Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 06, 2023

Global economic growth slowed for a third straight month in August, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. A third month of falling worldwide factory output amid weakened global trade was accompanied by a further faltering of this year's recent revival of service sector growth.

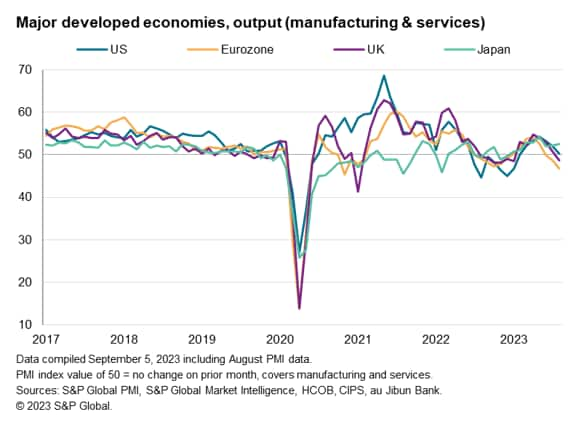

The slowdown was driven by the first fall in developed world output since January, hinting at the intensifying drag on growth from higher interest rates and the cost-of-living crisis. Falling output in Europe led the deteriorating picture, but the US also came close to stalling, leaving Japan as the only major developed economy sustaining growth.

However, growth also slowed in mainland China, dampening the overall emerging market expansion. India remained a notable bright spot.

Global economic growth slowed for a third successive month in August, according to the Global PMI data compiled by S&P Global.

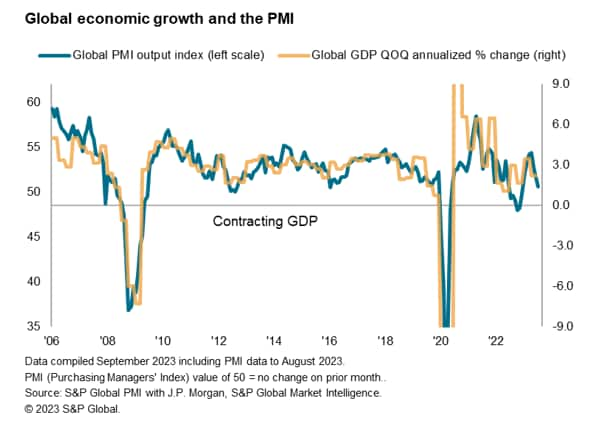

The headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, fell from 51.6 in July to 50.6, its lowest since the current global economic upturn began in February and closer to the 'no-change' level of 50.0.

The current reading takes the PMI further below the survey's long-run average of 53.3 and is broadly consistent with annualized quarterly global GDP growth of just under 1% midway through the third quarter, well below the pre-pandemic ten-year average of 3.0%.

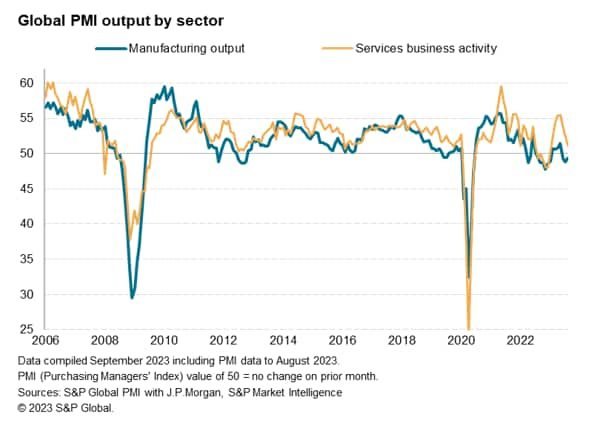

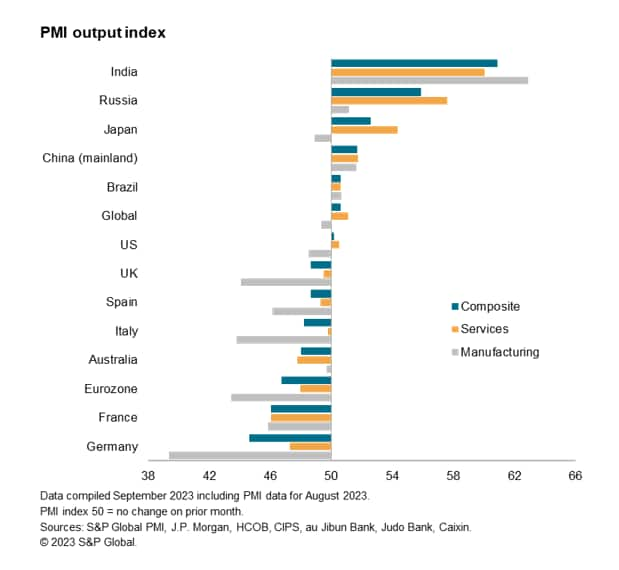

The global slowdown was again led by manufacturing, which saw output decline for a third consecutive month in August, albeit at a reduced (and only modest) rate. Only India, mainland China, Russia and Brazil reported higher production.

More noteworthy was a third successive monthly slowing in global service sector activity to the weakest since the sector's upturn began in February. Although services still outperformed manufacturing in all major economies except Australia, India and Brazil, any significant gains were limited to India, Russia and Japan. Only marginal increases were seen in Brazil and the US and declines were recorded elsewhere, led by France and Germany.

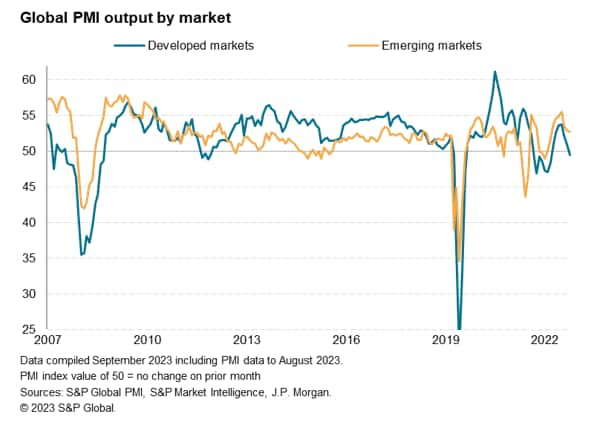

The slowdown was most pronounced in the developed world, where output contracted - albeit only modestly - for the first time since January.

Emerging market output rose for an eighth successive month in August, though the rate of expansion was the slowest since January.

The eurozone led the weakening developed world picture, with output dropping for a third successive month and at the fastest rate since November 2020. A fifth month of falling manufacturing output was accompanied by the first fall in services activity since December.

Output also fell in the UK, dropping for the first time since January. A deepening factory downturn was joined by a renewed drop in services activity; down for the first time since the start of the year.

Growth meanwhile came close to stalling in the US, the rate of expansion cooling for a third month to show the smallest rise since February. A markedly weaker rate of services growth, down to near stagnation, was met with a renewed fall in manufacturing output.

That left Japan as the only one of the four largest developed economies reporting any noteworthy growth. Japan's growth edged up to a three-month high as a faster upturn in the service sector offset an ongoing manufacturing decline.

In the emerging markets, India once again stood out by sustaining its best growth spell for 13 years despite the pace slipping lower thanks to a weaker (but still impressive) rise in services activity. India's factory sector meanwhile reported the fastest output growth since January 2012 barring only the initial pandemic reopening months in 2020.

In contrast, growth slowed for a third straight month in mainland China, down to the lowest since January. Although factory output returned to modest growth after dipping in July, services growth was the lowest since China's post-pandemic upturn began at the start of the year.

Growth meanwhile picked up in Russia, as faster services growth offset a factory slowdown.

Brazil meanwhile enjoyed a modest return to growth after output fell into decline in July, lifted by the first rise in manufacturing output for ten months and further modest services growth.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location