Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 8 Dec, 2021

By Louis Bacani

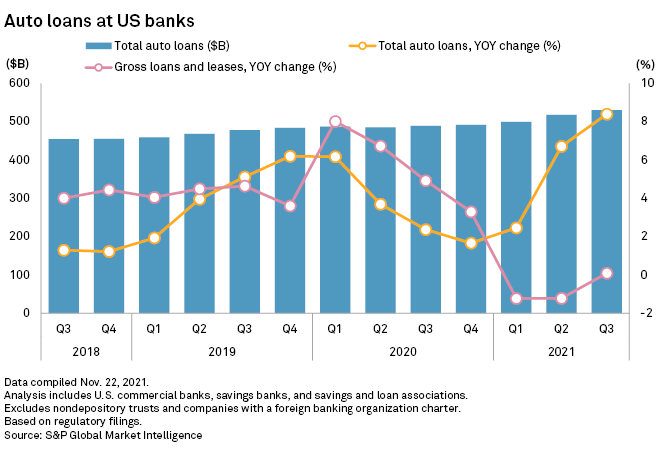

In this edition, we take a close look at the U.S. banking industry’s third-quarter loan growth, which came to a year-over-year rate of 3.1%, excluding loans under the Paycheck Protection Program. Credit card loans rose 1.2% from a year ago, following five consecutive quarters of declines as consumer spending continued to accelerate. Construction loans climbed 4.1%, with loans for residential and nonresidential properties logging increases, while loan delinquencies continued to shrink. Auto loans grew robustly at 8.4%, as lenders resorted to competitive product offerings amid high demand and prices.

Share buybacks by S&P 500 companies totaled $232 billion in the third quarter of 2021, beating the quarterly record of $222.98 billion in the fourth quarter of 2018, according to data from S&P Dow Jones Indices. Share buybacks are on track for a new annual record this year as companies spend cash stockpiled during the early part of the pandemic.

North American electric utilities could flood the M&A market with contracted renewables portfolios in 2022 as those assets fetch attractive prices and the trend toward pure-play, investor-owned and regulated rate bases persists. While there may be some corporate-level and whole-subsidiary transactions, minority stake transactions and contracted renewable power asset recycling will likely dominate deal-making in 2022, analysts said.

Loan growth lags QOQ at largest US banks in Q3

Loans excluding the Paycheck Protection Program at the 15 largest U.S. banks grew by 1.7% quarter over quarter, compared to 2.0% growth for the wider industry.

Read the full article from S&P Global Market Intelligence

Banks see credit card loans rise YOY in Q3 as spending further accelerates

Credit card loans rose 1.2% year over year during the third quarter, compared to a 2.0% drop in the previous quarter, according to data from S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

Banks' exposure to construction loans kept climbing in Q3

Banks continued to increase their real estate construction lending portfolios, both nominally and relative to their balance sheets.

Read the full article from S&P Global Market Intelligence

'Planets aligned' for auto sector as banks record robust loan growth in Q3

Banks' total auto loans rose to $530.20 billion in the third quarter, up from $518.11 billion in the second quarter and $489.16 billion in the year-ago period.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Credit and Markets

US share buybacks on track for record year after rebound

Record levels of bond issuance and a sharp economic recovery have left companies flush with cash, encouraging corporate board rooms to return capital to shareholders.

Read the full article from S&P Global Market Intelligence

Fed risks liquidity crisis as it manages withdrawal from Treasury market

The size and structure of the Treasury market means it is likely the Federal Reserve will have to step in to provide liquidity in times of market stress.

Read the full article from S&P Global Market Intelligence

Financials

Top 50 US banks in Q3'21

Forty-one of the 50 largest U.S. banks and thrifts reported an increase in assets during the third quarter.

Read the full article from S&P Global Market Intelligence

US regulators worried about stablecoin risk weigh broader bank participation

A recent speech by a Federal Reserve official and the President's Working Group's stablecoin report suggested that banks can take on a larger role in the evolution toward a future monetary system through the use of stablecoins.

Read the full article from S&P Global Market Intelligence

European banks' Q3 profits rebound as provisions decline

The biggest banks in Europe booked significantly lower loan loss provisions in the third quarter, largely due to reduced downside risks as economies rebound from a coronavirus-prompted downturn, S&P Global Market Intelligence data shows.

Read the full article from S&P Global Market Intelligence

Better asset quality, economic rebound brighten Indian banks' earnings outlook

India's largest banks are well-positioned to see improved earnings for the rest of the fiscal year that ends in March 2022 as bad loans decline and the country's economic recovery picks up pace.

Read the full article from S&P Global Market Intelligence

Insurance

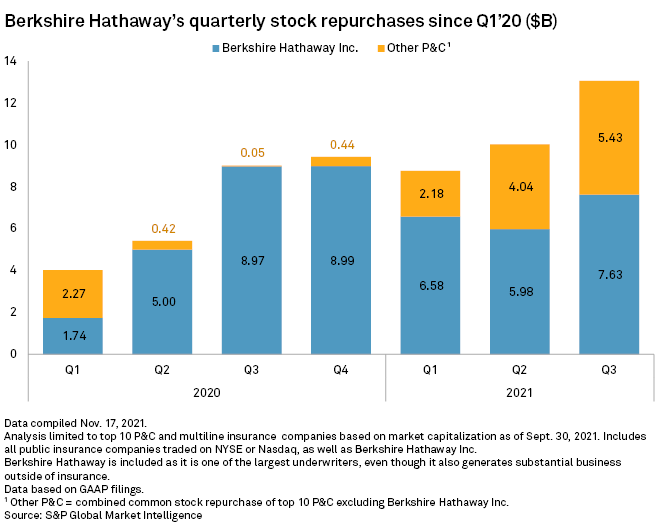

Berkshire leads the way as US P&C insurers grow share buybacks in Q3

Warren Buffett's Berkshire Hathaway accounted for the lion's share of buybacks at $7.63 billion, up 28% from the second quarter but down 15% from a year ago.

Read the full article from S&P Global Market Intelligence

Fintech

Chile's fintech bill raises expectations for growth in the sector

The proposed bill sets the stage for regulation of cryptocurrency providers, peer-to-peer lending, digital banks and online investment brokers, among other subsectors in the fintech industry.

Read the full article from S&P Global Market Intelligence

Lending fintechs in Argentina target low-income adults

During the pandemic, fintechs expanded to the interior of Argentina to deliver loan products. Online lenders in Argentina serve the underbanked, a high-risk segment overlooked by traditional banks that can provide opportunities for strong gains.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

2022 utility M&A to focus on renewable asset recycling, minority stake sales

Industry analysts expect North American electric utilities to shed contracted renewables portfolios as momentum for shrinking unregulated businesses continues.

Read the full article from S&P Global Market Intelligence

Gas generators make their move as Texas redesigns power market

Plant developers are lobbying Texas regulators to create market products that would incentivize new gas-fired generation. One company, WattBridge, is leading the charge.

Read the full article from S&P Global Market Intelligence

US utilities ramp up spending plans, brace for winter and legislation

Management teams kept their eyes on rising gas prices, supply chain constraints and the passage and impact of federal energy policy during third-quarter earnings calls and the 2021 Edison Electric Institute Financial Conference.

Read the full article from S&P Global Market Intelligence

Metals and Mining

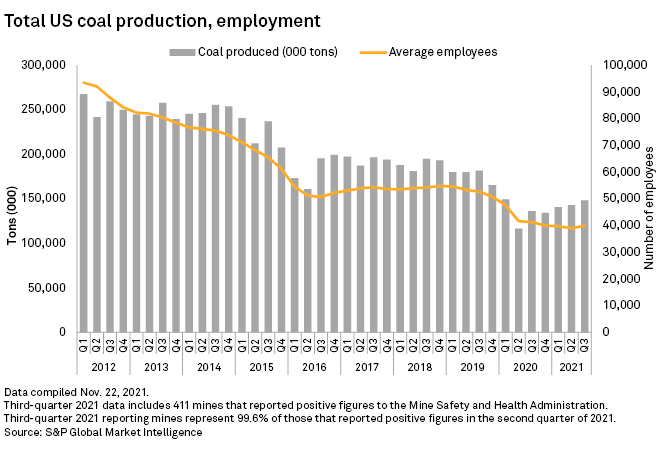

US coal employment holds steady as producers face tight labor market

The number of workers employed at U.S. coal mines was steady during the third quarter, barely budging as producers struggled to keep up with a rebound in coal demand tied to surging natural gas prices.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Twitter CEO change 'pivotal' as new chief confronts stalling user growth

After Twitter CEO Jack Dorsey confirmed his resignation, investor groups and analysts said the leadership change is a net positive for the microblogging platform as it seeks to expand its user base and product offerings.

Read the full article from S&P Global Market Intelligence

The Week in M&A

Private equity investment in European financial services poised to dip in 2021

Read full article

Private equity firms keen on UK midtier banks, but deals prove elusive

Read full article

Chinese steel deal tops metals, mining M&A for week ended Nov. 26

Read full article

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Upcoming & On-demand Webinars

M&A in Focus: 2021 Trends and the Deal Horizon featuring City and Blackstone | 8 December

Register Now

The Growth of (Fin)tech in Europe: What’s in Store for Investment and M&A in 2022?

Watch Replay

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.