Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 30, 2023

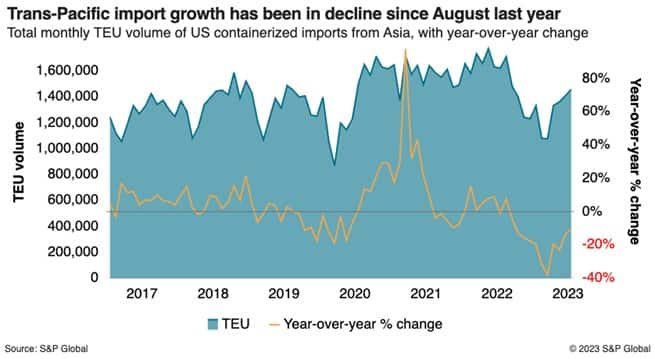

The apparent slight and short-lived peak season on the trans-Pacific has shifted the container shipping industry's hopes of a more significant U.S. import boost to late December and early January. But forwarders, shippers and carrier executives aren't sure a rebound will happen then either, even though retailers historically stock up for the spring season and top off inventories following winter holiday depletion and before the Chinese New Year.

"There was a little bit of a [volume] bump for a peak that is subsiding," said James Caradonna, vice president at MCL-Multi Container Line. "A big reason why space is tight in late August in LA/Long Beach is because about 15% percent of the capacity was blanked in the second half of the month.

"[The bump was] not awful in terms of month-over-month volume growth, but it's far from what we would call a traditional peak season," he added.

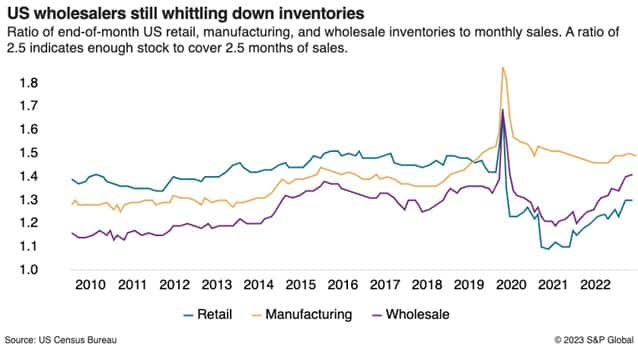

Inventory destocking continues, inching closer to a point where most retail shippers will need to put in strong purchase orders with Asian factories. An analysis of U.S. federal data on inventories suggests soft U.S. import volumes will continue into the middle of 2024, according to Jason Miller, associate professor of logistics at Michigan State University and a Journal of Commerce analyst.

Some industries have made significant headway in destocking, such as sellers of furniture and home furnishings, which as of June had cut inventories 6.3% from the high in September 2022, according to Miller's analysis. But there's still some ways to go for other sectors, such as wholesalers of apparel, who have cut inventories nearly 12% from 2022 highs but would need to slash stocks 33% to get back to the inventory-sales balance enjoyed in 2019.

Asia imports into the U.S. in July hit their peak for the year to date, reaching an 11-month high, according to PIERS, a sister company of the Journal of Commerce within S&P Global. That was still down 10% from July 2022, although Global Port Tracker sees some modest year-over-year bumps in November and December, at 8% and 10.7%, respectively.

The prospects of a significant rebound in import volumes keeps getting pushed back, said Kevin Parkerson, a consultant and former logistics leader at Hasbro, Dollar General and Walmart. At this point, the soonest the trans-Pacific may return to traditional seasonality is in the lead up to Chinese New Year, when manufacturing production traditionally slows for the two-week holiday, which next year begins on Feb. 10. The period between the end-of-the-year winter holidays and Chinese New Year has traditionally been seen in the industry as a barometer of both the restocking appetite of retailers and carriers' control of capacity to meet the generally heightened demand.

"However, I'm starting to hear more and more that it will be Q2 before anything significant," Parkerson said.

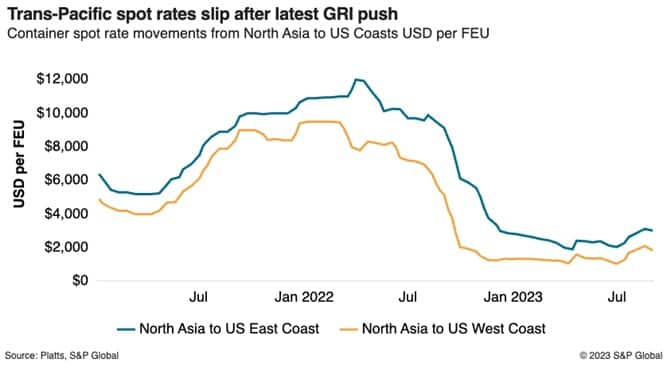

Even as they receive vessels from shipyards and analysts warn of major capacity injections ahead, container lines have blanked capacity and slow steamed, making slot space tighter than it needs to be, according to forwarders, and keeping spot rates from plunging. Since the Aug. 15 general rate increase (GRI) sought by carriers, spot rates have been static or dipped slightly, according to indices published by Drewry, Platts and the Shanghai Shipping Exchange.

Demand and rate movements vary by routing, with Asia to Southern California services handling the overflow from ports in Western Canada, which have nearly recovered from last month's labor disruption. Demand from Asia to the Pacific Northwest is weaker. All-in pricing to inland points such as Chicago and for ocean routing from the East Coast are fluid as some carriers chase September business, Caradonna said.

Shippers and forwarders, meanwhile, grumble about getting short notice of blank sailings — or none at all. They could easily see more of the same in the weeks leading up to the Golden Week holiday in early October, warns Alan Murphy, CEO of Sea-Intelligence Maritime Analysis. As of Aug. 28, Sea-Intelligence data showed that container lines have so far blanked just 3% of deployed capacity in the run-up to the holiday, compared with a 12.4% slash in 2019. That's bound to change, or there will be sharper downward pressure on spot rates, Murphy said.

And there will likely be less work awaiting Chinese factory employees when they return from the holiday. Chinese manufacturing activity fell from 50.5 in June to 49.2 in July, the lowest reading of the Caixin China General Manufacturing PMI in the last six months.

The run-up to the Golden Week holiday is the last shot for carriers at a spot rate rally this year, Jefferies said in an Aug. 28 research note.

"With container volumes traditionally weakening the closer to October's Golden Week holidays, we expect trans-Pacific spot freight rates are peaking as we assume [the Sept. 1 GRI will] fail," Jefferies said.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?