Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 23 May, 2023

By Sarah Cottle

Today is Tuesday, May 23, 2023, and here’s your weekly selection of essential intelligence on financial markets and the global economy from S&P Global Market Intelligence. Subscribe to be notified of each new Insight Weekly.

In this edition of Insight Weekly, we take a close look at the development of the sustainable debt market. Experts say banks and governments have mostly avoided raising funds through sustainability-linked bonds (SLBs) amid regulatory hurdles, investor skepticism and other challenges, making the widespread adoption of the instrument unlikely in the foreseeable future. Fifteen index-eligible SLBs have observation dates this year, with several issuers facing the risk of higher coupon payments as external factors impact their sustainability performance. Banks are mulling alternative sustainable bond structures to expand their issuance capacity. Analysts expect to see increasing issuance of social bonds and other instruments linked to green transition activities. European Union negotiators have agreed to a new green bond standard that aims to aid market growth. However, the new standard may see limited initial uptake as disincentives weigh on issuers, according to market participants.

European banks are expected to face an increase in bad loans among owners of old and poorly located office buildings. The impact of environmental, social and governance policies on occupiers, investors and lenders is casting doubt on the viability of secondary assets outside prime locations in major cities.

Private equity and venture capital firms have invested $10.34 billion in the global artificial intelligence and machine learning sector through 342 transactions in the year through May 14, according to S&P Global Market Intelligence data. The US and Canada had the most number of transactions during the period, with 147 deals worth an aggregate $5.05 billion.

The Big Number

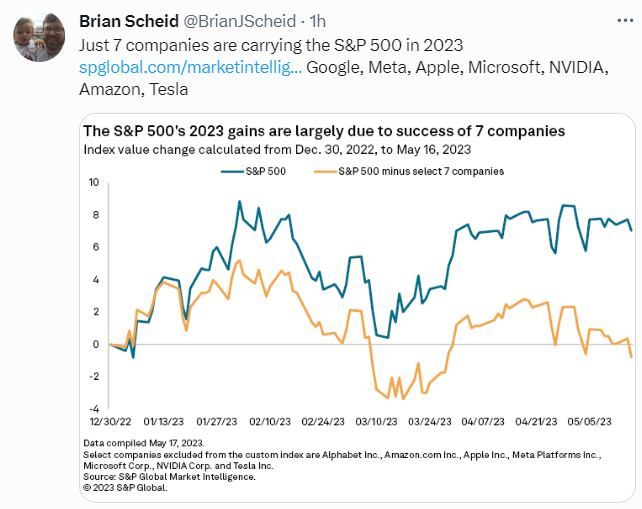

Trending

—Read more on S&P Global Market Intelligence and follow @BrianJScheid on Twitter.

Transform Your Tomorrow

A sustainable tomorrow starts with actionable intelligence today. Advance your sustainability journey with data, analytics and workflow solutions that help you take the next step. And the step after that.

Additional Insights from S&P Global Market Intelligence

Increase your competitive edge with essential insights delivered straight to your inbox. We offer complimentary newsletters on a wide variety of topics to help you stay on top of what’s moving the markets, separating the immaterial from the invaluable. Review our newsletters and sign up here.

IHS Markit is now part of S&P Global.

Compiled by Alex Virtucio

Theme