Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 21, 2023

PMI survey data point to the Japanese economy enjoying a solid start to the second quarter, with business activity rising for a fourth successive month. Leading the upturn was an unprecedented surge in demand for services, which prompted a near-record increase in job creation in the sector. However, manufacturing remained in decline, stymied by weak demand and destocking.

Reduced demand for goods helped cool price pressure in the manufacturing sector, but overall cost growth in the economy remained elevated, albeit consistent with inflation moving closer toward the Bank of Japan's target.

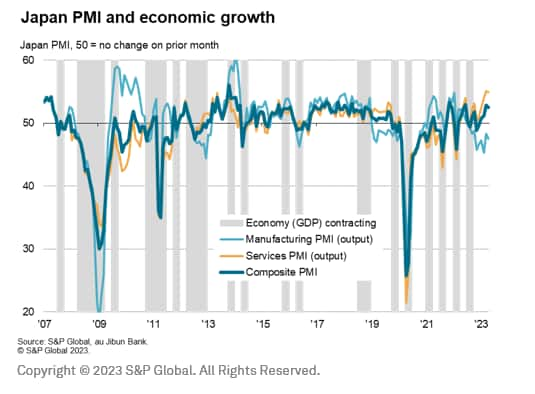

Japan's economy started the second quarter on a solid note, according to the flash au Jibun Bank PMI, compiled by S&P Global. The preliminary reading of the PMI, based on around 85% of usual survey replies for the month, registered 52.5 in April, down slightly from 52.9 in March but still signalling a fourth successive month of growth after two months of decline at the end of last year.

The latest reading compares favourably with an average of just 51.4 in the five years preceding the pandemic and is broadly consistent with GDP growing at an annual rate of just under 2%.

There were marked variations in performance by sector, however, raising concerns over the durability of the upturn. While service sector growth continued to run at one of the fastest rates on record for the survey, manufacturing output continued to decline at a marked pace.

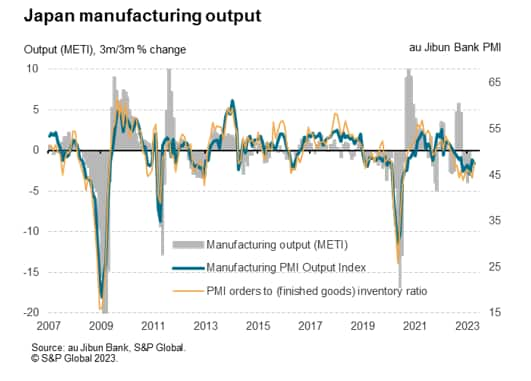

Manufacturing output contracted in April at a rate comparable to a 2% quarterly production decline, underscoring the sustained drag from the goods producing sector into the start of the second quarter.

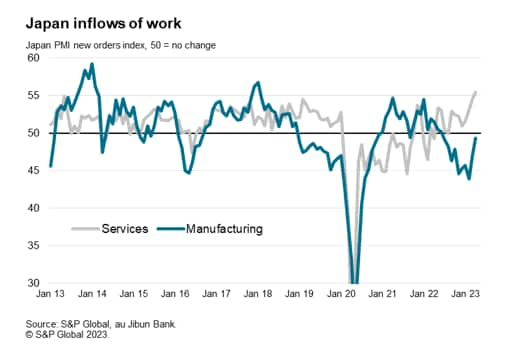

The diverging sector trends look likely to persist in the near term. New order inflows fell again in manufacturing during April, down for the tenth successive month, albeit declining only modestly. However, inventories rose during the month, often due to lower than planned sales, meaning the survey's forward-looking new orders-to-inventory ratio remained in negative territory.

In contrast, inflows of work into the service sector rose at a rate unprecedented since services survey data were first compiled in 2007.

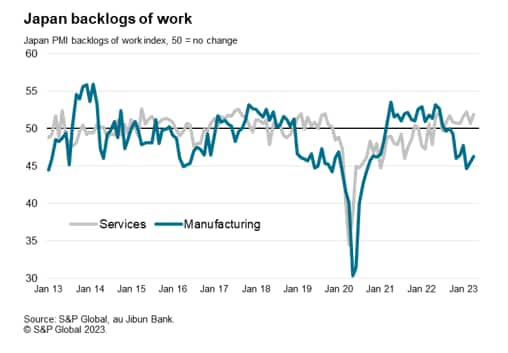

These divergent indicators of inflows of new work fed through to similar varying trends in backlogs of work. Backlogs of uncompleted orders provide an important insight into likely future capacity requirements, and the clear signal from the survey is that service sector firms are likely to expand capacity in the coming months to meet rising backlogs of work, but in manufacturing a steep fall in backlogs means factories may start to be concerned about excess capacity.

These varying capacity requirements were in fact borne out by manufacturing employment remaining largely unchanged in April, contrasting with a gain in service sector employment that has only been exceeded once since 2007.

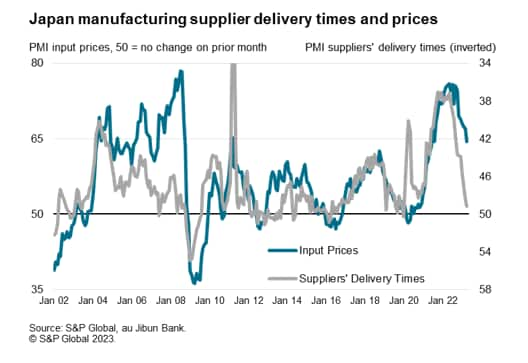

One ongoing upside from the downturn in demand in the manufacturing sector was a further easing of supply chain delays. With suppliers being less busy, delivery times lengthened in April to the smallest degree seen since the start of the pandemic in January 2020, lengthening only very marginally.

These easing supply chain constraints and the further drop in demand mean pricing power has shifted further from the seller to the buyer, helping bring manufacturing input cost inflation down in April to its lowest since June 2021. Note though that the rate of increase remains stubbornly high by standards seen in the decade leading up to the pandemic, in part reflecting the impact of the weak yen.

However, stickiness is also seen in terms of service sector costs, which rose at a slightly increased rate in April. Although down from the peak seen in June of last year, the rate of service sector input cost inflation remains far higher than anything recorded by the survey in the decade prior to the pandemic, in part due to rising staff costs as well as rising raw material costs, leading to a near-record rate of increase for prices charged for services.

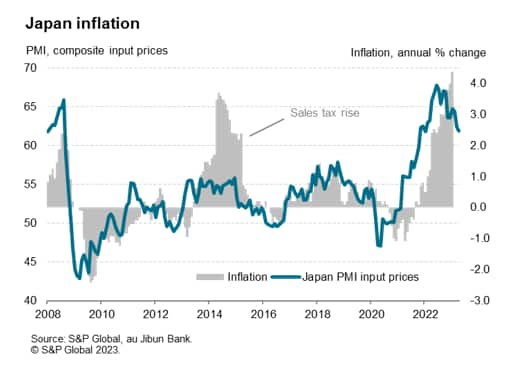

More positively, even the still-elevated rate of input price inflation seen across manufacturing and services remains consistent with consumer price inflation running at just 2.5%, down from signalling a peak of around 4% in June of last year. The rate of inflation is therefore signalled to be cooling further toward the Bank of Japan's 2% target, which will likely encourage policymakers to retain their ultra-loose policy stance in the near term.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location