Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 May, 2017 | 08:30

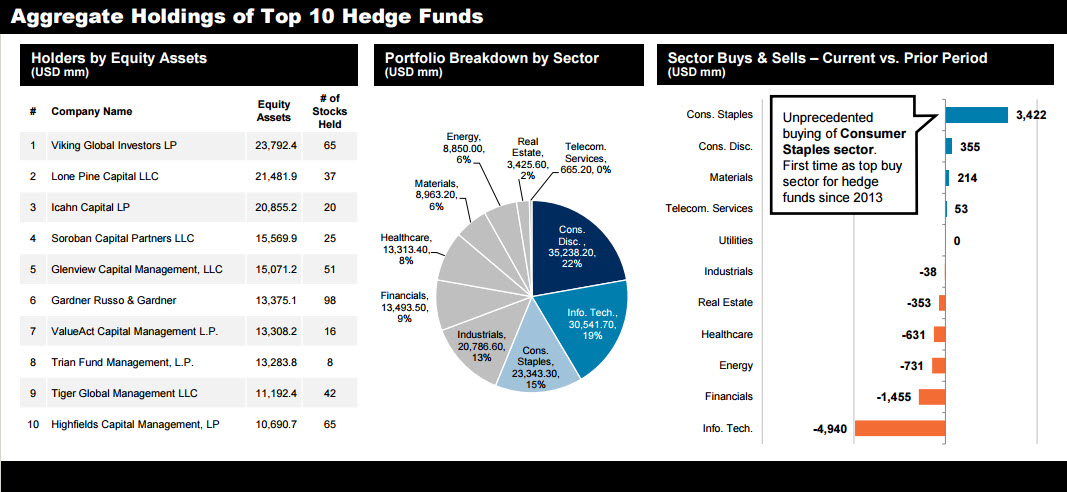

The latest Hedge Fund Tracker analysis shows the top funds managed approximately $159 billion in equity holdings, an increase from the $153 billion under management in Q4 2016. The total number of equity positions held also increased from 424 in Q4 to 427 in Q1, as hedge funds made a significant move into the consumer staples sector.

The volume of hedge fund buying in the consumer staples sector this past quarter was the highest level of buying activity we’ve seen in that sector since we began tracking this data in 2013. This momentum is a signal that hedge funds, as a group, are seeing upside potential in the non-cyclical, consumer staples sector, which can be more resilient in times of recession.

Following is a summary of findings in the Q1 2017 Hedge Fund Tracker:

S&P Global Market Intelligence analyzes the latest quarterly 13F filings* to determine the top ten largest hedge funds based on reported equity assets. Further analysis isolates the universe to pure-play hedge funds that focus on stock picks and hones that universe further to isolate the hedge funds that overweight their biggest investments by capping the number of stocks held at 100. S&P Global Market Intelligence performs this research quarterly in order to understand what the most prominent hedge funds are buying, holding and selling. The firm develops the analysis through an examination of both industry filings as well as Excel-based holding models, allowing clients to quickly spot global trends in asset category and understand what some of the largest investors buying, selling and holding.

S&P Global Market Intelligence also provides rankings on approximately 1,100 equity and fixed income ETFs based on performance, risk and cost factors, including holdings-level analysis and expenses.

View the full S&P Global Market Intelligence Hedge Fund Tracker.