Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 27, 2025

By Paul Manalo

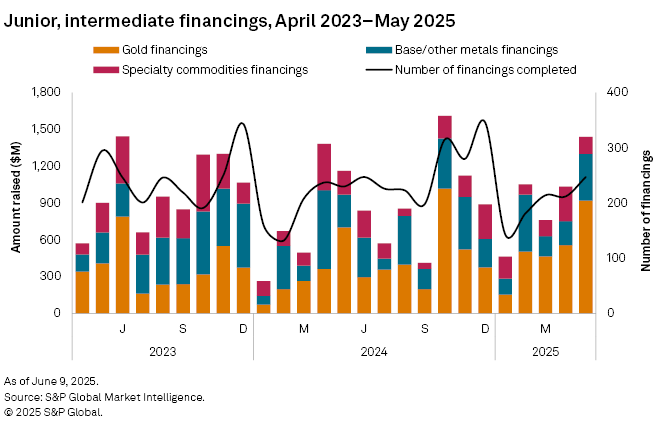

Funds raised by junior and intermediate companies reached $1.44 billion in May, a 39% increase from the $1.03 billion reported in April. This growth was driven by a rise in high-value financings across gold and base metals. The number of transactions also jumped to 247, up from 212 in April. Significant financings — transactions valued at over $2 million — rose to 96, compared to 58 in the previous month. Notably, there were seven transactions valued at over $50 million, an increase from four in April.

May 2025 financing data is available in the accompanying databook.

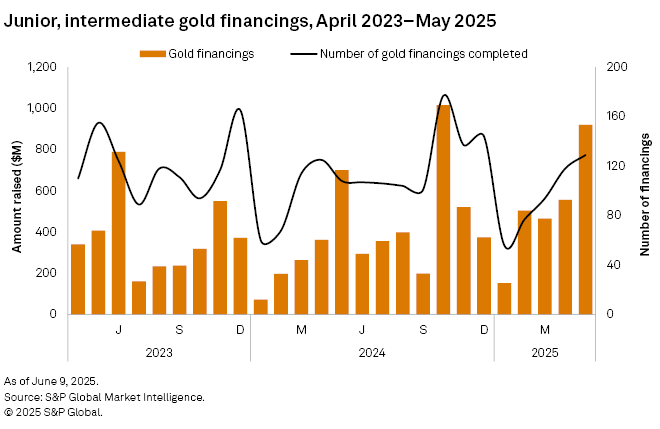

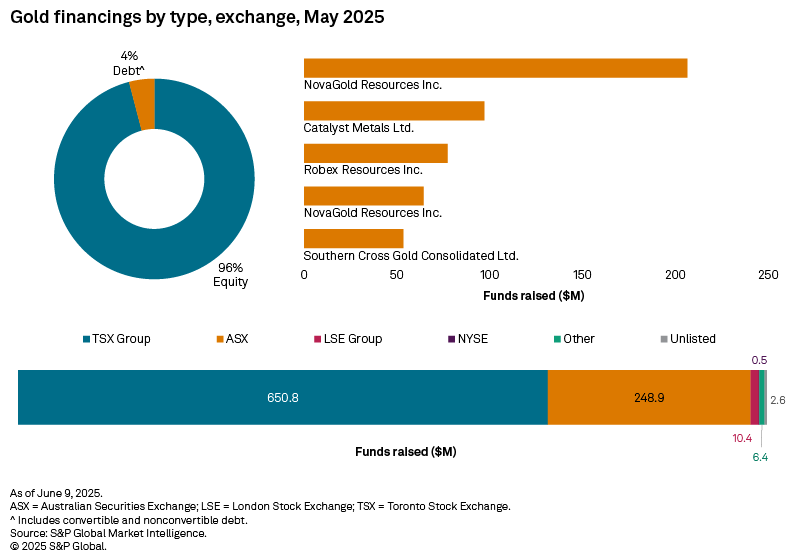

Gold financings jumped to 7-month high

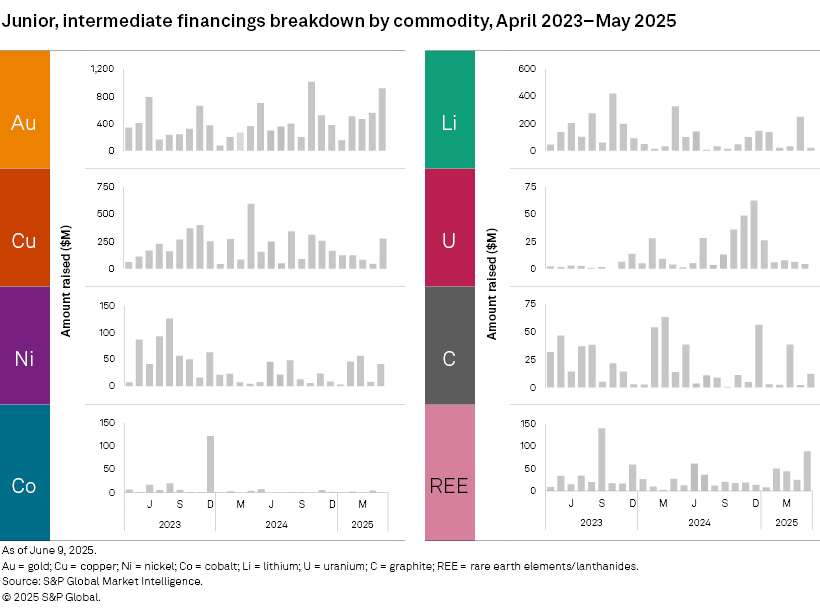

Gold financings reached a seven-month high in May, rising to $920 million, up 65% from $557 million in April. The number of transactions increased for the fourth consecutive month, climbing to 129 from 118 in April, while the number of significant financings nearly doubled to 67. Additionally, there were five transactions valued at over $50 million, compared to two in April.

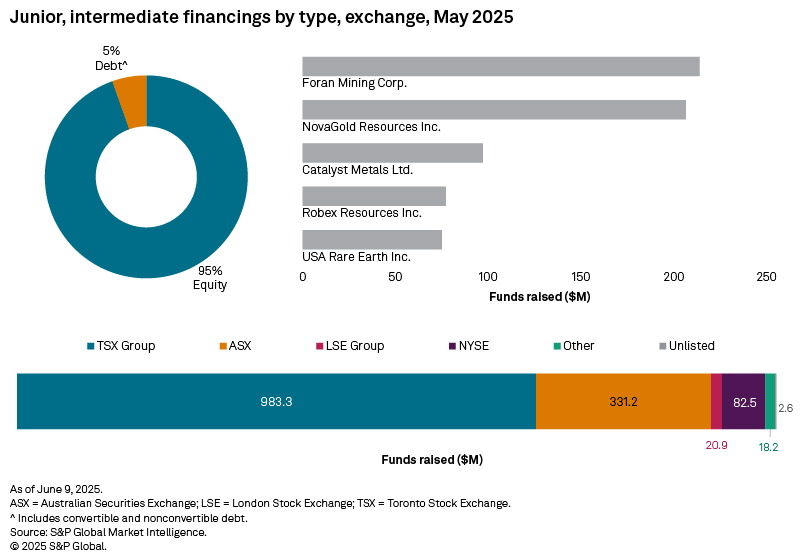

The largest gold financing, and the second-largest overall, was the $206 million domestic follow-on offering by Vancouver-based NovaGold Resources Inc. The company allocated the proceeds for updating the feasibility study and constructing the Donlin gold-silver mine in Alaska.

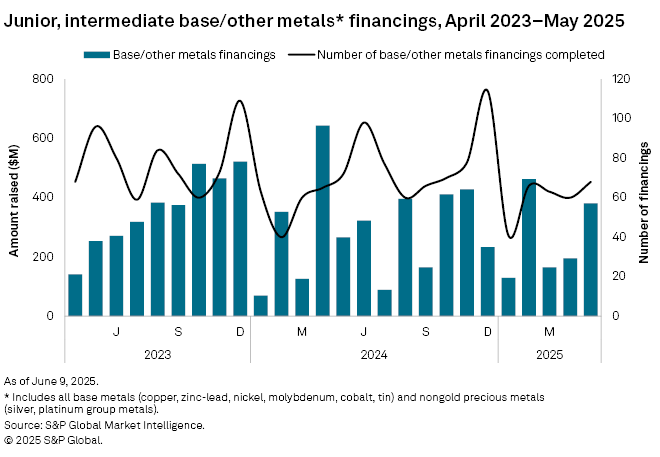

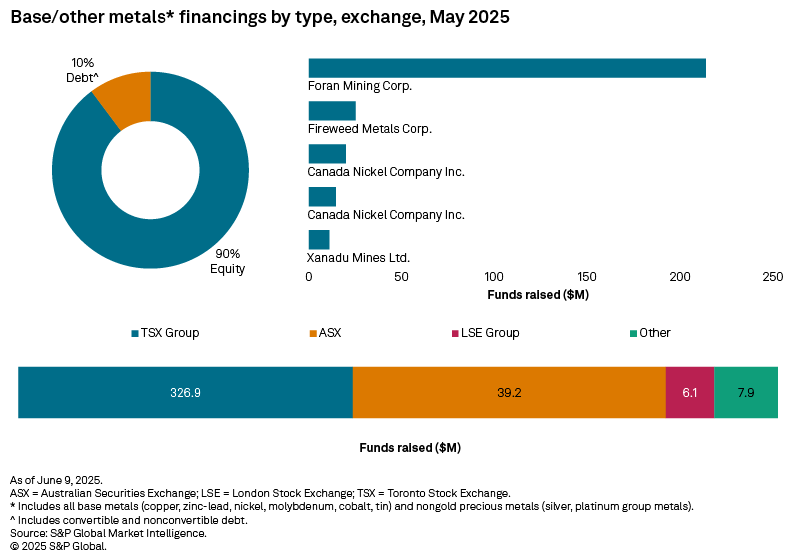

Copper boosts base, other metals group

Funds raised for the base and other metals group nearly doubled to $380 million in May. Copper experienced the largest gain, increasing more than sixfold. Funds raised for nickel and zinc-lead also increased month over month, which helped to offset the decline in silver financings. The number of transactions in this group rose to 68, up from 60 the previous month, while the number of significant financings increased by six to 20. There was one transaction valued at over $50 million, the same as in April.

The largest financing in this category, and the largest overall, was a C$296 million private placement of common stock by Vancouver-based Foran Mining Corp. This transaction represents the first tranche of Foran's plan to raise a total of C$350 million to fund the construction of the McIlvenna Bay copper mine in Saskatchewan, which is expected to begin commercial production in mid-2026.

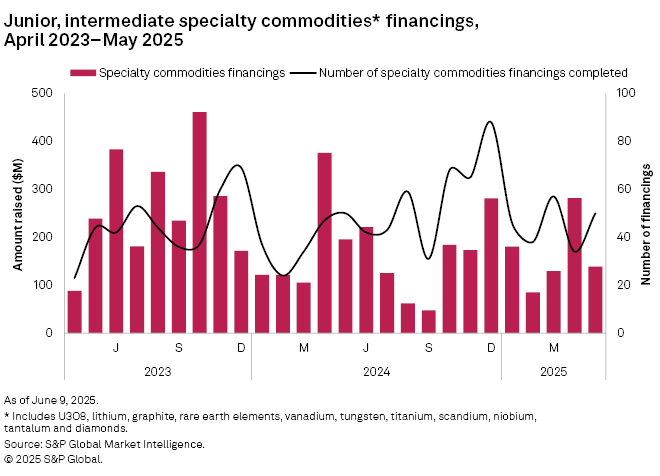

Lithium financings fell

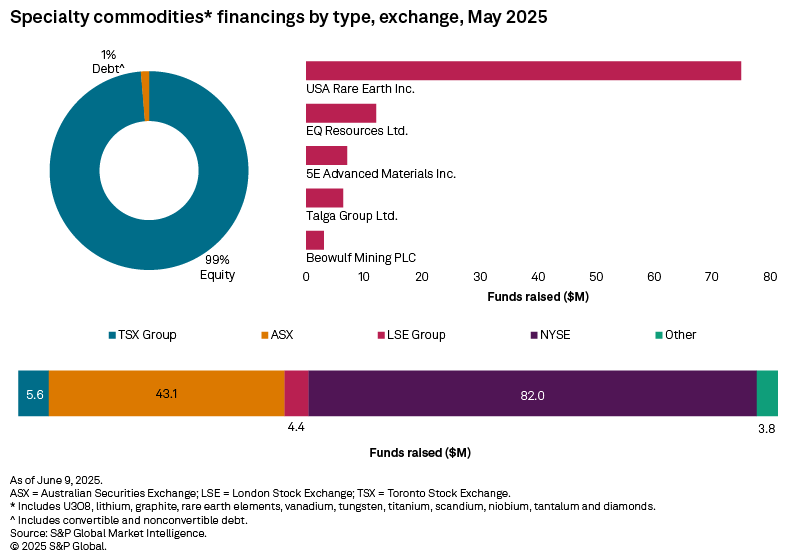

The only group to experience a decline in May was specialty commodities, with funds raised dropping by half to $139 million. Lithium financings experienced the largest decrease, falling by more than 90% to $21 million. While rare earth elements, graphite and tungsten saw some increases, they were not enough to offset the decline in lithium financings. The number of transactions rose to 53, up from 34 in April, while the number of significant financings decreased by one to 9. There was one transaction valued at over $50 million in May, similar to April.

The largest transaction in this category, and the fifth-largest overall, was the $75 million private placement of common stock by US-based USA Rare Earth Inc. The company plans to use the proceeds to fund capital expenditures for its magnet manufacturing facility in Stillwater, Oklahoma. USA Rare Earth Inc. also holds 80% equity ownership in the Round Top rare-earth-lanthanides project in Texas.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.