Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 24, 2023

By Jingyi Pan

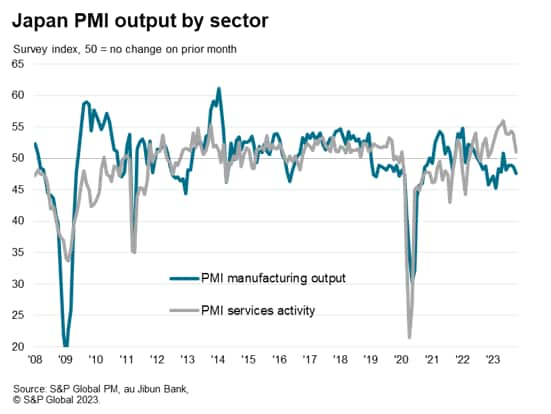

October's flash PMI data revealed that Japan's private sector economy concluded the eight-month growth streak that commenced in January 2023. This was attributed primarily to a sharper fall in manufacturing production, though services activity growth also slowed to the weakest in the year-to-date.

At the same time, forward looking indicators outlined the likelihood for further paring of growth momentum within the service sector while manufacturing production is expected to remain in contraction, especially with sharper dips in new orders and backlogs noted.

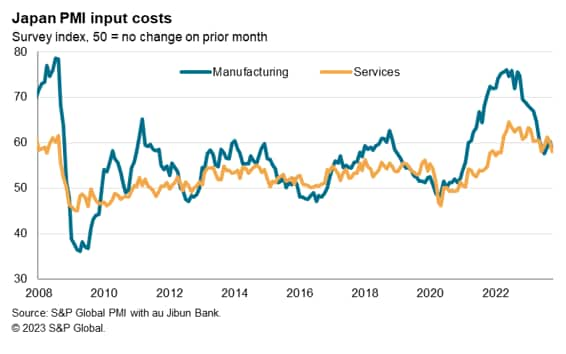

More positively, Japanese manufacturers and service providers faced reduced cost pressures in October amid the cooling of demand, thereby leading to slower increase in prices charged. This, however, casts some doubt on whether headline CPI can continue to run above the central bank's target into 2024.

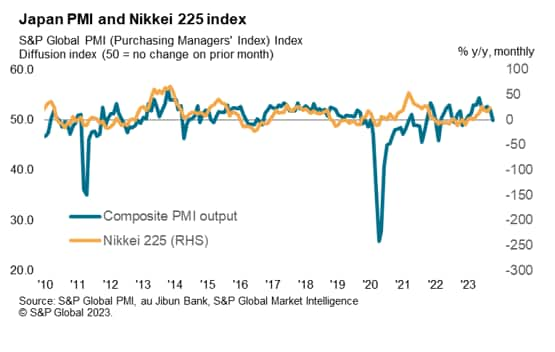

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, slipped to 49.9 in October from a final reading of 52.1 in September. This marked the first contraction in private sector activity since December 2022, and signals a weak start to the fourth quarter of 2023.

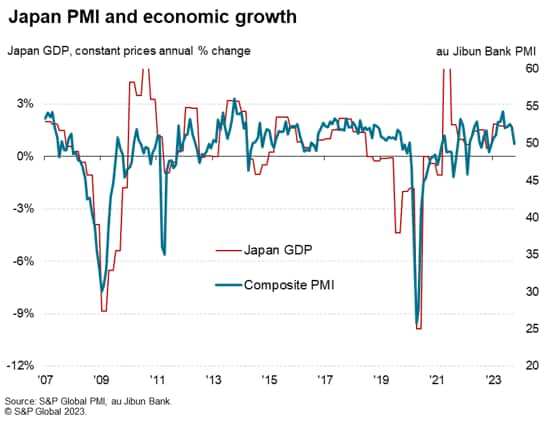

The latest composite output reading - covering both manufacturing and services - therefore points to GDP growing at an annual rate just under 1.0% at the start of the fourth quarter, which is in line with the pre-pandemic 10-year average.

The latest downturn was primarily underpinned by a sharper contraction in manufacturing production. Output fell at the quickest rate since February, according to flash PMI data, as economic conditions deteriorated both domestically and externally. Anecdotal evidence further suggested that destocking efforts remain underway at clients of Japanese goods producers, thus leading to reduced operations in October.

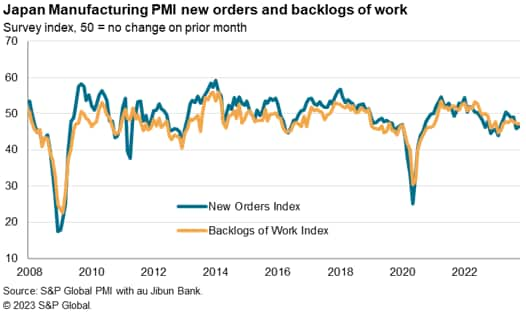

Examining the new orders and backlogs of work indices, which tend to offer valuable insights into production trends in the coming months, both gauges have remained in sub-50.0 territory to hint at worsening production conditions in the months ahead. According to survey respondents, softening demand conditions from key export destinations including mainland China and Europe were highlighted as reasons for reduced new export orders over October.

On the other hand, services activity remained in expansion amid still-robust consumer services demand. Anecdotal evidence highlighted that tourism demand continued to support service sector growth. That said, with the latest slowdown in services growth momentum, improvements in the sector failed to offset manufacturing sector weakness, thus resulting in private sector conditions being tipped into contraction territory.

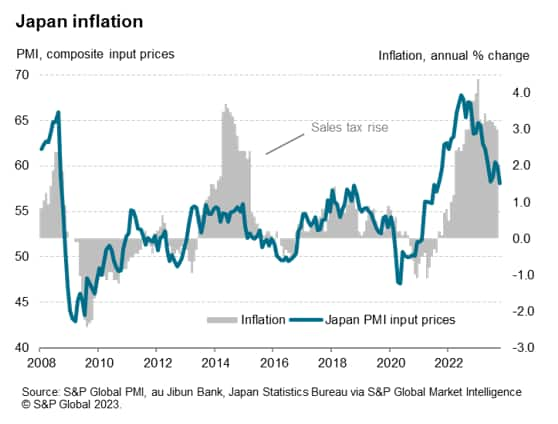

Price pressures cooled off the back of the softening demand conditions. Input cost inflation fell for a second straight month in October, leading to the slowest rise in average output prices for goods and services since February 2022. This was underpinned by softer input cost inflation across both manufacturing and service sectors.

On a three-month rolling average basis, however, service sector cost inflation remained above that of the goods producing sector. And amid sustained services new business growth, while manufacturing demand deteriorated, the service sector will be the one to watch for further indications on whether CPI can remain elevated into 2024.

Overall, however, the latest PMI price data suggest there may be some uncertainty pertaining to prices staying above the 2% level into 2024, which may complicate the Bank of Japan's decisions with regards to monetary policy changes. Next week's Bank of Japan meeting, alongside their inflation projections, will be keenly watched in light of the latest developments.

Looking at the Future Output Index, the only sentiment-based PMI sub-index, Japanese private sector firms are the least upbeat with regards to output in the next 12 months since January. Weakening domestic and global economic outlooks, as well as longer-term labour constraints, were listed as principal reasons for the reduced optimism in October.

Consequently, for private sector business activity and thereby the Japanese equity market, which finds a broad correlation with PMI output indices, the lower Future Output Index alongside other forward-looking indicators hint at the potential for downsides to be observed in the coming month.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.