Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jul 19, 2023

Shippers of goods in and out of ports in the U.S. and Canada have been forced to navigate an unusually volatile longshore labor environment over the past three years that is not guaranteed to settle down despite the recent tentative contract agreement on the U.S. West Coast.

With dockworkers on the Canadian West Coast planning to resume a strike on July 22 after rejecting a tentative agreement, upcoming talks in Montreal and an unsettled picture on the US East Coast, shippers are staring at the prospect of ongoing waterfront labor uncertainty for many months to come.

Part of the dynamic on the waterfront reflects wider transportation labor activism where rail, aviation, trucking and longshore workers have achieved or are seeking to achieve substantial enhancements in pay and work rules. Dockworkers are riding that wave, but also being further assertive in light of the historic windfall in profits for ocean carriers — estimated at over $400 billion in total during the COVID-19 pandemic.

The new waterfront labor dynamic is most clearly seen at present on the Canadian West Coast, where history of labor peace — there had not been a work stoppage since 1999 — was shattered on July 1 when members of the Canadian affiliate of the International Longshore and Warehouse Union (ILWU) went on strike at Vancouver and Prince Rupert for what turned out to be, at least initially, a 13-day work stoppage.

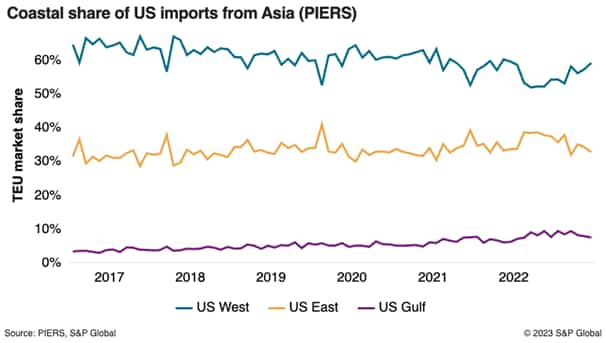

That followed a series of disruptive actions up and down the U.S. West Coast during a 13-month negotiation that only ended, after intervention by acting U.S. Secretary of Labor Julie Su, in a deal announced on June 15 that is still subject to ratification by the rank and file. The importance of longshore labor to the supply chains of beneficial cargo owners (BCOs) was in stark relief during the protracted U.S. West Coast negotiations given how much cargo was diverted to East and Gulf coast ports during the talks. The West Coast's share of containerized imports from Asia in the January-June period dropped from 62% in 2021 to 57% in 2023, according to PIERS, a sister company of the Journal of Commerce within S&P Global.

Making the labor outlook especially uncertain for shippers is how it could play out in unfamiliar ways, with new dynamics emerging that were not present in recent years. On the U.S. East Coast, for example, long a bastion of labor stability ever since the last major unrest in the late 1970s, a growing effort by the International Longshoremen's Association (ILA) to unionize state-employed dockworkers at a Charleston terminal has led to that terminal being underutilized for over two years and has opened the door to new uncertainties to come.

Sources speaking to the Journal of Commerce point to the emergence of questions as to whether the conflict, now in federal court, will remain limited to the Hugh K. Leatherman Terminal at Charleston or potentially expand beyond the facility given the ILA's ambitions to unionize all dockworkers handling containers at ports on the East and Gulf coasts.

Any widening of the conflict beyond Leatherman would expose clashing interests between, on one side, the collective bargaining agreement negotiated between the ILA and a management group led by ocean carriers, and on the other side an entrenched commitment by the state port authorities of South Carolina, Georgia and North Carolina to maintain their longstanding "hybrid" model that dates back to the early days of containerization. Under this model, the port authorities directly operate their terminals by employing state employees for key tasks such as operating ship-to-shore cranes, while employing ILA-represented workers for other tasks such as maintenance and repair. The port authorities view this model as being core to the growth at their ports over many decades.

The influence of the labor contract over the behavior of carriers was obvious when the ILA in 2021 claimed that the collective bargaining agreement entitled them to nonunionized jobs at the newly opened Leatherman terminal, leading a number of carriers, not wanting to be in breach of the contract, to refuse to relocate services to the new facility as requested by the South Carolina Ports Authority.

Litigation initiated by the state of South Carolina claiming that the union coerced the carriers to avoid Leatherman is still under way, but even the outcome will not necessarily change the reality of how carriers' actions can be influenced by contract terms negotiated between them and the union. Negotiations for a new contract or an extension of the existing agreement are likely to commence this year, whereupon many expect the union will seek to clarify or expand language related to its right to represent dockworkers at state-run facilities.

For shippers looking for ways to de-risk supply chains following the pandemic, waterfront labor will likely remain a concern.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?