Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Oct, 2023

By Sean DeCoff

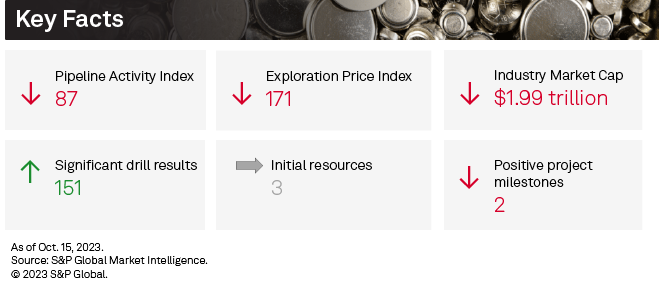

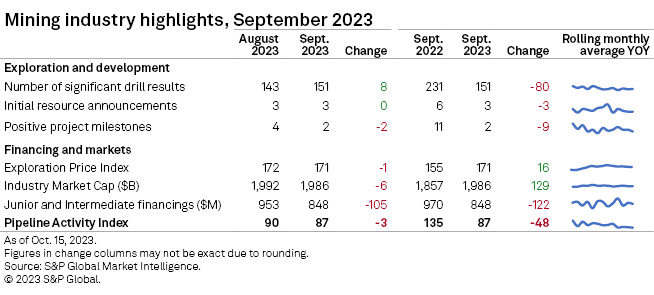

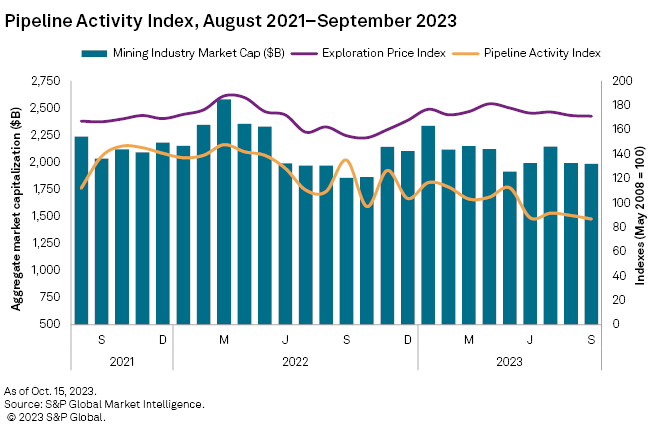

S&P Global Market Intelligence's Pipeline Activity Index (PAI) continued to show weakness in September, decreasing another 3% to 87, the lowest level since May 2020. Similar to August, the gold PAI increased slightly while the base metals PAI declined. The gold PAI rose 3% month over month from 110 to 113, while the base/other category dropped 12% from 73 to 64.

Most metrics used in our PAI decreased month over month, with drops in positive milestones, completed financings and industry market cap. Initial resources were flat while the number significant drill result increased slightly.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

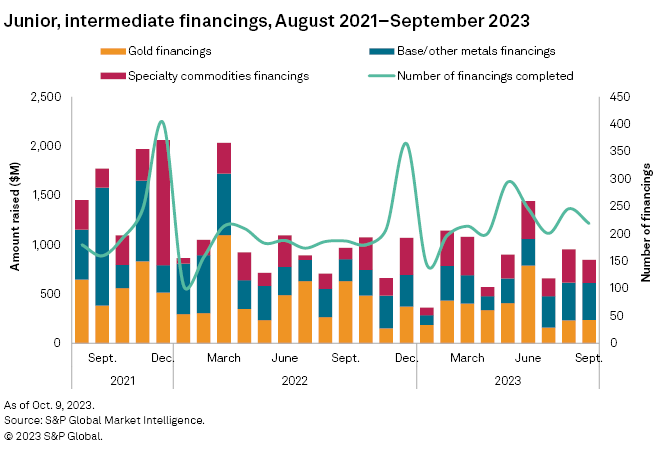

Nickel, lithium, graphite weigh down September fundraisings

Funds raised by junior and intermediate mining companies fell 11% to $848 million in September, weighed down by a decrease in funds raised for minerals in the specialty commodities group, particularly lithium and graphite. Gold and base/other metals fundraisings were relatively flat. The number of transactions fell 11% to 219 with significant financings falling to 57, from 70 in August. Three transactions were valued at more than $50 million in September, down from five in August.

Gold financings were up slightly, growing 2% to $238 million, but remained in the lower range with only one transaction valued at more than $30 million. The number of gold transactions fell 6% to 111, down from 118 in August.

The largest gold financing and the third-largest overall was the C$70 million follow-on offering of Ontario-based Reunion Gold Corp. The company owns various gold assets in Guyana and French Guiana and recently reported a resource estimate for its Oko West gold project in Guyana totaling 6.8 million metric tons grading 1.912 grams of gold per metric ton.

The base/other metals group retreated for the first time in five months, falling 2% to $375 million. The group's total was buoyed by funds raised for copper but was weighed down by lower nickel and silver financings. The number of transactions fell to 72, from 84 in August. Only one transaction in the group was valued at more than $30 million, down from four in August.

The largest base/other metals financings and the largest overall was the $184 million follow-on offering of Canada-based, US-listed Ivanhoe Electric Inc., which owns multiple projects in the US and Côte d'Ivoire and is currently focused on drilling on its Santa Cruz project in Arizona.

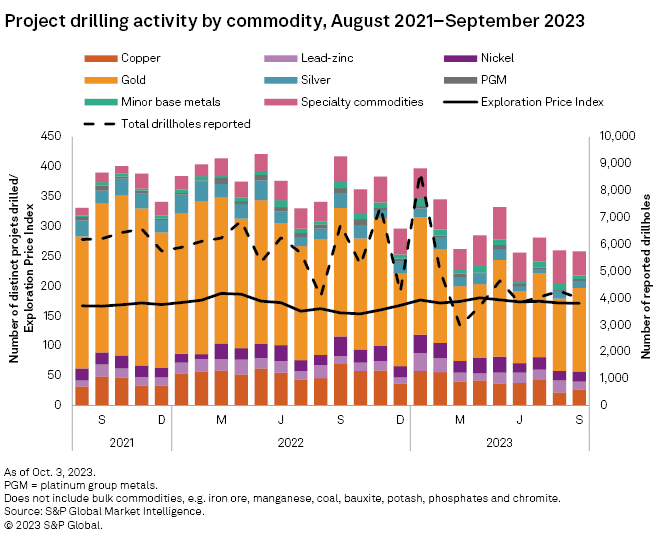

Slowest September for drilling in 3 years

Most drilling metrics were down for September, with drilled projects decreasing to 258, inching closer to the year's low of 256 recorded in June. Distinct drillholes fell 6% from 4,258 to 3,982 — a September low not seen since 2020. A year-to-date comparison shows the total reported drilled projects and drillholes were both 23% lower than in 2022. The total early-stage projects remained constant at 96, while late-stage projects decreased 7% to 115 and minesite projects drilled rose 18% to 47.

After falling to its lowest total of the year in August, gold projects rebounded in September, up 16% to 140 projects. Of the 19 gold project additions, 11 came from Canada with most reporting from early-stage projects. As a group, base metals projects decreased 9% to 63 projects, with lead-zinc down 35% to 13 and minor base metals down 45% to six. Alternatively, nickel projects increased to 17, and copper projects rose 23% to 27 after August's 33-month low of 22 projects. Drilled projects for silver decreased to 12, platinum group metals projects increased slightly to three, and specialty metals dropped to 40 with 16 fewer projects than in August.

Australia barely made it as the top country reporting, down to 70 projects with a significant decrease of 17 projects month over month. The country saw decreases in gold, lead-zinc and specialty metals projects. Canada came close to tying for the top spot, increasing 15% to 69 projects, driven by a boost in gold projects reporting. The US remained a distant third but increased 22% to 33 projects, buoyed by gold projects.

August's top result came from Australian Securities Exchange-listed Southern Cross Gold Ltd.'s late-stage Sunday Creek gold project in Victoria, Australia. Southern Cross reported its best drillhole to date with an intersect of 404.4 meters grading 5.1 g/t gold. This drillhole exceeds the previous best hole by almost three times and is the first hole to expand the mineralized footprint at the Rising Sun prospect area. The project continues to develop, with ongoing laboratory work and four drill rigs operating.

Toronto Stock Exchange-listed Aya Gold & Silver Inc. reported the most drillholes in September with 185 holes drilled between its Zgounder silver mine and Boumadine project, both in Morocco. Following a devastating earthquake in early September, the company temporarily suspended operations at Zgounder to inspect the mine and mining infrastructure; it was able to resume operations after 24 hours.

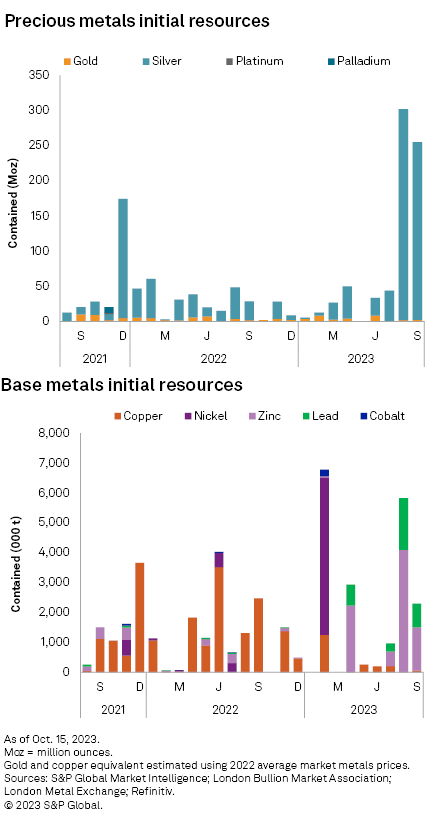

Initial resource announcements drop

As in August, there were three initial resource announcements in September: two for a gold primary project and one for silver.

The largest announcement came from New Pacific Metals Corp., which reported an indicated and inferred mineral resource for its silver-zinc-lead project in Bolivia. The estimate came in at 260 million metric tons (MMt), containing 253 million ounces of silver, 1,800 ounces of gold, 1.45 MMt of zinc, 790,000 metric tons of lead and 59,000 metric tons of copper.

The other two announcements were relatively minor. Asante Gold Corp. announced an indicated resource containing 157,000 ounces for the recently discovered South Russel, which is within the mine lease of its Bibiani gold mine. Calibre Mining Corp. announced another mineral resource, this time for the Volcan Gold Deposit located 5 kilometers from the Libertad processing facility. The announcement includes 30,000 ounces of gold indicated and 131,000 ounces of inferred gold.

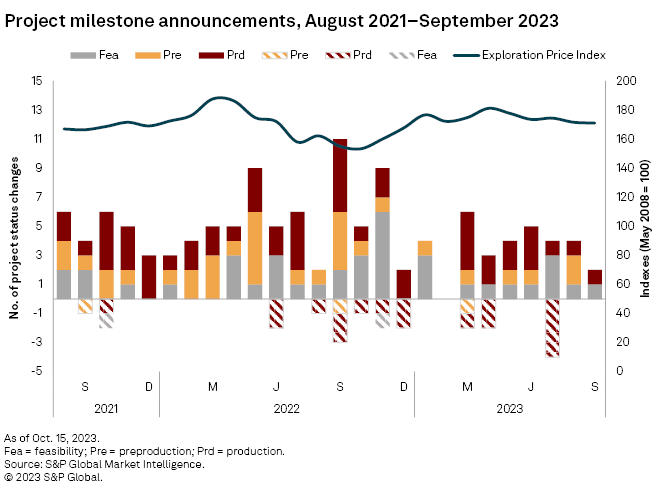

Project milestones weaker

Positive project milestones dropped by one, to two in September. Both were for gold primary projects. One project announced production and one announced the completion of a feasibility study. As with August, there were no negative milestones for September.

First, Rio2 Ltd. announced the feasibility study for its Fenix gold project in Chile. The study estimates 91,000 ounces gold average annual production during the first 12 years and 54,000 ounces for the final five years. Initial capital costs of the project were estimated at $117 million with life-of-mine sustaining capital costs of $88 million, and the construction timeline estimate came in at 14 months. Project after-tax net present value (5% discount rate) was estimated at $210.3 million.

Second, Monument Mining Ltd. said it achieved commercial production at the Selinsing gold Mine in Malaysia after operating for 30 days consecutive production of gold concentrate at 90% of designed capacity.

Exploration Price Index down marginally

Market Intelligence's Exploration Price Index slipped slightly September, coming in at 171 compared to 172 in August. Of the eight metals included in the index, four posted minor decreases (gold, silver, copper and platinum), two declined significantly (nickel, down 3.9%, and molybdenum, down 4.5%), one was flat (cobalt) and one strongly increased (zinc, up 3.8%).

The Exploration Price Index measures the relative change in precious and base metals prices, weighted by the overall exploration spending percentage for each metal as a proxy of its relative importance to the industry at a given time.

Equities remain weak

Mining equities again lost ground in September, but only slightly. Market Intelligence's aggregate market cap of 2,652 listed mining companies declined 0.3% in September to $1.99 trillion.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.