Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 07, 2022

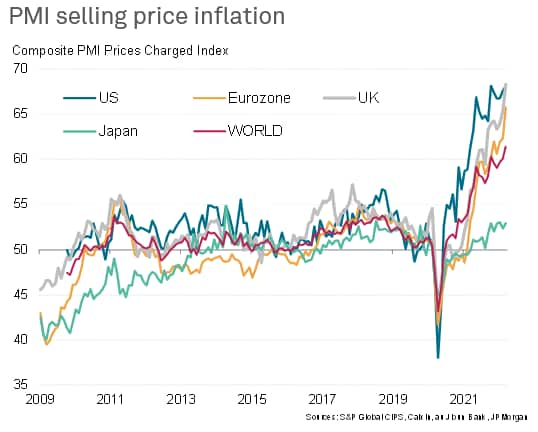

Inflationary pressures intensified around the world in March according to the latest PMI data compiled for JPMorgan by S&P Global. The PMI survey data, based on panels of over 30,000 companies in 45 countries, showed renewed upward pressure on firms' costs as supply chain disruptions and energy price hikes resulting from the Ukraine war exacerbated existing price and supply issues arising from the pandemic. Business costs are now rising at a rate not seen since 2008. These higher costs are being increasingly passed on to customers, leading to record rates of inflation in the US and Europe.

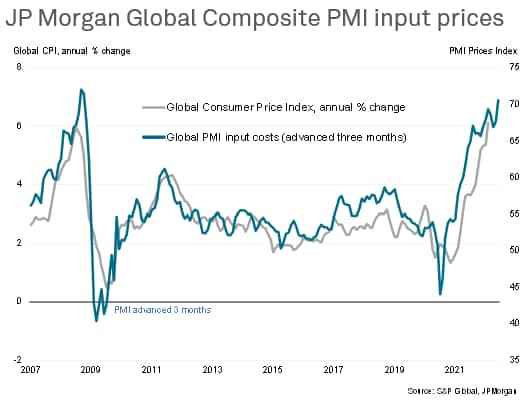

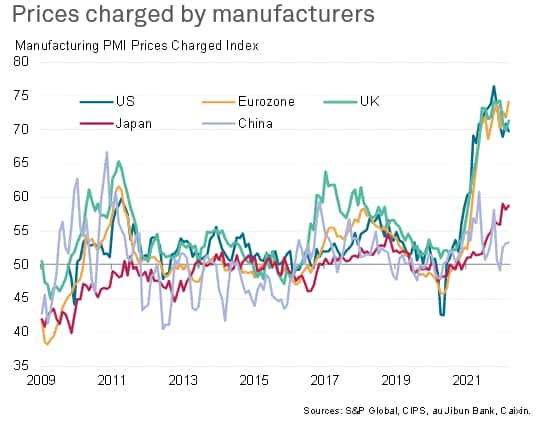

The JPMorgan Manufacturing Purchasing Managers' Index™ (PMI™), compiled by S&P Global, showed average input prices paid by manufacturing and service sector companies to have risen in March at the fastest rate since July 2008.

By measuring how companies' cost pressures are changing, this index provides a reliable advance guide to consumer prices, tending to change around three months ahead of the annual rate of consumer inflation. Recently, the price index provided a very early steer into the severity and persistence of the surge in inflation triggered by the pandemic, and the latest rise in this index therefore hints at further upward inflationary pressures to come for households.

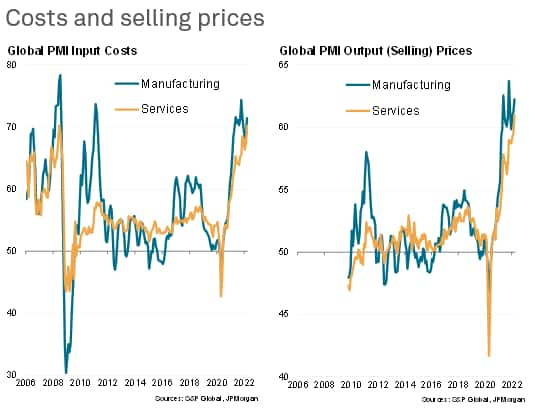

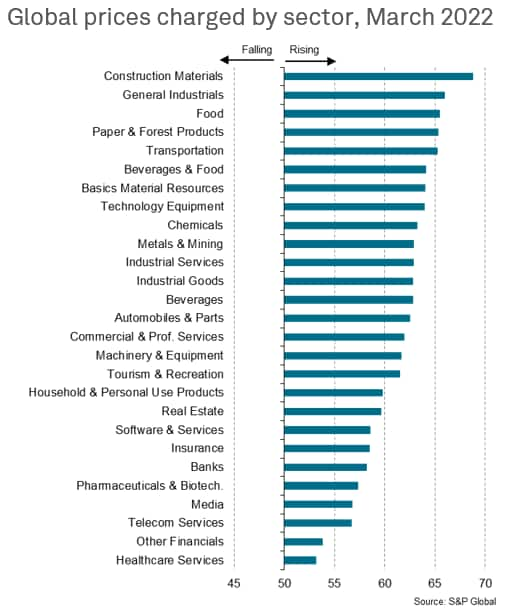

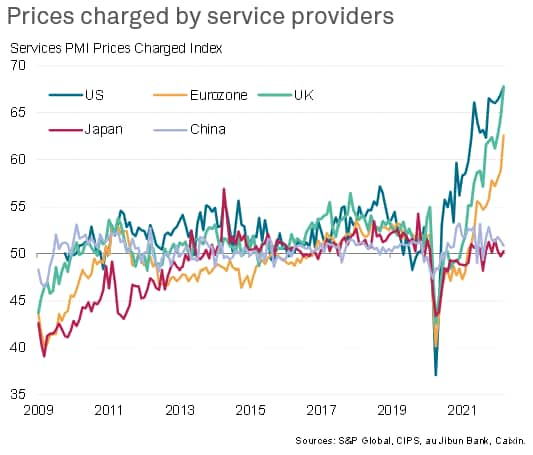

Input cost inflation accelerated worldwide in both manufacturing and services, in both cases feeding through to higher rates of selling price inflation as higher costs were passed on to customers. While manufacturing input cost inflation and selling price growth remained below recent highs, new all-time peaks were recorded in the service sector.

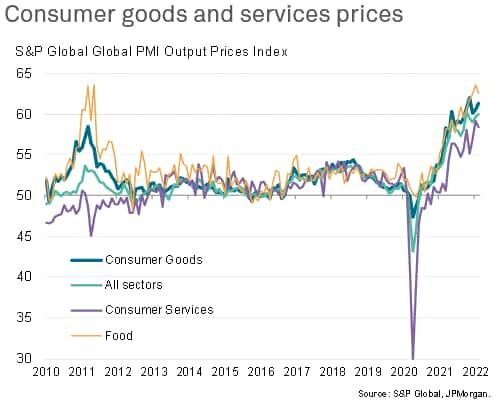

While service sector inflation rates for both costs and selling prices lagged manufacturing throughout 2021 on average globally, the divergence has recently narrowed, largely reflecting the increasing spill-over of higher goods and fuel costs to the service sector, notably in terms of higher food and transport prices, and the later pick-up in demand for services since the start of the pandemic. Lockdowns and other health-related restrictions meant spending was diverted away from services to goods in the early stages of the pandemic, but spending is shifting back towards services as economies reopen, which is causing a commensurate shift in pricing power from goods producers back to service providers. However, goods producers also continue to see strong pricing power as supply shortages ( which worsened in March) once again restrict supply relative to demand. This has been particularly evident for food in recent months; a situation which will inevitably worsen amid the Russia-Ukraine war.

Rates of manufacturing and service sector selling price inflation remained highest in the US and Europe. With its proximity to the supply disruptions caused by the Russia-Ukraine war, the eurozone saw the steepest rate of manufacturing price inflation - which hit a new all-time high - of the world's major economies, as well as a record rate of service sector inflation.

However, rates of US and UK service sector inflation remained even higher than the eurozone, likewise at new highs, reflecting the greater degree to which these economies have seen demand stimulated by opening up more fully from the pandemic. COVID-19 containment measures have been almost completely removed in the UK and US, though many restrictions persist in the eurozone.

Inflationary pressures remain far more muted in Asia than in the US and Europe, especially for services, where restrictions to contain the Omicron variant limit scope for spending and therefore demand. However, price pressures have lifted in many Asian manufacturing sectors, especially in Japan, as additional supply chain stress caused by recent lockdowns (such as those seen in mainland China during March) add further to goods price inflation. That said, even in these manufacturing sectors of Asia, rates of inflation remain far below those seen in the west, where supply is far more problematic.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.