Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 06, 2023

The Global PMI data - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - showed companies' costs and selling prices continued to rise at historically elevated rates in June, buoyed in particular by rising wage costs, though rates of inflation ran well below last year's peaks.

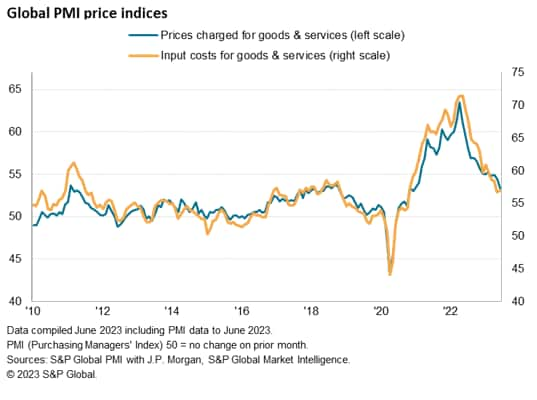

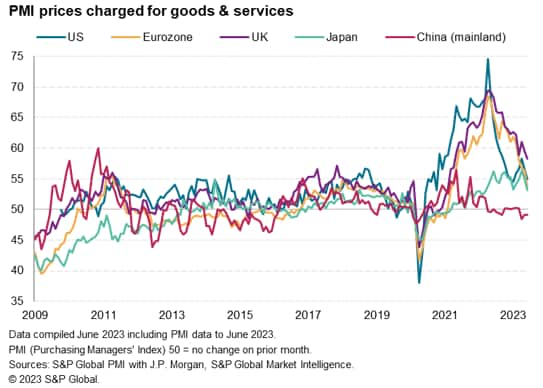

The survey's selling price index - covering both goods and services in all major developed and emerging markets - fell to 53.4 in June, down one point from May and down to its lowest since December 2020. This index has now slumped just over ten points from a high in April of last year, indicating a sharp cooling of inflationary pressures. However, the index remains well above the pre-pandemic ten-year average of 51.2 to suggest that price pressures remain somewhat elevated by historical standards.

Furthermore, a steepening rate of increase in cost pressures hints at selling price inflation remaining elevated in July. The global PMI's index of companies' costs across both goods and services rose for the first time in five months in June, signalling a modest increase in input cost inflation. While this index has likewise fallen sharply over the course of the past year, it too remains considerably higher than the pre-pandemic ten-year average.

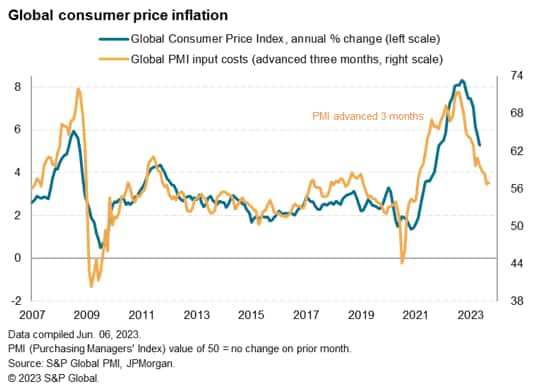

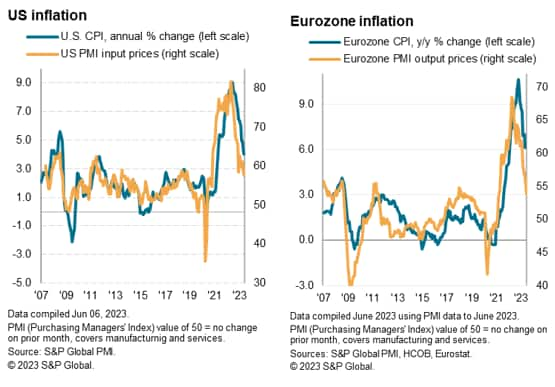

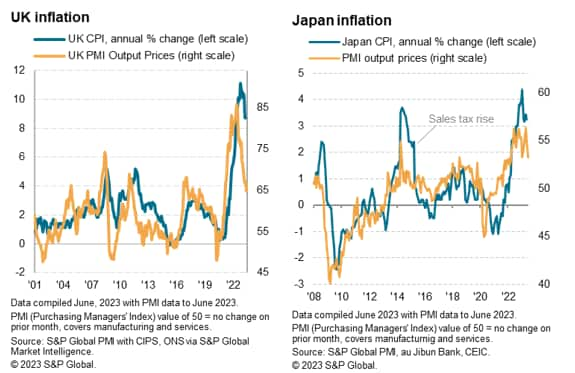

Putting the latest PMI data into perspective, the current readings suggest global consumer price inflation will continue to cool from the estimated 5.3% annual rate seen in May. However, any further fall much beyond 4% looks unlikely on the basis of these latest PMI readings, pointing to a stubborn stickiness of global inflation relative to the pre-pandemic decade average of 2.7%.

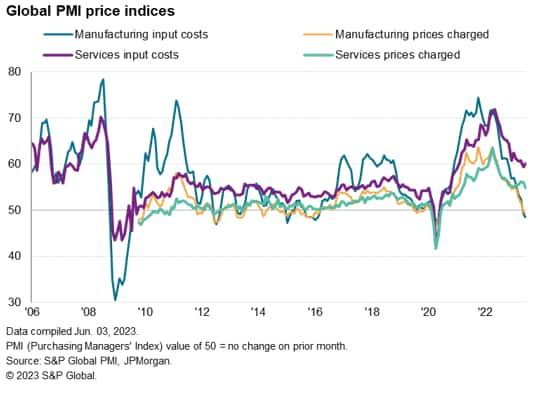

The stickiness of inflation is stemming from the service sector. Whereas the PMI surveys showed both input prices and selling prices falling worldwide for manufactured goods for a second successive month in June, service sector costs and selling prices continued to rise, with costs notably growing at an increased rate.

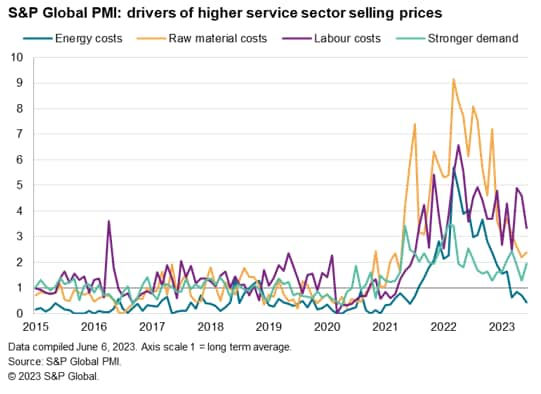

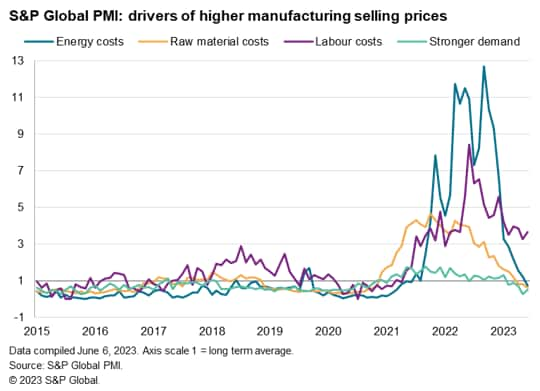

Analysis of the responses provided by PMI survey respondents can be used to estimate the degree to which different factors are driving inflation in different sectors. This information is gleaned from anecdotal evidence provided by companies to accompany the direction of change signaled for each survey variable. These data are presented as time series for which a value of 1.0 represents the long-run average.

These data inform us that the biggest upward pressure on service sector costs has been coming from wages so far this year, with the inflationary impact from labour costs running at over three times the long run average again in June. Upward pressures from raw material costs - notably food - are running at over twice the long run average, as are demand-pull price pressures. Thankfully, some respite is coming from energy prices, the pressure from which is now at a two-year low.

In manufacturing, the only major factor now exerting any significant upward pressure on selling prices in May was labour costs. At over three times the long-run average, the upward pressure on goods prices from labour costs is well above anything seen prior to the pandemic since data were first available in 2005. However, this inflationary pressure is being offset by diminished pressures from raw materials, energy and demand, all of which are now below their long-run averages in manufacturing.

Looking at the world's major economies, falling average selling prices in mainland China were accompanied by cooling rates of inflation in the US, Eurozone, UK and Japan in June. However, in all cases, the rate of inflation remained well above the pre-pandemic averages to suggest some stickiness to consumer price inflation ranging from the highest degree in the UK to the lowest in Japan.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location