Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jun 16, 2021

By Sian Jones

Service sector reopens, but vaccination rollouts and international travel restrictions set to weigh on tourism-led recovery

Manufacturing operating conditions improve markedly amid stronger client demand

Business confidence almost at levels seen in February 2020

As Europe begins to ramp up vaccination rollouts, countries such as Greece, where the tourism sector is vital to the wider economy, have an additional pressure to maintain vaccine take-up across the population to ensure visitor bookings. The recent reopening of the service sector has boosted sales at some manufacturers, but for a broader economic recovery to take hold and be sustained Greece requires travel restrictions to loosen in key markets and confidence in the safety of travel to be re-established among customers.

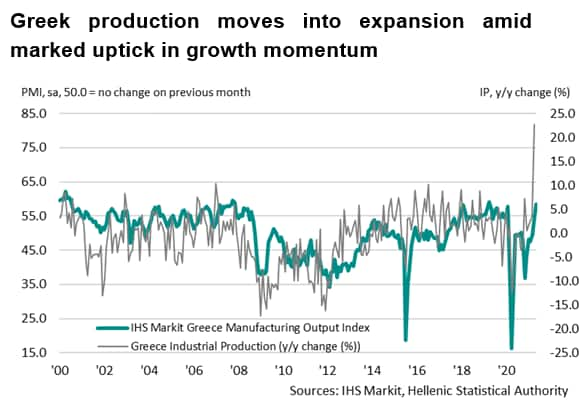

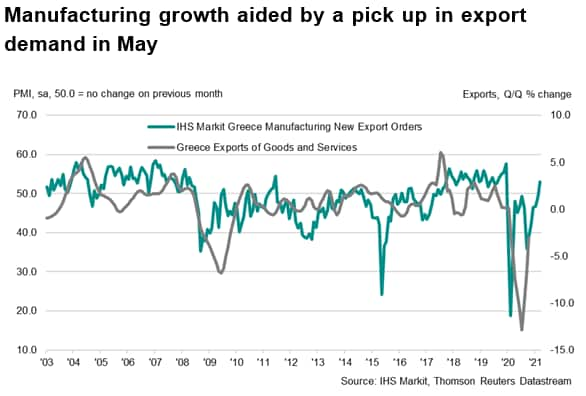

As the economy has gradually reopened through 2021 so far, the manufacturing sector has strengthened from the historic lows seen in 2020. The IHS Markit Greece PMI Manufacturing Output Index signalled the strongest expansion in production for over two years, boosted by a significant upturn in new orders. Anecdotally, many firms mentioned that the relaxation of virus-fighting restrictions early in May had driven client demand.

Manufacturing sector building strength once more

In February 2020, the Greek manufacturing sector was signalling a marked upturn in production and a second successive monthly acceleration in the rate of new order growth. However, the pandemic and associated lockdown restrictions soon plunged the Greek manufacturing sector into decline. Output fell at the sharpest pace on record in April 2020, with the seasonally adjusted index dropping some 41.3 points in just two months.

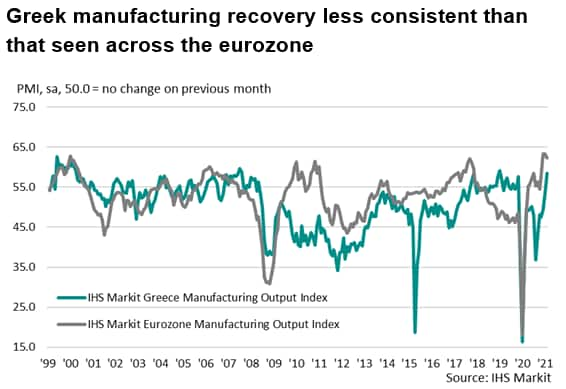

After a year of moves towards recovery which were often stifled by a resurgence in COVID-19 cases and renewed lockdowns, the manufacturing sector indicated the first rise in output for seven months in April 2021. The expansion gained notable ground in May, with the rate of production growth the steepest since April 2019. In fact, our current forecast signals a 2.8% increase in output in 2021 compared to 2020. This rise in production is expected to outstrip the decline seen in 2020, with the manufacturing sector likely to return to pre-pandemic levels by the end of the year.

In fact, goods producers registered historically elevated levels of optimism regarding the outlook for the coming 12 months in May. The degree of confidence in a rise in production over the coming year rose to the highest since February 2020, amid stronger domestic and foreign client demand, and a hopes of a successful vaccination rollout.

Short terms challenges remain, however, as significant supply chain disruptions drove cost burdens up markedly in May. Although still substantial, pressure on supply chains seemingly eased marginally, as supplier delays lengthened to a slightly less marked degree during the month. That said, longer delivery times continued to exert strain on cost burdens as input prices rose at the sharpest pace on record (since data collection began in May 1999).

Service sector outlook less certain

Although the outlook for the manufacturing sector is reasonably rosy given ongoing restrictions and pandemic uncertainty, the driving force that is the service sector has a greater number of hurdles to jump before a significant recovery can be noted. Greece's service sector is heavily based around the tourism industry, which in turn is reliant on successful vaccination rollouts, as well as a revival in customer confidence in leisure travel and the further easing of international restrictions.

Although some travel certificates and bridges have been announced for the summer season 2021, many of the key markets Greek firms would expect to receive tourists from remain cautious to encourage international travel without restrictions or quarantine measures attached. Our current expectations do not put the tourism sector recovering to pre-pandemic levels until at least 2022, and this is of course dependent on no further large spikes in cases in the latter stage of 2021 or a slowdown in vaccine rollouts, which would further delay the reopening of borders and leisure travel.

At the time of writing, just over one-in-four Greek citizens were fully vaccinated. This proportion is much higher when focussing on the popular Greek island tourist destinations as it is hoped all citizens in these areas will be fully vaccinated by the end of June to coincide with the summer holiday season.

Forthcoming economic data releases:

1st July 2021: IHS Markit Greece Manufacturing PMI (June)

7th July 2021: IHS Markit Europe Sector PMI (June)

Siân Jones, Senior Economist, IHS Markit

Tel: +44 1491 461017

sian.jones@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location