Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Jul, 2021

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

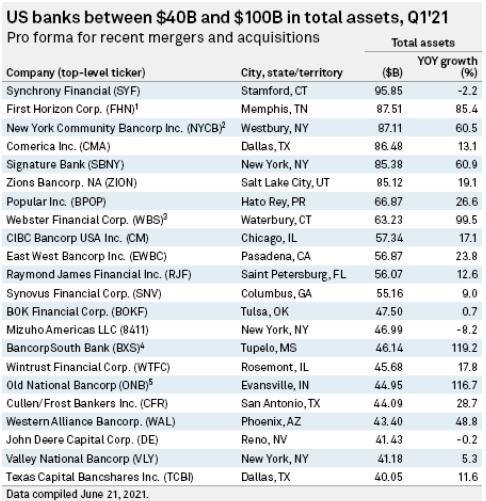

In this edition, we explore recent consolidation trends in the U.S. banking industry. The number of banks in the country with more than $50 billion in assets has increased by one-third since 2018, when lawmakers voted to roll back some of the provisions of the Dodd-Frank Act. The change, which meant that onerous stress testing requirements would not kick in until banks reached $100 billion in assets, paved the way for lenders to grow, some through large deals that have reshaped the regional banking landscape. Illinois, long a hotspot for bank M&A, kept up the pace this year with seven deal announcements as of June 24, second only to California's eight. The deal activity came as community banks in Illinois lagged the broader industry during the first quarter in all six major banking metrics examined by S&P Global Market Intelligence.

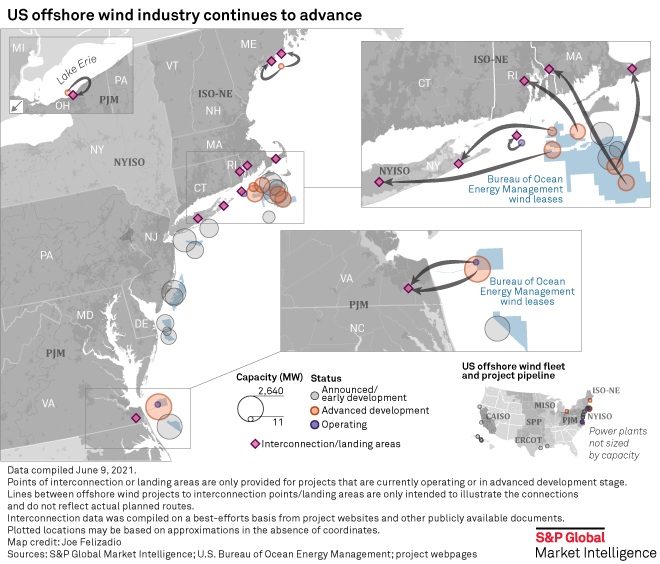

As the Biden administration pushes ahead with offshore wind development in the U.S., the burgeoning industry is confronting an issue of growing importance: how to build the huge amount of electric cabling needed to deliver all that power from sea to the onshore grid. The U.S. wants to install 30 GW of offshore wind parks by the end of the decade, more than all of Europe has built to date. But some in the industry are sounding alarms that it may fall short of that target if federal agencies, states and grid operators do not coordinate on transmission plans.

In the U.K., a government's initiative to "level the playing field" between broadcasters and video-on-demand services is unlikely to curb the growth of U.S. streamers in the country, analysts said. While a new regulatory regime could increase compliance costs for streaming firms, it would not address the real reason traditional broadcasters are struggling to compete — the resource imbalance.

Illinois community bank M&A continues as profitability lags

Illinois is keeping up with its reputation of being a hotspot for bank M&A. Old National Bancorp and Chicago-based First Midwest Bancorp's recently announced merger of equals with a value of $2.47 billion is the biggest deal in Illinois since May 2018.

Read the full article from S&P Global Market Intelligence

With the sting taken out of crossing $50B in assets, banks pursue M&A

The relaxation of rules for U.S. banks with more than $50 billion in assets has increased appetite for M&A as banks look to scale up and become more competitive. There were 52 banks with more than $50 billion in assets at the end of the first quarter of 2021, up from 39 banks at the end of 2017.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Reserve releases boost earnings but excess liquidity smothers US bank margins

Bank earnings are poised to jump nearly 80% year over year due to substantially lower credit costs, but net interest margins likely will remain depressed as excess liquidity continues to build on balance sheets.

Read the full article from S&P Global Market Intelligence

Nonbanks continue taking mortgage share, nearly doubling originations in 2020

Quicken Loans retained its spot as the top U.S. nonbank mortgage originator, having written over $313.41 billion in mortgages in 2020, which was more than double the $141.64 billion in 2019.

sp; Read the full article from S&P Global Market Intelligence

Debt collectors have their work cut out as Italian securitizations underperform

Special servicers have taken billions of euros of soured debts off the hands of Italian banks in recent years, but the coronavirus pandemic has created challenges for them as they aim to extract value from bundles of nonperforming loans.

Read the full article from S&P Global Market Intelligence

Itaú shifts strategy, creates digital bank to fend off fintech pressures

Faced with rising fintech competition, Brazilian banking giant Itaú's new CEO is shifting a digital transformation strategy laid out in previous years. The company's payment unit has been revamped into a full-fledged digital bank and is succeeding in tapping new clients.

Read the full article from S&P Global Market Intelligence

Insurance

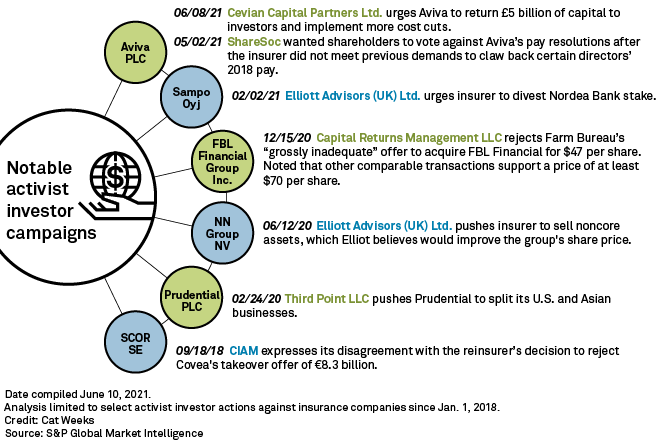

Activist investors take aim at insurers amid pandemic rebound

Investors are demanding insurance companies divest capital-intensive businesses and pursue new strategies in a changing market.

Read the full article from S&P Global Market Intelligence

Credit and Markets

Fed officials see sooner-than-expected end to $120B in monthly bond buys

Minutes of the latest Federal Open Market Committee meeting show that a reduction of the pace of asset purchases may be "somewhat earlier" than expected as some officials press to end mortgage-backed securities buys first.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

SPAC frenzy to accelerate consolidation wave sweeping EV charging sector

Following in the footsteps of major utilities and oil companies, a number of blank-check mergers over the coming months could create new players looking to hoover up startups in the electric vehicle charging space.

Read the full article from S&P Global Market Intelligence

US offshore wind boom entangled in transmission debate

The offshore wind industry and policymakers are sending out warnings that the U.S. may not meet its target of 30 GW of offshore wind by 2030 if the federal government, grid operators and states do not develop coordinated transmission strategies.

Read the full article from S&P Global Market Intelligence

Metals and Mining

Australia copper discoveries lay groundwork for miners' exploration investment

Copper's key role in the growing global trend of electrification is expected to continue the momentum in exploration investment in Australia following significant discoveries by Rio Tinto and BHP Down Under.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

UK regulation plans unlikely to hold streamers back

When it comes to helping home-grown broadcasters compete with U.S. streamers, the U.K. government can only do so much, analysts told S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

Amazon's possible exit from seller fulfillment may spur competition, raise costs

A forced divestiture of Amazon.com Inc.'s fulfillment business could open the door to more competition for merchants seeking shipping alternatives. But it could also mean higher costs for third-party sellers, at least in the short-term.

Read the full article from S&P Global Market Intelligence

Private Equity

PE firms could come to the table as restaurant M&A activity picks up pace in H2

Venture capital investments in the sector globally amounted to $874.5 million to date, according to S&P Global Market Intelligence data.

Read the full article from S&P Global Market Intelligence

The Week in M&A

D.A. Davidson bets on fintech M&A with acquisition of boutique i-bank

Georgia-based Pinnacle Financial to acquire Liberty First Bank for $19.1M

Valley National bolstering growth initiatives with M&A, digital bank

The Big Number

Trending

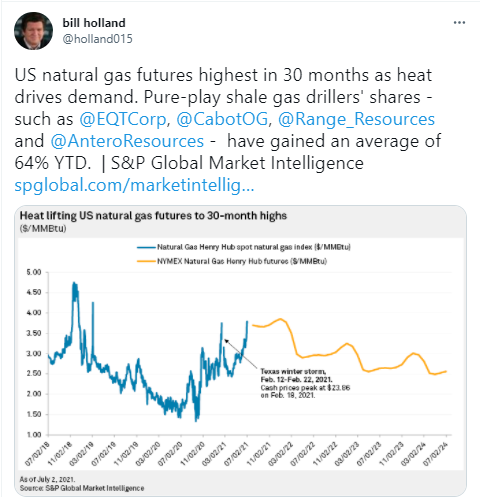

—Read the full article from S&P Global Market Intelligence and follow @holland015 on Twitter

[Webinar] Global Credit Risk – Trends and Outlooks for 2021 and Beyond | July 20, 2021

Join us for our flagship webinar.

Register now

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets.