Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 9 Nov, 2021

By Jasim Zahid

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

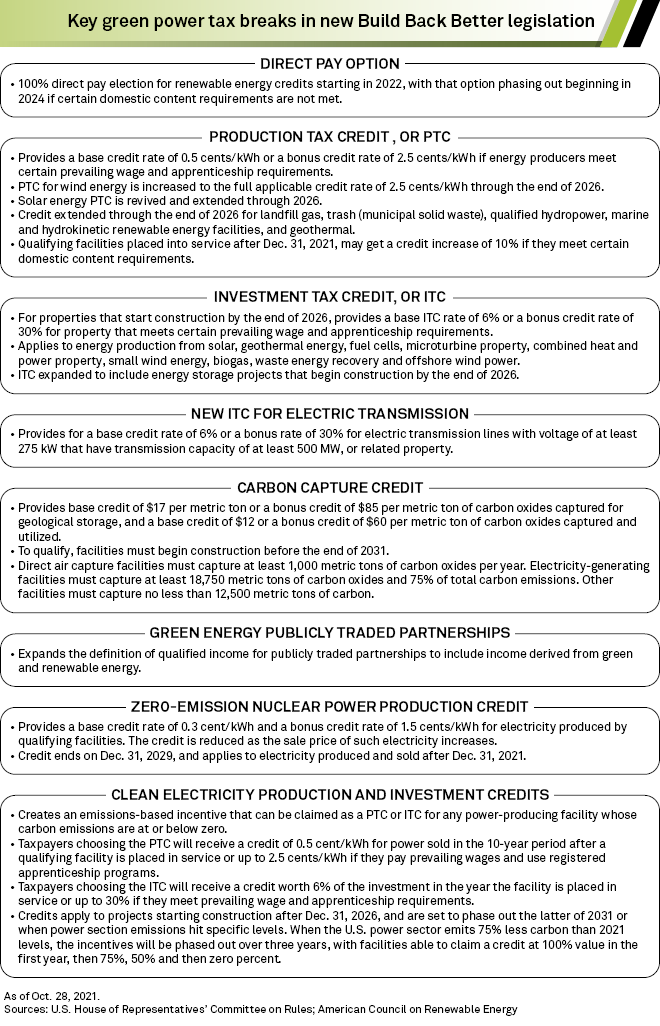

In this edition, we take a close look at the Build Back Better Act, the U.S. House of Representatives' new $1.75 trillion reconciliation package and infrastructure bill loaded with major climate and clean energy provisions. Renewable energy developers have welcomed the bill's proposal to expand and extend tax credits for clean power projects. However, utilities and other project owners would need to meet domestic content and labor requirements to receive the full benefit of the credits, something that industry experts say could be tough to satisfy.

Several U.S. banks recorded higher expenses in the third quarter related to increased employee wages, as companies sought to tackle the labor supply shortage by raising compensation. Some banking executives are not optimistic that they can manage the expenses and are searching for ways to offset wage inflation.

Recommendations for new cryptocurrency rules are expected to be published within weeks as the growth of stablecoins has prompted calls for issuers to be regulated like banks. The market for stablecoins, which are pegged to government-issued currencies, has ballooned to about $130 billion, according to data from Coin Metrics and The Block.

US House unveils new reconciliation bill loaded with climate, clean energy money

The nearly 1,700-page bill was stuffed with major climate and clean energy provisions but excluded some key climate measures that Democrats had been advocating to curb greenhouse gas emissions.

Read the full article from S&P Global Market Intelligence

Proposed US clean energy tax breaks could be transformational, but risks loom

Congressional Democrats are pursuing a massive 10-year program of clean energy tax incentives, but developers are nervous about related domestic content and labor requirements and a potential new tax on corporations that could affect large utilities.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Bank M&A's near-term outlook unclear as Fed operates without supervision chief

The Federal Reserve has been operating without a vice chair for supervision since Randal Quarles' term expired Oct. 13, which industry observers say could complicate deal approvals and other regulatory issues.

Read the full article from S&P Global Market Intelligence

Wage pressures inflate US banks' expenses in Q3

A number of U.S. banks reported higher expenses in the third quarter, partly due to increases in compensation-related expenses as companies attempt to attract and retain workers.

Read the full article from S&P Global Market Intelligence

US banks with lowest price-to-adjusted tangible book values in October

Republic First Bancorp Inc. is the lowest-priced bank in the analysis.

Read the full article from S&P Global Market Intelligence

Columbia, Umpqua avoid merger-of-equal label but still get MOE treatment

Columbia and Umpqua did not label their deal a merger of equals, but part of the initial sell-off of their stocks was likely due to the perception that the deal looks like an MOE, industry observers said.

Read the full article from S&P Global Market Intelligence

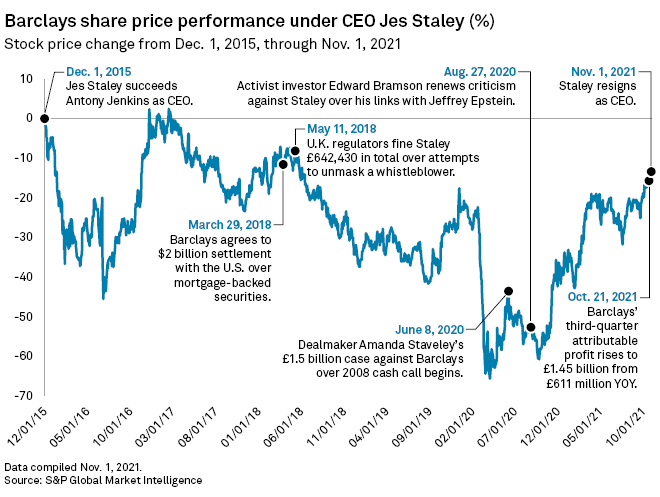

Barclays expected to remain committed to i-bank after Staley's departure

The appointment of C.S. Venkatakrishnan, head of Barclays' global markets division, is a sign that the bank's strategic focus on its corporate and investment banking arm is set to continue, analysts said.

Read the full article from S&P Global Market Intelligence

Insurance

California has hit brakes on private auto rate hikes since start of pandemic

An S&P Global Market Intelligence analysis shows that the regulator signed off on 29 requests for private auto rate increases between January 2019 and March 2020, but none since April 2020.

Read the full article from S&P Global Market Intelligence

California approves significant workers' comp insurance rate cuts in Q3

All 10 of the most notable rate reductions in the period were approved in the Golden State, according to an S&P Global Market Intelligence analysis.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

Proposed methane fee would mark major development in US climate policy

The oil and gas industry strongly opposes the fee, but a market observer said the sector could absorb expenses associated with proposed methane standards, reduce emissions and still remain profitable.

Read the full article from S&P Global Market Intelligence

US solar firms spar over trade as Biden tries to cut carbon, boost manufacturing

The impact of tariffs on the pace of construction in the U.S. solar market is a pivotal issue as trade officials consider whether to recommend that President Joe Biden extend sweeping import tariffs or allow them to expire in 2022.

Read the full article from S&P Global Market Intelligence

Inflation, supply-chain risks weigh on some utility, renewables execs

General Electric and Enphase Energy see macroeconomic uncertainty lasting into 2022, while other companies told investors they have financial cushions.

Read the full article from S&P Global Market Intelligence

Fintech

Stablecoins face industry-defining regulatory guidance

While the adoption of stablecoins in the U.S. is at the very early stages, regulatory clarity is viewed as necessary for the industry to decide the next moves.

Read the full article from S&P Global Market Intelligence

Real Estate

Specialty finance firms, mortgage REITs deliver mixed Q3 results

Mortgage brokers and servicers generally recorded weaker EPS results than in the second quarter.

Read the full article from S&P Global Market Intelligence

Over 1,000 Calif. REIT properties face likely chance of strong future earthquake

S&P Global Market Intelligence analyzed properties owned by publicly traded real estate investment trusts in California to identify those with a 50%, 10% and 2% chance of experiencing very strong earthquake in the next 50 years.

Read the full article from S&P Global Market Intelligence

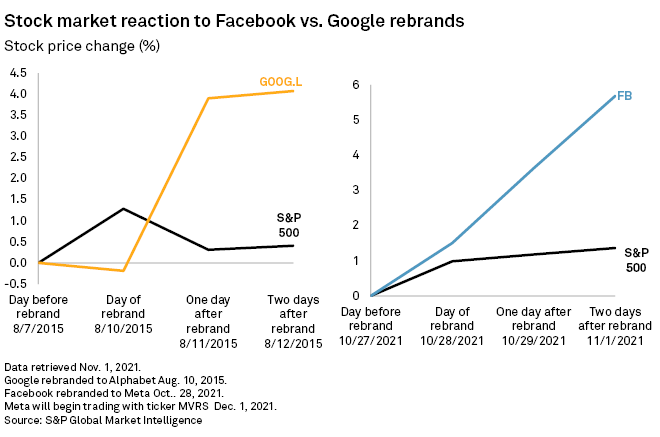

Technology, Media and Telecommunications

Cloud industry continues to soar as demand set to extend past pandemic

The cloud-computing market's third-quarter growth continues a trend that analysts expect will accelerate as companies ramp up digital migrations of their workloads for organizational needs that evolved due to the pandemic.

Read the full article from S&P Global Market Intelligence

Facebook's facial recognition about-face sparks renewed calls for US federal law

While many applauded Facebook's acknowledgement of public concerns regarding facial-recognition technology, they noted that its use on the Facebook platform was already limited.

Read the full article from S&P Global Market Intelligence

Metals and Mining

China mining, battery companies sweep up lithium supplies in acquisition blitz

In the face of mounting battery demand from electric-vehicle sales, the robust acquisition drive led by Chinese companies in recent years has positioned China with increasing control over the world's lithium market.

Read the full article from S&P Global Market Intelligence

The Week in M&A

NM hearing examiner calls for rejection of PNM-Avangrid merger

Capital One expands M&A advisory services in healthcare with TripleTree deal

Franklin Templeton aids alternative asset business with Lexington Partners move

Seacoast Banking Corp. of Florida eyes more home-state M&A

The Big Number

Trending

Read more on S&P Global Market Intelligence and follow @vanya_damyanova on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

The Big Picture.

Summarizing the key themes impacting companies and industries, around the world, in 2022. Dive deeper into M&A trends, shifts in capital requirements, the ever-evolving growth of ESG and the “new normal” of life in pandemic times. Learn More >

[Webinar] The Big Picture: Outlook & Predictions for 2022

[Reports] 2022 Outlook Reports - A look ahead to the key strategic trends and opportunities expected through 2022 and beyond.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.