Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Apr, 2016 | 12:00

By Tom Manzella

Highlights

Capital costs data from the SNL Metals & Mining product indicates a significant increase in announced capital expenditure since our November 2015 analysis.

Despite persistent uncertainty in the mining sector, SNL Metals & Mining data shows that the industry's planned capital spending announced since January 2015 has risen to roughly US$108 billion from US$60.09 billion recorded in late 2015. While this estimate primarily comprises announced costs, which may never actually be spent, it provides context on where companies currently intend to allocate resources.

Last November, SNL Metals & Mining published an analysis of CapEx data, as reported by mining companies through October 2015, which offered insight into spending patterns based on target regions and commodities. The analysis documented CapEx plans totaling US$60.09 billion from 298 announcements. At that time, the U.S. and Canada together took the top spot for expenditure between Jan. 1 and Oct. 28, 2015, accounting for US$20.29 billion of spending on projects in the two countries. Gold was the highest-ranking commodity globally with US$15.05 billion earmarked in 136 announcements, and copper placed second with US$14.93 billion in 38 announcements.

Five months later, the data paints a different picture. As of April 7, 2016, SNL's database shows aggregate planned CapEx surging to US$108 billion in 505 announcements. Of this total, only US$5.07 billion has been reported spent since January 2015, while the remaining amount will potentially be spent over the next few years.

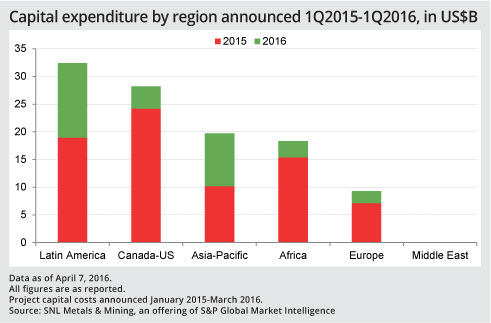

Between November 2015 and April this year, the bulk of announced capital spending shifted to Latin American mining projects, which accounted for US$32.43 billion in committed or actual spending. Copper projects, which are especially prevalent in the region, accounted for US$21.13 billion of the US$34.93 billion global total for copper projects.

Gold was a close second globally at US$32.12 billion, having risen 113% since November.Harmony Gold Mining Co. Ltd. and Newcrest Mining Ltd.'s 50/50 late-stage Wafi-Golpu project in Papua New Guinea recently projected investments of US$2.66 billion in initial CapEx, and an additional US$3.73 billion for expansion work.

NGEx Resources Inc.'s 60%-owned late-stage Constellation copper project in Chile will need US$7.44 billion, the largest planned capital allocation included in this analysis. The amount includes an estimated US$3.08 billion for initial capital costs, and an additional US$4.36 billion for sustaining capital over the mine's estimated 48-year life. Both spending projections were announced in January 2016, and are thus major contributors to the recently elevated figure for Latin America. Large CapEx projections were also announced since November last year for other Latin American projects, including US$1.93 billion for Vale SA's Salobo copper project in Brazil and US$725 million for Hot Chili Ltd.'s 49.9%-owned Productora copper project in Chile.

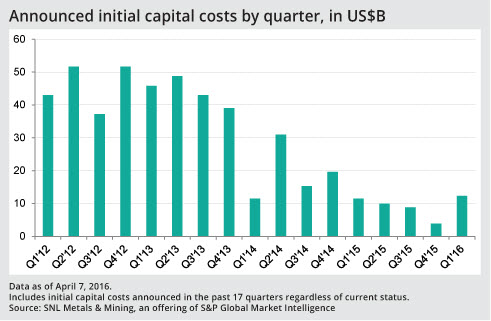

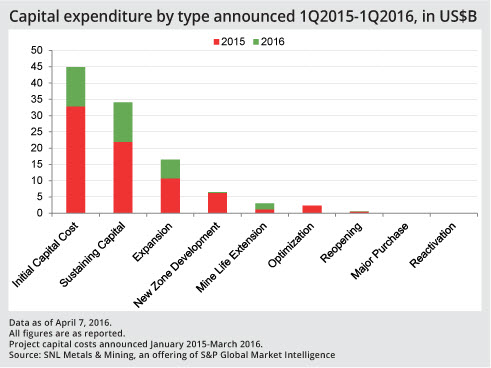

Initial capital spending has also increased significantly, rising 216% quarter over quarter in the first three months of 2016. The US$12.28 billion of projected initial CapEx announced in the last quarter is the highest since the fourth quarter of 2014, when mining companies allocated US$19.63 billion for initial capital costs. This is an encouraging sign for the industry — that as market sentiment slowly begins to improve, companies will likely continue to invest in new projects rather than focusing solely on sustaining capital. Renewed confidence could also lead to an increase in expansion and new zone development efforts at existing projects.

Sustaining capital spending has also improved since November, rising by 99%. Globally, companies have announced allocations of US$34.08 billion for sustaining capital, which is necessary for maintaining mining operations but does not necessarily lead to increased revenue from an asset.

In its November 2015 analysis, SNL projected a track for capital spending over the next few years using reported spending allocations. The projection accurately predicted an uptick in expenditure for Latin America, with copper rising to the top spot for commodities. It is important to note that while these estimates serve a useful purpose in providing context for current market sentiment, they are certain to change as companies continue to announce new or revised CapEx programs.

Based on SNL's assessment of reported data, projections for 2016-2021 show that, regionally, Latin America will continue to reign supreme, accounting for US$100.30 billion of planned capital spending over the next six years. In terms of commodities, copper is currently projected to account for 30% of the projected US$258.73 billion in global CapEx over the six-year period. Initial capital costs account for US$151.97 billion, or 59%, of the projected total for the next six years.