Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 22, 2025

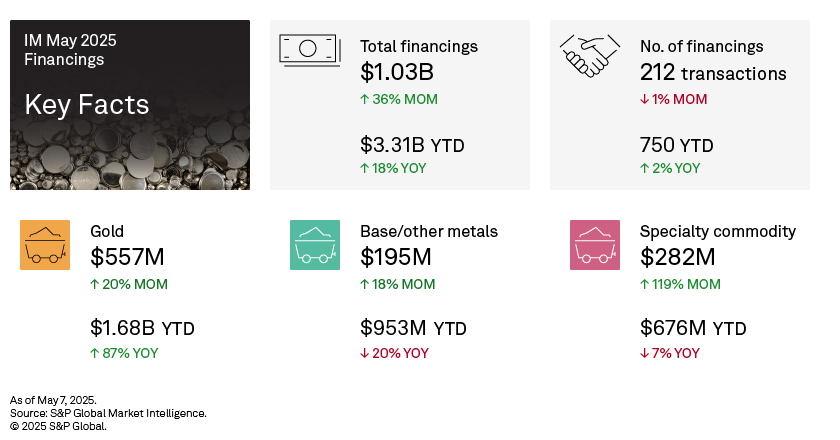

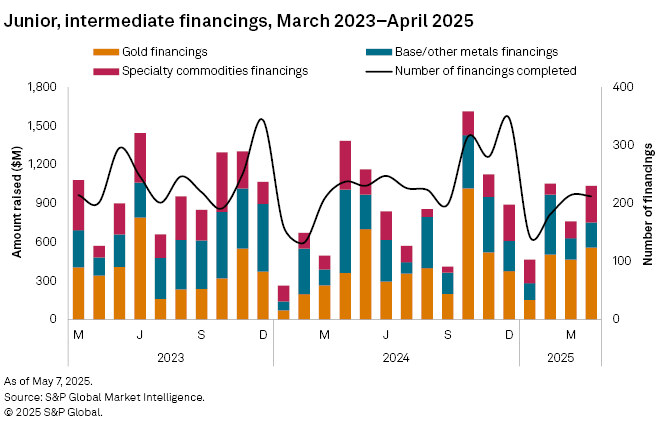

Funds raised by junior and intermediate companies increased to $1.03 billion in April, up 36% from the $759 million reported in March, as high-value financings across all commodity groups increased. This growth came about despite the number of transactions slightly decreasing 1% to 212 from 214 in March, and the number of significant financings — transactions valued at over $2 million — falling to 58 from 68. Notably, there were four transactions valued at over $50 million, up from zero in March.

The April 2025 financing data is available in the accompanying databook.

Gold financings go up

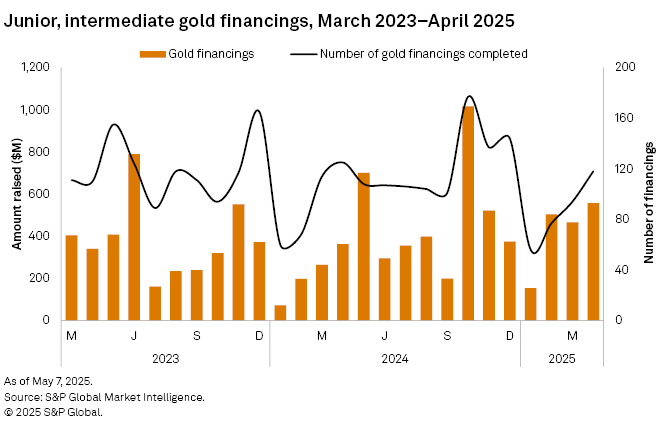

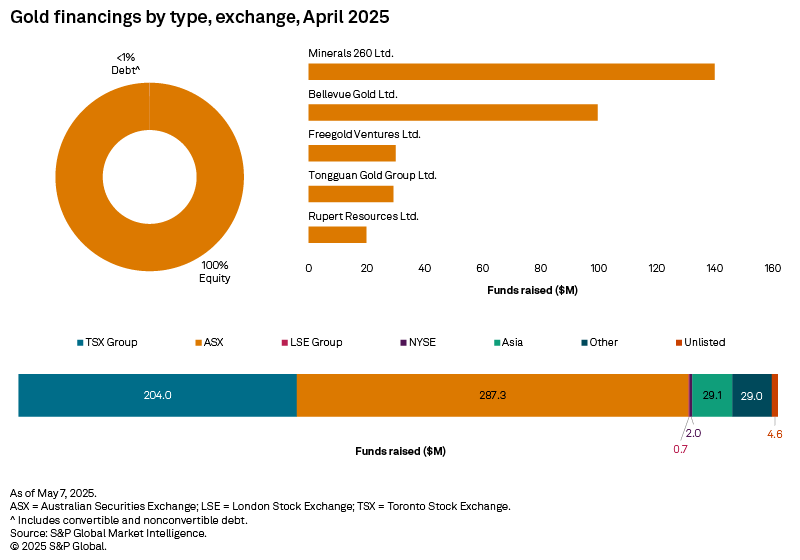

Gold financings rose 20% to $557 million from $465 million in March, the segment's highest fundraising in six months. The number of transactions increased for the third consecutive month to 118 from 94 in March, and the number of significant financings went up by one, reaching 34 transactions. There were two transactions valued at over $50 million, from zero in March.

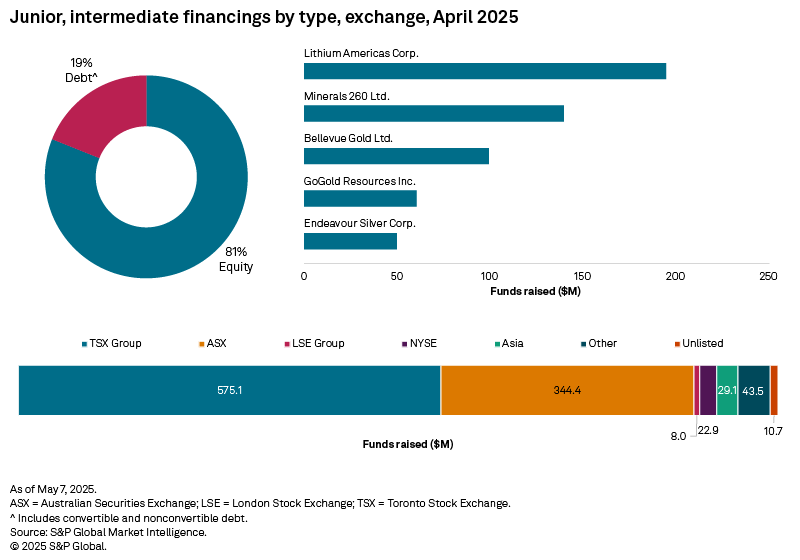

The largest gold financing and the second-largest overall was the A$220 million international and domestic placement of common shares by Australian Securities Exchange-listed Minerals 260 Ltd. Proceeds from this transaction are to be used for the acquisition and exploration of the Bullabulling gold project in Western Australia and for the exploration of other existing projects. In April 2025, Minerals 260 commenced an 80,000-meter drill program at Bullabulling.

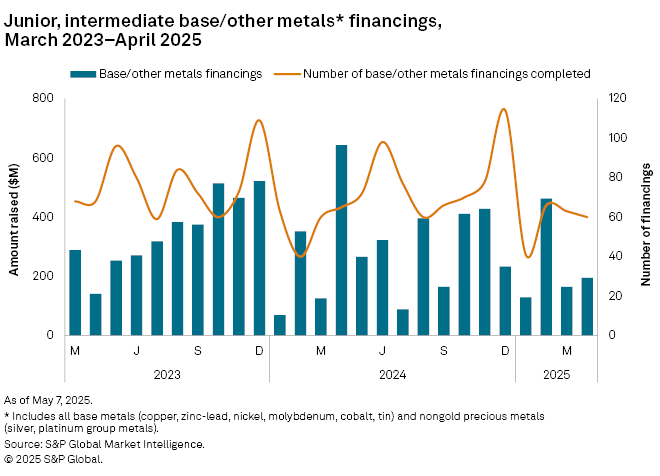

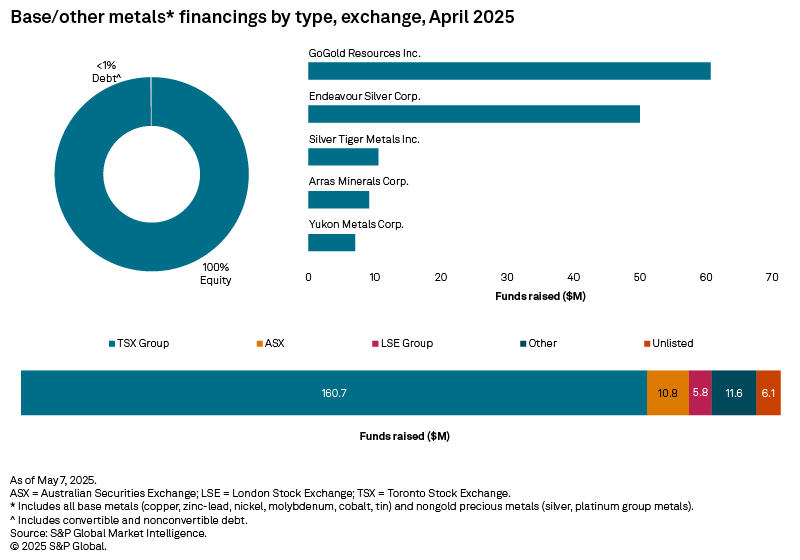

Silver boost base, other metals group

Funds raised for the base and other metals group increased 18% to $195 million, after a significant decline of $298 million in March. Cobalt experienced a modest gain, but more notably, silver buoyed the group's total by rising 446% to $134 million. This effectively reversed the fall of other major targets in this group, with nickel and copper posting the largest declines. The number of transactions in the base and other metals group declined slightly to 60 from 63, while the number of significant transactions also fell by seven to 14. There was one transaction valued at over $50 million, compared to zero in March.

The largest financing in this category and the fourth-largest overall was a C$86 million bought deal offering by Halifax-based and Toronto Stock Exchange-listed GoGold Resources Inc. Proceeds from this transaction are earmarked for the development and exploration of the Los Ricos South and North silver projects in Mexico. In January 2025, GoGold released the results of the feasibility study and mineral reserves for Los Ricos.

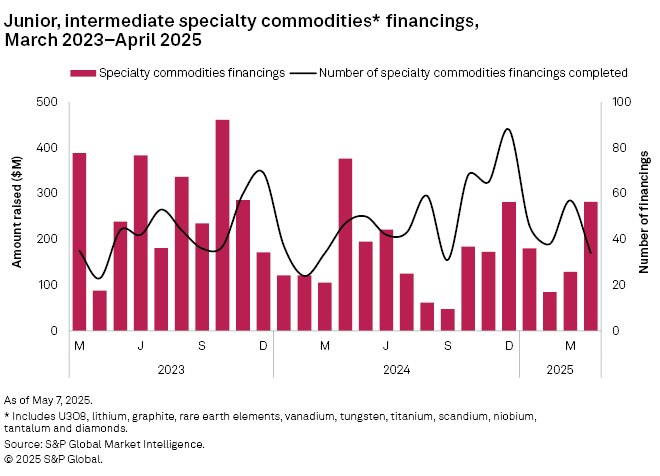

Lithium financings jump, offsetting specialty group decline

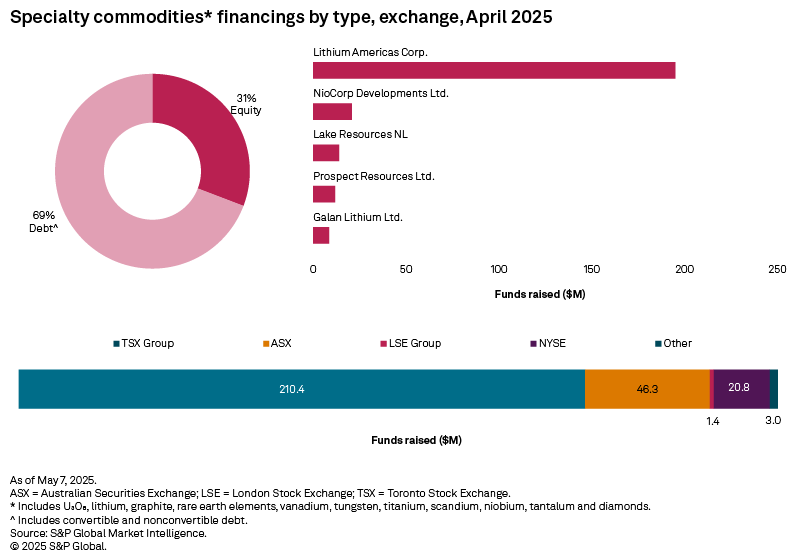

Funds raised for specialty commodities more than doubled in April, jumping to $282 million from $129 million, the group's highest level since April 2024. However, with the exception of lithium and vanadium, all commodities within the group experienced declines. As in the previous month, vanadium did not raise any funds, while lithium boosted the group by spiking 720% to $249 million — its highest since April 2024. The number of transactions fell to 34 from 57 in March, while the number of significant financings decreased by four to 10. There was one transaction valued at more than $50 million in April, compared to zero in March.

The largest transaction in this category and the largest overall was the US$195 million convertible bond offering by Vancouver-based Lithium Americas Corp. Proceeds from this transaction are allocated for the development and construction of phase 1 of the Thacker Pass lithium project in Nevada, with the phase 1 completion targeted for late 2027.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.