potential additional consideration in the form of the contingent value right (CVR) of some Media General stations in the spectrum auction that both parties on the Jan. 27 investor call estimate could be in the $2-to-$4 per MEG share range on an after-tax basis.

Using our 2016/2017 broadcast cash flow estimates for Media General, the Nexstar deal price excluding the CVR is valued at 8.3x on the seller's side and 7.3x on the buyer's side, including year-one closing annual synergies of approximately $27 million in corporate overhead, $25 million in station and digital overlap costs, and $24 million from net retrans revenue.

Based on the reported $4.6 billion transaction value, the Nexstar deal for Media General ranks fourth overall in history behind the Univision Communications Inc. privatization deal led by Saban Capital Group Inc. back in June 2006 at $4.7 billion.