Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Nov, 2016 | 12:45

By Nathan Stovall

Highlights

Small banks in the U.S. should finally see an end to yield compression, according to the latest industry projections from S&P Global Market Intelligence.

Small banks should finally see an end to yield compression.

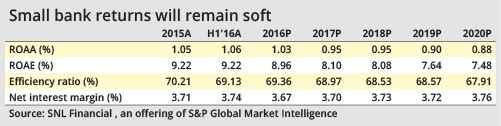

Net interest margins at the nation's smallest institutions, those with less than $1 billion in assets, should fall in the remainder of the year, largely due to additional pressure on loan yields. But margins should decline less than previously expected, allowing for earnings to grow when adjusting for consolidation and institutions growing organically above $1 billion in assets.

S&P Global Market Intelligence expects small bank margins to fall to 3.67% in 2016, up from our 3.61% projection in July. Margins should rebound to 3.70% in 2017 as interest rates move higher.

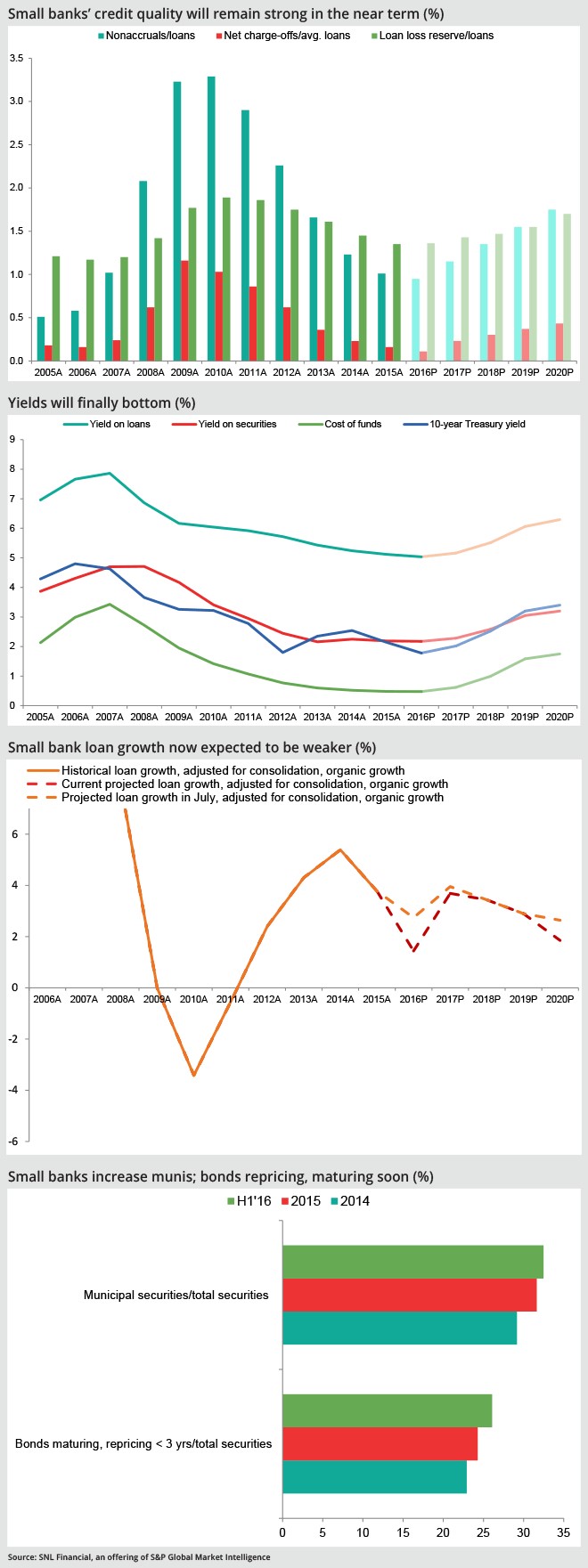

Small banks managed to maintain deposit costs and security yields at or near 2015 levels through the first six months of 2016, despite persistently low long-term rates.

The same cannot be said for larger institutions, which saw deposit costs rise and security yields come under considerable pressure during the same time period as they reinvested cash flows at lower rates. Many large banks are subject to regulations such as the liquidity coverage ratio, or LCR, requiring them to hold higher concentrations of low-yielding securities.

Small banks are not subject to those provisions, and they have also added securities that are maturing or repricing in a shorter time frame while increasing their exposure to municipal securities, which tend to carry longer durations.

Small banks have grown muni balances in their securities portfolios. Banks subject to the LCR could not use those securities to comply with the regulation through the first half of 2016. The Federal Reserve finalized a rule in April that will allow investment-grade general obligation state and municipal securities to count among assets banks may use to comply with the LCR, effective July 1, albeit with larger haircuts than other securities.

Through June 30, small banks had increased munis to 32.5% of securities from 31.6% in 2015 and 29.2% in 2014. The group also increased the portion of bonds maturing or repricing in less than three years to 27.1% of securities from 25.1% in 2015 and 23.8% in 2014, according to repricing disclosures in call reports.

As banks have added those exposures, long-term rates have remained under pressure, while short-term rates have risen.

Three-month LIBOR climbed ahead of money market reforms in mid-October, after the beginning of 2016 opened with the key market rate roughly 30 basis points higher than the average witnessed throughout 2015. Three-month LIBOR has increased more than 25 basis points since the beginning of 2016, hitting another new 52-week high on Oct. 26. Meanwhile, the yield on the 10-year Treasury fell 78 basis points in the first half of 2016 and only rose 36 basis points between June 30 and October 27.

Short-term rate increases could offer support for security yields while offering a modest benefit to loan yields. The boost to loan portfolios will be limited because just 26% of small banks' loans at June 30 were set to reprice in less than 12 months, compared to roughly 52% among their larger counterparts.

Loan growth likely will also remain challenged for small institutions due to relatively weak economic growth and the group's outsized exposure to commercial real estate lending. Regulators have subjected banks with elevated CRE exposures to higher scrutiny and required them to operate with stronger risk management processes. Regulators have even encouraged some of those institutions to build capital levels.

The regulatory pressure has caused some lenders to exit their respective CRE markets. A number of bankers said in early August that they had seen little change in the competitive environment. More recently, some lenders said the exits were beginning to lead to better pricing on credits. The focus on the lending segment likely will limit growth at a number of small institutions that wish to avoid heightened scrutiny, as well as those unwilling to invest in enhanced risk management practices.

Small banks should grow loans by 1.44% in 2016, when adjusting for consolidation and institutions growing organically above $1 billion in assets. That growth should improve in 2017 as institutions build their capital levels and relieve some pressure on CRE concentrations.

Small banks, however, will continue to lag increases in market rates when pricing their deposits. While the lower for longer rate environment has kept deposit prices from moving much higher, we have maintained that small banks would be able to increase their rates at a slower pace than the rest of the industry. That has proven the case thus far and is expected to continue as small banks often attract deposits from more rural footprints, where they face less competition from other institutions. Smaller institutions also have lower concentrations of money market and savings accounts than larger banks, and they rely more heavily on CDs, allowing them to lock in portions of their funding bases for months to years.

Small banks should enjoy relatively clean credit quality in the near term. While regulators have pointed to signs of stress and easing underwriting standards in a handful of asset classes, including CRE, credit quality to date has proven better than many bank observers have expected, and early stage delinquencies continue to decline.

Nonaccrual loans are expected to hold steady through the remainder the year, and loss severities should remain low, which could allow for modest credit leverage over the next two quarters. Credit quality will emerge as a modest headwind in 2017 and begin to revert to more normal levels.

Scope and methodology

S&P Global Market Intelligence conducted an analysis highlighting small banks' core balance sheet and income statement metrics as well as key capital, asset quality and performance ratios.

The analysis of small banks stems from a larger examination of nearly 10,000 banking subsidiaries, covering the core banking industry from 2005 through the first half of 2016. The analysis includes all commercial and savings banks and savings and loan associations and historical institutions as long as they were still considered current at the end of a given year. It excludes several hundred institutions that hold bank charters but do not principally engage in banking activities, among them industrial banks, nondepository trusts and cooperative banks.

The analysis looked back more than a decade to help inform projected results for the banking industry by examining long-term performance over periods outside the peak of the asset bubble from 2006 to 2007.

S&P Global Market Intelligence has created a model that projects the balance sheet and income statement for all banks below $1 billion in assets and allows for different growth assumptions from one year to the next.

The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

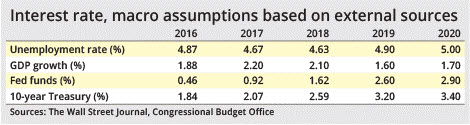

The projections assume future fed funds rates and 10-year Treasury yields based on a monthly survey of more than 60 economists conducted by The Wall Street Journal. Interest rate assumptions for 2019 and 2020 are based on the Congressional Budget Office's annual outlook. S&P Global Market Intelligence does not forecast changes in interest rates or macroeconomic indicators and aims to project what the banking industry will look like if the future holds what most economic observers expect.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly if material changes occur such as the implementation of the Financial Accounting Standards Board's impairment model, which is known as the current expected credit loss model, or CECL. The provision will drastically change the way banks reserve for loan losses. S&P Global Market Intelligence intends to make periodic updates as circumstances warrant.