Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Feb 18, 2025

By Paul Manalo

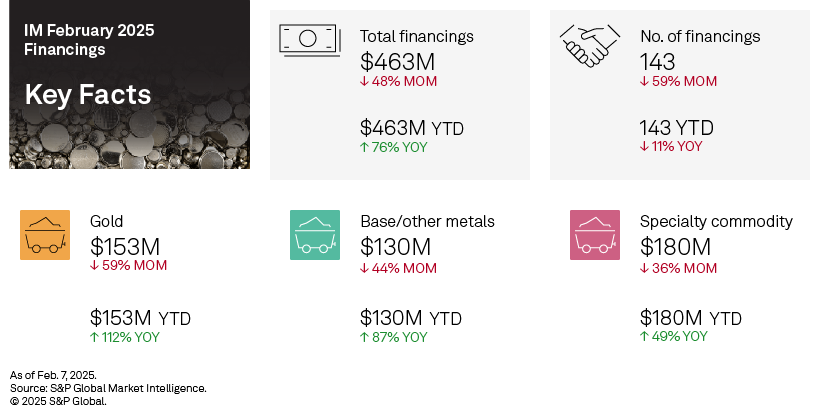

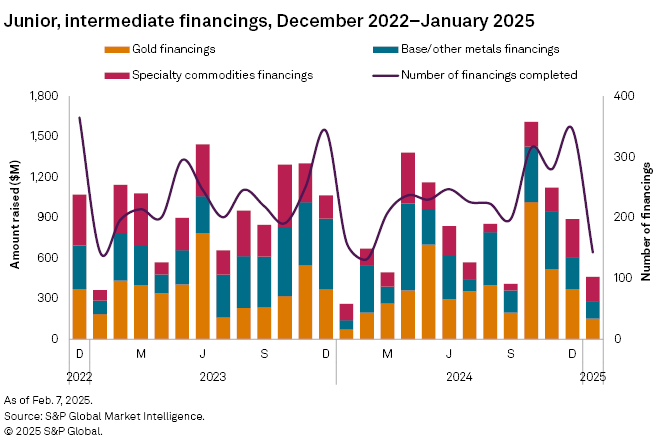

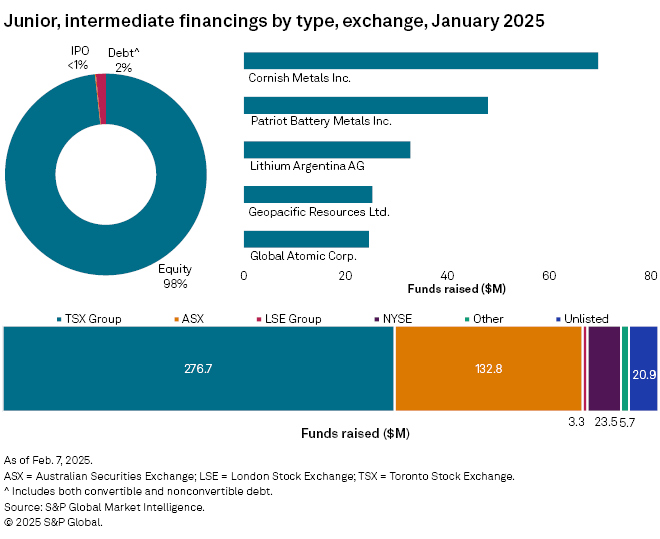

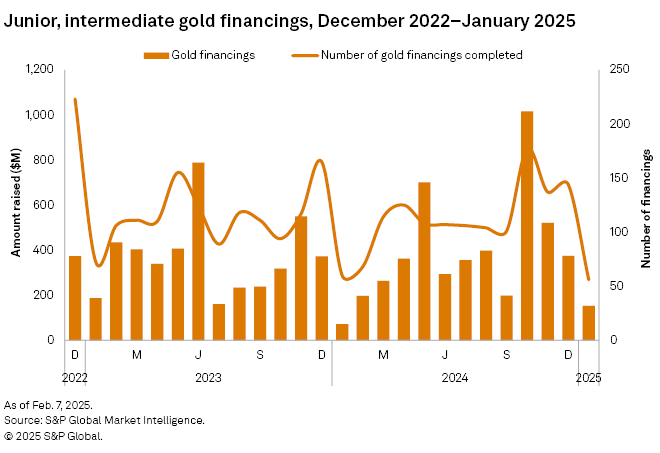

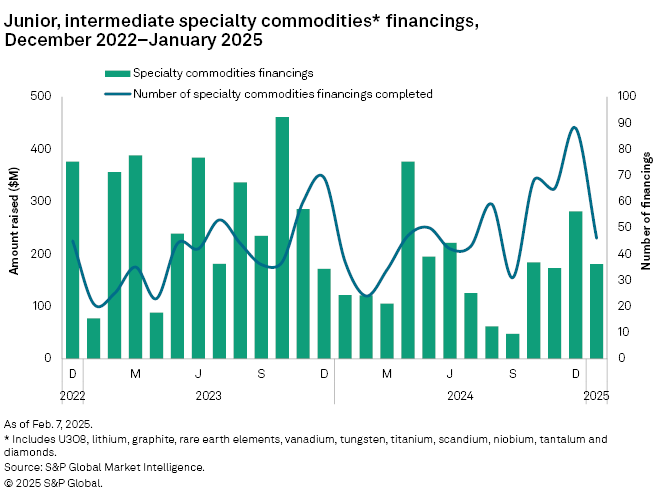

Funds raised by junior and intermediate companies dropped 48% to $463 million, as the number of transactions decreased by nearly 60% to 143, marking the lowest monthly total number of transactions in three years. The number of significant financings, defined as transactions valued at over US$2 million, fell to 31 from 66 in December 2024. Additionally, there was only one transaction valued at over US$50 million, down from four in December 2024.

The January 2025 financing data is available in the accompanying databook.

Gold financings fell again

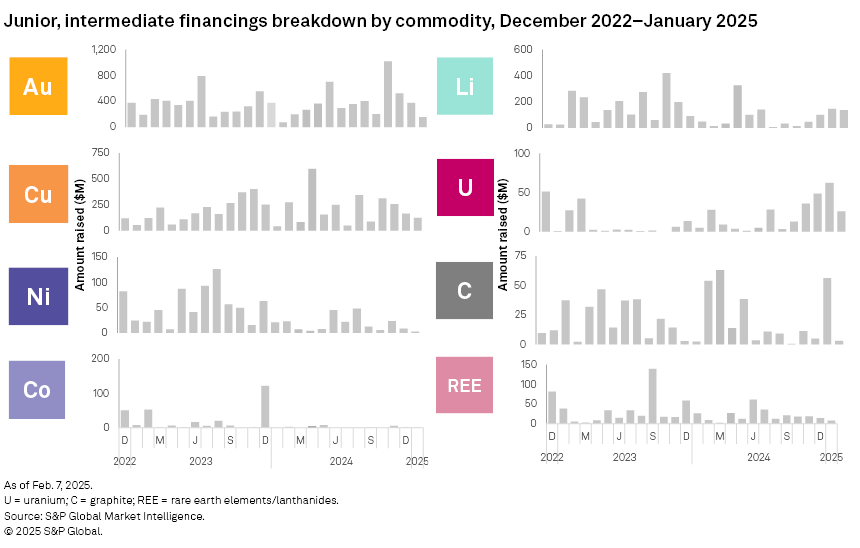

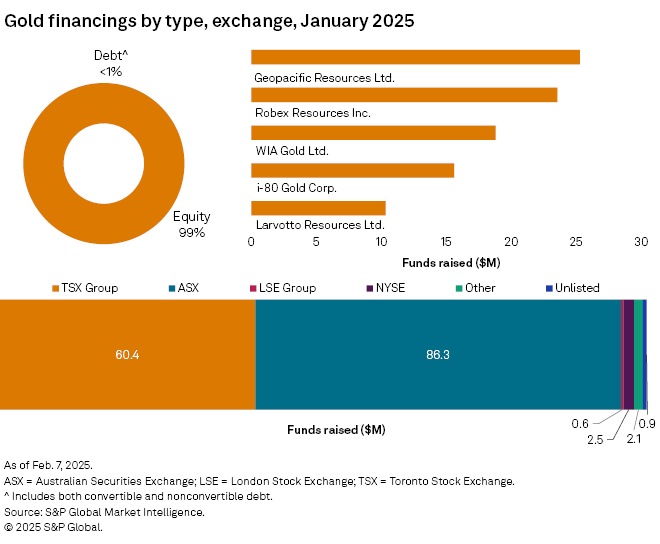

Gold financings declined for the third consecutive month, decreasing by 59% to $153 million. The number of transactions reached a multiyear low of 56. Furthermore, the number of significant financings — defined as transactions over $2 million —more than halved, dropping to 13 from 29 in December 2024. Notably, no transactions were valued at over $50 million, a decrease from one in December 2024.

The largest gold financing and the fourth-largest overall was the A$40 million subscription rights offering of Australian Securities Exchange-listed Geopacific Resources Ltd. The company is constructing its gold-silver mine in Milne Bay in Papua New Guinea. Geopacific recently announced its plan to conduct a 5,000-meter trenching and 30,000-meter drill program in the Woodlark Island project.

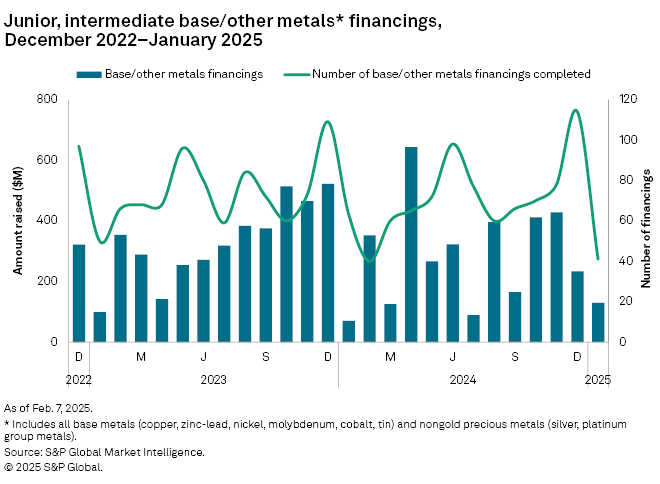

Base and other metals group fell again

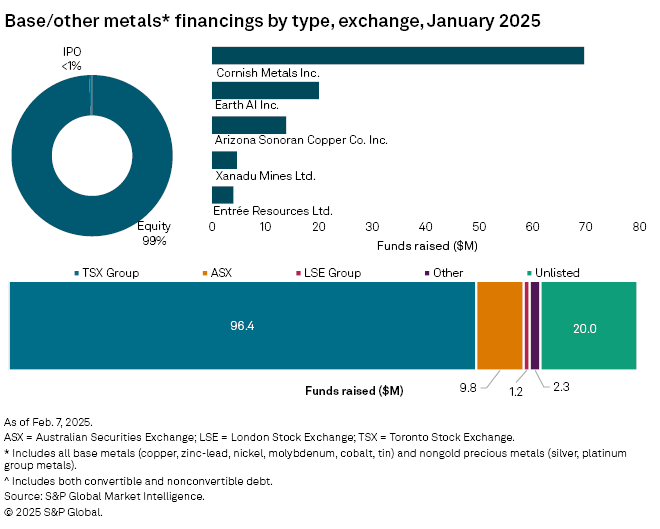

Funds raised for the base and other metals group declined for the second consecutive month, falling 44% to $130 million. All major targets in this group, led by copper, zinc and silver, decreased. The number of transactions in the base/other metals group dropped by nearly two-thirds to 41, marking the lowest total in three years.

The largest financing in this category, and the largest overall, was a £56 million private placement by Vancouver-based Cornish Metals Inc. This funding is intended to support the company's plan to restart production at its South Crofty tin-copper project in Cornwall, United Kingdom. Cornish Metals is completing the shaft refurbishment and de-watering process for the said project.

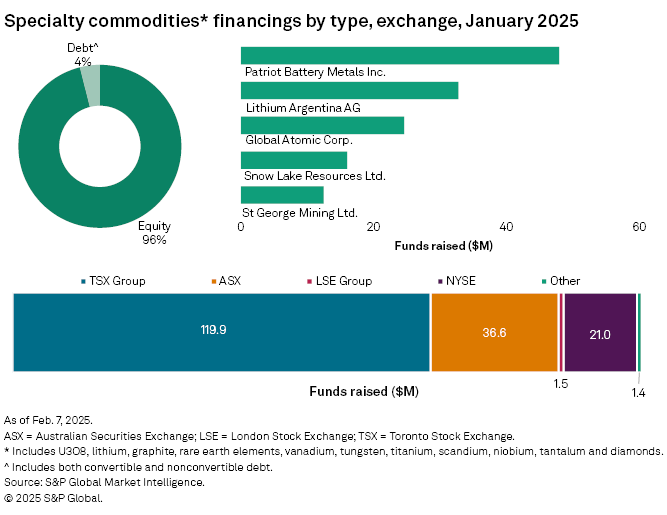

Lower graphite and uranium drag specialty group

Funds raised for the specialty commodities group fell 36% to $180 million, retreating from a recent high of $281 million in December 2024. Lithium financings fell slightly, down 6% to $136 million, while graphite and uranium financings fell by an aggregate of $90 million, weighing down the group's total. The number of transactions fell to 46, from 88 in December 2024. No transaction was valued at more than $50 million in January, compared to two in December 2024.

The group's largest transaction and the second-largest overall was the C$69 million international private placement offering by Vancouver-based Patriot Battery Metals Inc. The proceeds from this transaction will be used to fund a 15,000-meter winter drilling program at the Shaakichiuwaanaan lithium project in Quebec.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.