Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 06, 2024

Global output growth accelerated for a third straight month in January, according to the S&P Global PMI surveys. Looser financial conditions helped boost financial services activity and consumer spending, while manufacturing was also buoyed by a reduced focus on inventory reduction.

Growth picked up in the US, Japan, UK, India and Brazil, and downturns moderated in the eurozone, Canada and Australia. China's (mainland) economy also continued to expand.

The survey sub-indices hint at global growth gaining further momentum in the near-term. New order inflows accelerated, helping stabilize backlogs of work and pushing worldwide business optimism about the year ahead to its highest since last June. These improvements in demand and sentiment meanwhile encouraged increased global hiring.

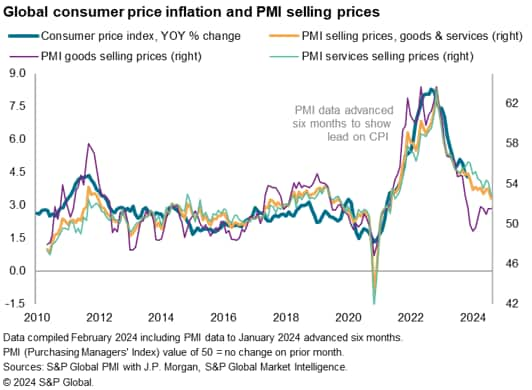

The survey meanwhile pointed to a further easing of global inflationary pressures, bolstering the likelihood that central banks will be able to lower interest rates to further aid the growth outlook. However, some price data are worthy of close monitoring in the coming months, notably around supply delays and producer input costs.

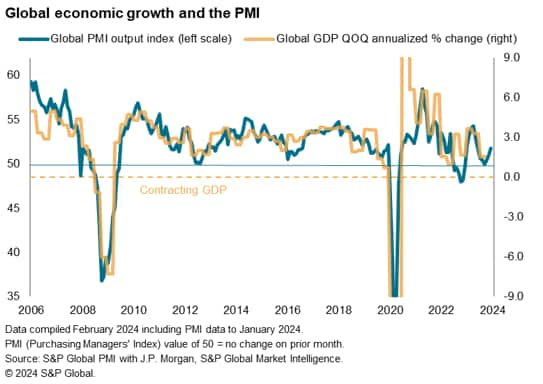

The global economy started 2024 on a stronger footing, with worldwide business activity growth hitting a seven-month high, according to the Global PMI data compiled by S&P Global. At 51.8 in January, the headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, rose for a third consecutive month, signaling accelerating growth.

Although the PMI remains well below the survey's long-run average of 53.2 and is broadly consistent with annualized quarterly global GDP growth of approximately 1.8% (below the pre-pandemic ten-year average of 3.0%), the upturn allays concerns of a global recession, and points to the worst impact of prior rate hikes having now passed.

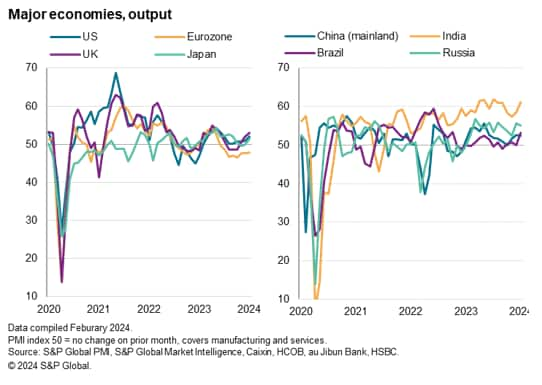

Business activity in the developed world rose for the first time since last July. Growth accelerated in the US to a six-month high, while also reaching four- and eight-month highs respectively in Japan and the UK. These improved performances helped offset an eighth consecutive month of contraction in the eurozone, through even here the rate of decline moderated fractionally to the lowest since last July. Downturns also eased in Australia and Canada, albeit the latter remaining especially marked.

A brighter picture was also evident in the emerging markets, which collectively grew in January at the fastest rate since last June. India continued to lead the pack by a wide margin, with growth accelerating to a six-month high and one of the steepest rates seen over the past 15 years.

Growth also accelerated in Brazil from the stalled situation at the end of last year, with growth hitting its sharpest since October 2022. Mainland China's expansion meanwhile lost only marginal momentum from December's seven-month high, and Russia continued to grow at one of the strongest rates seen over the past five years.

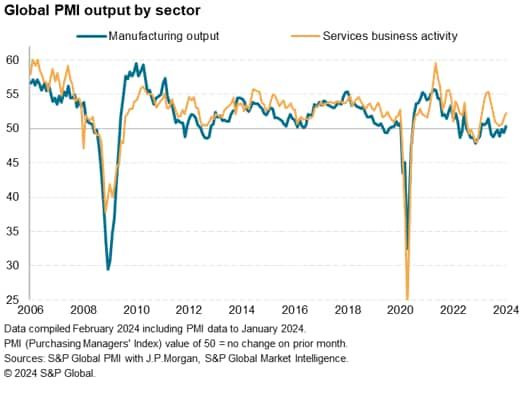

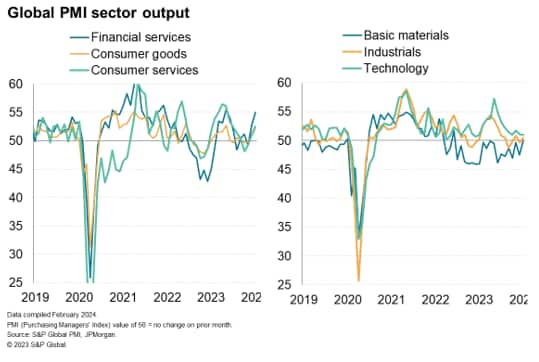

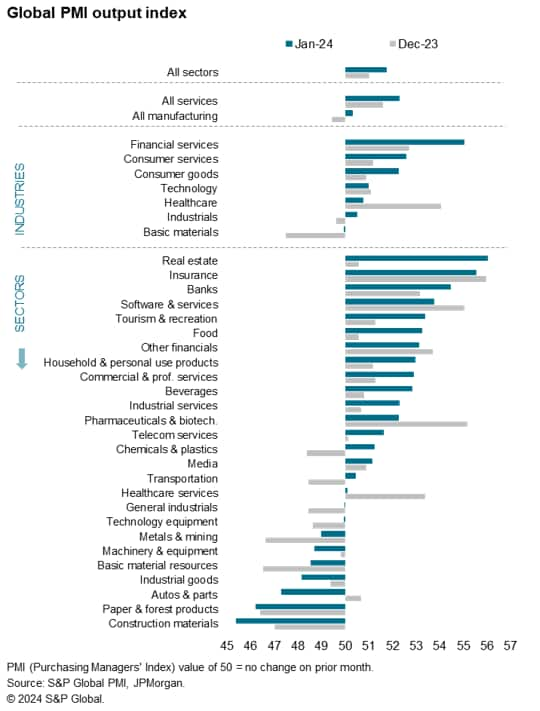

By sector, an improvement in global performance was recorded across both manufacturing and services. The former edged back into growth territory for the first time in eight months, and the latter reported a modest acceleration of growth for a third successive month, notching up the best output gain for six months.

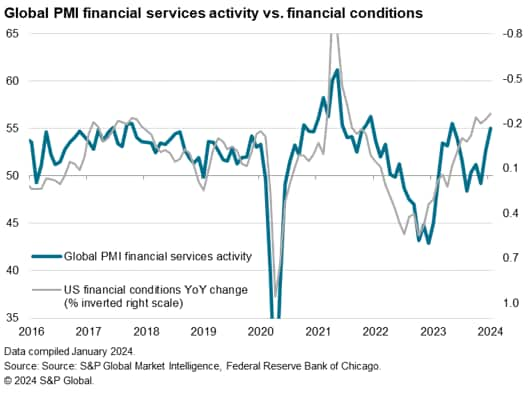

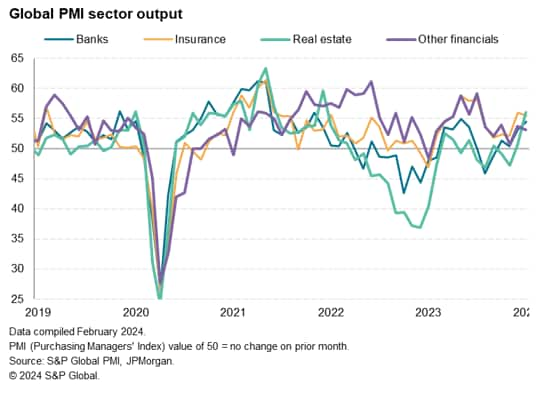

Digging deeper into sectors, financial services reported by far the strongest expansion of the major industries tracked by the global PMI, fueled in turn by resurgent activity in the real estate, insurance and banking sectors. These activities have been buoyed by looser financial conditions associated with expectations of interest rates falling in many economies in 2024. The financial conditions index compiled by the Federal Reserve Bank of Chicago, for example, is currently indicating the loosest conditions for almost two years.

Overall, global financial services activity grew in January at the fastest rate since last May and the second-fastest rate for just over two years. Of particular note, real estate activity is now rising at a pace not seen globally since December 2021 and growth of banking activity has risen to its second-fastest since November 2021.

However, the brighter picture is not limited to financial services. Companies providing consumer-facing goods and services also reported improved growth for a second consecutive month in January after declines seen late last year, often linked to diminishing concerns over the cost-of-living crisis and looser financial conditions.

The support to the broader manufacturing economy from rising demand for consumer goods was accompanied by the first rise in demand for basic materials for almost two years, the latter buoyed by a reduced incidence of cost-focused inventory reduction policies around the world. Output of basic materials consequently came close to stabilizing after over one-and-a-half years of continual decline. Production of certain goods, notably construction materials and forest & paper products, nevertheless continued to fall at especially steep rates.

The loosening of financial conditions and positive shift in the inventory cycle both add to signs that the global economy will gain further momentum in the months ahead. This view is supported by some of the other indices from the global PMI.

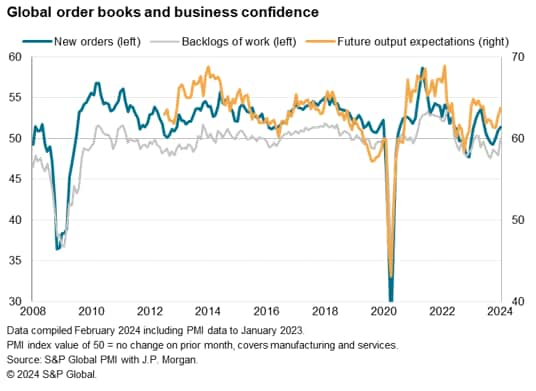

New order inflows hit a seven-month high in January, with growth accelerating in services while the demand downturn within the manufacturing sector showed signs of stabilizing for the first time in over one-and-a-half years.

These improved new business metrics helped soften the rate of decline in backlogs of work to the smallest seen over the past nine months.

Future output expectations were also buoyed by the signs of improving demand, rising to the highest level since last June. Sentiment about prospects for the year picked up in both manufacturing and services.

This more optimistic outlook was in turn matched by hiring regaining some momentum worldwide for a second successive month at the start of 2024.

The January PMI survey data therefore signalled an improved current situation and brightened outlook at the start of 2024, hinting that business output and hiring are likely to gain further momentum in the near term. However, the improvement is predicated to a degree on expectations of loosened financial conditions in 2024, which will need to materialise for growth to show a sustained upturn. These looser conditions will in turn be dependent on inflation pressures cooling to extents that enable central banks lower interest rates.

In this respect, January's PMI brought welcome news of average prices charged for goods and services rising globally at the slowest rate since October 2020. The falling PMI price gauge hints at a further cooling of global consumer inflation in the months ahead. However, the survey data sound a note of caution amid some signs of manufacturing costs rising on the back of renewed supply constraints, which will need to be monitored carefully in the months ahead.

More insights will be available with the flash February PMI data, published 22 February.

Access the Global Composite PMI press release here.

Access the Global Sector PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location