Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 6 Jul, 2022

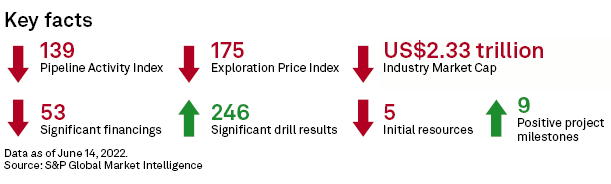

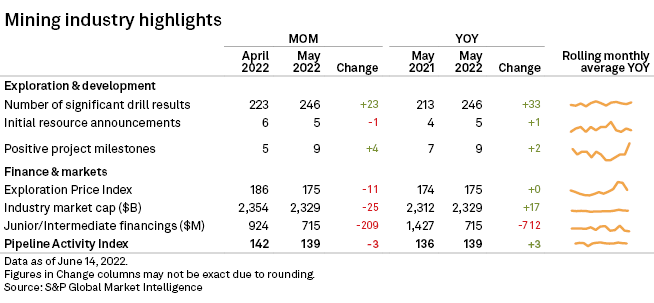

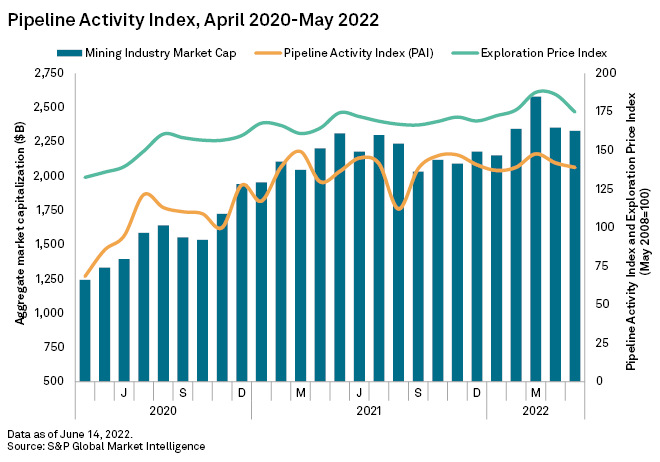

S&P Global Market Intelligence's Pipeline Activity Index, or PAI, retreated for a second consecutive month in May, falling to 139 from 142 in April, as decreases in significant financings and initial resources were partially offset by increases in significant drill results and positive project milestones. The gold PAI fell to 169 from 181, while the base/other metals PAI rose to 113 from 108.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

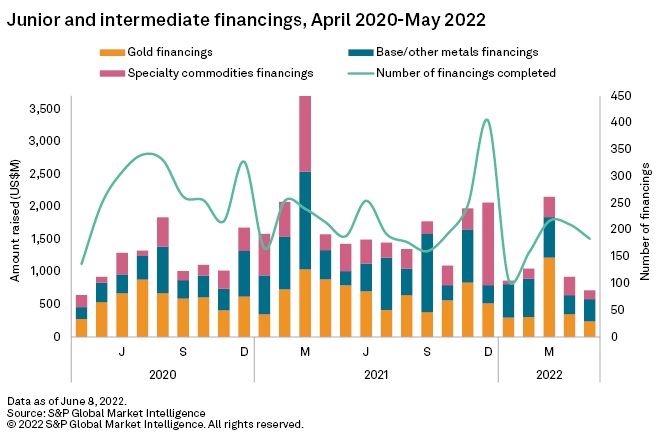

Total raisings down 23%, number of financings off for 2nd month

The number of financings by junior and intermediate companies decreased for a second consecutive month in May, falling to 183 from 210 in April. The US$715 million raised was off 23% from the US$924 million garnered in the previous month. It was the lowest amount raised in two years.

In line with the overall decrease in financings, the number of significant gold and base metals financings, used in the PAI calculation, decreased sharply in May, falling to 53 from 88 in April. Significant gold financings decreased by 28, falling to 25 from 53, while base/other metals financings fell by seven, dropping to 28 from 35.

Hong Kong-based Grand T G Gold Holdings Ltd., an investment company engaged in the gold mining and processing business, had May's largest gold financing with a HK$157.2 million (US$36.4 million) subscription rights offering. The company's main mining asset is the Taizhou gold project in China's Shanxi province.

In the month's largest base/other metals financing and the largest raising overall, Australian Securities Exchange-listed Chalice Mining Ltd. completed a A$100 million (US$70.8 million) institutional share placement. The company will use the proceeds to fund ongoing exploration and predevelopment activities at its Julimar nickel-copper-platinum group elements project in Western Australia.

Calgary-based Lithium Chile Inc. had May's largest specialty commodities financing, a C$27.9 million (US$21.6 million) non-brokered private placement with Chengxin Lithium Group Co. Ltd. Lithium Chile will use the proceeds to accelerate existing exploration projects and pursue other opportunities. The company has expanded the phase-two exploration program at its Salar De Arizaro lithium project in Argentina's Salta province.

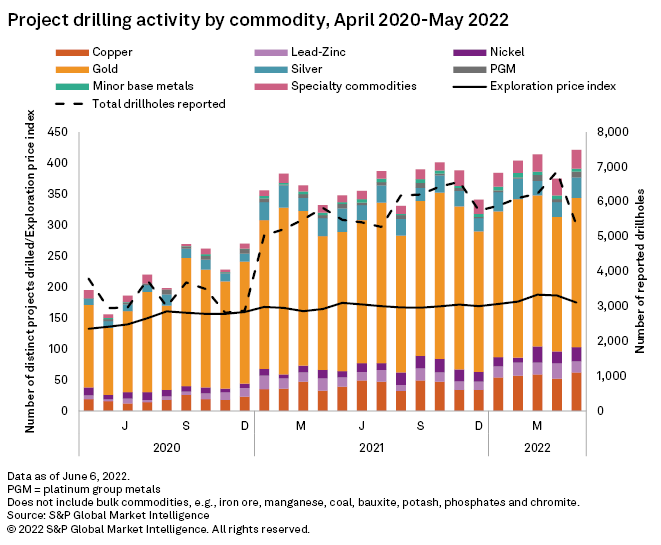

Drilling activity increases, with record number of projects drilled

After a dip in April from an all-time high in March, global drilling activity increased sharply in May, with the total number of distinct projects reporting drill results setting a new record of 421, up from 375 projects in April.

Reported drilling increased for gold, silver, copper, nickel, platinum group metals and specialty commodities projects. Drilling decreased for zinc-lead and minor base metals projects.

In contrast with the increase in projects, the number of reported drillholes fell sharply in May to 5,338 from a record 6,866 in April.

ASX-listed Twenty Seven Co. Ltd. reported the most drill results with 373 assays from its Rover copper project and Yarbu gold project in Western Australia. Another Australian junior, Mako Gold Ltd., was second with 262 drillholes at its Napie and Korhogo gold projects in Cote d'Ivoire.

By country, Australia led with 134 projects reporting drilling, up from 112 in April, followed by Canada with 101, unchanged from the previous month. The U.S. was a distant third with 42 projects, up from 37 in April.

In line with the increase in the number of projects, the number of significant drill intersections, used in the PAI calculation, rose in May, to 246 from 223 in the previous month, with the increase spread equally between gold and base/other metals projects.

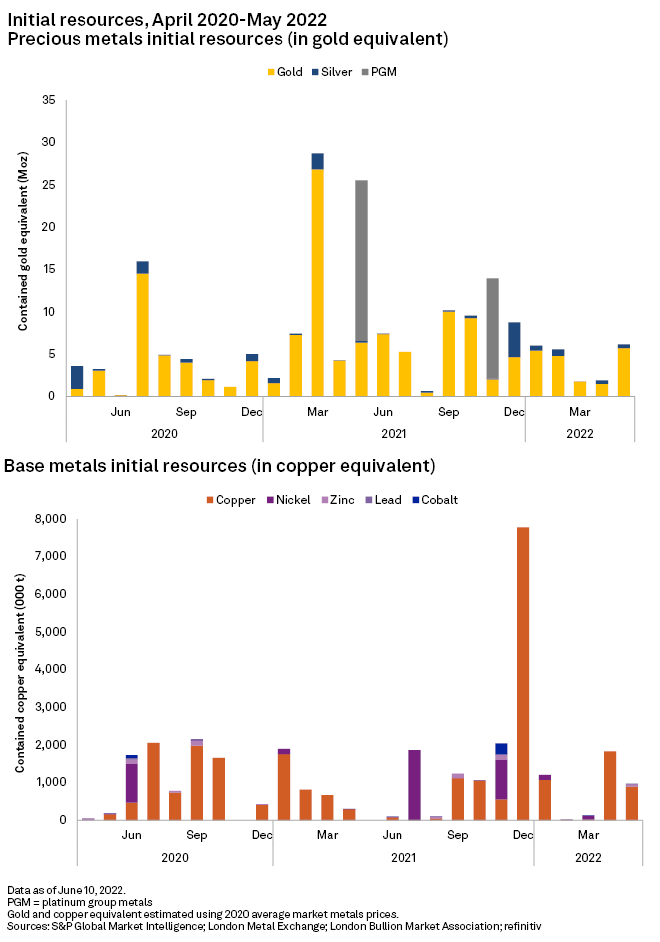

New resources down

The number of initial resource announcements decreased to five in May from six in April; three resources were for gold projects and two were for base/other metals.

May's largest new resource by far was announced by ASX-listed Alkane Resources Ltd. at its Northern Molong gold-copper project in New South Wales, where inferred resources at the Boda deposit totaled 624 million tonnes grading 0.26 grams of gold per tonne and 0.14% copper (containing 5.2 million ounces of gold and 900,000 tonnes of copper). The deposit remains open at depth and along strike to the south and to the northwest within the Boda intrusive corridor.

The month's second-largest new resource was at Vancouver-based Blackrock Silver Corp.'s Tonopah West project in Nevada, where inferred resources totaled 2.975 Mt grading 208 g/t Ag and 2.5 g/t Au (containing 19.9 Moz of silver and 238,000 ounces of gold). Representing just 18 months of drilling data, this initial resource establishes Tonopah West as one of the world's highest-grade undeveloped silver deposits of size, with substantial resource-expansion potential remaining.

May's third-largest new resource was at London-based Rockfire Resources PLC's Molaoi zinc project in Greece, where inferred resources totaled 2.3 Mt grading 9.4% Zn, 1.7% Pb and 47.0 g/t Ag (containing 210,000 tonnes of zinc, 39,000 tonnes of lead and 3.5 Moz of silver). Only 1,400 meters of a potential 7-kilometer strike length is included in the estimate; the resource remains open at depth and along strike.

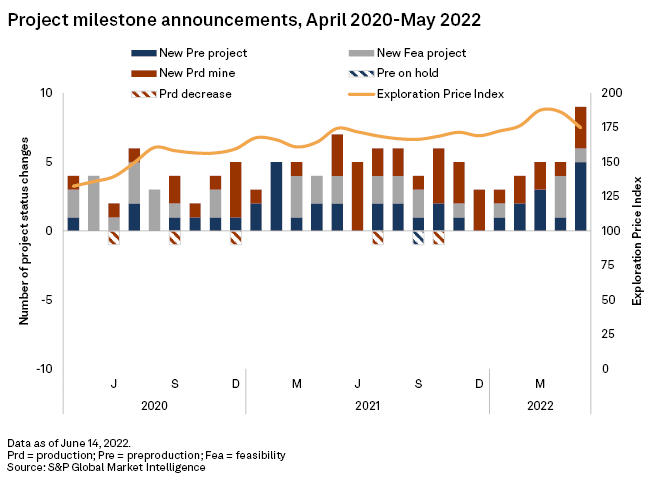

Milestone activity up sharply

As the graph below indicates, positive project milestone activity was up sharply in May, to nine announcements from five in April. There were no negative milestones.

May's positive milestones included one project entering feasibility, five projects entering preproduction and three production startups. Seven milestones were for base/other metals projects, and two were for gold.

In the month's largest milestone by far, China Molybdenum Co. Ltd. approved a mixed mine development project at its Tenke Fungurume copper-cobalt mine in Democratic Republic of Congo. The US$2.51 billion project is expected to increase copper cathode production by 200,000 tonnes per year and raise cobalt hydroxide output by 17,000 t/y, beginning in 2023.

May's second-largest milestone was at Vancouver-based Ivanhoe Mines Ltd.'s Platreef project in South Africa's Limpopo province, where lateral mine development toward the Flatreef orebody has begun. The first high-grade area of the orebody is situated about 450 meters from the recently completed Shaft 1, which will be the project's initial production shaft. First production is scheduled for the third quarter of 2024.

In the month's third-largest milestone, Toronto-based First Quantum Minerals Ltd. approved the S3 Expansion project at its Kansanshi copper mine in Zambia. The US$1.25 billion project will transition the current selective high-grade, medium-scale mining operation to a medium-grade, larger-scale mining operation that will be more appropriate for the higher proportion of primary, lower-grade sulfide ores at depth. When the expansion is completed in 2025, copper production from Kansanshi is expected to average about 250,000 t/y for the remaining life of mine to 2044.

Exploration Price Index falls for 2nd month

Metals prices decreased for a second consecutive month in May, lowering Market Intelligence's Exploration Price Index to 175 from 186 in April. The indexed price fell for all — gold, silver, platinum, copper, nickel, zinc, cobalt and molybdenum — of the eight constituents of the index.

The index measures the relative change in precious and base metals prices, weighted by the percentage of overall exploration spending for each metal as a proxy of its relative importance to the industry at a given time.

Equities off slightly

After reaching an all-time high in March, mining equities pulled back for a second consecutive month in May, as Market Intelligence's aggregate market value of the industry's listed companies, based on 2,365 firms, decreased 1% month over month to US$2.33 trillion. The aggregate market cap of the industry's top 100 companies was also down 1% in May at US$1.92 trillion.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.