Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 07, 2022

By Jingyi Pan

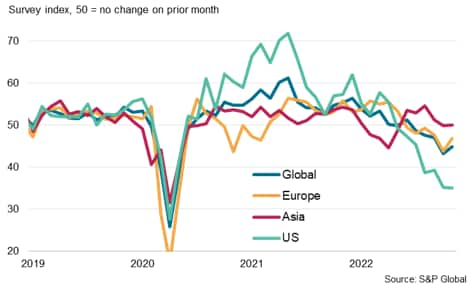

Global business conditions worsened in the penultimate month of the year according to the JPMorgan Global Composite PMI, compiled by S&P Global. Drilling down to the details, sector PMI data globally and across regions including the US, Europe and Asia further revealed a broadening of the decline in November.

We review the sectoral performance in the first 11 months of 2022 across the regions and outline the key items to watch going into 2023. Furthermore, we highlight the trends in key sectors such as autos and financials, further examining the trajectory from here with evidence provided by sector PMI data.

The latest JPMorgan Global Composite PMI, derived from S&P Global's business surveys conducted in over 40 countries, revealed that the global economic downturn accelerated midway into the final quarter of the year. Furthermore, the contraction in output cut through both manufacturing and service sectors, with both manufacturing and services now having failed to register any growth over the past four months.

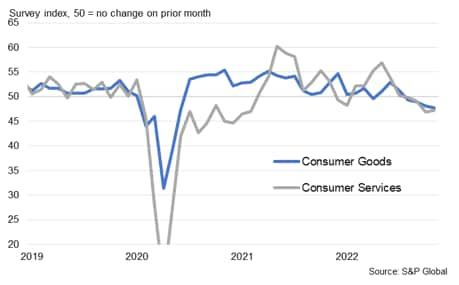

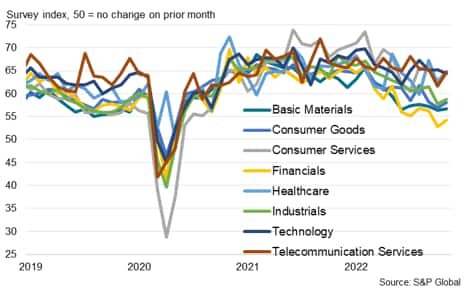

More conclusions on the extent of the slowdown can be drawn with observations from the detailed sector data. As shown in chart 1, of the eight broad industry sectors tracked, only healthcare and technology retained their footing in expansion territory in November while the six remaining sectors all contracted. Looking 12 months back, all eight sectors were in expansion while a mere two were in contraction six months back (in May), thus outlining the widening of the contraction of output across the eight major sectors tracked by the S&P Global Sector PMI. The broad trend is unsurprisingly similar to the global composite data with growth peaking somewhere in the first half of 2021 before adopting a downtrend through 2022.

What is useful to know is that while sectors like technology had largely held its ground in mild to modest growth territory in the first 11 months of 2022, other sectors like financials took a relatively sharp turn for the worse in the second quarter. Evidently issues including rising prices, tightening of monetary policy conditions, deteriorating confidence and lingering COVID-19 implications affected all the sectors in one way or another. However, the likes of financials were clearly hit harder than the rest, given the exposure to tightening financial conditions. Furthermore, we have yet to observe a clear turnaround in trend for financial sector activity even though the latest November data revealed a shallower contraction of the sector's output.

Chart 1: S&P Global Sector PMI output

Consumer sectors, including both consumer goods and consumer services - keenly watched with their varying trends through the early COVID-19 pandemic months - have also seen a synchronized decline in business conditions of late. Amid the headwinds from rising costs of living and higher interest rates, consumers have clearly pared back their spending. Excluding pandemic lockdown months, consumer-facing businesses are suffering the steepest drop in activity since detailed sector PMI data were first available in late-2009.

Chart 2: Consumer sectors output

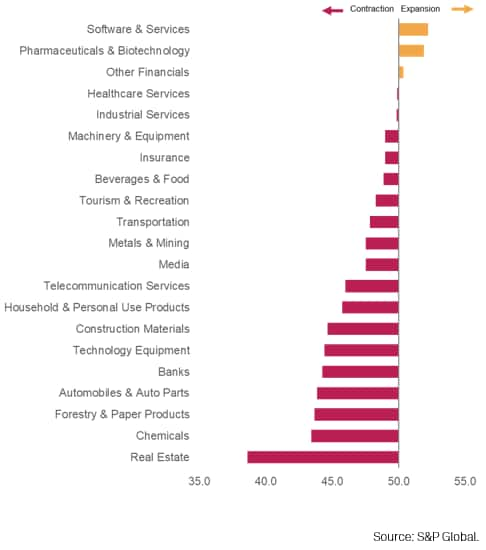

Diving further into the sector PMI and analysing the sub-indices beyond the output data, PMI new orders figures for the Global Sector PMI is a key gauge to observe for the trend going forward, given that demand acts as a leading indicator of broader business conditions.

New orders expansions were seen in merely three of the 21 sectors tracked by the global PMI - software & services, pharmaceuticals & biotechnology and 'other' financials. The latter notably saw only a marginal gain. On the other hand, steep downturns in demand can be tracked across various other sectors, led by the real estate sector.

Chart 3: Global sub-sector new orders, Nov. '22

Of the regions, Asia can be seen exhibiting a more synchronised slowdown in activity. All seven sector groups contracted according to the latest November data, led by consumer services (linked in part to ongoing COVID-19 restrictions in mainland China).

Conversely, the financial sector was the least underperforming in Asia at an almost unchanged rate of activity, which ran contrary to the global trend. Banks notably performed the best amongst the sub-sectors, supporting the broader financial sector in November. Demand for banking services was also one of the few areas that remained in growth in the penultimate month of the year.

Chart 4: S&P Asia Sector PMI output

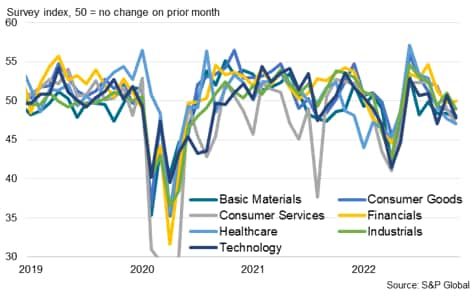

Meanwhile in Europe, almost all sector groups were found to have recorded lower activity in November. This is with exception of healthcare, which chalked up a modest expansion.

With that said, the rates of decline generally eased in November, offering a glimmer of light for further improvements. While prices remained steep by historical standards across the sectors, they have also come down from their respective heights in 2022 to signal an easing of inflationary pressures for private sector firms.

The technology sector was the best performing sector on average in Europe over the first 11 months of 2022, though giving up its top position in the latest month. Basic material companies meanwhile consistently saw the lowest output as a whole through most of 2022.

Chart 5: S&P Europe Sector PMI output

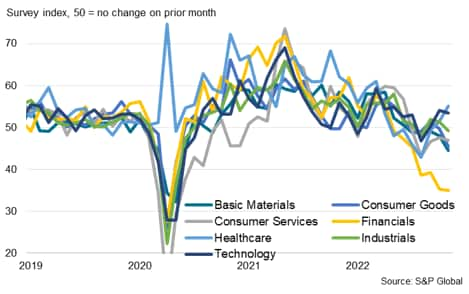

While relatively synchronized movements across sectors can be seen across Asia and Europe sectors, the same may not be said about US sectors which showed signs of divergence into the second half of 2022.

Most of the seven sectors tracked began treading water somewhere around July while healthcare and technology activity improved at the start of the fourth quarter. On the other hand, financials strayed further from the group to extend its downturn in activity to the sharpest rate since the pandemic. This coincided with a persistent and faster contraction of the US private sector according to the S&P Global US Composite PMI. The deterioration in broader conditions coupled with the tightening of monetary policy conditions can be seen broadly squeezing financial firms according to the latest survey responses. Whether there will be a convergence to mean between the sectors, especially with signals of smaller interest rate hikes coming through from the Federal Reserve, will be closely watched with upcoming PMI releases.

Chart 6: S&P US Sector PMI output

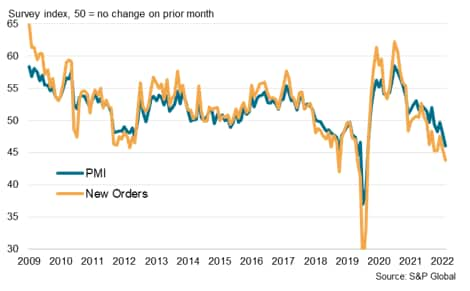

One sub-sector capturing the attention in November had been the automobile and auto parts sector, which saw production shrink at the fastest pace in two-and-a-half years according to the latest survey. This is also a prevalent trend in both Asia and Europe, with automobiles & auto parts output falling at the fastest rate in all 18 monitored sub-sectors in Asia.

While supply bottlenecks had been key issues limiting auto output earlier, the situation has vastly improved with global delays easing to pre-pandemic extents in November for the automobile & auto parts sector.

Central to the deterioration in conditions has been the fall in demand, a phenomenon cutting through most consumer goods as mentioned above. New orders continued to fall at a severe rate in November, which led manufacturers to rely on backlog orders to sustain operating capacity. Furthermore, pricing power can be seen shifting towards auto buyers as selling price inflation strayed from peaks seen earlier in the year. Firms in the sector were also hesitant in retaining inventory according to latest survey data. Overall sentiment remained positive in November, but the level of business confidence was amongst the lowest in the series to indicate a subdued outlook for the autos sector.

Chart 7: Global auto sector PMI and new orders

In addition to the auto sector, financial services activity shrank at an alarming pace across most of the regions tracked by our sector PMI data. Globally and in the US, financial activity contracted at the fastest pace since the pandemic. While Asia's financial sector registered almost no-change in activity from October, Europe saw only a slight cooling in the rate of contraction.

A combination of weaker confidence, a tightening of monetary policy conditions and greater market volatility appear to have been at the core of the wider financials downturn. That said, not only had the Fed been one to signal the slowing down of aggressive interest rate hikes, other central banks around the world have also indicated similar intentions, or have already done so. It will be of interest to examine if things take a turn for the better globally going into 2023, especially with recession risks yet to be dismissed.

Chart 8: Financial sector activity

With sector PMI data, including national sector PMI data, that we compile coming in useful to provide indications on equity movements and even corporate earnings, the signals that are derived here will be eagerly watched in the coming months.

In addition to the new orders sub-index, the future output index is also helpful in understanding companies' own views on output in the year ahead. The latest picture provided by the S&P Global Sector PMI reflected sustained optimism cutting across all eight major sector groups.

With the above said, the level of confidence varied extensively by sector. Heading the sentiment rankings in November were consumer services, healthcare and telecommunication services, all improving from the previous month. Financials meanwhile saw a slight improvement in confidence but, in line with overall output, have yet to demonstrate a convincing trend to indicate better confidence for the month ahead.

Chart 9: S&P Global Sector PMI future output

Read the accompanying press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.