Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Sep, 2021

By Atif Hussain

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

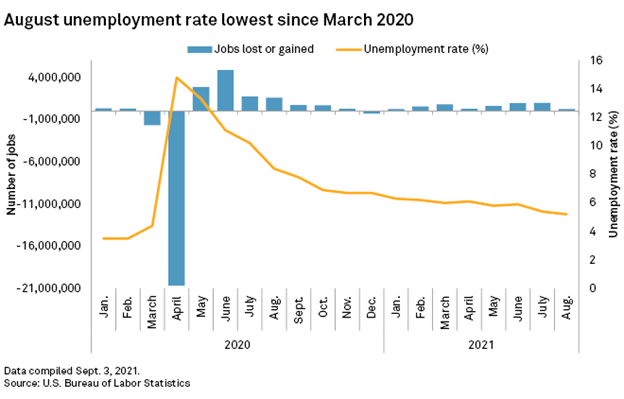

In this edition, we take a close look at the struggles of businesses in luring workers back into a stagnant workforce as wages continue to rise in the U.S. Average hourly earnings rose to $30.73 in August, a 4.3% jump in the last 12 months, while the proportion of people who are either working or looking for work was 61.7% last month, roughly where it has been since April. Economists have pinned the decline in labor market participation on several factors, such as health concerns amid the pandemic. Weak job numbers could derail the Federal Reserve's much-awaited plan to start tapering $120 billion in monthly securities later in September, according to analysts.

Solar power capacity additions in the second quarter dipped compared to the year-ago period as developers encountered supply-side headwinds. However, solar demand remained strong, with a robust pipeline of projects totaling 17,428 MW under construction.

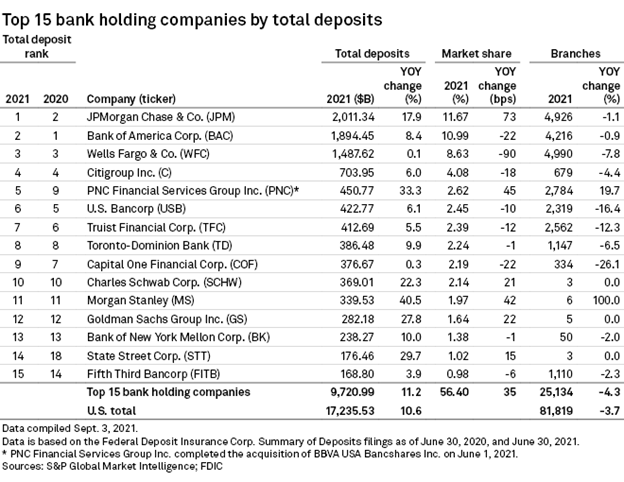

JPMorgan Chase & Co. overtook Bank of America Corp. as the largest U.S. bank by total deposits for the first time in four years, according to the latest Summary of Deposits data from the Federal Deposit Insurance Corp. JPMorgan's deposits totaled $2.011 trillion at the end of June, up 19.9% from a year earlier, while Bank of America's deposits came in at $1.894 trillion.

US Labor Market in Focus

Weak jobs data could derail Federal Reserve's bond tapering plans

The central bank may slow down its plans to end a key pandemic economic support program if the Sept. 3 U.S. employment report shows fewer new jobs than expected, analysts said.

—Read the full article from S&P Global Market Intelligence

Wages keep rising as employers try to lure reluctant Americans back to work

Hourly earnings have hit an all-time high as the labor participation rate remains stuck in place, according to the U.S. Labor Department's latest jobs report.

—Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

European banks able to cope with bad loans, as UK banks release provisions

Banks in some European countries are expected to release further provisions in the second half of 2021, and should be able to cope with a deterioration in asset quality as government support measures end, analysts said.

—Read the full article from S&P Global Market Intelligence

US banks with lowest price-to-adjusted tangible book values in August

Republic First Bancorp trades at the lowest price-to-adjusted tangible book value.

—Read the full article from S&P Global Market Intelligence

Summertime US corporate bankruptcy filings warm from 2021 low

Experts say the rest of the year will likely be fairly quiet, unless lenders lose patience with struggling companies or credit conditions change.

—Read the full article from S&P Global Market Intelligence

Credit quality at US banks strengthens further in Q2

Across most loan types, U.S. banks saw improvements in credit quality during the second quarter, with consumers and businesses alike paying down debt in a recovering economy.

—Read the full article from S&P Global Market Intelligence

JPMorgan overtakes BofA as top US deposit holder

JPMorgan took the No. 1 position with 17.9% deposit growth, compared to Bank of America's 8.4% increase.

—Read the full article from S&P Global Market Intelligence

Insurance

US private auto insurance faces 'tough environment' as losses rise in Q2

Wells Fargo analyst Elyse Greenspan said loss trends are likely to remain elevated. Chip shortages, which are leading to higher used and new car prices, as well as increased labor costs, have impacted severity trends.

—Read the full article from S&P Global Market Intelligence

BlackRock dominates asset management for US insurers again in 2020

In total, 38 insurers included in S&P Global Market Intelligence's analysis marked BlackRock as their unaffiliated asset manager in their 2020 annual statements.

—Read the full article from S&P Global Market Intelligence

Energy and Utilities

Buffett's PacifiCorp details sweeping energy transition in Western US

The Portland, Ore.-based utility's latest integrated resource plan leans heavily on renewable energy and battery storage, as well as nuclear energy, new transmission and possibly hydrogen.

—Read the full article from S&P Global Market Intelligence

LA green hydrogen hub developers map out role for gas pipelines, storage

Among other findings, a study by HyDeal LA partners concluded that dedicated hydrogen pipelines and geological underground storage would drive down delivered costs for green hydrogen.

—Read the full article from S&P Global Market Intelligence

US solar demand strong with 17.4 GW of projects under construction

Solar power capacity additions in the second quarter of 2021 dipped compared to the year-ago period as developers encountered supply-side headwinds. However, demand remained strong, with a robust pipeline of projects totaling 17,428 MW under construction.

—Read the full article from S&P Global Market Intelligence

Fintech

Some hot fintech IPOs falter in public markets

Among the 18 U.S. fintech companies that conducted traditional IPOs or direct listings since January 2020, six were trading below their IPO price as of Aug. 31, reflecting a disconnect between private investors' optimism and public market skepticism.

—Read the full article from S&P Global Market Intelligence

Healthcare

First in Human: Big Pharma eyes blood cancer drugs; ketamine for gambling

Large acquisitions suggest the CD47 space is heating up even as most research remains in the earliest clinical stage, RBC Capital Markets analyst Brian Abrahams said in an interview.

—Read the full article from S&P Global Market Intelligence

Real Estate

Goldman Sachs, J.P. Morgan stand to lose millions in M&A fees as REIT deal fails

Monmouth Real Estate Investment Corp. failed to secure shareholder approval for an acquisition by Sam Zell's Equity Commonwealth, costing advisory firms tens of millions of dollars in fees.

—Read the full article from S&P Global Market Intelligence

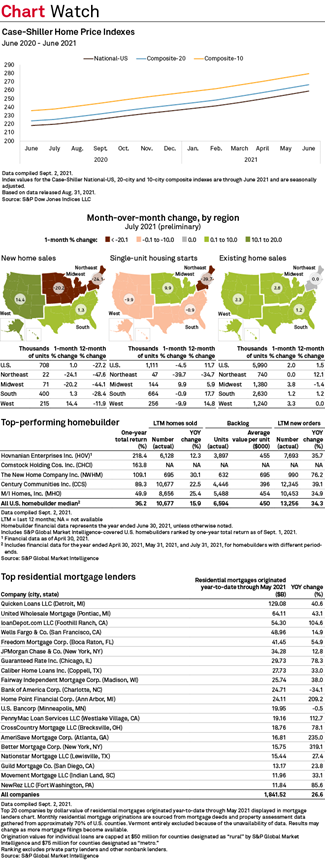

US housing market: New, existing home sales up, starts down MOM in July

New and existing home sales rose month over month in July, while new housing starts dropped from the previous month.

—Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

August extends infotech buying spree as Centerview returns to major PE client

Centerview Partners will advise on August's top information technology transaction amid a run of 10-figure deals that could push 2021 deal totals above the $1 trillion mark across the technology industry.

—Read the full article from S&P Global Market Intelligence

Leveraged Finance

ESG issuance ramps up in Europe amid signs of market evolution

September's leveraged loan and high-yield bond issuance has so far been dominated by environmental, social and governance-related debt, in a likely taster of what's to come for Europe's sub-investment-grade capital markets.

—Read the full article from S&P Global Market Intelligence

Metals and Mining

US lithium-ion battery supply chain underdeveloped, analysts say

Imports of several types of lithium materials to the U.S. have been decreasing in recent years as most lithium extraction, processing and refinement occur outside the country.

—Read the full article from S&P Global Market Intelligence

The Week in M&A

Bank M&A 2021 Deal Tracker: Fla. deals lead US in a hot August

Read full article

Enbridge's $3B deal to buy Moda Midstream gets positive reaction from analysts

Read full article

Baxter's $10.5B acquisition of Hill-Rom may accelerate its digital health goals

Read full article

$3.5B acquisition makes State Street world's largest asset servicer, CEO says

Read full article

Asia-Pacific financial institutions M&A interest tracker

Read full article

The Big Number

Trending

Read more on the S&P Global Market Intelligence and follow @karinrives on Twitter

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.