Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — May 9, 2025

By Francesca Price

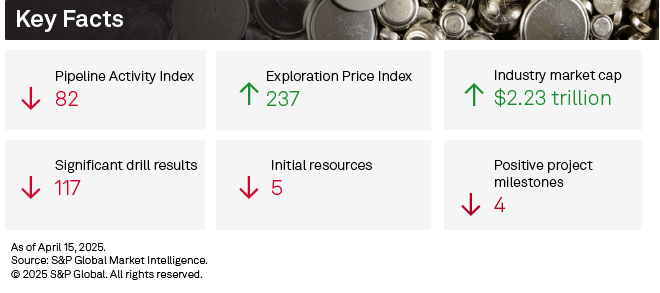

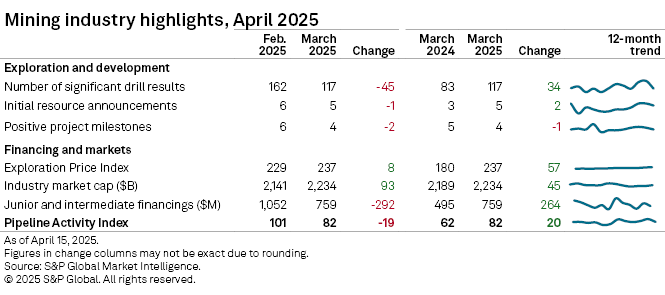

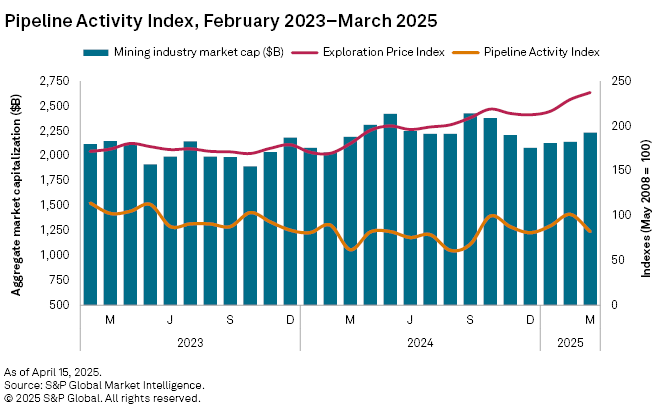

The S&P Global Market Intelligence Pipeline Activity Index (PAI) declined 19% month over month in March 2025, to 82 from 101 in February. The gold PAI fell 19% to 117 from 144 in February, while the base/other PAI decreased 17% to 54 from 66 in February.

In March, the metrics used to calculate the PAI presented a mixed picture, reflecting declines in significant drilling, positive milestones and initial resource announcements. However, the Exploration Price Index (EPI) soared to a new record high, fueled by robust gold price performance throughout the month. The other precious and base metal prices gained substantially, except for molybdenum. Consequently, mining equities overall experienced a significant uptick, with the aggregate industry market capitalization increasing 4.3%.

The PAI measures the level and direction of overall activity in the commodity supply pipeline by incorporating significant drill results, initial resource announcements, significant financings and positive project development milestones into a single comparable index.

Detailed data on the PAI metrics is available in the accompanying Excel databook.

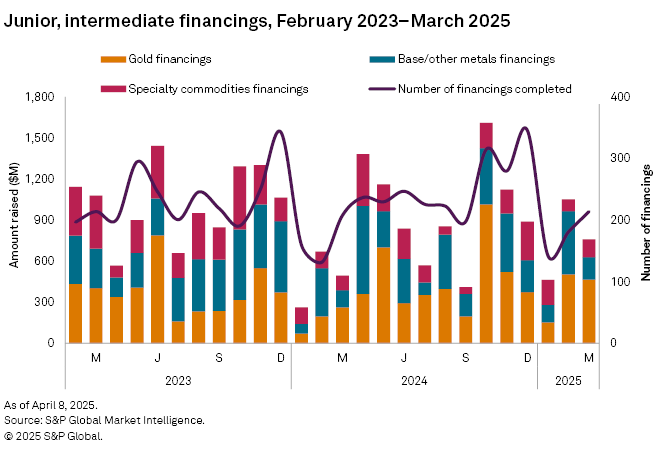

Decline in high-value transactions pushes fundraising 28% lower

In March, funds raised by junior and intermediate companies fell 28%, totaling $759 million, compared to $1.05 billion in February. Despite the decline in funding, the number of transactions rose 18%, reaching 214 — the highest in three months. However, the absence of larger transactions negatively impacted the overall total for March. Notably, the number of significant financings — transactions valued at over $2 million — increased to 68 from 57 in February. There were no transactions valued at over $50 million, a decrease from four in February.

Gold financings decreased 8%, totaling $465 million, down from $504 million in February. Despite this decline in funding, the number of transactions rose to 94 from 77, and the number of significant financings increased by 6, reaching 33 transactions. Notably, there were no transactions valued at over $50 million, a decrease from two in February.

Funds raised for the base and other metals group fell nearly two-thirds, totaling $165 million, following a significant increase to $463 million in February. Apart from nickel, which increased by $10 million, all major targets in this group declined, with silver and copper leading the downturn. The number of transactions in the base and other metals group decreased slightly to 63 from 66, while the number of significant transactions increased by one to 21. Similar to gold, there were no transactions valued at over $50 million, down from two in February.

Year-to-date drilling metrics strong despite seasonal lull

Drilling metrics dipped across the board in March as global drilling activity reporting entered a seasonal lull. A total of 3,601 drillholes were reported across 203 drilling projects by 193 companies. While these numbers are significantly down from the total in February, the year-to-date total is still marginally greater than in 2024, which can be primarily attributed to increased drilling activity for gold and copper so far in 2025. Month-over-month project drilling declined across all stages of development. However, year-to-date totals show that early- and late-stage project drilling is stronger year over year, while minesite project drilling decreased. More than half of the projects reporting drilling are in the late stage, mainly for gold assets.

March's top result came from West McArthur — an early-stage uranium project in Saskatchewan operated by TSX Venture-listed CanAlaska Uranium Ltd. (85.79%) in a joint venture with Cameco Corp. — with an intersect of 17 meters grading 10.81% U3O8. The project was also the second-best result reported in February. The drill results are part of the summer 2024 drill program on the Pike Zone within the project. A winter 2025 exploration program is ongoing, with completion expected in April 2025.

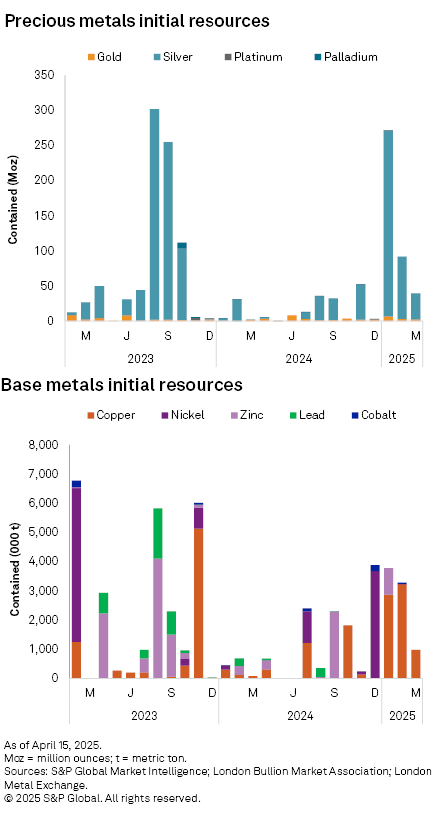

1 fewer initial resource registered

Five initial resource announcements were made in March: three for gold-focused projects and two for copper projects.

The largest announcements were for the copper-focused projects. Arctic Minerals AB (publ) announced a maiden mineral resource estimate for the Hennes Bay copper-silver project in Sweden. The estimate came in at 55.39 million metric tons with a grade of 0.8% copper and 20.8 grams per metric ton of silver, for a total contained of 447,000 metric tons of copper and 37 million ounces of silver. The second copper announcement came from Prospect Resources Ltd. The company announced a maiden mineral resource estimate for its Mumbezhi copper project in Zambia. The estimate showed 107.2 MMt with a grade of 0.5% copper, for a total of 515,000 metric tons of contained copper.

The most notable gold initial resource announcement came from New Found Gold Corp. The company announced an initial mineral resource estimate for its Queensway Gold Project in Newfoundland and Labrador. Indicated mineral resource totaled 18.0 MMt grading 2.40 g/t Au, for 1.39 Moz. Inferred mineral resource totaled 10.7 MMt grading 1.77 g/t Au, for 0.61 Moz.

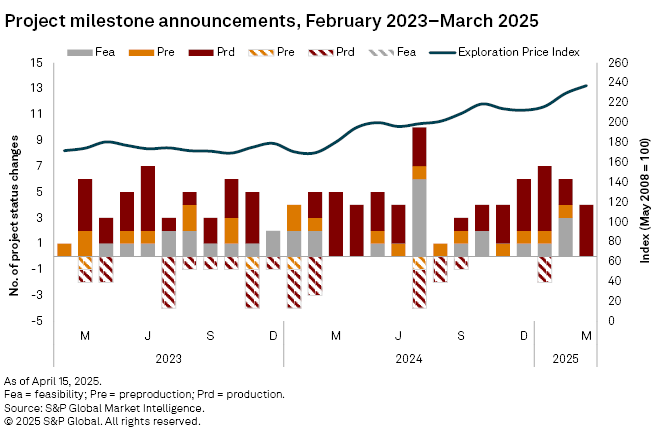

Positive milestones drop 2

Four positive milestones were registered in March; all were for gold-related projects and were production-related. No negative milestones were recorded in March.

The most notable milestone came from Torex Gold Resources Inc., which reported a precious metal-rich copper concentrate from its underground Media Luna mine in Mexico. Aura Minerals Inc. announced the start of production ramp-up at its Borborema Mine in Brazil, with commercial production expected by the third quarter of 2025. Luca Mining Corp. reported commercial production at its Tahuehueto gold mine in Mexico. Lastly, Brightstar Resources Ltd. provided an update on the commencement of its maiden gold processing parcel through Genesis Minerals Ltd.'s Laverton Mill.

EPI rises

Market Intelligence's EPI reached a new all-time high in March, coming in at 237, compared with 229 in February. The gold, silver and zinc monthly average increased by 3.2%. Copper gained 4.4%, while nickel rose 5.1%. Platinum increased a slight 0.2%, but molybdenum was down 2.6%. Notably, cobalt prices surged 44% following an export ban from the Democratic Republic of Congo.

The EPI measures the relative change in precious and base metals prices, weighted by each metal's overall exploration spending percentage as a proxy for its relative importance to the industry at a given time.

Mining equities increase slightly

Given the strong metal price performances for the month, the aggregate valuation of mining equities increased. Market Intelligence's total market capitalization of the 2,651 listed mining companies rose 4.3% to $2.23 trillion, from $2.14 trillion in February.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.