Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Insurance — 23 Jan, 2018

By Matei Rosca and JahanZaib Mehmood

When private equity giant KKR & Co. LP bought a margarine business from Anglo-Dutch consumer conglomerate Unilever Plc for around €6.8 billion in December 2017, a group of banks financed a large part of the deal through leveraged debt, which they intended to repackage and sell to investors.

But should the public's taste for spreading vegetable fat on their toast wane and KKR's new buy get into trouble, investors may find it hard to recover their money, since the terms of leveraged loans and high-yielding bonds, both of which classify as leveraged finance, have been giving creditors far less protection than they would have two or three years ago.

Far from being unusual, the KKR deal for brands including Flora is just one example of a trend that has been growing fast since 2015: so-called covenant-light, or cov-lite, financing.

Looser contract terms

Leveraged debt has become a borrowers' market, data and contract analysis shows, with the erosion of safeguards making it difficult to identify stress in the corporate sector.

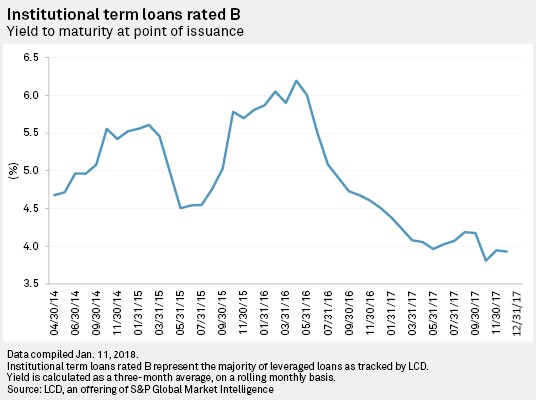

With mergers and acquisitions becoming more frequent, debt for company buyouts continues to be successfully issued at lower rates by banks competing for market share. Beneficiaries, usually private equity companies, push for increasingly loose terms while investors, chasing yield, are willing to buy the resulting assets because higher-rated securities come with historically low interest payments."All the early-warning triggers have disappeared from leveraged loans contracts. It is a major issue," said Jane Gray, the co-head of European research at Covenant Review, an independent research firm, in London. "Demand is far outweighing supply … certain firms are habitually more aggressive."

Among the protections that have now largely disappeared from leveraged deals are bans on selling company assets and extracting profits before the borrower pays down its debts, obligations to settle overdrafts known as revolving credit facilities at least once a year, and certain restrictions on taking on further debt, Gray said. Should a company tip into bankruptcy, its creditors are now less likely to recover their money in a restructuring due to the cov-lite model, she added.

The ECB, which monitors the financial stability of banks in the eurozone, defines leveraged finance as credit to companies whose debt exceeds earnings before interest, taxes, depreciation and amortization, or EBITDA, by more than 4x, and has recommended that deals with leverage of more than 6x should be "exceptional." It also said it would count all debt-funded private equity buyouts as leveraged, and indicated it would police bank risks in this field by increasing reserve capital requirements as needed.

Property website Zoopla Ltd. recently tapped the debt market for the first time in its existence by issuing £200 million in high-yield notes, which qualify as leveraged finance and which Covenant Review has highlighted as risky due to a "phony" leverage test that it says may be easily gamed. But in a sign of investor eagerness, the bonds were multiple times oversubscribed.

Borrowers are also increasingly demanding a veto over investors' ability to sell their loans on to specialized debt recovery companies, Gray said.

"The implication is that lenders may not be able to transfer out in case of stress or distress," she said. "Some investors do not have the skill set to go through a restructuring, or they do not have the appetite for it."

A robust market

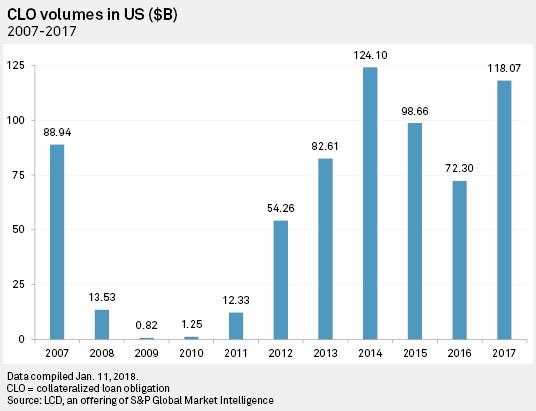

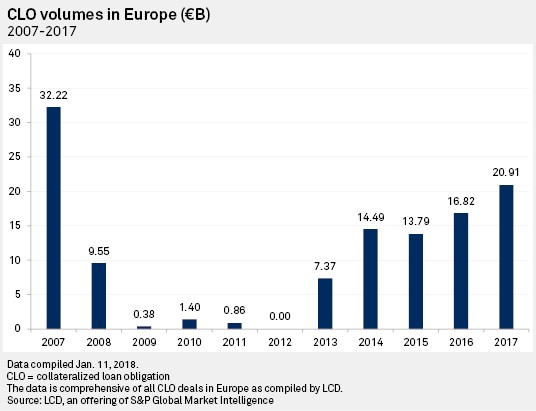

The market grew dramatically in both Europe and the U.S. in 2017, and, in the latter, has far exceeded pre-crisis levels, according to data compiled by LCD, an offering of S&P Global Market Intelligence.

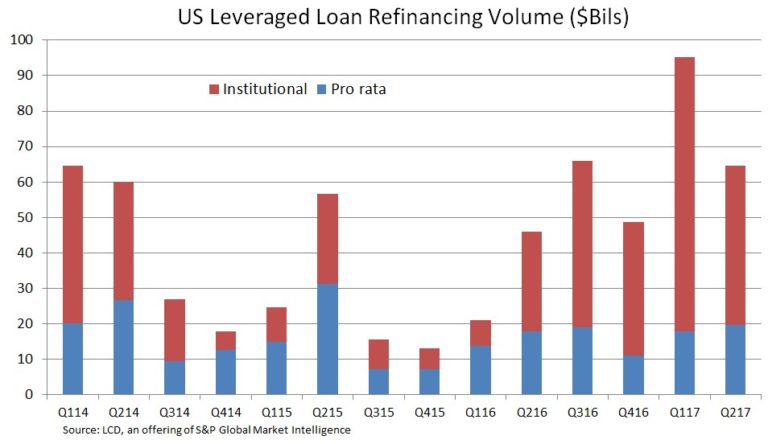

Total leveraged loan volumes in Europe jumped to $135.95 billion in 2017 from $77.06 billion in 2016, and in the U.S. to $645.70 billion from $481.93 billion, according to LCD.

European collateralized loan obligations, or CLOs, — funds that trade such loans — totaled €20.91 billion in volume at the end of 2017, compared to €16.82 billion in 2016 and €32.22 billion in 2007. In the U.S., the total volume at the end of 2017 was $118.07 billion, up from $72.30 billion in 2016 and $88.94 billion in 2007.

As issuance has increased, yields have come down, indicating growing demand from investors despite an increasing lack of protections. As of the end of 2017, 73.29% of the S&P European Leveraged Loan Index were cov-lite, with a default rate of 1.11% for the past 12 months, according to LCD.

"2017 was a record year," said a senior executive at a top European bank, adding that bank income from leveraged finance went up some 14%.

Revenues and volumes may be slightly lower in 2018 because of a high level of refinancing in 2017 that is unlikely to be matched, he said, requesting anonymity due to the sensitivity of the matter. However, banks hope the gap will be filled by mergers and takeovers, as "corporate confidence remains strong," he said.

The financier conceded that protections have decreased, saying that "marginally, banks are more at risk now." He added, though, that revolving credit facilities, which banks keep on their balance sheets, remain broadly safe.

"Banks retain an element of control over revolving credit," although the covenants for this type of overdraft are not as numerous as they were two years ago, he said.

Some see the cov-lite phenomenon as beneficial.

"There's ... a view that the more flexible capital structures actually give [private equity firms] more options to inject equity, quasi equity or junior debt," said Nick Clark, a lawyer specializing in leveraged deals at law firm Allen & Overy. "Having these options available can mean an increased chance of raising capital to help businesses manage through the downturns."

But not all investors are convinced. Patrick Marshall, head of private debt and CLOs at asset manager Hermes Investment Management, wrote in a recent blog post that "the current dominance of cov-lite loans may result in higher losses in the large-cap market in the future," adding that Hermes "never" lends on cov-lite terms.

Learn more about LCD, an offering of S&P Global Market Intelligence.

Theme

Products & Offerings

Segment