Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

NEWSLETTER — Oct 20, 2021

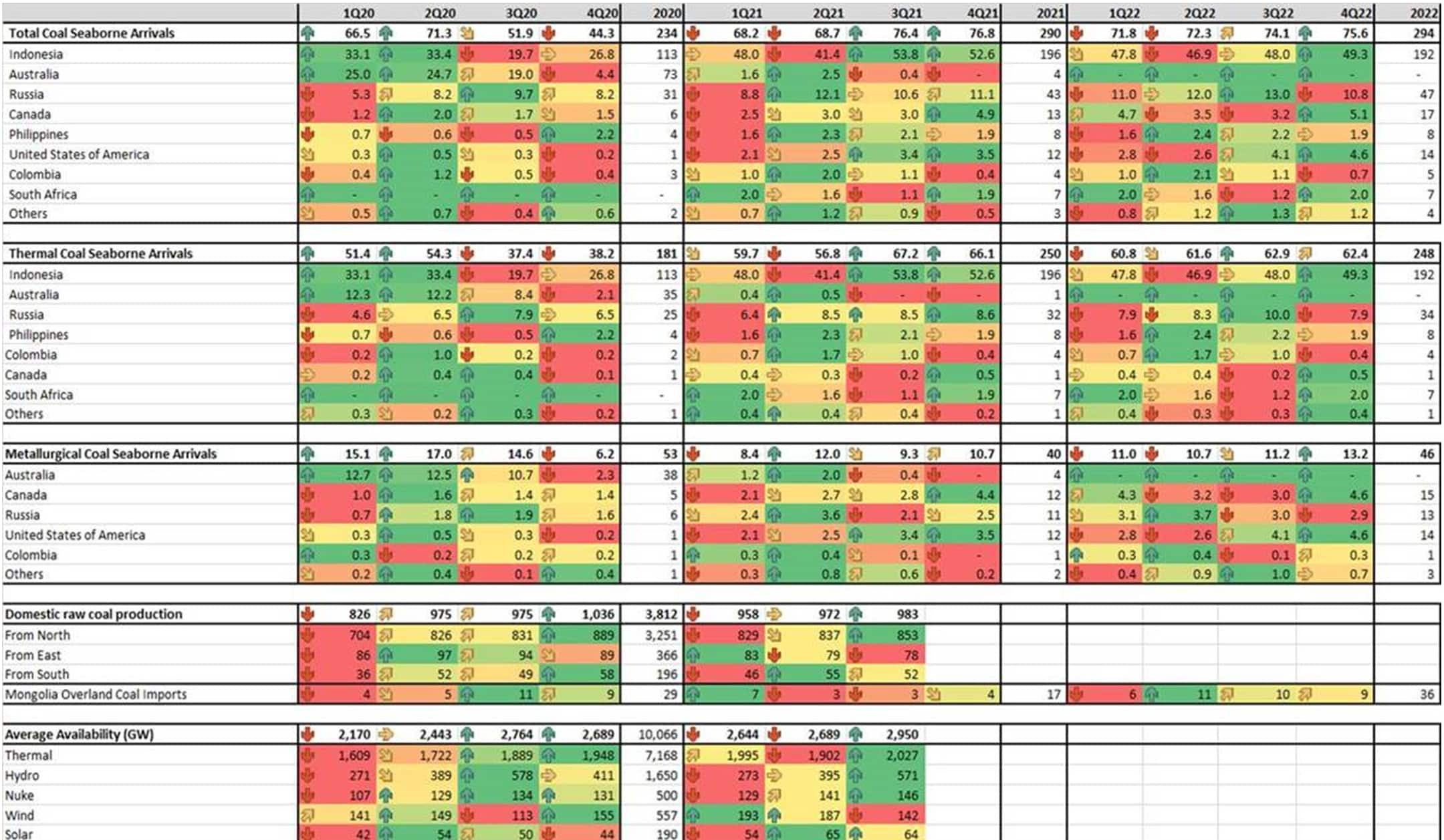

China's official composite output PMI - covering manufacturing and non-manufacturing sectors - grew by 2.6 points from the previous month to 51.7 in September, largely owing to the non-manufacturing sector bouncing back, while factory activity slowed on the back of wider curbs on electricity use and higher input prices. The official manufacturing PMI declined by 0.5 points to 49.6 in September.

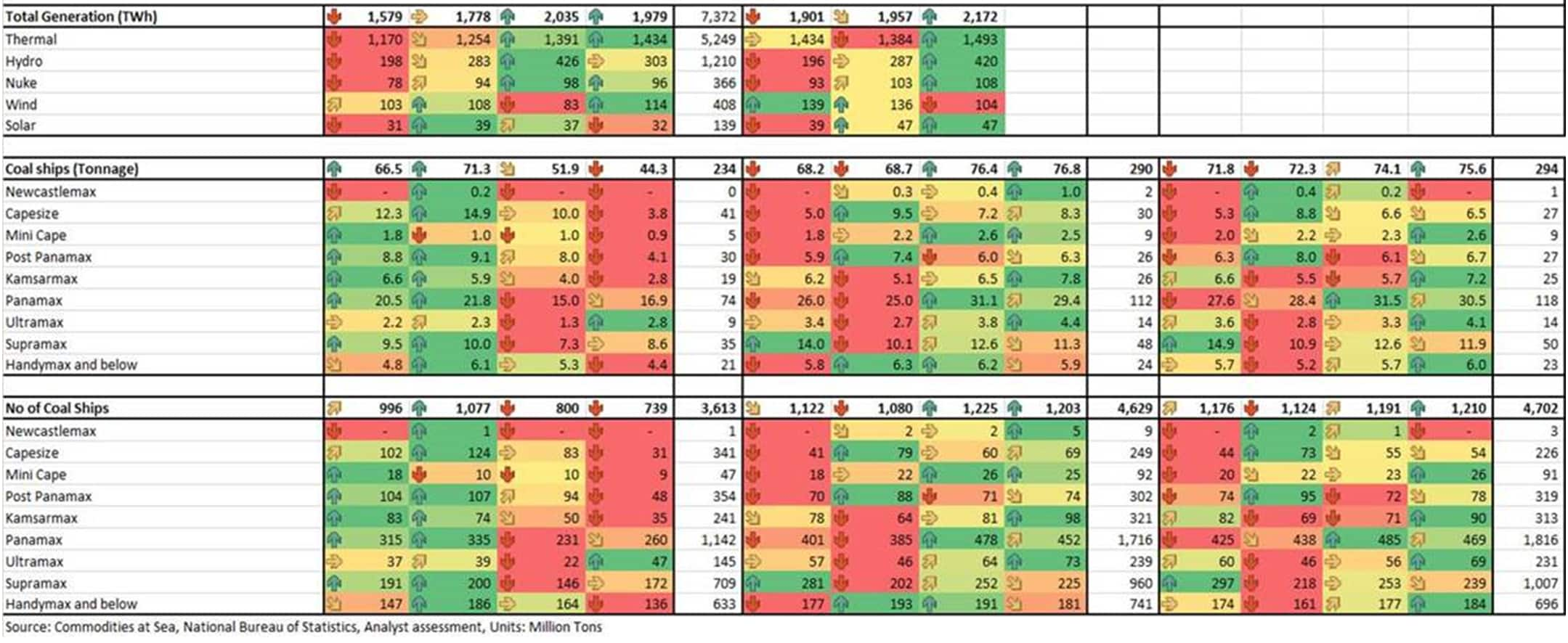

Despite a decline in manufacturing PMI numbers, power generation in Mainland China during September 2021 increased on strong demand and stood at 675.1TWh (up 4.9 percent year-on-year (y/y)), with generation from thermal at 452.1TWh (up 5.7 percent y/y), hydro at 140.9TWh (down 0.3 percent), nuclear at 33.2TWh (up 4.3 percent), wind at 34.0TWh (up 19.7 percent), and solar at 14.8TWh (up 4.5 percent).

As per the National Bureau of Statistics, raw coal production in Mainland China during September 2021 stood at 334.1mt (down 0.9 percent y/y). During 15-27 September, mining operations in Shaanxi were reported to be suspended to prevent any mining accidents during the 2021 National Games of China. This could have tightened up domestic supplies during the month. Overall, coal production during 9M21 stood at 2.9bn t (up 3.7 percent y/y). One of the major coal miners - China Shenhua Energy has reported a commercial coal production of 23.6mt (marginally higher y/y) for September 2021, with total production during 9M21 at 224.2mt (up 3 percent y/y). Shenhua's coal sales (including 3rd party) stood at 40.7mt (up 1 percent y/y) during the reported month, and during 9M21 at 361.6mt (up 12 percent y/y). Broadly, Shenhua third party sales (combined sales minus captive production) during September 2021 and 9M21 stood at 17.1mt (up 2 percent y/y) and 137.4mt (up 29 percent), respectively.

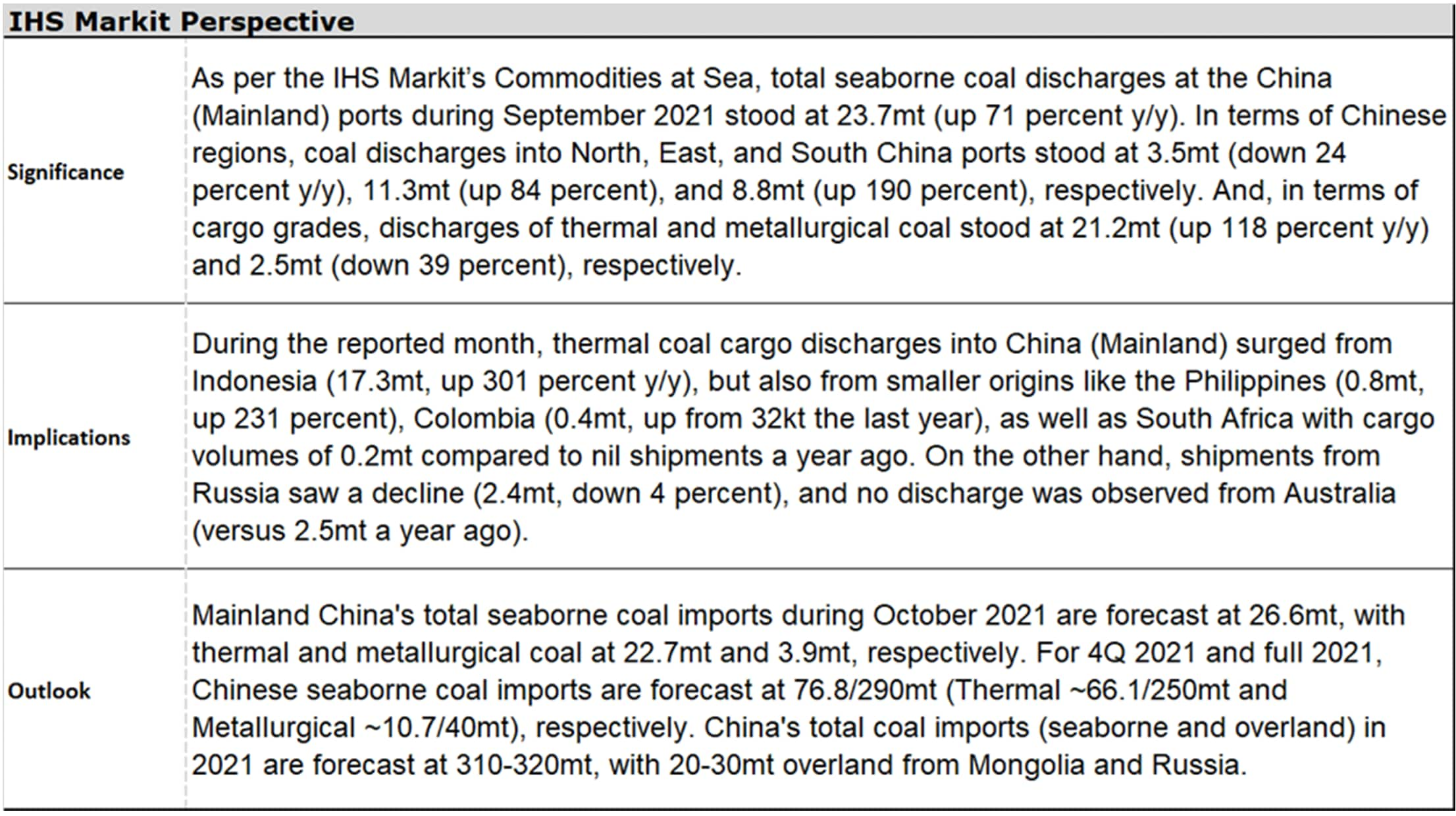

As per the IHS Markit's Commodities at Sea, total seaborne coal discharges at the China (Mainland) ports during September 2021 stood at 23.7mt (up 71 percent y/y). In terms of Chinese regions, coal discharges into North, East, and South China ports stood at 3.5mt (down 24 percent y/y), 11.3mt (up 84 percent), and 8.8mt (up 190 percent), respectively. And, in terms of cargo grades, discharges of thermal and metallurgical coal stood at 21.2mt (up 118 percent y/y) and 2.5mt (down 39 percent), respectively.

During the reported month, thermal coal cargo discharges into China (Mainland) surged from Indonesia (17.3mt, up 301 percent y/y), but also from smaller origins like the Philippines (0.8mt, up 231 percent), Colombia (0.4mt, up from 32kt the last year), as well as South Africa with cargo volumes of 0.2mt compared to nil shipments a year ago. On the other hand, shipments from Russia saw a decline (2.4mt, down 4 percent), and no discharges was observed from Australia (versus 2.5mt a year ago). Mainland China buyers have been hoovering up Indonesia's excess thermal coal as a replacement for Australian material due to Beijing's ongoing trade embargo.

In terms of metallurgical coal, during September 2021, discharges increased from Canada (0.8mt, up 234 percent y/y), the USA (1.0mt, up 669 percent). While metallurgical coal shipments decreased from Russia (0.6mt, down 3 percent); and no shipments from Australia (versus 3.0mt the previous year), Colombia (versus 0.1mt the previous year), and Ukraine (versus 27kt the previous year).

During the reported month, an increase in thermal coal shipments has been observed across all vessel segments except Capesize (1.1mt, down 33 percent y/y). For the rest of the vessel sizes, Mini Capesize (0.7mt, up 228 percent), Post Panamax (1.4mt, up 111 percent), Kamsarmax (2.2mt, up 317 percent), Panamax (9.6mt up 159 percent), Ultramax (1.0mt, up 240 percent), and Supramax (3.8mt, up 121 percent). For metallurgical coal, shipments increased on Capesize (0.6mt, up 5 percent y/y); while declined on Mini Capesize (0.1mt, down 55 percent), Post Panamax (0.6mt, down 60 percent), Kamsarmax (0.4mt, down 34 percent), Panamax (0.5mt, down 24 percent), Ultramax (63kt, down 58 percent), and Supramax (50kt, down 74 percent).

As per IHS Markit's Commodities at Sea Coal Port Stocks, Caofeidian Basin 1 Coal Terminal Phase 3 stockpile as of 7 October 2021 stood at 1,073kt (up 19 percent m/m), Huaneng Coal Terminal as of 7 October 2021 stood at 1,490kt (up 61 percent m/m), SDIC Caofeidian Port as of 11 October 2021 at 3,005kt (improved from the 2,168kt level recorded on 13 September 2021), and SDIC Caofeidian Port Phase 2 as of 7 October 2021 at 1,590kt (up 28 percent m/m).

At the Mainland China ports, congestion from coal vessels arrivals has eased significantly in the last month. As per IHS Markit's Bulkers at Sea, currently, there are 125 vessels (8.6mn dwt) laden with coal waiting to be discharged at Mainland China's ports, compared to 149 vessels on week 38. In terms of load country/territory of the bulkers currently waiting to be discharged - Indonesian cargoes stood at 39 vessels (2.95mn dwt) and Russia at 11 vessels (0.9mn dwt).

As per the Mongolian Customs General Administration, Mongolian overland coal exports (which are mostly metallurgical) to China (Mainland) during September 2021 stood at 0.95mt (down 4 percent m/m, and down 78.7 percent y/y). During 9M2021, Mongolian coal overland shipments stood at 11.38mt, down 40 percent y/y.

As per IHS Markit's Commodities at Sea, during the first nine months of 2021, total seaborne coal discharge at the China (Mainland) ports stood at 213.2mt (up 12 percent y/y). In terms of the Chinese regions, coal discharges into North, East, and South China stood at 32.6mt (down 24 percent y/y), 97.8mt (up 18 percent), and 82.8mt (up 30 percent), respectively. In terms of cargo grade, thermal coal and metallurgical coal stood at 183.7mt (up 28 percent y/y) and 29.6mt (down 37 percent), respectively.

During 9M21, thermal coal discharges into China (Mainland) increased from Indonesia (143.1mt, up 66 percent y/y), Russia (23.4mt, up 24 percent), Philippines (6.1mt, up 222 percent), Colombia (3.4mt, up 143 percent), Canada (0.9mt, level y/y); while shipments declined from Vietnam (0.6mt, down 8 percent). Discharges have almost halted from Australia (0.8mt versus 32.9mt a year ago) on the back of an informal ban since last year.

In terms of metallurgical coal, throughout the first nine months of 2021, discharges significantly declined from Australia (3.6mt versus 35.8mt a year ago). While discharges increased from Canada (7.5mt, up 87 percent y/y), Russia (8.1mt, up 86 percent), the USA (8.0mt, versus 1.1mt a year ago), Colombia (0.7mt, up 2 percent), Latvia (0.2mt, up 95 percent), and Mozambique (0.8mt, versus 214kt a year ago), but were not able to cover up for the loss of tonnage from Australia.

In terms of vessel segments, during 9M21, total coal shipments increased on Newcastlemax (0.7mt, up 286 percent y/y), Mini Capesize (6.7mt, up 76 percent), Kamsarmax (17.8mt, up 8 percent), Panamax (82.2mt, up 43 percent), Ultramax (10.0mt, up 69 percent), and Supramax (36.7mt, up 37 percent); while coal shipments declined on Capesize (21.6mt, down 42 percent y/y), and Post Panamax (19.4mt, down 25 percent).

Short-Medium term outlook

Mainland China's total seaborne coal imports during October 2021 are forecast at 26.6mt, with thermal and metallurgical coal at 22.7mt and 3.9mt, respectively. For 4Q 2021 and full 2021, Chinese seaborne coal imports are forecast at 76.8/290mt (Thermal ~66.1/250mt and Metallurgical ~10.7/40mt), respectively. Daqin line is scheduled to undergo maintenance in October which could pose a domestic coal supply-side risk for 4Q21. Anticipating coal shortage to be prevalent during 4Q, North Asia LNG prices are receiving a boost but could also be due to coal to gas switching in an attempt by Beijing to have Blue Skies as the country is hosting winter Olympics in February 2022. China's total coal imports (seaborne and overland) in 2021 are forecast at 310-320mt, with 20-30mt overland from Mongolia and Russia.

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 20 October 2021 by Pranay Shukla, Research and Analysis Director, Refining Chemicals And Resources Solutions, S&P Global Commodity Insights

How can our products help you?