Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 2 Nov, 2021

By Jasim Zahid

Exclusive features and news analysis of key sectors and markets. Subscribe on LinkedIn >

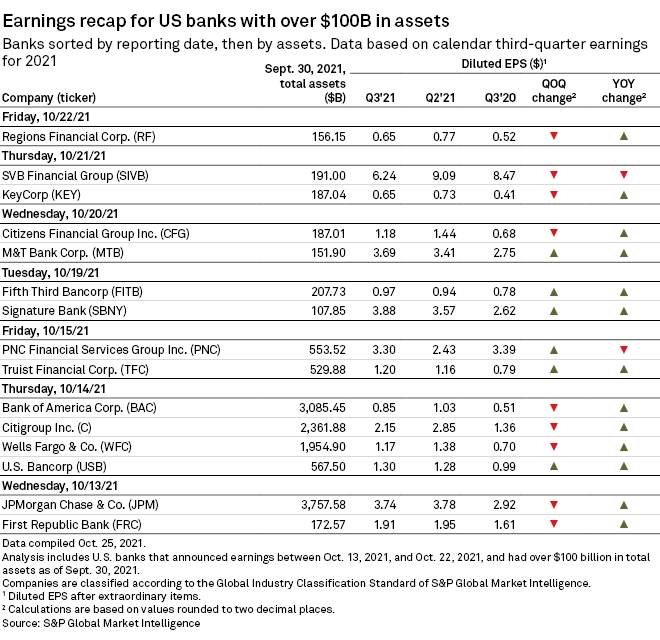

In this edition, we take a close look at the U.S. banking industry where 13 of the 15 largest banks posted double-digit year-over-year increases in third-quarter EPS. Credit loss reserve releases were the primary drivers of the EPS growth, while higher revenues and lower expenses resulting from efficiency initiatives also pushed up earnings. Most regional banks also reported stronger results in the third quarter.

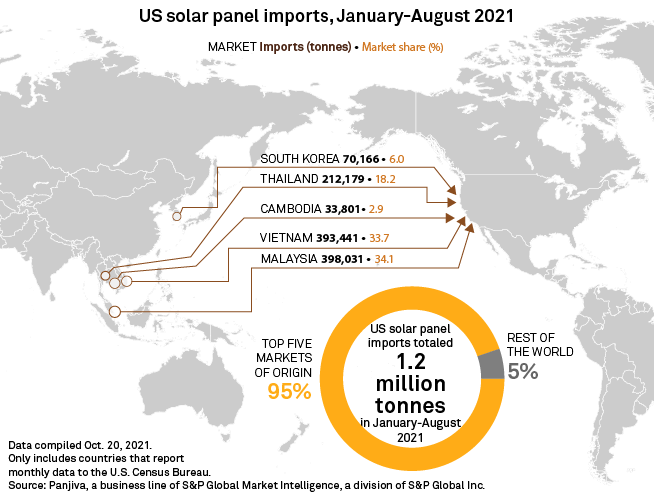

U.S. solar panel imports plunged during the third quarter as the industry grappled with equipment shortages that project developers blamed on a proposed expansion of tariffs. The number of shipping containers delivering solar panels to American ports between July and September was down 27% from the prior quarter and 11% from a year earlier, according to research firm Panjiva.

Investors' expectations that the Federal Reserve will hike interest rates by the summer of 2022 are rapidly growing as inflation continues to run hot. The consumer price index, the market's preferred inflation metric, has recorded an average increase of 5.4% year-over-year each month since June, driven by a supply chain crunch and rising energy prices.

Most US regional banks report higher earnings in Q3

Credit strength continued to be a tailwind for many banks, helping most regional banks report year-over-year increases in earnings.

Read the full article from S&P Global Market Intelligence

Big banks post YOY EPS growth in Q3 as credit reserve releases continue

The majority of the largest U.S. banks reported double-digit year-over-year growth in third-quarter EPS. Results were mixed when compared to the previous quarter.

Read the full article from S&P Global Market Intelligence

Deep Dives

In-depth features looking at the impact of major news developments in key industries.

Financials

Credit card loss rates drop below 1% for 1st time in at least a decade

As the economy continued to support credit quality, card charge-offs and delinquencies were down and portfolio yields were up year over year for all six U.S. major card issuers in September.

Read the full article from S&P Global Market Intelligence

US banks hold billions above TLAC minimums

At one time, it appeared total loss-absorbing capacity requirements might constrain banks' capital management decisions, but on recent earnings calls, executives have focused more on common equity Tier 1 ratios when discussing shareholder returns.

Read the full article from S&P Global Market Intelligence

Bank M&A backlog builds as deals await Fed approval

Several bankers said they are unsure of when they will secure regulatory approval for their large deals.

Read the full article from S&P Global Market Intelligence

Insurance

Metromile, Root further encroaching on traditional auto underwriters' turf

The full-stack personal auto insurance companies are looking to expand their customer reach by allowing independent insurance agents to sell their private auto policies.

Read the full article from S&P Global Market Intelligence

Fallout from $1B nuclear commercial auto verdict may spread as award contracts

A recent concession by plaintiffs in a Florida case may slash the size of a punitive damage award described by the defendants as "excessive," but the case will remain a potent reminder of the effects of social inflation on commercial auto insurance.

Read the full article from S&P Global Market Intelligence

Credit and Markets

Climbing inflation heads for collision with record home prices

The consumer price index has yet to catch up with a near-20% surge in housing prices. Once that happens, analysts expect inflation to jump even higher than the fast-paced increases this year.

Read the full article from S&P Global Market Intelligence

Market expectations grow for early Fed rate hike as inflation rises

A majority of investors now believe the Federal Open Market Committee may boost rates from near 0% as soon as June.

Read the full article from S&P Global Market Intelligence

Energy and Utilities

European utility Q3 earnings to digest price surge, policy fallout

The third quarter was dominated by a surge in commodity prices across Europe, which sent power prices to record highs and triggered government interventions aimed at curbing domestic electricity bills.

Read the full article from S&P Global Market Intelligence

AEP utilities to add more than 7 GW of renewables in Plains states

Southwestern Electric Power and Public Service Co. of Oklahoma are continuing their moves away from their traditional coal- and gas-fired power generation resources.

Read the full article from S&P Global Market Intelligence

US solar panel imports tumble as industry fights over proposed tariffs

The number of shipping containers delivering solar panels to American ports during the third quarter was down 27% from the prior quarter and 11% from a year earlier, according to research firm Panjiva.

Read the full article from S&P Global Market Intelligence

Fintech

Payments to continue to drive finance M&A in Asia-Pacific

In the quarter ended Sept. 30, the financial industry in Asia-Pacific saw $60.84 billion of M&A transactions, a significant increase from $25.25 billion in the first half of the year, according to S&P Global Market Intelligence.

Read the full article from S&P Global Market Intelligence

Real Estate

US equity REITs improve liquidity, maintain stable leverage

Compared to pre-pandemic levels, U.S. equity real estate investment trusts now have more liquidity through higher savings and expanded credit facilities while maintaining overall constant leverage.

Read the full article from S&P Global Market Intelligence

Net-zero transition gains momentum in real estate as commitments grow

With buildings contributing roughly 40% of carbon emissions globally, real estate companies in North America are increasingly under pressure to decarbonize their portfolios.

Read the full article from S&P Global Market Intelligence

Technology, Media and Telecommunications

Netflix pays top median employee salary; cable CEO pay ratios skyrocket

Charter Communications had the largest CEO to median employee pay ratio among top media companies in 2020 at 687x after CEO Tom Rutledge signed a new employment agreement.

Read the full article from S&P Global Market Intelligence

AWS, advertising expected to power Amazon's Q3 growth as online sales slow

Analysts expect Amazon's cloud-computing unit to drive profits in the third quarter as the company looks to offset a potential slowdown in e-commerce sales.

Read the full article from S&P Global Market Intelligence

Metals and Mining

Analysts expect lower Q3 earnings per share from most top gold miners

Among 10 large global gold producers analyzed by S&P Global Market Intelligence, most are expected to report lower earnings per share in the third quarter compared with the year-ago and prior quarter.

Read the full article from S&P Global Market Intelligence

Cooling iron ore, coal demand to dampen 12-year-high freight rates

As China's steel cuts are hitting iron ore prices, the country's ongoing energy woes are also set to drive iron ore freight rates down in 2022 but not before the rates hit a 12-year high in October, according to S&P Global Platts Analytics

Read the full article from S&P Global Market Intelligence

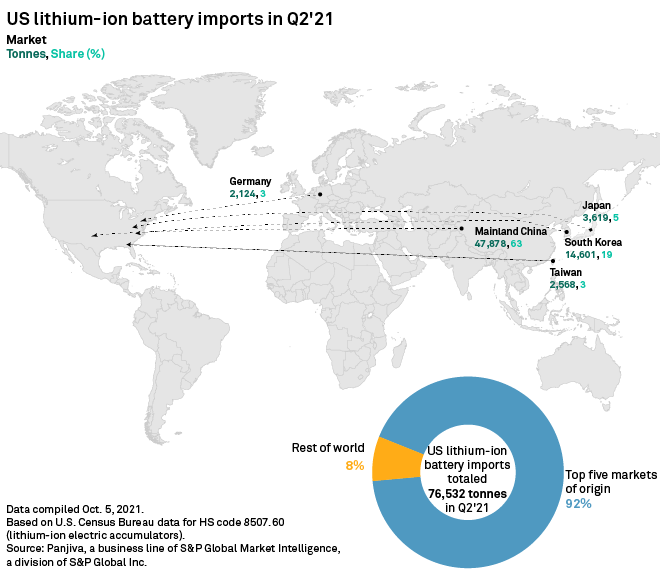

US lithium-ion battery imports spike amid scramble to address ethical risks

"I just don't believe there's a way of demonstrating ethical performance or greenhouse gas footprint" without a database to authenticate the claims, said a supply chain expert working on transparency.

Read the full article from S&P Global Market Intelligence

The Week in M&A

Atlantic Union using 'guerrilla warfare' to capitalize on M&A fallout in markets

Trustmark interested in $500M to $5B banks in Southeast

Mitsubishi UFJ may look at Japan, Vietnam bank stake sales after US exit

Oil, gas deal tracker: Deals fall YOY in September, but asset value skyrockets

Altus Midstream deal with private equity could signal more midstream targets

The Big Number

Trending

—Read more on S&P Global Market Intelligence and follow @holland015 on Twitter.

S&P Capital IQ Pro. A single platform for essential intelligence.

Do you need a single source of industry intelligence? Discover the S&P Capital IQ Pro platform. Bringing together an unrivaled breadth and depth of data, news, and research, combined with tech-forward productivity tools. All in one platform that powers your edge.

Additional Insights from S&P Global Market Intelligence

Check out other weekly newsletters highlighting our exclusive features and analysis:

ESG Insider: News and insights into environmental, social and governance developments driving change in business and investment decisions. Click here to subscribe.

Policy Intel: Explore exclusive news and research on policy and regulatory developments in the U.S. and around the globe. Click here to subscribe.

Essential Healthcare: Our guide to the week's top headlines in pharmaceuticals, biotech, hospitals, medtech and more. Click here to subscribe.

Private Equity Pulse: Need-to-know investments. Sharp insight. Private Equity Pulse offers our top picks of global private equity news stories. Click here to subscribe.

NEXT: Stay up-to-date on how technology is reshaping the future of industries across global markets. Click here to subscribe.

Written and compiled by Jasim Zahid.