Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 23, 2025

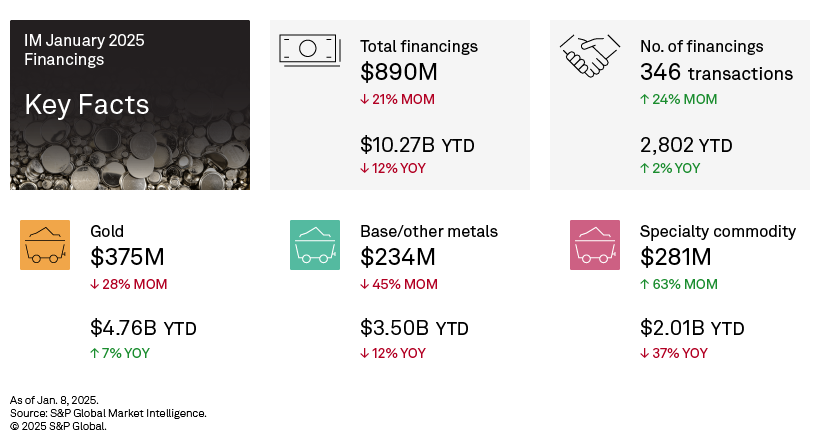

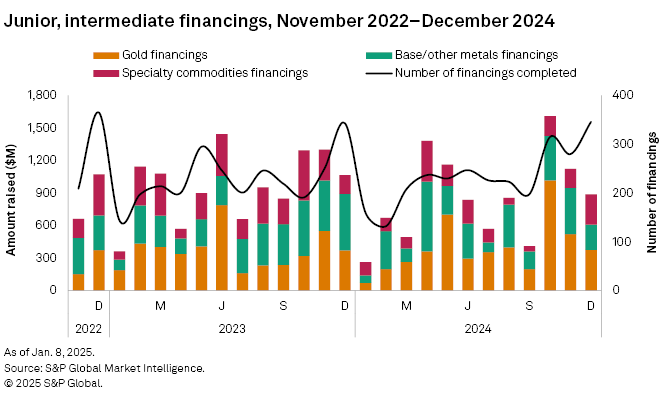

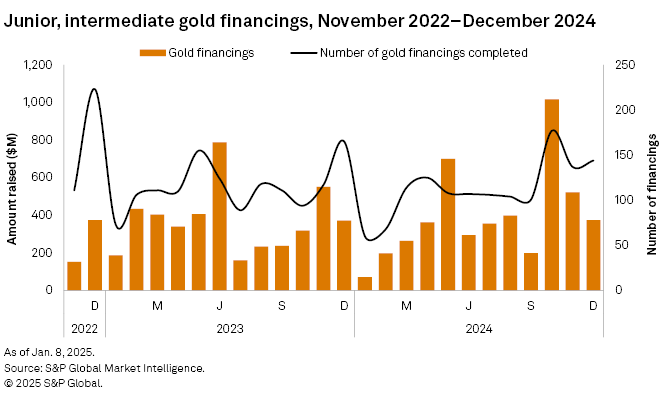

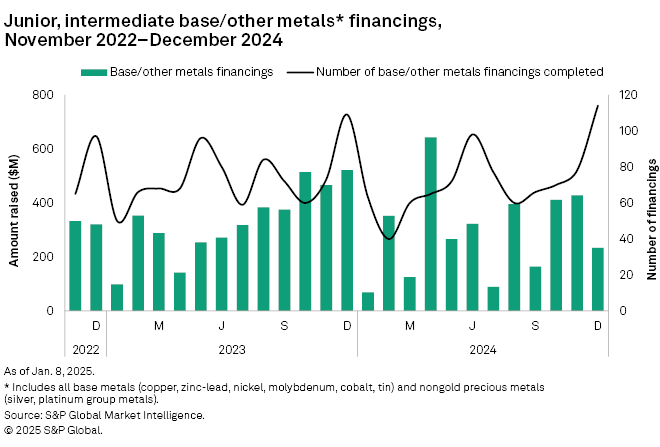

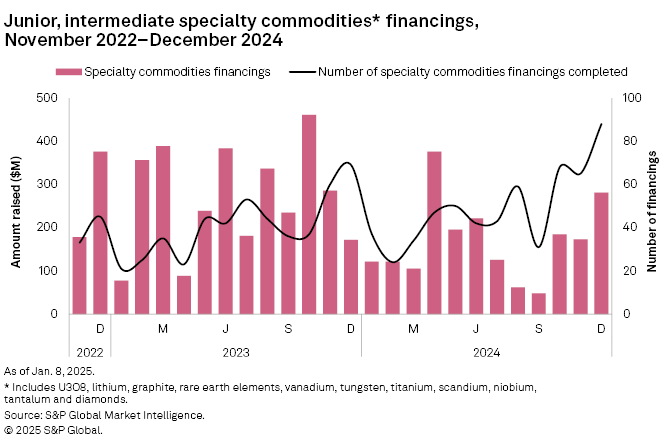

Funds raised by junior and intermediate companies dropped in December, falling 21% to $890 million. Despite an increase in transactions, fewer high-value gold and base/other metals financings weighed down the monthly totals. As a result, year-to-date financings fell 12% to $10.27 billion, the lowest since 2019. The number of transactions rose 24% to 346 — the highest since December 2022 — bringing the year-to-date total to 2,802, up 2% year over year. However, the number of significant financings — transactions valued at more than US$2 million — decreased by nine to 66 in December. There were four transactions valued at over US$50 million, unchanged from November.

The December 2024 financing data is available in the accompanying databook.

Reduced high-value gold financings impact total funds raised

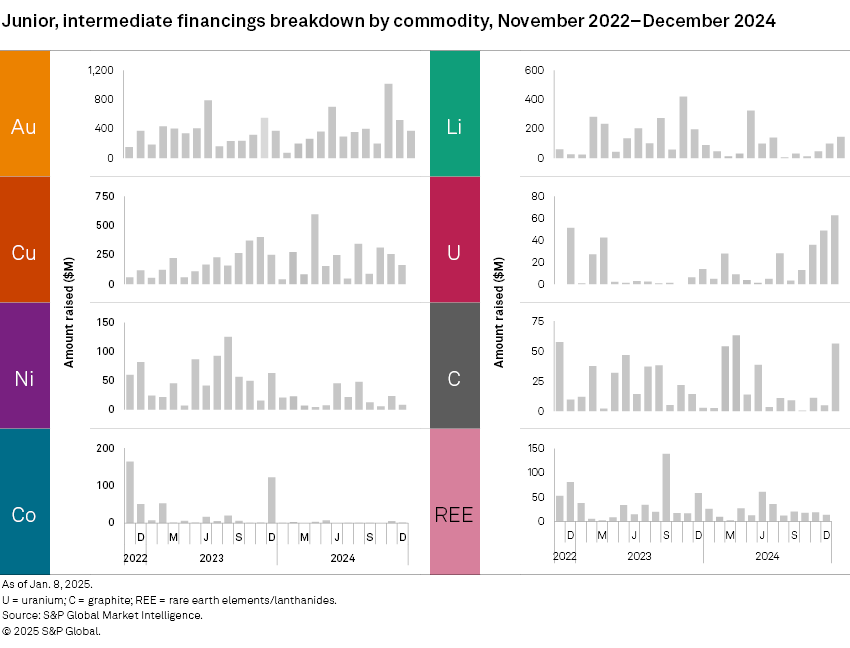

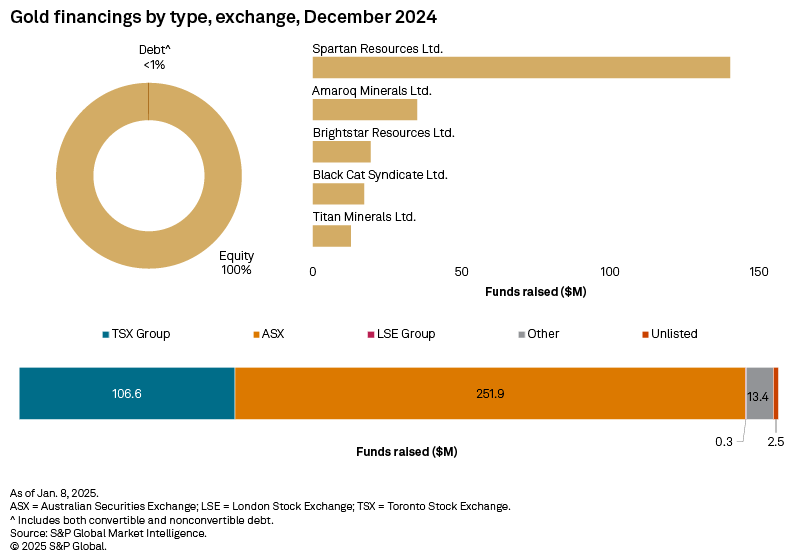

Gold financings fell for the second consecutive month, down 28% to $375 million, despite an increase in the number of funds raised. The number of gold transactions rose in December to 144 from 137 in November; however, the number of significant financings decreased to 29 from 36 in November, dragging down the group's monthly totals. There was only one transaction valued at more than $50 million, down from two in November.

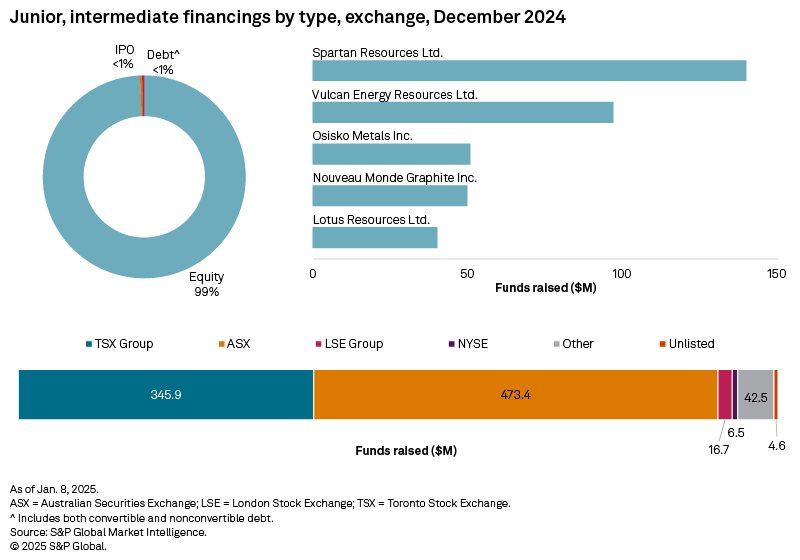

The largest gold financing and the largest overall was the A$220 million private institutional placement of ordinary shares from Australian Securities Exchange-listed Spartan Resources Ltd. The funds will be used to accelerate the production restart activities and support an expanded drilling campaign at the Dalgaranga gold project in Western Australia.

Copper, silver, nickel financings take down base/other metals group

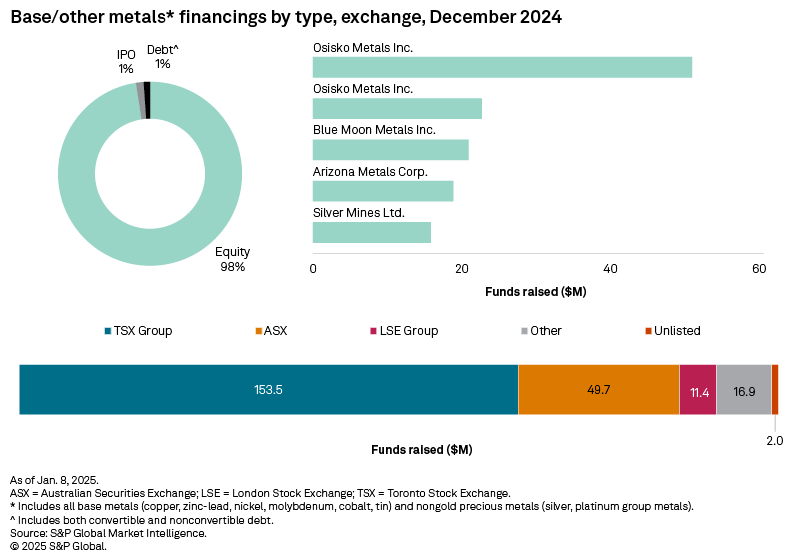

Funds raised for the base/other metals group fell 45% in December to $234 million due to a decline in copper, silver and nickel financings after reaching a seven-month high of $428 million in November. Like gold, there were fewer high-value financings, despite the number of transactions rising to a record high of 114 from 78 in November. There was one transaction valued at more than $50 million, down from two in November.

The largest base/other metals financing and the third-largest overall was the C$72 million bought deal private placement of Toronto Stock Exchange-listed Osisko Metals Inc., which was part of a placement with aggregate gross proceeds of C$107 million. Proceeds from the transaction will be used for the advancement of its assets in Quebec and the Northwest Territories, including the Gaspe copper project in Quebec.

Lithium, uranium, graphite gains boost specialty group

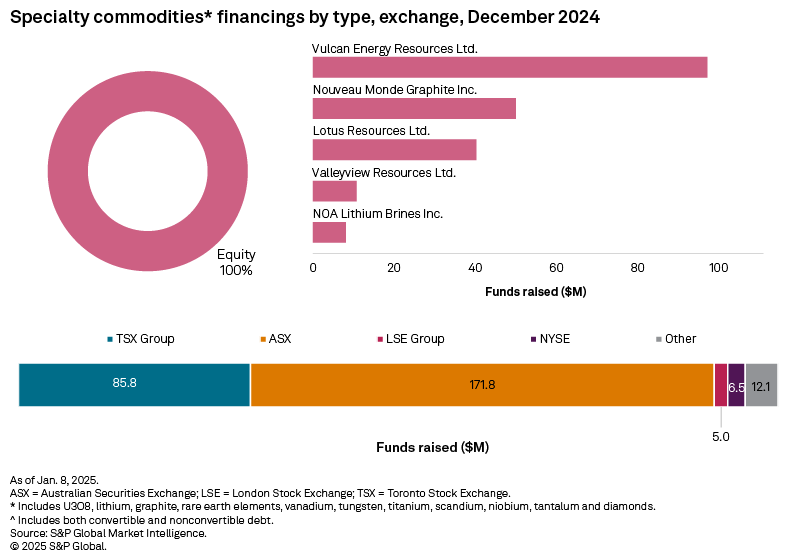

Funds raised for the specialty commodities group jumped 63% to $281 million, marking the highest total in eight months. Lithium financings increased for the third consecutive month to $145 million, while funds raised for uranium increased for the fourth straight month to $63 million. Graphite financings also rose significantly, reaching $56 million. The number of transactions grew to 88, up from 65 in November, and there were two transactions valued at more than $50 million in December, compared to none in November.

The group's largest transaction and the second-largest overall was the A$154 million follow-on equity offering by Australia-based Vulcan Energy Resources Ltd. Proceeds from this transaction will be used to fund the commencement of project execution of its phase one Lionheart lithium project in Germany.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.