Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Oct, 2023

By Alice Yu

In its monthly Lithium and Cobalt Commodity Briefing Service report, S&P Global Commodity Insights discusses the lithium and cobalt markets within the broader macroeconomic environment and provides rolling five-year supply, demand and price forecasts.

➤ Passenger plug-in electric vehicle (PEV) sales across top markets rose a combined 12.4% month over month in August but are still 9.6% below the previous peak in December 2022.

➤ A lack of restocking ahead of the National Day holiday season in China suggests a delay in peak-season demand and a possibly more muted response than in previous years, pressuring lithium and cobalt prices.

➤ The battery-grade lithium carbonate spot price in China declined 15.6% in the month to Sept. 21 on sustained market surplus and slow demand.

➤ The lithium market surplus has compelled refineries to cut lithium chemical production and reduce product inventory, though this has not yet managed to lift prices.

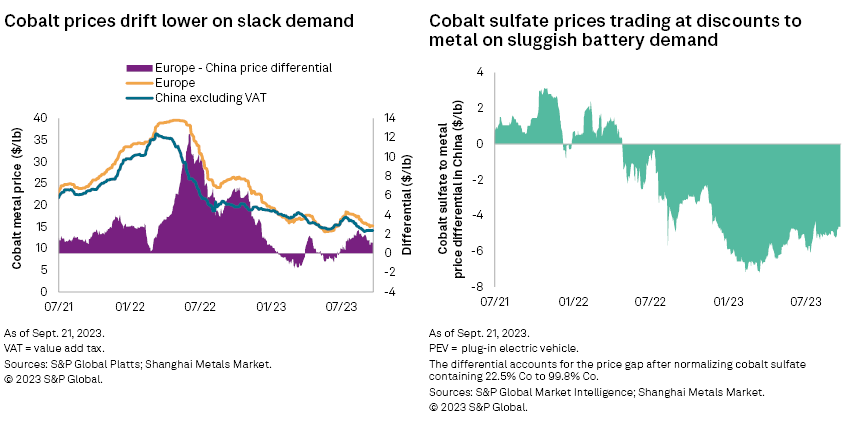

➤ The Platts-assessed cobalt 99.8% European price decreased $0.88/lb on Sept. 1–14 on demand softness before recovering slightly by $0.25/lb to $15.25/lb on Sept. 21.

➤ Cobalt raw material supply availability could improve further on the expected arrival of stockpiles, widening the current market surplus and further pressuring prices.

Plug-in EVs

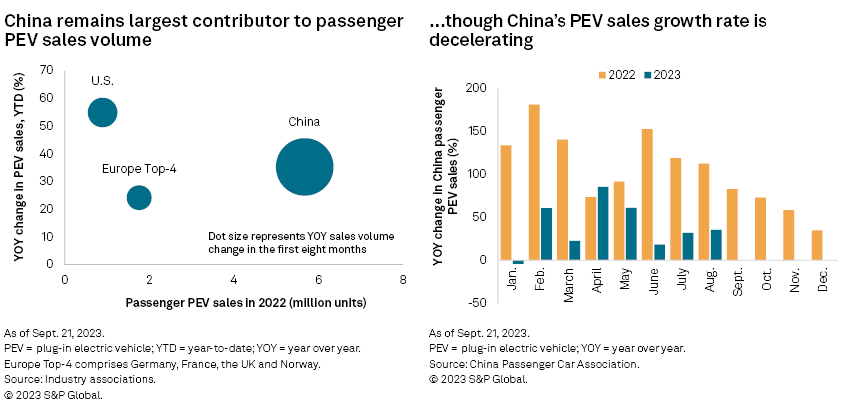

Passenger PEV sales across top markets rose a combined 12.4% month over month in August. Sales increased across all top markets except the UK, which experienced a drop in line with the summer lull in previous years. Sales in Germany grew the most, rising 60.6% month over month as commercial buyers rushed to purchase pure battery EVs before Sept. 1, when an environmental subsidy for company cars ended. Cumulative sales across the top markets were nevertheless still down 9.6% from the previous peak in December 2022.

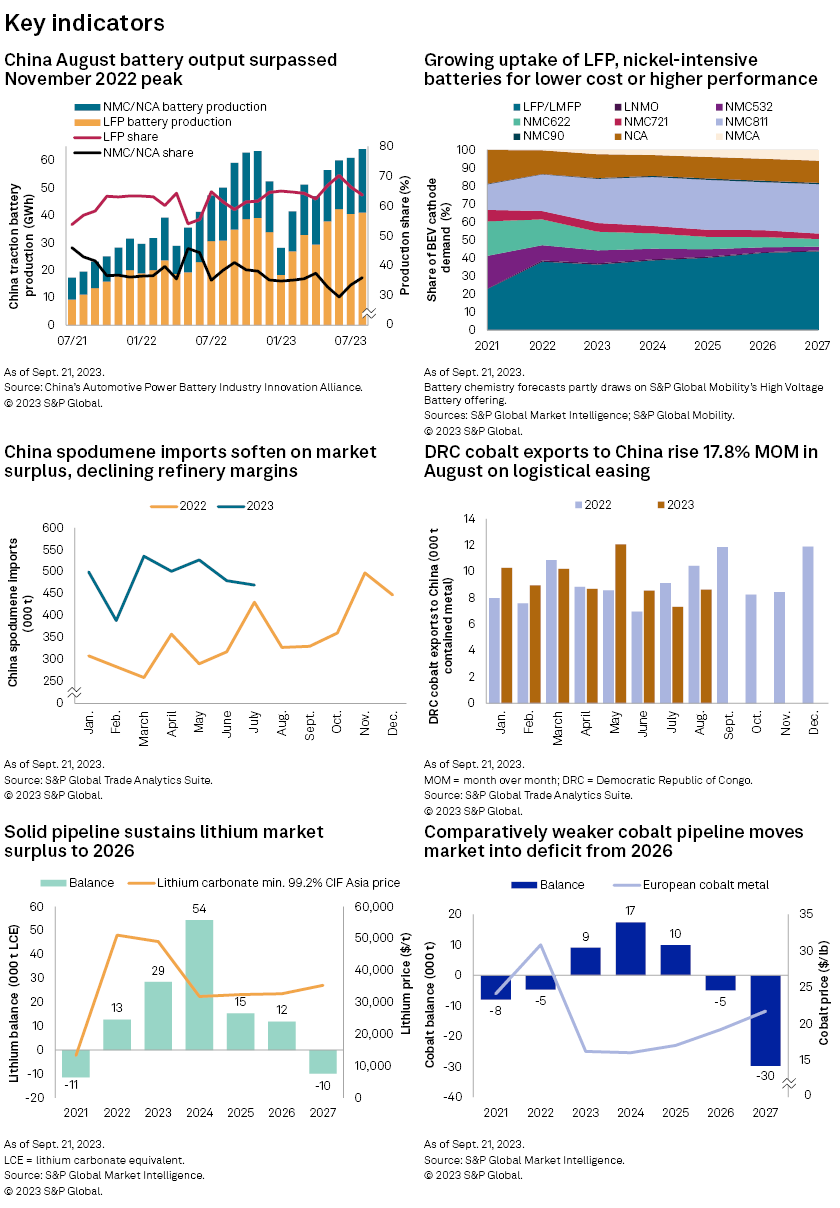

China's traction battery production rose 5.4% month over month to 64.3 GWh in August, above the previous high of 63.4 GWh in November 2022. The growth rate, however, has slowed; in 2022, battery production in March overtook the December 2021 high. Meanwhile, China's PEV sector was largely unmoved by economic stimulus measures announced since the end of August that were predominately targeted at bolstering property sales and consumer spending.

The EU announced an anti-subsidy investigation into China's EV exports on Sept. 13. The policy-led shift to electrification in Europe is delivering increases in PEV sales, while overall passenger car sales in the region are still lower than pre-pandemic levels. The growth prospect of Europe's PEV market is attractive for global automakers, which has spurred China's passenger PEV exports to increase 110.2% in the first eight months of the year, with Southeast Asia as another top destination market. Europe's PEV manufacturing industry made the shift to electrification later than their counterparts in China, and now they face competition from Chinese imports in their home markets. Any consequence from the investigation that limits EU imports or increases the price of PEVs from China will slow the uptake of PEVs within the bloc. And it adds a further roadblock to meeting the EU's 2035 target to phase out internal combustion engine vehicles, even though encouraging onshoring of PEV production in the EU.

Lithium

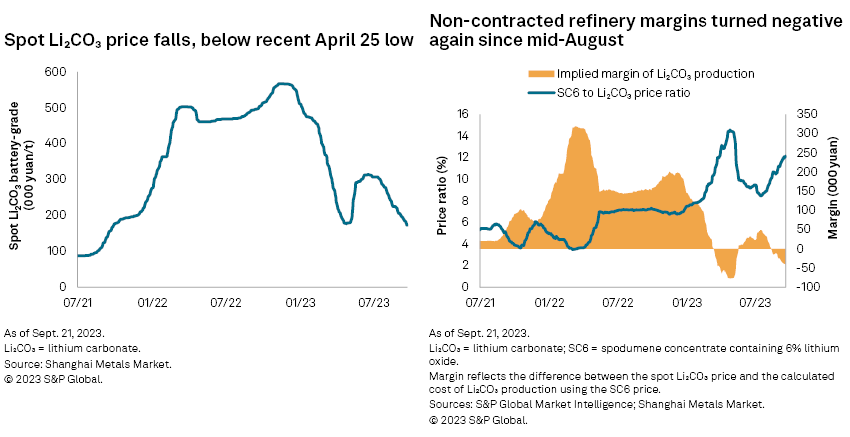

The battery-grade lithium carbonate spot price in China declined 15.6% in the month to Sept. 21, similar to the 17.9% drop over the same period in August, weighed by an ongoing market surplus. The price fell to 173,500 yuan per metric ton, below the previous floor of 176,500 yuan/t on April 25. Peak season demand for batteries has yet to take off, with anticipations that it will come later in 2023. Weaker-than-expected demand has caused the lithium-ion battery downstream sector to maintain a lean-inventory approach, only procuring lithium chemicals on an as-needed basis, further squeezing already thin demand.

The lithium market surplus has compelled refineries to cut lithium chemical production and reduce product inventory, which will help narrow the market surplus, but these responses have been insufficient to lift prices to date. Chinese lithium refinery margins are also being squeezed by rising spodumene costs and falling product prices. The price ratio of spodumene to battery-grade lithium carbonate increased from 8.5% in mid-July to 12.5% on Sept. 21. The margins of noncontracted refineries that procure lithium concentrate from the spot market have been negative since mid-August, compelling further production cuts. China's spodumene imports have also slowed since June.

Cobalt

The Platts-assessed cobalt 99.8% European price decreased $0.88/lb Sept. 1–14 on demand softness before recovering slightly by $0.25/lb to $15.25/lb on Sept. 21, the level last held June 20 before the European market entered the summer holiday lull.

There has been a moderate uplift in electronics demand benefiting from new phone model releases in September, following a 7.0% year-over-year rise in China's mobile phone production in August. Reluctance to hold cobalt inventory will nevertheless limit the corresponding cobalt demand increase. Affordability strain amid a high interest environment in the US and Europe will also challenge the traditional year-end peak season for consumer electronics in the lead-up to widespread sales campaigns such as Black Friday in the US and Europe and Singles' Day in China, as well as the festive period itself.

The cobalt sulfate price in China has been trading at a discount to metal due to weak demand in battery use across PEV and electronics market segments since April 2022. Reduced profitability and demand have pushed some cobalt sulfate producers to switch their product mixes.

Further cobalt raw material availability could swell the current market surplus, from improvements in the export capacity of the Democratic Republic of the Congo (DRC) and the resumption of exports from the Tenke Fungurume operation in the country since May. DRC exports to China rose 17.8% month over month in August and could rise further as material stockpiles are gradually shipped. Production cuts by miners in the second half, including Glencore PLC, as discussed in the July report, will nonetheless help cushion the cobalt price.

Outlook

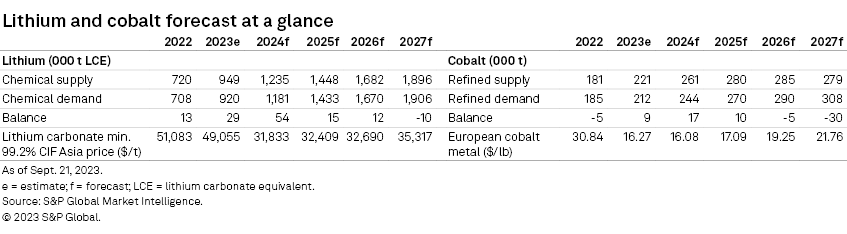

China's PEV sales have emerged from the March quarter slump. Monthly sales since June have exceeded the previous peak in December 2022. We have nonetheless downgraded our China passenger PEV sales forecast for full year 2023, from 8.2 million units to 7.8 million units, due to lower-than-expected sales year to date. Sales would need to average over 939,000 units per month in the final four months of the year — 31% higher than the 717,000 units sold in August — if our previous forecast were to be realized; in 2022, the equivalent ratio was 14%.

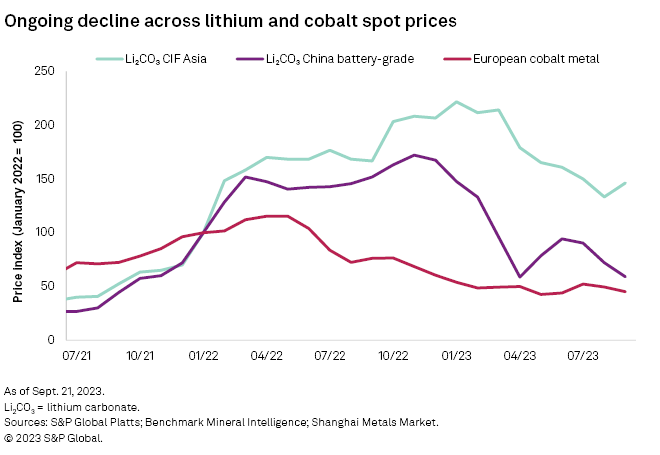

Decelerating growth in China's passenger PEV sales is set alongside a shift in battery material producers' inventory approach under a falling price environment. Meanwhile, macroeconomic headwinds are challenging consumer affordability, and planned supply additions have sustained the price correction across lithium and cobalt, more than offsetting temporary production cuts amid lower margins. The lack of restocking activity ahead of the National Day holidays in China and the peak-season demand delay could result in consumption coming in later than in previous years. As a result, we have downgraded our European cobalt metal price forecast for 2023 by $0.40/lb to $16.27/lb.

The lithium carbonate CIF Asia price increased $3,855 per metric ton in the latest Sept. 6 assessment to $43,855/t, however. We have therefore upgraded our full-year forecast by $1,738/t to $49,055/t. The contract price currently yields a sizable premium over spot prices, although we expect the latter to continue pressuring the former in the near term until peak-season PEV sales and battery production support lithium and cobalt demand and prices.

Notes

Historical lithium carbonate CIF Asia prices refer to Benchmark Mineral Intelligence's assessments. Historical cobalt metal prices refer to the Platts Cobalt 99.8% European benchmark; historical refined cobalt supply figures draw partly on the work of the Cobalt Institute.

As of Sept. 25, 2023, US$1 was equivalent to 7.31 Chinese yuan.

Platts-assessed cobalt 99.8% European price is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is a division of S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.