Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 05, 2023

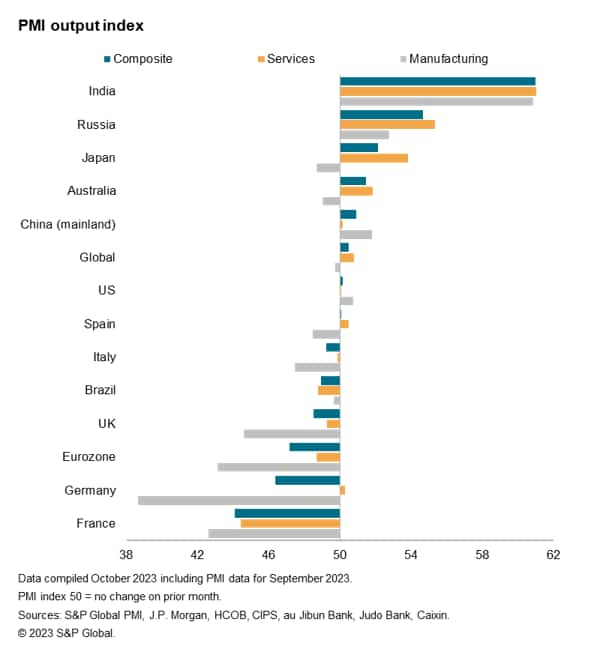

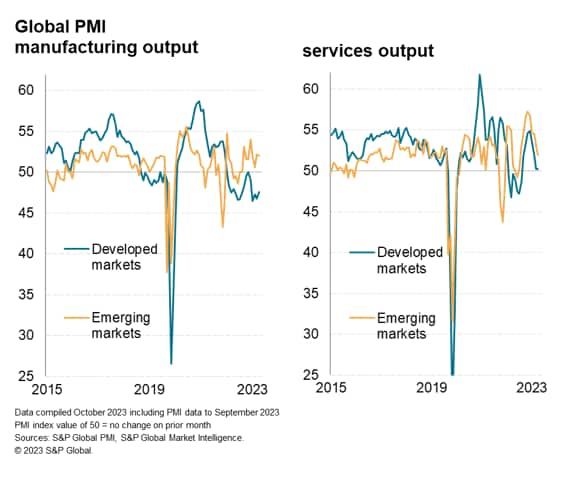

Global economic growth remained largely stalled for a second consecutive month in September, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. The data point to a significant loss of global growth momentum after the resurgence of demand seen earlier in the year, which had been fueled in particular by a post-pandemic revival of service sector activity.

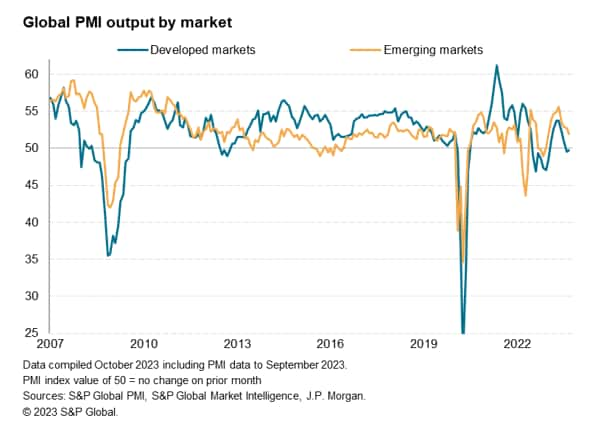

Growth is weakest in the developed world, and particularly in Europe, where higher interest rates have combined with the higher cost of living and uncertainty about the outlook to hinder expansions. However, at the same time China's recovery is also waning, acting as a drag on emerging market growth.

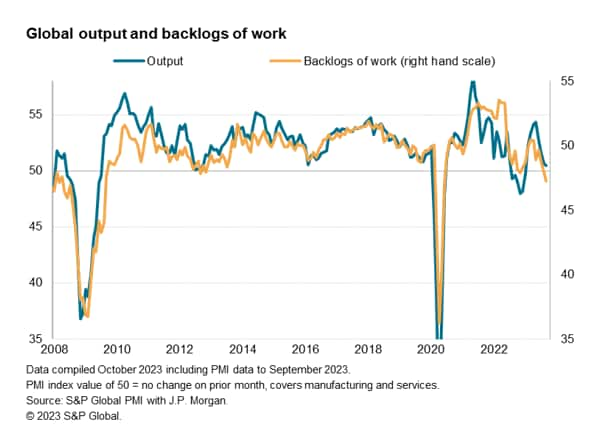

Near-term global output risks seem skewed to the downside, as backlogs of work fell worldwide in September at the sharpest pace since the global financial crisis when excluding the initial wave of COVID-19, hinting that companies will seek to scale back operating capacity in the months ahead unless demand revives.

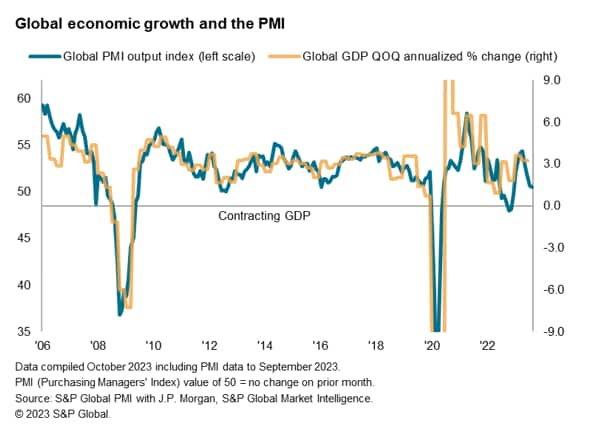

Global business activity growth remained largely stalled for a second successive month in September, according to the Global PMI data compiled by S&P Global. The headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, edged down from 50.6 in August to 50.5 in September, its lowest since the current global economic upturn began in February. Close to the 'no-change' level of 50.0, the PMI registered only very modest growth for a second month in a row.

The current reading takes the PMI further below the survey's long-run average of 53.3 and is broadly consistent with annualized quarterly global GDP growth of just under 1%, well below the pre-pandemic ten-year average of 3.0%.

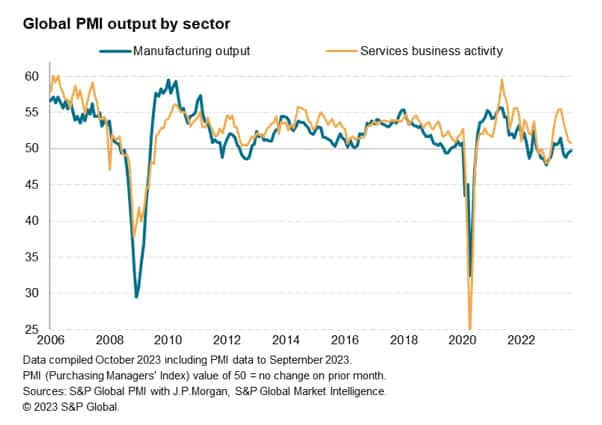

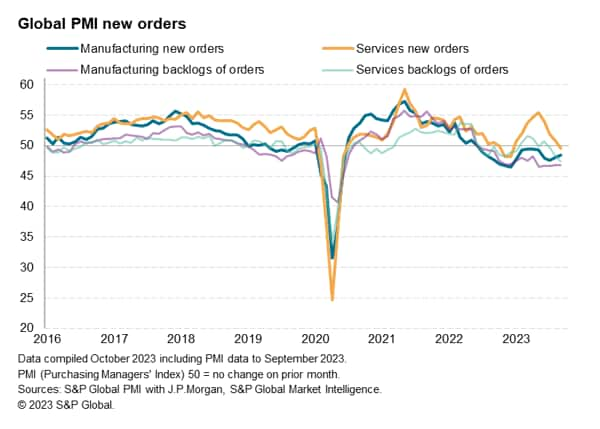

Manufacturing remained in contraction for a fourth successive month, albeit with the rate of decline moderating globally to signal only a marginal decline. However, new orders received by factories continued to fall, dropping at a faster rate than production, underscoring how producers remain reliant on a finite pipeline of back-orders to sustain growth.

Global service sector activity meanwhile also disappointed, expanding only marginally in September as the rate of growth faltered for a fourth consecutive month from the solid rates seen earlier in the year to register the smallest monthly improvement since January.

Worse may yet come, as new business inflows into the service sector fell worldwide in September for the first time since December. Moreover, backlogs of work in the service sector fell globally at the fastest rate since May 2020. Excluding the early pandemic lockdowns, the drop in backlogs was the steepest since September 2009, underlining the extent to which service providers, like their manufacturing counterparts, are having to eat into backlogs of previously-placed orders to sustain current activity levels in the absence of new orders.

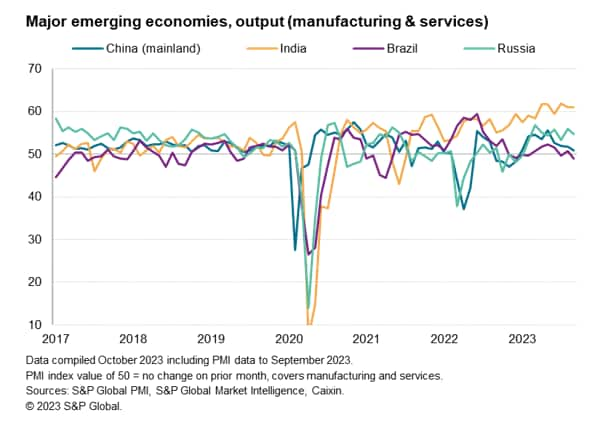

India remained the stand-out performer in September, extending its current boom that has seen both manufacturing and services grow at impressive rates to generate one of the strongest overall expansions seen over the past 15 years.

Robust growth was also reported in Russia, but China's mainland expansion slowed to the weakest since its recovery began in January to signal only very modest growth, thanks mainly to a near-stalled service sector revival. Brazil meanwhile slipped into contraction for the second time in the past three months.

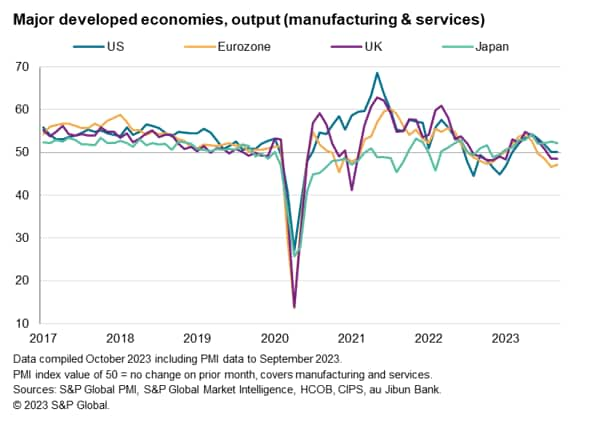

Divergent trends were also seen in the major developed markets. Only Japan reported a sustained expansion of output, enjoying continued robust service sector growth. But the US saw a near-stagnation of output for a second month in a row, with subdued performances recorded across both services and, to a lesser extent, manufacturing. Europe meanwhile remained in contraction amid falling levels of manufacturing and services output. Eurozone output fell for a fourth consecutive month and the UK reported a second successive month of decline.

The various national performances meant the developed world suffered a marginal overall contraction of output for a second straight month at the end of the third quarter, signaling a marked contrast to the robust improvement seen in the second quarter. The emerging markets meanwhile reported the weakest output gain since January.

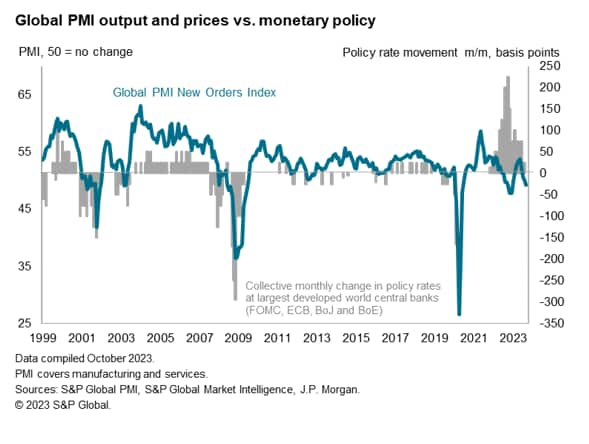

With the worst performances seen in those developed economies where interest rates have risen sharply - namely the US, Eurozone and UK - the surveys hint at further downward pressure on global demand in the coming months, as the lagged effect of rate hikes is likely to continue to feed through.

This dampening of demand poses downside risks to the outlook, as September has already seen inflows of new business fall globally for the first time since January.

This demand decline has caused companies across manufacturing, and increasingly also the service sector, to rely on backlogs of previously placed orders to sustain current production (output) levels. However, these backlogs are now collectively falling worldwide at the sharpest rate since August 2009, if pandemic lockdown months are excluded, suggesting firms could soon be running out of work to justify currently capacity levels.

Output may therefore soon come under pressure from depleted order books (see first chart above), and pressure on headcounts could follow, barring a revival of demand. However, the lagged impact of rate hikes bodes ill for the near-term demand outlook.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location