Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 16, 2025

By Cesar Pastrana

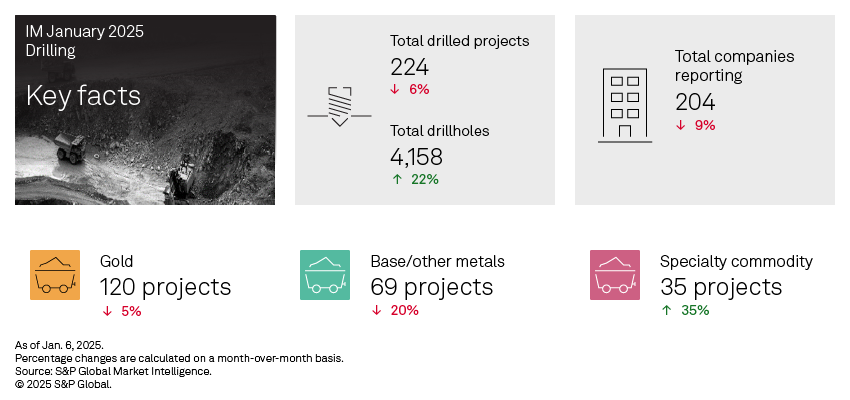

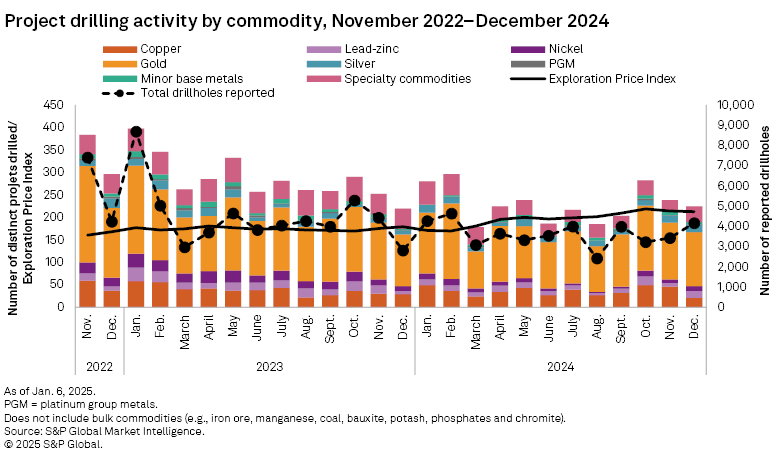

The trend of depressed drilling activity during December continued in 2024, with global drilling metrics coming in at a four-year low. Projects drilled fell 6% to 224, while total drillholes rebounded 22% to 4,158. However, year-over-year comparisons reveal a 19% decline in total holes drilled and a 20% drop in projects drilled. Early-stage projects decreased 13% to 78, and late-stage projects fell 6% to 109, while minesite projects rose 16% to 37.

Access the December 2024 drill results data in the accompanying Excel spreadsheet.

Projects reporting drilling recorded another decrease in December 2024, heavily weighed down by a 54% drop in copper to 21 projects — the lowest since November 2020. Gold projects fell by six to 120, while minor base metals were down by two to only five projects. Lead-zinc, nickel and specialty metals reported minor increases month over month, while silver and platinum group metals (PGM) remained unchanged from November 2024. Counterintuitively, almost all commodities reported an increase in total reported drillholes in December 2024, aside from minor base metals and PGM, with 26% and 96% month-over-month decreases, respectively.

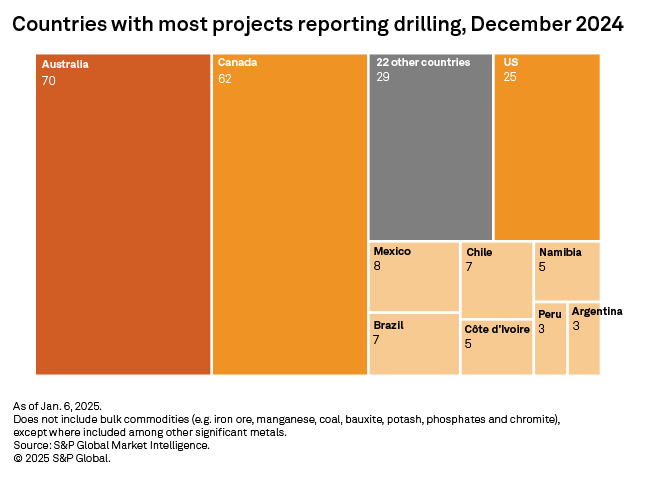

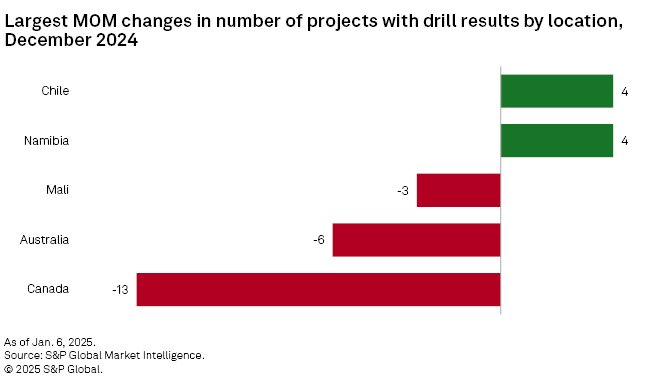

Project drilling declined for the top two countries, with Australia experiencing an 8% drop to 70 projects and Canada falling 17% to 62 projects. The US held its third place, reporting no month-over-month change. Conversely, Chile and Namibia increased the most, each reporting four additional projects in December 2024.

December's top result came from TSX Venture Exchange-listed F3 Uranium Corp.'s Patterson Lake North early-stage uranium project in Saskatchewan. The company reported an intersect of 5.5 meters grading at 42.2% uranium. The company mentioned that the drill results demonstrate the potential for substantial mineralization within the JR Zone, which indicates that the area may contain additional high-grade deposits, warranting further exploration and drilling.

The second-best result came from TSX Venture Exchange-listed New Found Gold Corp.'s Queensway early-stage gold project in Newfoundland and Labrador. The company reported an intersect of 4.1 meters grading at 455.33 grams of gold per metric ton. The company intends to conduct systematic channel sampling to assess the grade distribution of the Iceberg Trench in 2025.

TSX Venture Exchange-listed Silver Storm Mining Ltd.'s La Parrilla project in Mexico rounded out December's top three results, with an intersect of 6.1 meters grading at 277 g/t gold, 0.05 g/t silver, 0.23% copper, 2.34% zinc and 6.92% lead. The company reported that an updated Mineral Reported Estimate is expected in January 2025.

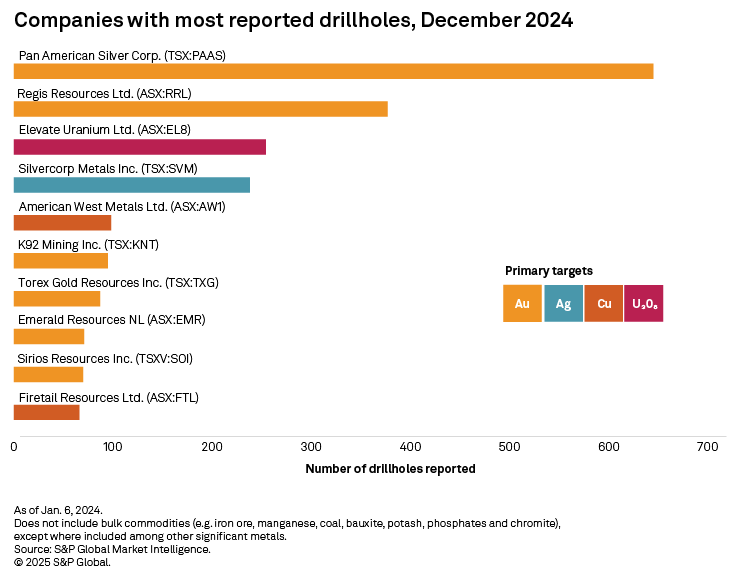

Pan American Silver Corp. reported the most drillholes in December, with 645 holes between six mines: Whitney in Ontario, La Colorada in Mexico, Jacobina in Brazil, El Penon and Minera Florida in Chile, and Huaron in Peru. The company announced it increased its drilling budget to up to 450,000 meters in 2024

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.